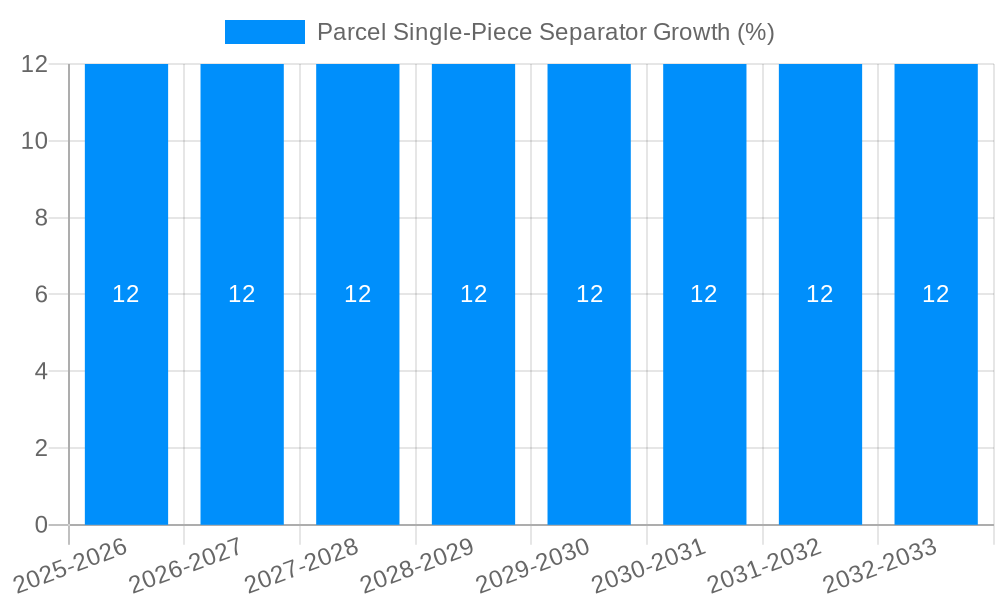

1. What is the projected Compound Annual Growth Rate (CAGR) of the Parcel Single-Piece Separator?

The projected CAGR is approximately XX%.

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.

Parcel Single-Piece Separator

Parcel Single-Piece SeparatorParcel Single-Piece Separator by Application (Postal Industry, E-Commerce Industry, Retail Industry, Others, World Parcel Single-Piece Separator Production ), by Type (Vision Control Based, Mechanical Based, World Parcel Single-Piece Separator Production ), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2025-2033

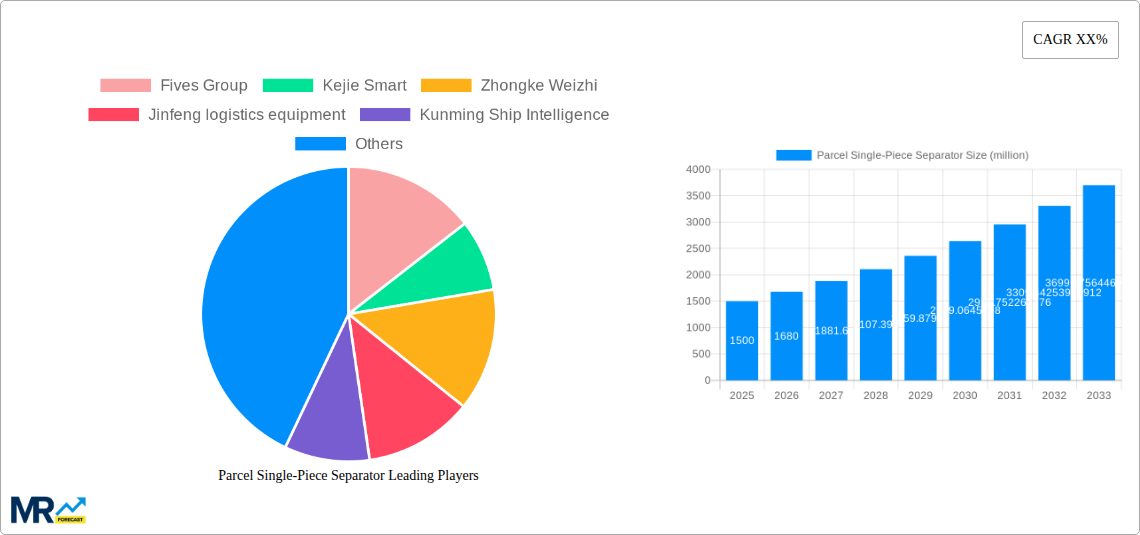

The global Parcel Single-Piece Separator market is poised for significant expansion, projected to reach an estimated market size of USD 1,500 million by 2025, with a robust Compound Annual Growth Rate (CAGR) of 12% through 2033. This growth is primarily propelled by the burgeoning e-commerce sector, which is continuously increasing the volume of parcels requiring efficient sorting and separation. The postal industry, a foundational pillar, also contributes significantly, demanding advanced automation to handle escalating delivery demands. Retailers are increasingly adopting these separators to streamline in-store fulfillment and reverse logistics, further bolstering market penetration. The "Others" segment, encompassing logistics hubs and specialized distribution centers, is also experiencing substantial uptake as businesses across various sectors prioritize operational efficiency. Vision control-based separators are leading the technological advancement due to their precision and adaptability, although mechanical-based systems continue to offer cost-effective solutions for specific applications.

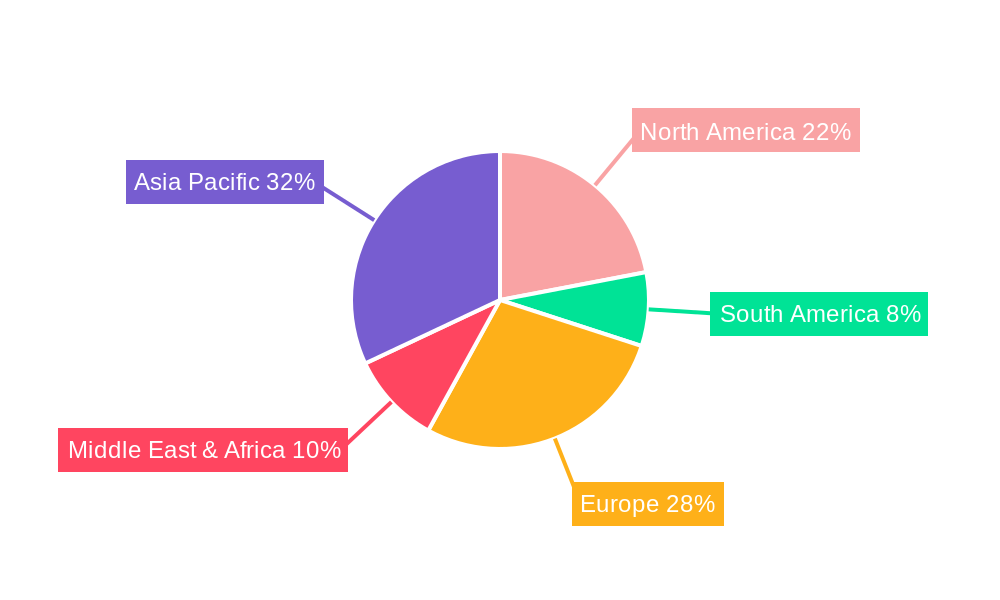

The Asia Pacific region is emerging as the dominant force in the Parcel Single-Piece Separator market, driven by China's massive e-commerce ecosystem and India's rapidly expanding logistics infrastructure. North America and Europe, with their established logistics networks and high adoption rates of automation, represent mature yet consistently growing markets. Restraints to market growth include the high initial investment cost associated with advanced vision control systems and the need for skilled personnel for maintenance and operation. However, the undeniable benefits in terms of increased throughput, reduced labor costs, and minimized errors are expected to outweigh these challenges. Key players like Fives Group, Kejie Smart, and BEUMER are actively innovating, focusing on developing more intelligent, adaptable, and cost-efficient solutions to capture the expanding market share, particularly within the dynamic e-commerce and postal industries. The ongoing evolution of logistics technology and the ever-increasing consumer demand for faster deliveries are powerful tailwinds for this market's sustained growth.

This comprehensive report delves into the global Parcel Single-Piece Separator market, offering an in-depth analysis of its trajectory from 2019 to 2033. Focusing on the crucial base and estimated year of 2025, the report provides granular insights into market dynamics during the historical period (2019-2024) and projects future growth through the forecast period (2025-2033). The report meticulously examines key market trends, driving forces, challenges, regional dominance, growth catalysts, leading players, and significant industry developments. With an estimated market size projected to reach $2.5 billion by 2033, this report is an indispensable resource for stakeholders seeking to understand and capitalize on the evolving landscape of automated parcel sorting.

The global Parcel Single-Piece Separator market is experiencing a transformative period, driven by the insatiable demand for faster, more accurate, and cost-effective logistics solutions. The sheer volume of parcels generated by the burgeoning e-commerce and retail sectors, projected to exceed 100 billion units annually by 2025, necessitates sophisticated automation. This surge in volume puts immense pressure on traditional manual sorting methods, highlighting the critical need for single-piece separation technology. A key trend observed during the historical period (2019-2024) was the gradual adoption of automated systems, primarily by larger logistics providers and postal services. However, the forecast period (2025-2033) is expected to witness an acceleration in this adoption, fueled by falling technology costs and increasing awareness of the operational efficiencies gained.

Vision control-based separators, leveraging advanced AI and machine learning for object recognition and dimensioning, are increasingly becoming the preferred choice, accounting for an estimated 65% of the market share by 2025. Their ability to handle diverse parcel shapes, sizes, and fragility levels with unparalleled accuracy surpasses the capabilities of purely mechanical systems. However, mechanical separators continue to hold a significant position, particularly in high-volume, standardized parcel environments, representing an estimated 35% of the market share in 2025 due to their robust nature and lower initial investment. The market is also seeing a trend towards modular and scalable solutions, allowing businesses of all sizes to integrate these separators into their existing infrastructure without significant disruption. Furthermore, the integration of these separators with Warehouse Management Systems (WMS) and other enterprise software is becoming standard, enabling end-to-end visibility and optimization of the entire logistics chain. The postal industry, a traditional behemoth in parcel handling, is undergoing significant modernization, with its adoption of single-piece separators expected to grow by 15% annually during the forecast period. The e-commerce industry, characterized by its rapid growth and need for speed, is already a major driver, expected to account for over 50% of the total market revenue by 2025. The retail sector, increasingly embracing direct-to-consumer models, is also a growing segment, with its demand for separators projected to increase by 12% annually.

The global Parcel Single-Piece Separator market is experiencing robust growth propelled by several interconnected factors. The most significant driving force is the exponential surge in e-commerce activities worldwide. As online shopping becomes increasingly mainstream, the volume of parcels requiring sorting and dispatch escalates dramatically, creating an urgent need for automated solutions to manage this influx efficiently. Traditional manual sorting methods are no longer sustainable, leading to increased labor costs, higher error rates, and significant delays. Consequently, businesses are investing heavily in technologies that can process parcels at unprecedented speeds and with exceptional accuracy. This demand is further amplified by the retail industry's shift towards omnichannel strategies and direct-to-consumer fulfillment, necessitating faster and more flexible distribution networks.

The pursuit of operational efficiency and cost reduction is another paramount driver. Parcel single-piece separators automate a labor-intensive and time-consuming process, thereby reducing operational expenses related to staffing, training, and error correction. The enhanced throughput and reduced processing time directly translate into cost savings and improved profit margins. Furthermore, the increasing emphasis on customer satisfaction, where timely and accurate delivery is a critical differentiator, compels companies to adopt advanced sorting technologies. The ability of these separators to minimize mis-sorted packages and reduce transit times directly impacts the end-customer experience, fostering brand loyalty and repeat business. The ongoing technological advancements, particularly in areas like artificial intelligence, machine vision, and robotics, are continuously improving the performance, accuracy, and affordability of these separation systems, making them more accessible to a wider range of businesses.

Despite the promising growth trajectory, the Parcel Single-Piece Separator market faces several inherent challenges and restraints that could impede its full potential. A primary obstacle is the substantial initial capital investment required for acquiring and implementing these sophisticated automated systems. For small and medium-sized enterprises (SMEs) in particular, the upfront cost of high-throughput, advanced vision control-based separators can be prohibitive, limiting their adoption and widening the gap between larger and smaller players. This financial barrier necessitates careful consideration of return on investment (ROI) and can slow down market penetration in certain segments.

Another significant restraint is the complexity of integration with existing warehouse management systems (WMS) and other legacy infrastructure. Ensuring seamless data flow and operational compatibility between new separation technology and established IT frameworks can be a complex and time-consuming process, often requiring specialized expertise and significant customization. Furthermore, the maintenance and operational costs associated with these advanced systems, including software updates, calibration, and the need for skilled technicians, can be a deterrent for some businesses. The lack of skilled workforce capable of operating and maintaining these sophisticated machines also poses a challenge in certain regions. Moreover, while vision control-based systems offer high accuracy, they can still face limitations when dealing with highly irregular shapes, excessively fragile items, or poorly packaged parcels, potentially leading to occasional mis-sorts or system downtime. The ongoing development and refinement of these systems are crucial to overcome these limitations and ensure wider applicability across diverse parcel types.

The global Parcel Single-Piece Separator market is poised for significant growth, with certain regions and segments expected to lead this expansion.

Dominant Region/Country:

Dominant Segments:

Application: E-Commerce Industry: The e-commerce industry is the undisputed powerhouse driving the demand for Parcel Single-Piece Separators.

Type: Vision Control Based: Vision control-based separators are increasingly dominating the market due to their superior capabilities.

The synergy between the booming e-commerce sector in the digitally advanced Asia Pacific region, coupled with the increasing preference for the precision and adaptability of vision control-based separation technology, will undoubtedly define the dominant forces shaping the global Parcel Single-Piece Separator market in the coming years.

Several key growth catalysts are propelling the Parcel Single-Piece Separator industry forward. The escalating global e-commerce volume remains the primary driver, necessitating automation for efficient parcel handling. Furthermore, the continuous advancements in artificial intelligence and machine vision technologies are enhancing the accuracy, speed, and versatility of these separators, making them more attractive to a wider range of businesses. Increasing labor costs and the persistent demand for faster delivery times are also compelling companies to invest in automated sorting solutions to improve operational efficiency and customer satisfaction.

This comprehensive report offers a deep dive into the global Parcel Single-Piece Separator market, spanning from 2019 to 2033, with a focus on the pivotal year of 2025. It meticulously analyzes market trends, growth drivers, challenges, key regional and segment dominance, and significant industry developments. The report projects a market size estimated to reach $2.5 billion by 2033, highlighting the significant expansion driven by the e-commerce boom and the ongoing pursuit of logistical efficiency. Stakeholders will find invaluable insights into the competitive landscape, including the leading players and their contributions. The report provides a forward-looking perspective, essential for strategic planning and investment decisions in this dynamic sector.

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of XX% from 2019-2033 |

| Segmentation |

|

Note*: In applicable scenarios

Primary Research

Secondary Research

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

The projected CAGR is approximately XX%.

Key companies in the market include Fives Group, Kejie Smart, Zhongke Weizhi, Jinfeng logistics equipment, Kunming Ship Intelligence, Dijie Industry, Feng Fu Technology, New Beiyang, BEUMER.

The market segments include Application, Type.

The market size is estimated to be USD XXX million as of 2022.

N/A

N/A

N/A

N/A

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4480.00, USD 6720.00, and USD 8960.00 respectively.

The market size is provided in terms of value, measured in million and volume, measured in K.

Yes, the market keyword associated with the report is "Parcel Single-Piece Separator," which aids in identifying and referencing the specific market segment covered.

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

To stay informed about further developments, trends, and reports in the Parcel Single-Piece Separator, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.