1. What is the projected Compound Annual Growth Rate (CAGR) of the OTC Headache Medicine?

The projected CAGR is approximately XX%.

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.

OTC Headache Medicine

OTC Headache MedicineOTC Headache Medicine by Type (/> NSAIDs, Acetaminophen, Others), by Application (/> Drug Stores, Hospitals), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2025-2033

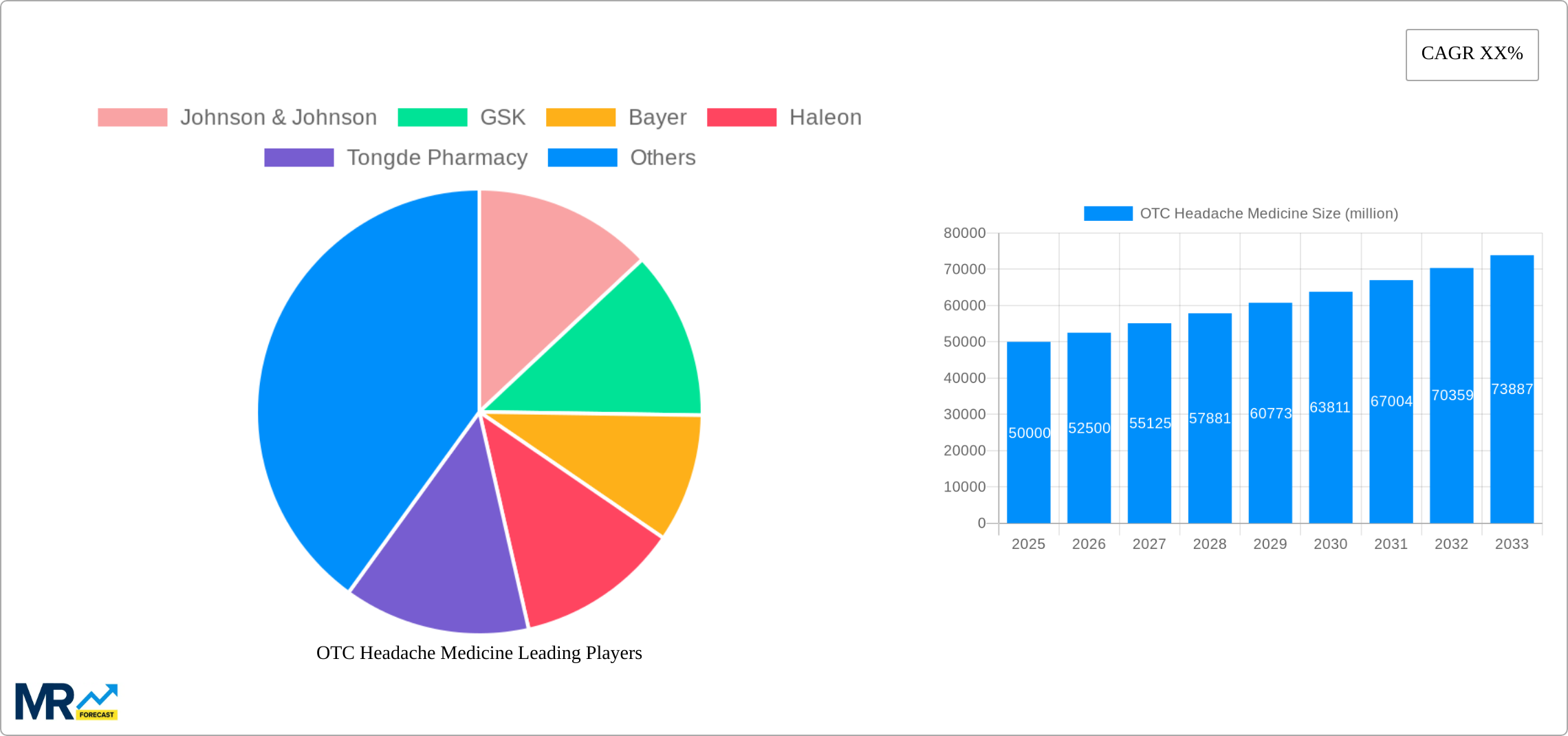

The over-the-counter (OTC) headache medicine market is a substantial and growing sector within the global pharmaceutical landscape. Driven by factors such as rising stress levels, increasing prevalence of headaches and migraines, and growing consumer awareness of self-care options, this market exhibits significant potential for expansion. The market's segmentation reveals a preference for NSAIDs (Nonsteroidal Anti-inflammatory Drugs) and Acetaminophen, reflecting established efficacy and consumer familiarity. Drug stores remain the primary distribution channel, underscoring the importance of retail partnerships in market penetration. However, the increasing adoption of telehealth and online pharmacies could reshape distribution strategies in the coming years. Major players like Johnson & Johnson, GSK, and Bayer hold significant market share, leveraging strong brand recognition and extensive research & development capabilities. Competition is likely to intensify with the rise of regional players, particularly in rapidly developing markets like China and India. Regulatory changes and growing concerns regarding the long-term effects of certain pain relievers present potential restraints. Future growth is projected to be influenced by technological advancements in pain management, the development of novel formulations, and personalized medicine approaches.

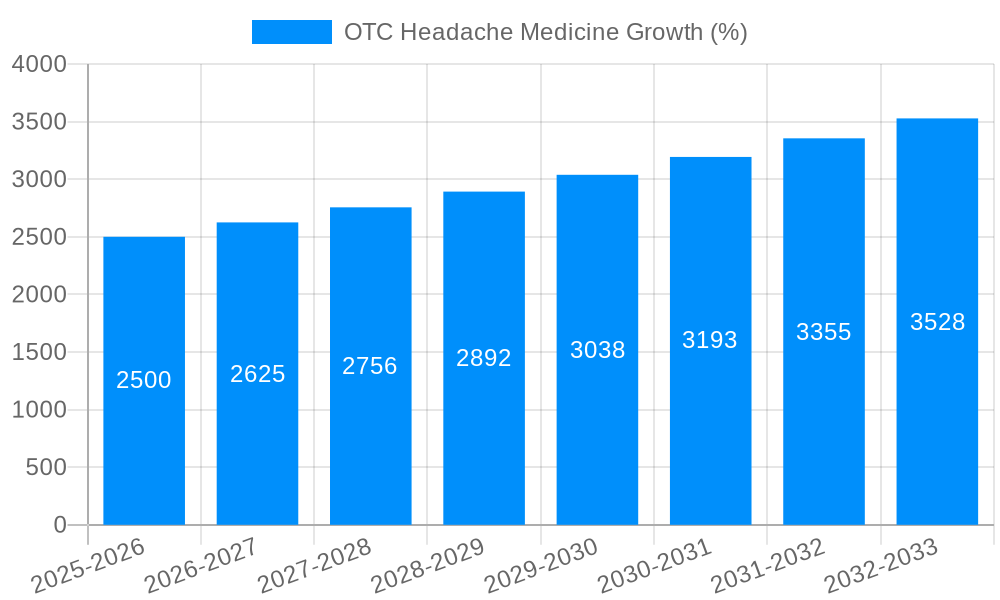

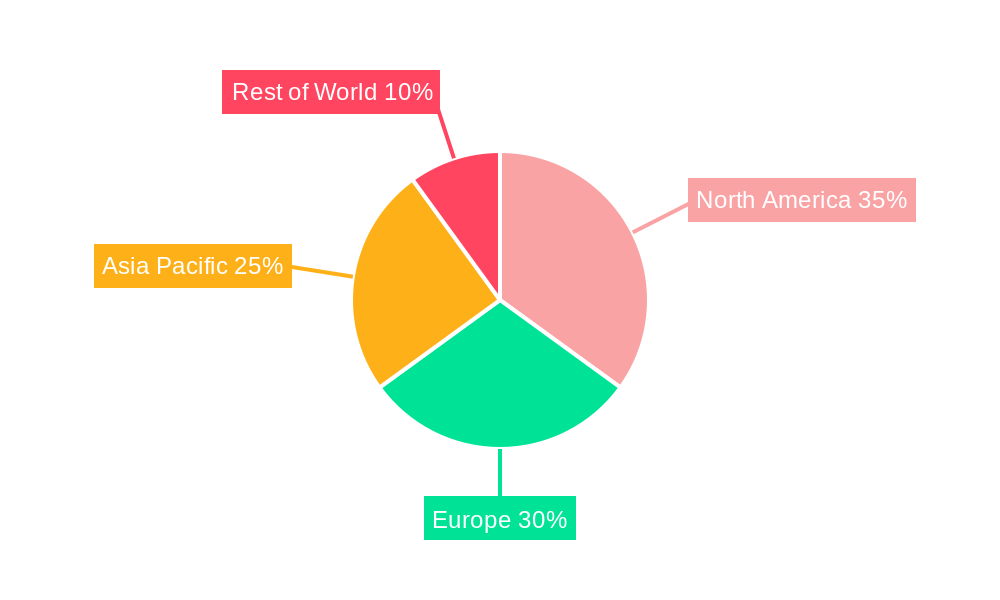

The forecast period (2025-2033) anticipates sustained growth, fueled by market penetration in emerging economies and an expanding elderly population, known to experience a higher incidence of headaches. However, pricing pressures, generic competition, and the emergence of alternative therapies pose challenges. Regional variations exist, with North America and Europe currently dominating the market, though Asia-Pacific is poised for considerable growth due to its large population and rising disposable incomes. Successful companies will need to adapt to shifting consumer preferences, invest in innovative product development, and build robust supply chains to meet growing global demand. A focus on product differentiation, including targeted formulations and convenient delivery systems, will be crucial for maintaining a competitive edge in this dynamic and expanding market. Understanding regional nuances and tailoring marketing strategies accordingly will also be vital for optimal growth.

The global over-the-counter (OTC) headache medicine market exhibited robust growth during the historical period (2019-2024), driven by rising prevalence of headaches and migraines across various demographics. The market size, estimated at XXX million units in 2025, is projected to reach XXX million units by 2033, showcasing a significant Compound Annual Growth Rate (CAGR) throughout the forecast period (2025-2033). This growth is fueled by increased awareness of self-medication options, readily available products in drugstores and supermarkets, and the rising disposable incomes in developing economies allowing greater access to healthcare products. However, the market isn't without its complexities. Variations in regulatory landscapes across different regions, coupled with fluctuating raw material prices and the increasing prevalence of generic alternatives, introduce challenges to consistent growth. Furthermore, the market demonstrates a clear preference for specific formulations, with NSAIDs and Acetaminophen remaining dominant, reflecting consumer familiarity and established efficacy. The increasing demand for convenient dosage forms, such as single-dose packets and effervescent tablets, points to changing consumer preferences that manufacturers must address to maintain market share. The market's growth is further segmented by the distribution channels, with drugstores currently holding the largest share, although online pharmacies are emerging as a significant disruptor, posing both opportunities and challenges for established players. Finally, industry developments concerning new formulations, improved efficacy, and enhanced safety profiles continuously reshape the market landscape, requiring constant adaptation and innovation from market leaders.

Several key factors are propelling the growth of the OTC headache medicine market. The soaring prevalence of headaches and migraines globally is a primary driver, affecting a significant portion of the adult population. This increasing prevalence, combined with busy lifestyles and reduced access to immediate medical care, has led to a greater reliance on readily available OTC pain relief options. The rising disposable incomes in emerging economies are significantly boosting market expansion, as more individuals can afford these previously inaccessible products. Furthermore, aggressive marketing campaigns by leading pharmaceutical companies effectively raise awareness of various headache medicine brands and their effectiveness, influencing consumer purchasing decisions. The convenience factor is also pivotal, with readily available products in various retail channels, including drugstores, supermarkets, and online pharmacies, making them easily accessible. Finally, continuous product innovation, including the development of new formulations with improved efficacy and fewer side effects, along with convenient dosage forms such as single-use packets, contributes significantly to market growth. The shift towards self-medication practices, particularly amongst younger demographics, also enhances market demand, adding another layer to the positive growth trajectory.

Despite the promising growth outlook, several challenges and restraints impact the OTC headache medicine market. The prevalence of generic alternatives poses a significant threat to brand-name medications, leading to price erosion and reduced profit margins for major players. Stringent regulatory environments, varying across different regions and countries, increase compliance costs and complexity for manufacturers seeking global market access. Fluctuations in the prices of raw materials, particularly key active pharmaceutical ingredients (APIs), directly affect production costs and overall profitability. Furthermore, concerns regarding potential side effects and drug interactions associated with certain OTC pain relievers, particularly long-term use of NSAIDs, lead to consumer apprehension and limit market growth potential. Growing awareness of natural and alternative treatment options for headaches also poses a threat, with consumers exploring herbal remedies and lifestyle changes to manage their pain. Finally, the emergence of online pharmacies, while presenting opportunities, also increases the risk of counterfeit products entering the market, requiring robust quality control measures from manufacturers and regulatory bodies.

Dominant Segment: Acetaminophen Acetaminophen-based OTC headache medicines consistently hold a significant market share due to their widespread availability, relatively low cost, and generally well-tolerated profile. The perceived safety profile of acetaminophen, compared to NSAIDs, contributes to its popularity amongst a broad consumer base. This segment is expected to experience substantial growth during the forecast period, driven by increasing affordability and growing consumer preference for readily available, effective, and relatively safe pain relief options. The continued focus on innovative formulations, including combination products containing acetaminophen with other active ingredients for enhanced relief, will fuel further growth.

Dominant Region/Country: North America North America, encompassing the United States and Canada, is expected to maintain its position as the dominant region in the OTC headache medicine market throughout the forecast period. High healthcare expenditure, a large aging population prone to headaches, and widespread availability of OTC medications contribute to this dominance. The strong presence of major pharmaceutical companies and significant marketing investments in the region further solidify North America's leading position. While other regions are exhibiting substantial growth, North America's established market infrastructure and well-developed healthcare systems provide a foundation for continued market leadership. The increasing adoption of self-medication practices and rising awareness of headache management solutions further contribute to the strong performance of the North American market. However, increasing competition from generic products and a growing emphasis on preventative healthcare measures may slightly moderate growth rates compared to developing economies.

In summary: While the global market demonstrates broad growth, the Acetaminophen segment and North America are expected to dominate due to strong existing market fundamentals and favorable conditions for continued expansion.

Several factors will accelerate the growth of the OTC headache medicine market. These include the continued development of innovative formulations with enhanced efficacy and reduced side effects, the expansion of distribution channels through online pharmacies and increased availability in developing countries, and targeted marketing campaigns educating consumers on safe and effective headache management. Furthermore, the growing prevalence of chronic headaches and migraines, coupled with increased disposable income globally, will fuel the demand for effective OTC solutions. Finally, proactive government support and healthcare initiatives promoting self-care solutions will further enhance market expansion.

This report provides a comprehensive overview of the OTC headache medicine market, including detailed market sizing, segmentation, and forecasting. The report analyzes major industry trends, drivers, restraints, and growth catalysts and also profiles key players and their strategic initiatives. The findings can provide valuable insights for stakeholders across the pharmaceutical industry and inform strategic decision-making.

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of XX% from 2019-2033 |

| Segmentation |

|

Note*: In applicable scenarios

Primary Research

Secondary Research

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

The projected CAGR is approximately XX%.

Key companies in the market include Johnson & Johnson, GSK, Bayer, Haleon, Tongde Pharmacy, Huazhong Pharmaceutical, Weisen Pharmaceutical, DIAO GROUP, Jiheng Pharmaceutical, Dirui Pharmaceutical, .

The market segments include Type, Application.

The market size is estimated to be USD XXX million as of 2022.

N/A

N/A

N/A

N/A

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4480.00, USD 6720.00, and USD 8960.00 respectively.

The market size is provided in terms of value, measured in million.

Yes, the market keyword associated with the report is "OTC Headache Medicine," which aids in identifying and referencing the specific market segment covered.

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

To stay informed about further developments, trends, and reports in the OTC Headache Medicine, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.