1. What is the projected Compound Annual Growth Rate (CAGR) of the Outdoor GPS?

The projected CAGR is approximately XX%.

Outdoor GPS

Outdoor GPSOutdoor GPS by Application (Outdoor Adventure, Rock Climbing, Run, Ride, Others), by Type (Handheld Devices, Wearable Device), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2026-2034

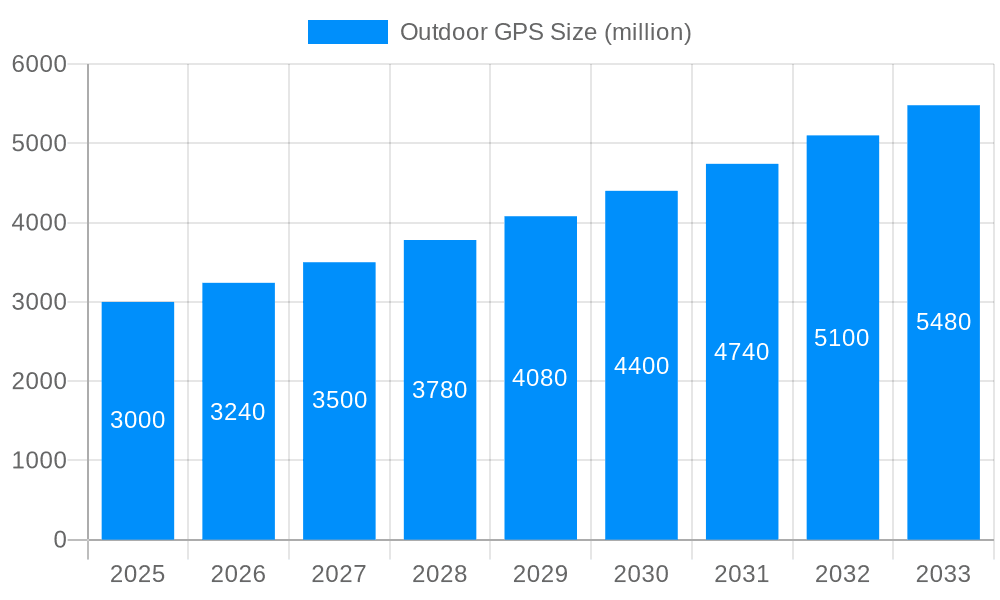

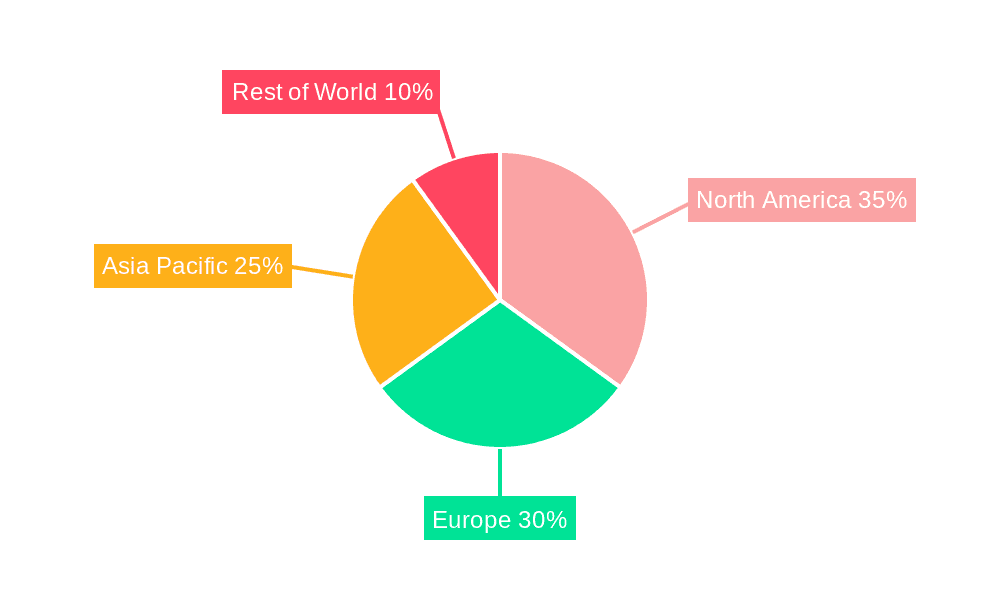

The global outdoor GPS market is experiencing robust growth, driven by the increasing popularity of outdoor activities like hiking, running, cycling, and rock climbing. The rising adoption of fitness trackers and smartwatches integrated with GPS capabilities further fuels market expansion. Technological advancements, such as improved accuracy, longer battery life, and enhanced mapping features, are key drivers. The market is segmented by device type (handheld and wearable) and application (outdoor adventure, rock climbing, running, riding, and others). Wearable devices are witnessing faster growth due to their convenience and integration with fitness apps. Handheld devices, while maintaining a significant market share, cater to users requiring more advanced features and durability. The market's geographic landscape is diverse, with North America and Europe holding substantial market shares, followed by the Asia-Pacific region experiencing rapid growth due to increasing disposable incomes and rising participation in outdoor recreational activities. Competitive rivalry among established players like Garmin, Suunto, and others, alongside the entry of new players, is intensifying, leading to product innovation and price competition. While the market exhibits strong growth potential, challenges such as high initial costs for premium devices and potential battery life limitations in extreme weather conditions act as restraints. Considering a conservative CAGR of 8% and a 2025 market size of $3 Billion (a reasonable estimate based on industry reports and the provided data), the market is projected to reach approximately $4.5 Billion by 2033.

The significant growth in the outdoor GPS market is not solely dependent on established players. Emerging markets are contributing significantly to its expansion, creating numerous opportunities for both established brands and new entrants. The market will continue to evolve with the integration of advanced features like augmented reality, improved satellite connectivity, and enhanced safety features, catering to a broader range of user needs. However, maintaining market share will require addressing evolving consumer preferences, adapting to technological innovations, and effectively managing pricing strategies to ensure competitiveness. The focus on sustainability and eco-friendly materials will also play a crucial role in shaping the future of the outdoor GPS market. The market's growth trajectory indicates significant investment opportunities, but careful consideration of market segments, technological trends, and regional variations is crucial for successful business strategies.

The global outdoor GPS market, valued at several million units in 2025, exhibits robust growth potential throughout the forecast period (2025-2033). Driven by increasing participation in outdoor activities and technological advancements, the market showcases a dynamic landscape. Analysis of the historical period (2019-2024) reveals a steady climb in consumption, with a notable surge in demand for wearable devices. This trend is expected to continue, fuelled by the convenience and discreet nature of wearable GPS technology compared to traditional handheld units. The rising popularity of fitness tracking and adventure sports, particularly amongst millennials and Gen Z, contributes significantly to this growth. Furthermore, the integration of advanced features like heart rate monitoring, sleep tracking, and route planning within outdoor GPS devices is enhancing user experience and driving adoption. The market also witnesses continuous innovation in mapping technology, with improved accuracy and offline map capabilities catering to the needs of users in remote areas. Competition among key players like Garmin, Suunto, and others is fostering continuous improvement in terms of functionality, durability, and affordability, making outdoor GPS devices more accessible to a wider consumer base. The integration of GPS technology with smartphones and other smart devices further expands market reach and penetration.

Several factors contribute to the substantial growth of the outdoor GPS market. The rising popularity of outdoor recreational activities, including hiking, trail running, cycling, and rock climbing, is a primary driver. Consumers are increasingly seeking ways to track their progress, monitor their fitness levels, and ensure their safety during these activities. The increasing affordability of GPS devices, particularly wearable options, is making them accessible to a broader consumer base. Technological advancements, such as improved battery life, enhanced mapping accuracy, and the integration of sophisticated health and fitness tracking features, further contribute to market expansion. The growing awareness of personal safety, especially among solo adventurers, also fuels demand for GPS devices. The integration of GPS technology with smartphones and smartwatches offers convenient access to navigation and tracking features, driving wider adoption. Marketing efforts by key players, highlighting the benefits of outdoor GPS devices for fitness tracking, safety, and navigational assistance, are also contributing to market expansion.

Despite the significant growth, the outdoor GPS market faces certain challenges. Competition is intense, with numerous established and emerging players vying for market share. Price sensitivity among consumers can impact the sales of higher-end devices with advanced features. The accuracy and reliability of GPS signals can be affected by environmental factors, such as dense foliage or atmospheric conditions, posing challenges to device performance and user experience. Battery life remains a crucial factor, with longer endurance being a highly desirable feature for users undertaking extended outdoor activities. Maintaining data security and privacy is critical, particularly given the collection and storage of personal activity data. Finally, the continuous evolution of technology requires manufacturers to consistently innovate and update their products to remain competitive in the market.

The wearable device segment is poised for significant growth, driven by the increasing preference for convenience and compact design. Handheld devices, while still holding a notable market share, are anticipated to see slower growth compared to wearables. Within the application segments, outdoor adventure and running are major contributors to the market’s overall value. This is particularly true in regions with a strong outdoor recreation culture and a rising middle class with disposable income.

Wearable Device Segment: This segment dominates due to its ease of use and integration with fitness tracking apps. The convenience of wearing a GPS device unobtrusively during various activities is a key driver.

Outdoor Adventure Application: The growing popularity of activities like hiking, camping, and trekking directly translates into higher demand for reliable navigation and safety features. This segment is particularly strong in regions with significant natural landscapes.

North America & Europe: These regions represent mature markets with a high adoption rate of fitness and outdoor technology, contributing significantly to the overall market value.

Asia-Pacific: Rapid economic growth and a rising middle class in several Asian countries are fueling increased participation in outdoor activities, thereby driving the growth of the outdoor GPS market in this region.

The overall market value is significantly influenced by the combined impact of these factors. The increasing integration of features like health tracking and improved mapping technologies further enhances the appeal of both wearable and handheld devices, driving this growth forward.

The outdoor GPS industry is fueled by the convergence of technological advancements, the growing popularity of fitness activities, and a heightened emphasis on personal safety during outdoor adventures. The miniaturization of GPS technology, resulting in smaller, lighter, and more comfortable wearable devices, has significantly broadened its appeal. Furthermore, improvements in battery life and mapping accuracy have enhanced the overall user experience, stimulating market expansion.

This report provides a comprehensive analysis of the outdoor GPS market, covering historical trends, current market dynamics, and future growth prospects. It offers detailed insights into market segmentation by device type (handheld and wearable) and application (outdoor adventure, running, cycling, etc.), as well as geographical analysis across key regions and countries. The report also identifies key market players, analyzes their competitive strategies, and highlights significant technological developments shaping the industry. The detailed forecast and analysis will help businesses make informed decisions to capitalize on the growth opportunities within this dynamic market.

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of XX% from 2020-2034 |

| Segmentation |

|

Note*: In applicable scenarios

Primary Research

Secondary Research

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

The projected CAGR is approximately XX%.

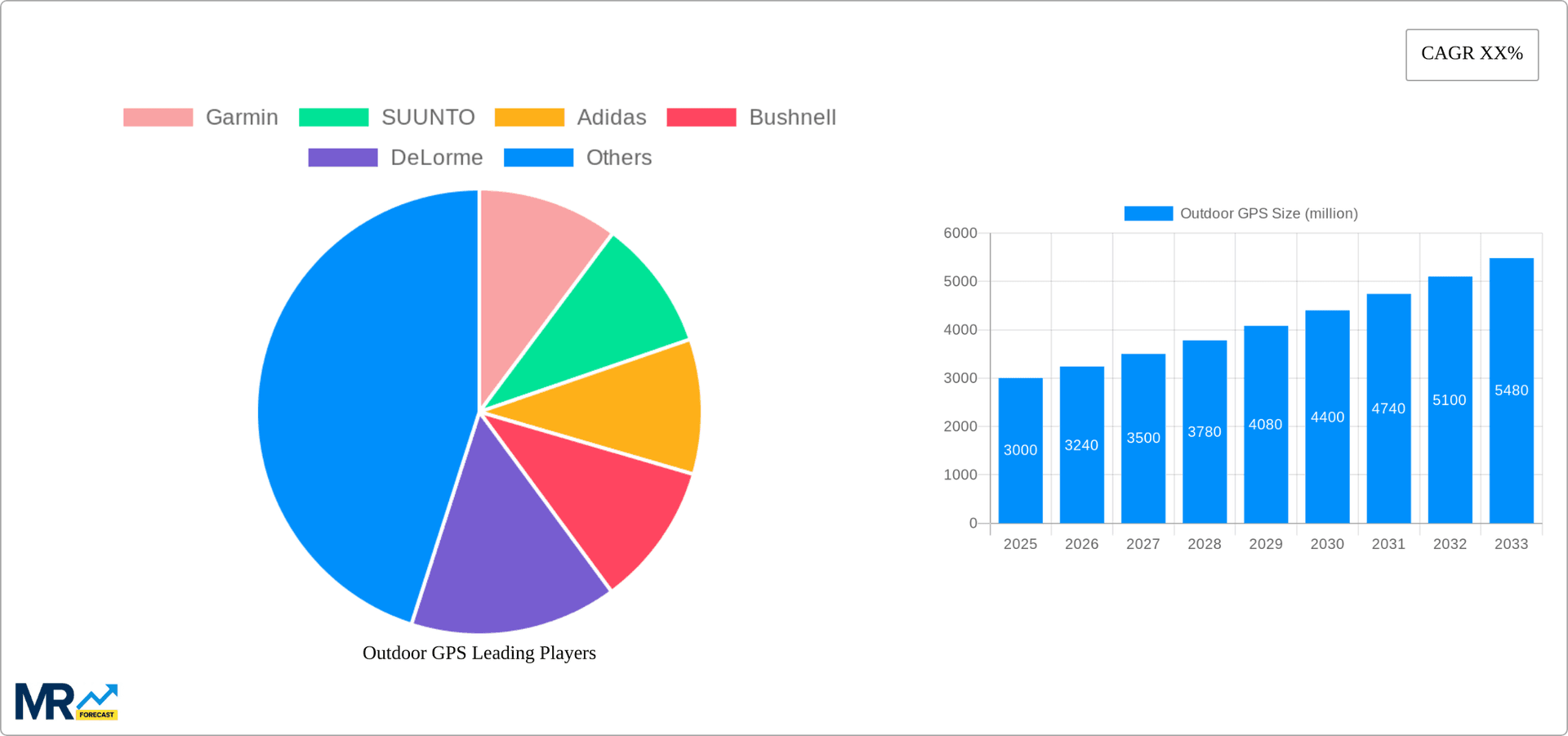

Key companies in the market include Garmin, SUUNTO, Adidas, Bushnell, DeLorme, Nike, Apple, Golife, Bryton, Samsung, SONY, Magellan, Fitbit, TomTom, Polar, Global Sat, Motorola, Gerk, Tomoon.

The market segments include Application, Type.

The market size is estimated to be USD XXX million as of 2022.

N/A

N/A

N/A

N/A

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3480.00, USD 5220.00, and USD 6960.00 respectively.

The market size is provided in terms of value, measured in million and volume, measured in K.

Yes, the market keyword associated with the report is "Outdoor GPS," which aids in identifying and referencing the specific market segment covered.

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

To stay informed about further developments, trends, and reports in the Outdoor GPS, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.