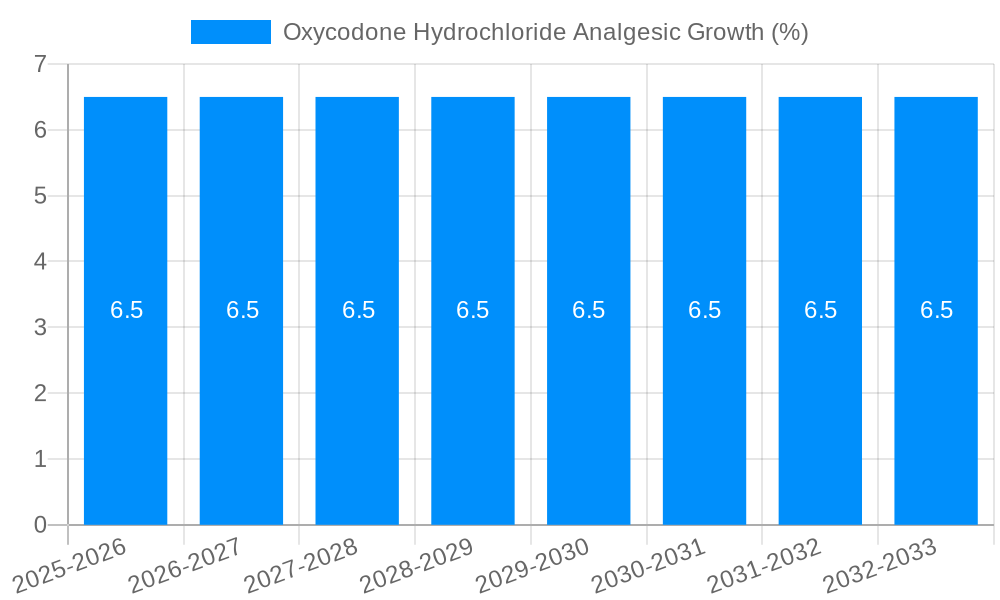

1. What is the projected Compound Annual Growth Rate (CAGR) of the Oxycodone Hydrochloride Analgesic?

The projected CAGR is approximately XX%.

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.

Oxycodone Hydrochloride Analgesic

Oxycodone Hydrochloride AnalgesicOxycodone Hydrochloride Analgesic by Type (/> Tablets, Injections), by Application (/> Hospital, Clinic, Others), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2025-2033

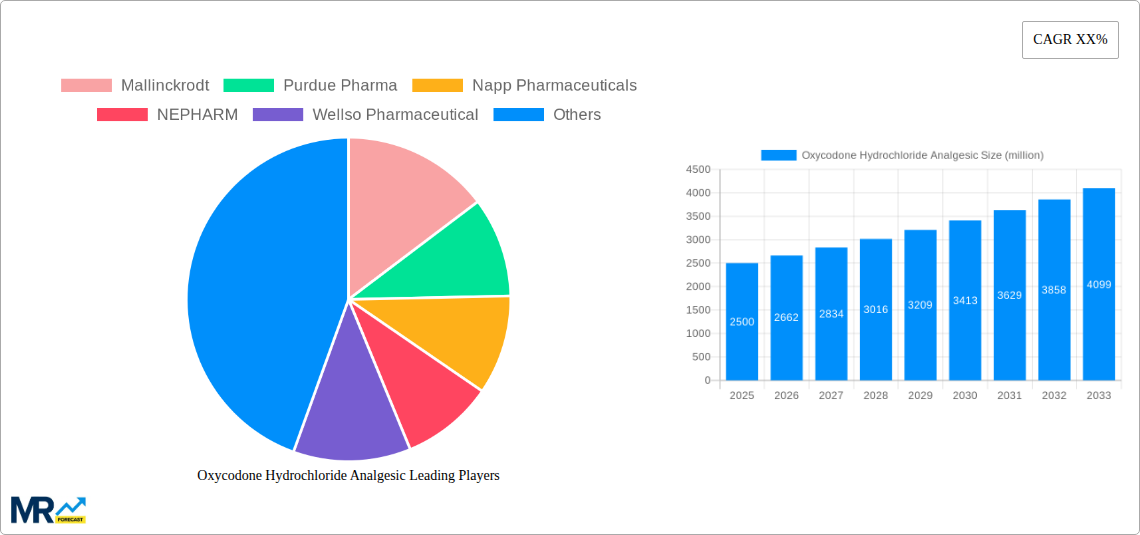

The global oxycodone hydrochloride analgesic market is a significant segment within the pain management therapeutics landscape. While precise market size figures are unavailable, considering the established presence of major pharmaceutical players like Mallinckrodt, Purdue Pharma, and Teva Pharmaceuticals, and the persistent demand for opioid analgesics, a reasonable estimate for the 2025 market size would be in the range of $2-3 billion USD. This market exhibits a moderate Compound Annual Growth Rate (CAGR), potentially around 3-5%, driven by factors such as the increasing prevalence of chronic pain conditions requiring opioid management, and the ongoing development of improved formulations offering better pain relief and reduced side effects. However, the market faces considerable restraints, predominantly stemming from stringent regulations aimed at curbing opioid abuse and misuse, coupled with growing awareness of the addictive nature of oxycodone and its associated risks. These regulatory hurdles are likely to influence the market's growth trajectory, especially in regions with proactive pain management policies.

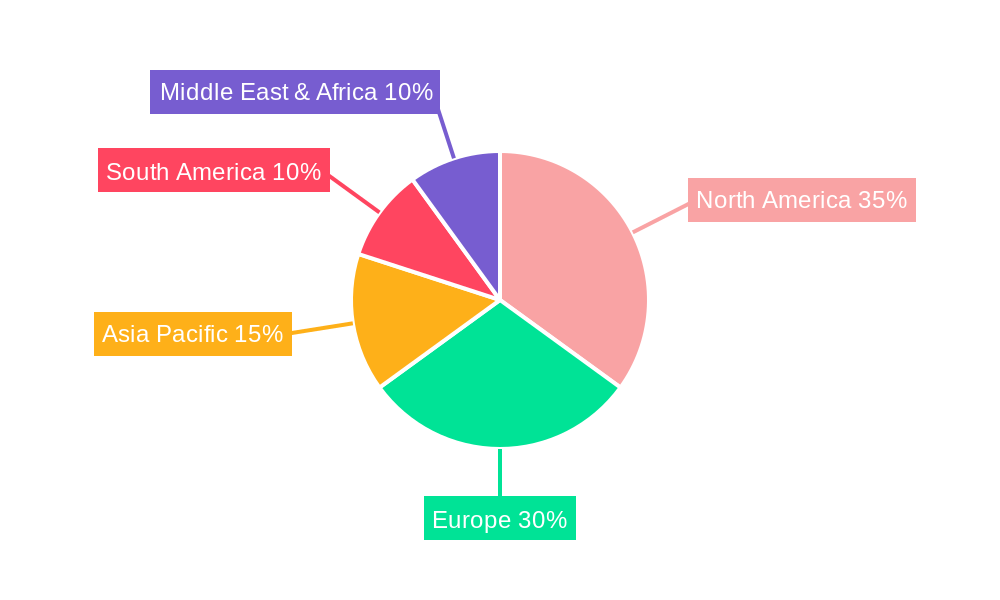

The market segmentation is likely based on dosage forms (e.g., immediate-release, extended-release tablets, capsules), routes of administration (oral, intravenous), and geographic regions. North America and Europe currently represent significant market shares, owing to high healthcare expenditure and a substantial patient population with chronic pain. However, emerging markets in Asia-Pacific and Latin America present considerable future growth potential driven by rising healthcare infrastructure and increased access to healthcare. Competitive dynamics are influenced by the established presence of large multinational pharmaceutical companies, coupled with the emergence of generic manufacturers seeking to capitalize on market opportunities. The ongoing evolution of pain management strategies, emphasizing multimodal approaches and non-opioid alternatives, poses a considerable challenge to the sustained growth of the oxycodone hydrochloride analgesic market.

The global oxycodone hydrochloride analgesic market exhibited a complex trajectory during the historical period (2019-2024), characterized by fluctuating demand influenced by stringent regulatory measures, heightened public awareness of opioid-related risks, and evolving treatment paradigms for chronic pain management. While the market initially experienced a decline due to increased scrutiny and restrictions on opioid prescriptions, certain segments, such as those catering to patients with severe, intractable pain unresponsive to other therapies, demonstrated resilience. The estimated market value in 2025 is projected to be in the multiple millions of units, reflecting a complex interplay of factors. The forecast period (2025-2033) anticipates a moderate growth rate, driven by a continued need for effective pain management in specific patient populations, coupled with ongoing efforts to improve prescribing practices and patient monitoring. This growth will likely be concentrated in regions with less stringent regulatory environments and a higher prevalence of chronic pain conditions. However, the market's future trajectory remains sensitive to evolving regulatory landscapes, the development of alternative pain management strategies, and ongoing public health initiatives aimed at curbing opioid misuse. The base year for this analysis is 2025, providing a benchmark for assessing future market performance. The study period, encompassing 2019-2033, allows for a comprehensive understanding of market dynamics across both historical and projected timelines. Key market insights suggest a move toward more controlled dispensing and a focus on personalized medicine approaches for opioid prescription, emphasizing patient risk assessment and appropriate pain management strategies. This shift is impacting the overall market size and structure, shaping future growth prospects. The introduction of new formulations and delivery systems might also influence market share dynamics among different companies.

Several factors are driving the oxycodone hydrochloride analgesic market, despite the challenges posed by regulatory scrutiny and public health concerns. The persistent need for effective pain management in patients suffering from severe, chronic conditions, such as cancer pain and post-surgical pain, remains a primary driver. These patients often require potent analgesics like oxycodone for adequate pain control, making it a necessary component of their treatment regimens. Furthermore, the ongoing development of new formulations and delivery systems, such as extended-release versions designed to minimize the risk of abuse and improve patient compliance, contribute to market growth. These advancements aim to address some of the concerns surrounding opioid use while still providing effective pain relief. Finally, the expanding geriatric population, coupled with an increasing prevalence of age-related chronic pain conditions, contributes to the continued demand for oxycodone hydrochloride analgesics. This demographic shift presents a significant market opportunity, provided appropriate safety measures and prescribing guidelines are adhered to. However, these positive drivers must be weighed against the significant regulatory and societal pressures surrounding opioid use, which remain influential factors in market dynamics.

The oxycodone hydrochloride analgesic market faces significant challenges and restraints, primarily stemming from widespread concerns regarding opioid addiction and misuse. Stringent regulations aimed at controlling opioid prescribing, such as prescription drug monitoring programs (PDMPs) and stricter guidelines for opioid prescribing, have significantly reduced the overall volume of oxycodone prescriptions. These regulations, while essential for public health, have impacted market growth. The rise in public awareness of the dangers of opioid addiction and the associated social costs has also negatively affected market demand. This increased awareness has led to increased patient hesitancy and physician reluctance to prescribe opioids, even in cases of legitimate medical need. Furthermore, the development and increased availability of alternative pain management therapies, including non-opioid analgesics and non-pharmacological approaches, offer patients and physicians alternatives to oxycodone, further impacting market growth. This competition from alternative pain management strategies adds to the market's complexity and challenges. The legal liabilities associated with opioid prescriptions further add layers of complexity for healthcare providers.

While precise market share data across all regions and segments requires proprietary market research, certain trends suggest areas of potential dominance.

North America (USA): Historically a large consumer of oxycodone, although the market has significantly shrunk due to stringent regulatory changes. The ongoing need for pain management in severe conditions, however, suggests a continued but moderated presence. The continued prevalence of chronic pain conditions within this population segment contributes to sustained demand.

Europe: Similar to North America, Europe faces increasingly strict regulations, but different national healthcare systems may lead to regional variations in market performance.

Other Regions: Emerging markets may show growth due to higher prevalence of untreated pain and less stringent regulatory frameworks, though ethical concerns and the risk of misuse remain.

Segments:

Extended-release formulations: These formulations are gaining market share due to their perceived reduced risk of abuse and improved patient compliance.

Specific therapeutic areas: The market is likely to be concentrated in segments that cater to patients with severe and intractable pain conditions unresponsive to other treatments, such as cancer pain and neuropathic pain. This will create a sustained demand despite stringent regulatory frameworks.

The substantial decline in opioid prescriptions suggests that the overall market size is considerably smaller than in previous years. However, the segments focusing on severe pain, utilizing newer extended-release formulations, and operating within regions with more lenient regulations, may experience relative growth, although they remain subject to the overarching regulatory pressures and ethical considerations associated with opioid use.

The development of novel formulations focusing on extended-release technologies and abuse-deterrent properties serves as a significant growth catalyst. These advancements address key concerns related to opioid misuse while providing sustained pain relief. Improved patient monitoring programs and increased emphasis on responsible prescribing practices can indirectly promote market growth by ensuring that oxycodone is used appropriately in patients who genuinely require this level of pain management. Finally, focusing on specific patient populations with severe pain conditions, where oxycodone remains an essential component of treatment, will contribute to market growth.

This report provides a comprehensive overview of the oxycodone hydrochloride analgesic market, incorporating historical data, current market trends, and future projections. It delves into market drivers and restraints, examining the evolving regulatory landscape, the impact of public health concerns, and the role of alternative pain management strategies. The report also identifies key market players and analyzes their competitive positions, while providing valuable insights for stakeholders across the pharmaceutical industry, healthcare providers, and regulatory agencies. The analysis considers various segments and geographic regions, offering a nuanced understanding of this complex and dynamic market. The projection of future market growth incorporates considerations of the identified market catalysts and challenges.

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of XX% from 2019-2033 |

| Segmentation |

|

Note*: In applicable scenarios

Primary Research

Secondary Research

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

The projected CAGR is approximately XX%.

Key companies in the market include Mallinckrodt, Purdue Pharma, Napp Pharmaceuticals, NEPHARM, Wellso Pharmaceutical, Teva Pharmaceutical Industries Ltd, Epic Pharma, LLC, Mylan, Amneal Pharmaceuticals, Inc.(Impax).

The market segments include Type, Application.

The market size is estimated to be USD XXX million as of 2022.

N/A

N/A

N/A

N/A

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4480.00, USD 6720.00, and USD 8960.00 respectively.

The market size is provided in terms of value, measured in million.

Yes, the market keyword associated with the report is "Oxycodone Hydrochloride Analgesic," which aids in identifying and referencing the specific market segment covered.

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

To stay informed about further developments, trends, and reports in the Oxycodone Hydrochloride Analgesic, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.