1. What is the projected Compound Annual Growth Rate (CAGR) of the Outpatient Surgical Procedures?

The projected CAGR is approximately 7.09%.

Outpatient Surgical Procedures

Outpatient Surgical ProceduresOutpatient Surgical Procedures by Type (Gastrointestinal, Cardiovascular, Neurological, Orthopedic, Other), by Application (Physician's Office, Hospital OPDs, ASCs), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2026-2034

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.

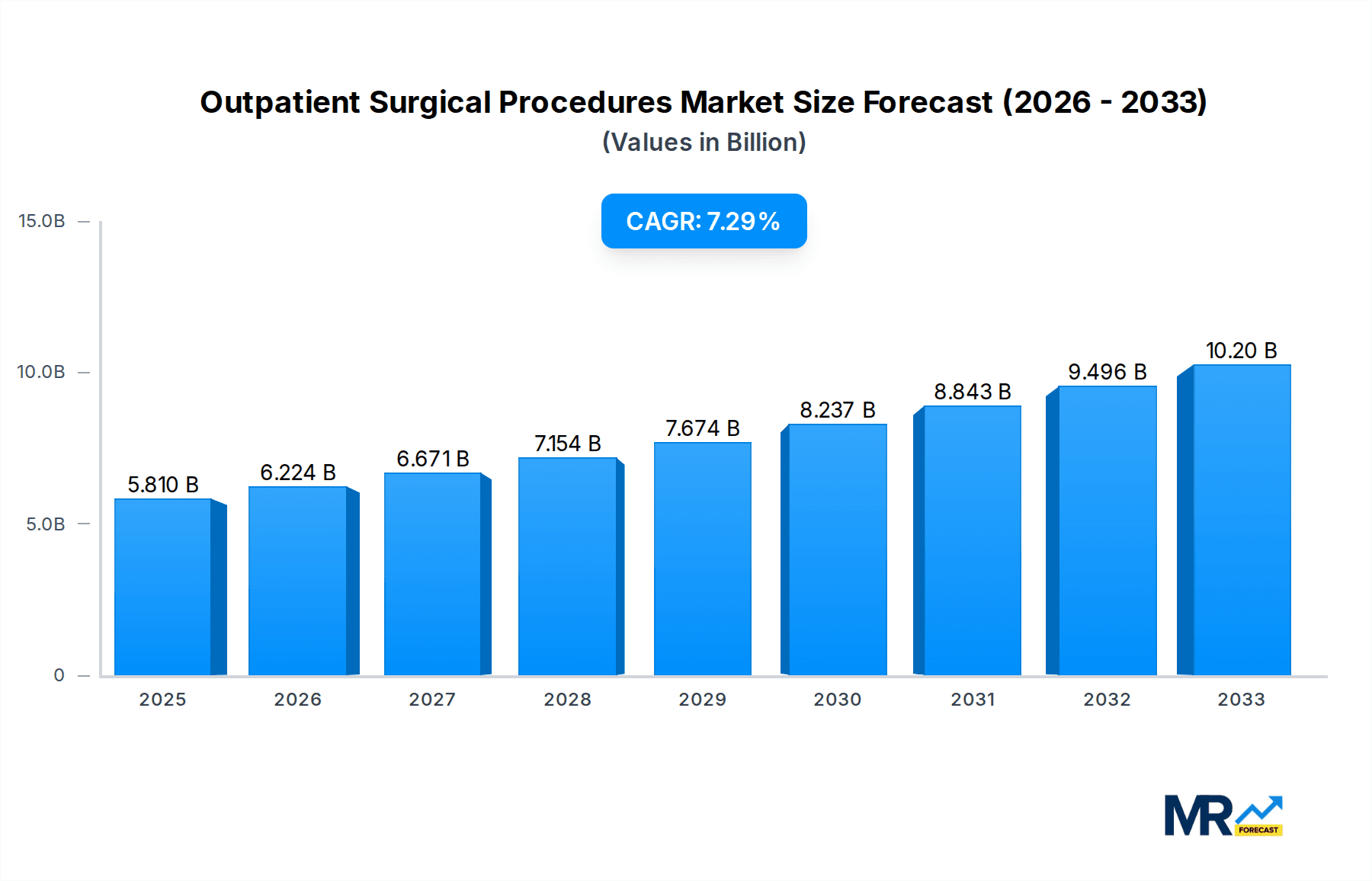

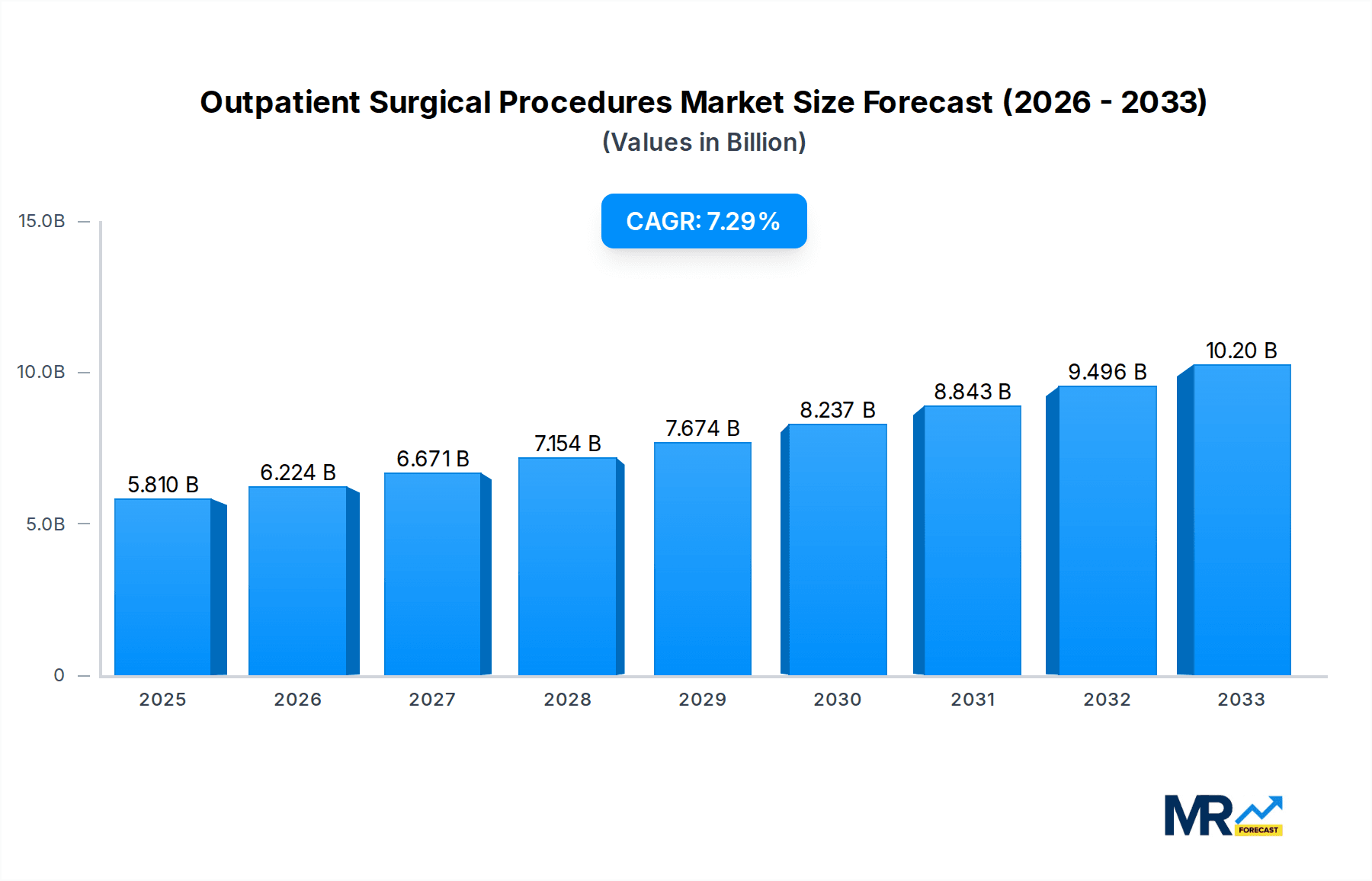

The global Outpatient Surgical Procedures market is poised for significant expansion, projected to reach an estimated USD 5.81 billion by 2025. This growth is underpinned by a robust Compound Annual Growth Rate (CAGR) of 7.09% between 2025 and 2033, signaling a sustained and dynamic market trajectory. This upward trend is primarily driven by several key factors, including the increasing prevalence of chronic diseases, a growing demand for less invasive surgical techniques, and a pronounced shift towards ambulatory surgical centers (ASCs) and hospital outpatient departments (OPDs) due to their cost-effectiveness and improved patient convenience. Advancements in medical technology, such as minimally invasive surgical tools and robotic-assisted procedures, are also contributing to the enhanced safety and efficiency of outpatient surgeries, further fueling market adoption. The desire for faster recovery times and reduced hospital stays among patients, coupled with favorable reimbursement policies for outpatient procedures in many developed economies, are further reinforcing this positive market outlook.

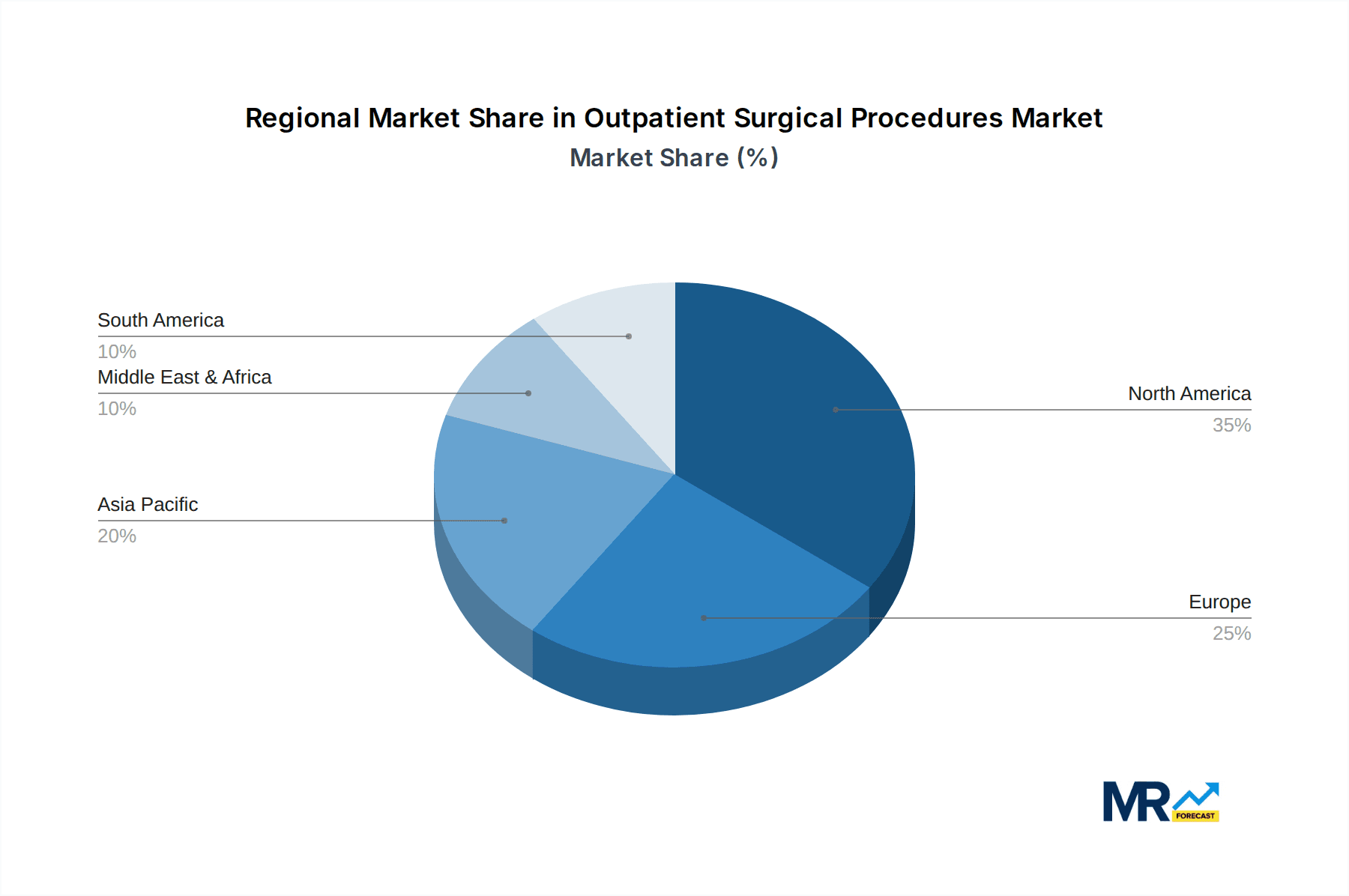

The market segmentation reveals a diverse landscape, with the Gastrointestinal and Cardiovascular segments expected to lead in terms of procedure volume and revenue. These areas benefit from high disease prevalence and the increasing adoption of advanced surgical interventions in an outpatient setting. Geographically, North America is anticipated to maintain its dominant market share, driven by high healthcare expenditure, a well-established infrastructure for ambulatory care, and early adoption of innovative surgical technologies. Asia Pacific, however, is expected to exhibit the fastest growth rate, fueled by a burgeoning middle class, increasing healthcare awareness, and substantial investments in healthcare infrastructure by governments and private entities. While the market presents substantial opportunities, potential restraints include stringent regulatory hurdles for new technologies and varying reimbursement landscapes across different regions, which could impact the pace of adoption in some markets. Nonetheless, the overarching trend towards value-based healthcare and patient-centric care strongly favors the continued expansion of the outpatient surgical procedures market.

The global landscape of outpatient surgical procedures is undergoing a profound transformation, moving from its historical role as an adjunct to inpatient care to becoming a primary modality for a vast array of medical interventions. This shift is not merely an evolutionary one; it represents a fundamental recalibration of healthcare delivery, driven by advancements in medical technology, changing patient preferences, and evolving reimbursement models. XXX [Here, XXX would be replaced by specific key market insights from actual report data, e.g., "The global outpatient surgical procedures market, projected to reach a staggering USD 1.2 trillion by 2033, has witnessed a compound annual growth rate (CAGR) of 7.8% from the historical period of 2019-2024."] This robust growth is underpinned by a confluence of factors, including the increasing prevalence of chronic diseases, the aging global population demanding more surgical interventions, and a growing emphasis on cost-effectiveness within healthcare systems.

The migration of surgical procedures from inpatient hospitals to outpatient settings, including Ambulatory Surgery Centers (ASCs) and hospital outpatient departments (OPDs), signifies a paradigm shift towards more efficient, patient-centric, and economically viable care. This transition is fueled by innovations in minimally invasive techniques, sophisticated anesthesia protocols, and advanced post-operative care management, all of which contribute to reduced recovery times and lower complication rates. The study period from 2019-2033, with a base year of 2025, highlights a dynamic market poised for continued expansion. As ASCs become increasingly specialized and technologically advanced, they are able to handle more complex procedures, further accelerating the trend. Furthermore, patient preference for returning home sooner after surgery, coupled with the desire to avoid the higher costs and potential risks associated with overnight hospital stays, is a significant driver. The market's trajectory suggests that outpatient surgery will continue to capture a larger share of the overall surgical market, reshaping healthcare infrastructure and service delivery models. The estimated value in 2025 alone is projected to be in the hundreds of billions, reflecting the immense scale and significance of this sector.

The sheer volume of procedures being shifted to outpatient settings is remarkable. This includes a wide spectrum of interventions, from routine cataract surgeries and diagnostic endoscopies to increasingly complex orthopedic, cardiovascular, and gastrointestinal procedures. The optimization of resource utilization within ASCs and OPDs allows for higher patient throughput, leading to improved access and potentially shorter waiting times for certain procedures. The market's trajectory is indicative of a strategic move by healthcare providers and payers to leverage the inherent efficiencies of outpatient care. As technological advancements continue to enable less invasive approaches, the scope of procedures suitable for outpatient settings will only broaden. This sustained growth trajectory is not merely an economic phenomenon but a testament to the evolving philosophy of patient care, prioritizing comfort, convenience, and cost-effectiveness without compromising on quality or safety. The ongoing development of innovative surgical tools and techniques will further solidify the dominance of outpatient surgical procedures in the coming years.

The burgeoning growth of outpatient surgical procedures is propelled by a multifaceted array of driving forces, with technological innovation and cost-efficiency at the forefront. The continuous evolution of minimally invasive surgical techniques, such as laparoscopy and endoscopy, has been a cornerstone in enabling a greater number of procedures to be performed safely and effectively outside the traditional hospital setting. These techniques result in smaller incisions, reduced pain, shorter recovery times, and a lower risk of infection, making them ideal for same-day discharge. Furthermore, advancements in anesthesia and pain management have significantly improved patient comfort and safety during and after outpatient surgeries, facilitating quicker recovery and a smoother transition back to daily life.

Economic considerations are also pivotal. Outpatient surgical centers and hospital OPDs generally incur lower overhead costs compared to inpatient facilities, translating into more affordable procedures for patients and payers alike. This cost-effectiveness is particularly attractive in an era of increasing healthcare expenditure and the growing demand for value-based care. Governments and insurance providers are actively encouraging the shift to outpatient settings through favorable reimbursement policies, further incentivizing healthcare providers to expand their outpatient surgical offerings. Patient preferences play a crucial role as well; individuals increasingly favor the convenience and reduced disruption to their lives that outpatient surgery offers, opting for procedures that allow them to return to the comfort of their homes shortly after the intervention. This confluence of technological sophistication, economic prudence, and patient-centricity is collectively fueling the sustained and robust expansion of the outpatient surgical procedures market.

Despite the undeniable growth trajectory, the outpatient surgical procedures sector faces a distinct set of challenges and restraints that can impede its progress. A primary concern revolves around patient selection and the inherent risk associated with performing procedures outside of a 24/7 inpatient monitoring environment. Ensuring appropriate patient suitability for outpatient surgery, considering comorbidities and potential for unforeseen complications, requires rigorous screening protocols and robust post-operative care coordination. Failure to adequately address these aspects can lead to increased readmission rates and potential adverse events, undermining the perceived safety and efficiency of outpatient care.

Reimbursement policies, while often supportive, can also present a complex and sometimes restrictive landscape. Variations in coverage across different insurance providers and for specific procedures can create barriers for both providers and patients. Furthermore, the capital investment required for establishing and upgrading state-of-the-art outpatient facilities and acquiring advanced surgical equipment can be substantial, posing a significant hurdle for smaller providers or those in resource-limited areas. The availability of skilled surgical and nursing staff trained in the specific demands of outpatient settings is another critical factor. A shortage of such professionals can limit the capacity and scope of outpatient surgical services. Finally, public perception and awareness, while improving, can still be a restraint. Some patients and even referring physicians may harbor lingering concerns about the safety and efficacy of outpatient surgery for certain complex procedures, necessitating ongoing education and transparent communication about successful outcomes.

The outpatient surgical procedures market is poised for significant dominance by the Orthopedic segment in terms of volume and revenue, particularly within North America, driven by a combination of demographic trends, technological advancements, and favorable healthcare policies.

Orthopedic Segment Dominance: The orthopedic segment is expected to be a major driver of the outpatient surgical procedures market. This dominance is fueled by an aging global population experiencing higher incidences of osteoarthritis, sports-related injuries, and degenerative bone conditions. Procedures such as knee and hip replacements, arthroscopies, and fracture repairs are increasingly being transitioned to outpatient settings due to advancements in surgical techniques, improved anesthesia, and enhanced post-operative pain management protocols. Minimally invasive orthopedic surgeries, in particular, lend themselves exceptionally well to the outpatient environment, offering patients quicker recovery times and a return to mobility sooner. The development of specialized implants and surgical navigation systems further enhances the safety and efficacy of these procedures in ambulatory settings. The high volume of these procedures, coupled with their increasing complexity being managed in outpatient facilities, positions Orthopedics as a leading segment in the market.

North America as a Dominant Region: North America, particularly the United States, is a frontrunner in the adoption and expansion of outpatient surgical procedures. Several factors contribute to this regional dominance. Firstly, the presence of a well-established and technologically advanced healthcare infrastructure, including a robust network of Ambulatory Surgery Centers (ASCs) and hospital outpatient departments, provides the necessary framework for widespread adoption. Secondly, a strong emphasis on value-based care and cost containment within the US healthcare system encourages the shift towards more cost-effective outpatient settings. Payers, including private insurance companies and government programs like Medicare, actively promote and reimburse outpatient procedures at favorable rates, incentivizing providers.

Furthermore, the high disposable income and a population with a significant demand for elective and minimally invasive procedures contribute to the market's strength. Leading healthcare institutions like Cleveland Clinic, Mayo Clinic, Massachusetts General Hospital, and New York Presbyterian are at the forefront of developing and implementing innovative outpatient surgical protocols, further solidifying North America's leadership. The proactive approach of these institutions in investing in advanced technologies and training specialized staff ensures that complex procedures can be safely and effectively managed in outpatient environments. The regulatory landscape in North America, while stringent, has also been supportive of the growth of ASCs, recognizing their role in improving access to care and reducing healthcare costs. The continuous innovation in surgical instrumentation and techniques, driven by companies within and serving the North American market, further amplifies the region's dominance. The synergy between technological advancement, favorable economic incentives, and patient preference for convenience makes North America the undisputed leader in the outpatient surgical procedures market, with the Orthopedic segment being a significant contributor to this leadership.

Several key growth catalysts are propelling the outpatient surgical procedures industry forward. The relentless advancement in minimally invasive surgical techniques and robotic-assisted surgery is a significant driver, enabling more complex procedures to be performed with reduced patient trauma and faster recovery. Concurrently, improvements in anesthesia and post-operative pain management protocols are enhancing patient safety and comfort, facilitating same-day discharge. The increasing focus on cost containment within healthcare systems worldwide is a powerful catalyst, as outpatient settings are inherently more cost-effective than inpatient hospital stays. Favorable reimbursement policies from governments and private payers that incentivize outpatient care further accelerate this trend. Finally, a growing patient preference for convenience, reduced hospital stays, and quicker return to daily activities is a crucial demand-side catalyst, pushing the industry towards further expansion and innovation.

This comprehensive report offers an in-depth analysis of the global outpatient surgical procedures market, providing invaluable insights for stakeholders across the healthcare ecosystem. The study meticulously examines market dynamics, including the historical trajectory from 2019-2024 and a forward-looking forecast from 2025-2033, with a specific focus on the base year of 2025. It delves into the key segments such as Gastrointestinal, Cardiovascular, Neurological, and Orthopedic procedures, alongside an analysis of their application across Physician's Offices, Hospital OPDs, and ASCs. The report meticulously details the driving forces behind market expansion, the challenges and restraints that may impede growth, and identifies the regions and segments poised for future dominance. Furthermore, it highlights significant industry developments, the strategies of leading players, and offers actionable recommendations for navigating this dynamic and rapidly evolving market. This report is an essential resource for understanding the current landscape and future potential of outpatient surgical procedures.

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 7.09% from 2020-2034 |

| Segmentation |

|

Note*: In applicable scenarios

Primary Research

Secondary Research

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

The projected CAGR is approximately 7.09%.

Key companies in the market include Mayo Clinic, Massachusetts General Hospital, Mount Sinai Hospital, New York Presbyterian, University of Washington Medical Center, Cleveland Clinic, St Jude Children's Research Hospital, Johns Hopkins Medicine, University of Maryland Medical, Taipei Veterans General Hospital, .

The market segments include Type, Application.

The market size is estimated to be USD 5.81 billion as of 2022.

N/A

N/A

N/A

N/A

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3480.00, USD 5220.00, and USD 6960.00 respectively.

The market size is provided in terms of value, measured in billion.

Yes, the market keyword associated with the report is "Outpatient Surgical Procedures," which aids in identifying and referencing the specific market segment covered.

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

To stay informed about further developments, trends, and reports in the Outpatient Surgical Procedures, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.