1. What is the projected Compound Annual Growth Rate (CAGR) of the OTC Consumer Healthcare?

The projected CAGR is approximately XX%.

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.

OTC Consumer Healthcare

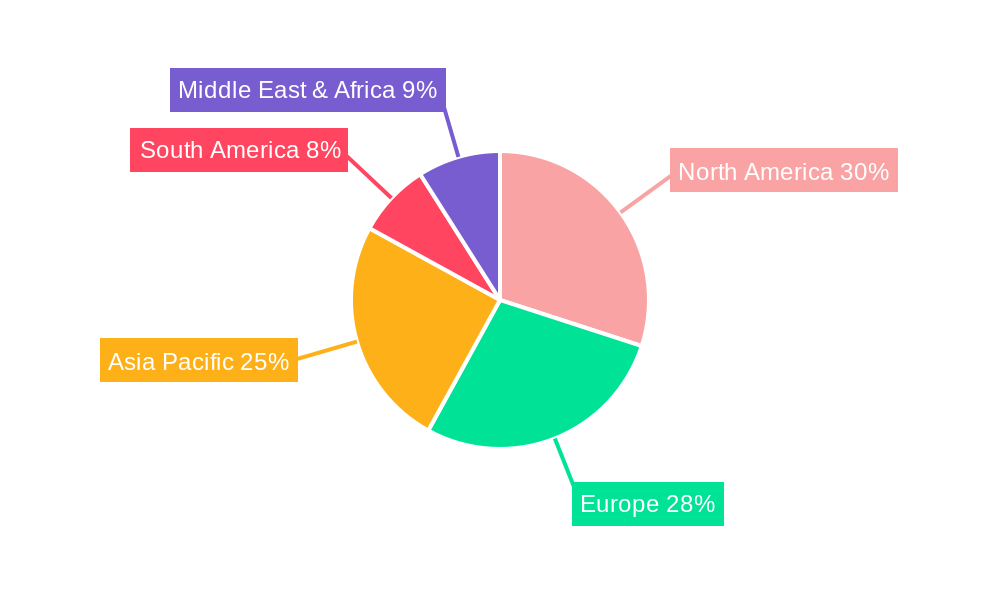

OTC Consumer HealthcareOTC Consumer Healthcare by Type (/> OTC Pharmaceuticals, Dietary Supplement), by Application (/> Pharmacy or Drug Stores, Specialty Stores, Online Retailers), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2025-2033

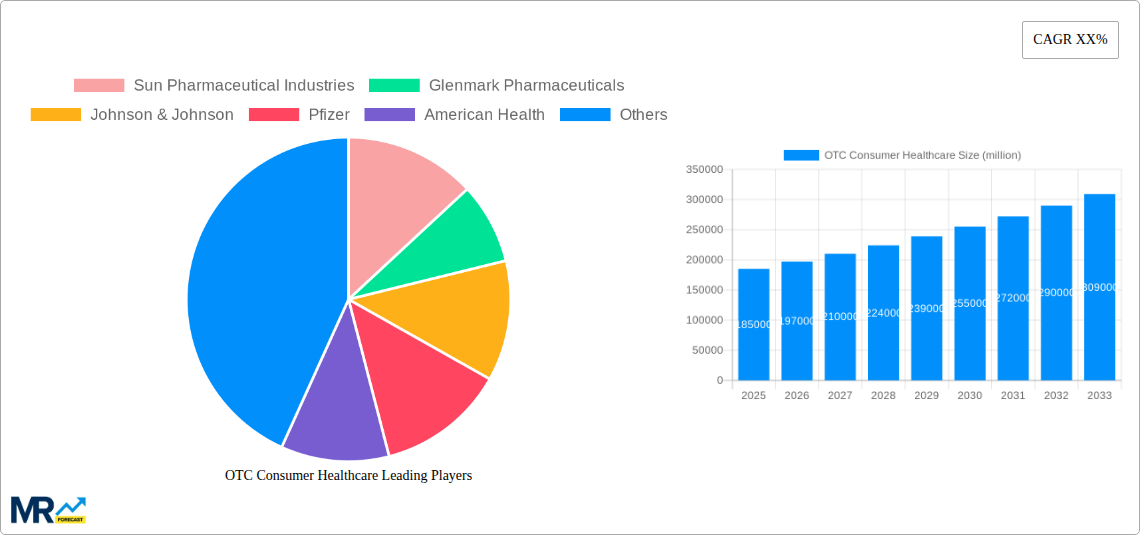

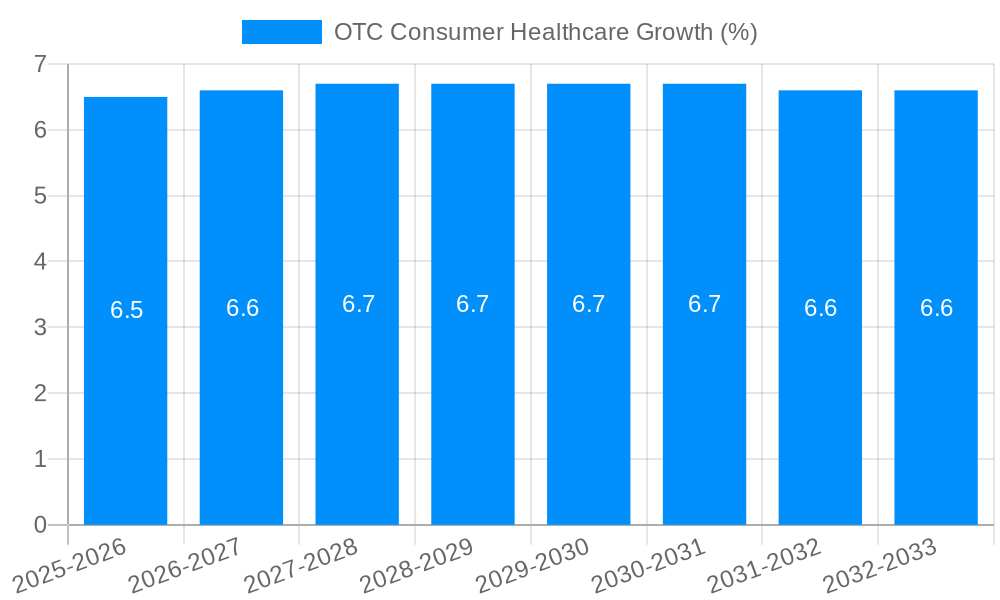

The global OTC Consumer Healthcare market is poised for robust expansion, projected to reach an estimated market size of approximately USD 185 billion by 2025, with a projected Compound Annual Growth Rate (CAGR) of around 6.5% over the forecast period of 2025-2033. This substantial growth is fueled by an increasing consumer focus on preventative healthcare, a rising prevalence of chronic and lifestyle-related ailments, and a growing preference for self-medication due to convenience and cost-effectiveness. The demand for over-the-counter (OTC) pharmaceuticals and dietary supplements is particularly strong, as consumers actively seek accessible solutions for common health concerns and to enhance their overall well-being. The aging global population also contributes significantly, as older demographics often require a greater number of self-managed health products. Furthermore, innovative product development, including the introduction of more targeted and efficacious formulations, alongside expanding distribution channels like online retail, is expected to propel market growth. Emerging economies, with their burgeoning middle classes and increasing healthcare awareness, represent significant untapped potential, further underscoring the positive outlook for this dynamic sector.

The market's expansion is underpinned by several key drivers. The increasing disposable income in many regions allows consumers to invest more in their health and wellness, leading to higher spending on OTC products. A heightened awareness of health and fitness, promoted by various public health campaigns and accessible information online, encourages proactive health management. Regulatory shifts that facilitate the broader availability of certain medications over-the-counter also play a crucial role. However, the market faces some restraints, including stringent regulatory frameworks in certain regions that can slow down product approvals and market entry. Intense competition among established players and the emergence of private label brands can also put pressure on pricing. Nevertheless, the overarching trend towards consumer empowerment in healthcare decision-making, coupled with continuous innovation in product offerings and delivery systems, is expected to largely outweigh these challenges, ensuring sustained growth and market opportunities for key players.

This report provides an in-depth analysis of the global OTC Consumer Healthcare market, offering a comprehensive overview of its current landscape and future trajectory. Spanning the Study Period of 2019-2033, with 2025 serving as both the Base Year and Estimated Year, this research meticulously examines the Historical Period of 2019-2024 to forecast trends and opportunities through 2033. The report delves into the intricate dynamics of market segmentation, including Type (e.g., OTC Pharmaceuticals, Dietary Supplements) and Application (e.g., Pharmacy or Drug Stores, Specialty Stores, Online Retailers), while also highlighting critical Industry Developments. Our extensive research encompasses a wide array of leading companies, including but not limited to Sun Pharmaceutical Industries, Glenmark Pharmaceuticals, Johnson & Johnson, Pfizer, American Health, Abbott Laboratories, GlaxoSmithKline, Sanofi, Piramal Enterprises, Boehringer Ingelheim, Bayer, Teva Pharmaceutical Industries, Ipsen SA, Koninklijke DSM, Reckitt Benckiser, and Lonza Group, providing a holistic perspective on the competitive ecosystem. We project significant unit sales across various segments, for instance, the OTC Pharmaceuticals segment alone is anticipated to witness sales in the hundreds of million units by 2033. Similarly, Dietary Supplements are expected to see robust growth, reaching over 500 million units in sales during the forecast period. The burgeoning Online Retailers segment for healthcare products is projected to surpass 800 million units in transactions by 2033, underscoring the shift in consumer purchasing habits.

XXX The global Over-the-Counter (OTC) Consumer Healthcare market is undergoing a significant transformation, driven by an increasing consumer awareness of preventative health and wellness, coupled with a growing preference for self-medication for minor ailments. This shift is particularly pronounced among the aging global population, who are increasingly seeking convenient and accessible solutions for managing chronic conditions and age-related health concerns. The demand for vitamins, minerals, and supplements (VMS) is experiencing an unprecedented surge, fueled by a broader understanding of their role in immune support, energy enhancement, and overall well-being. For example, the VMS segment, a key component of the Dietary Supplement category, is projected to see unit sales exceeding 300 million units annually within the forecast period. Furthermore, the market is witnessing a growing convergence of traditional pharmaceutical products and nutritional supplements, blurring the lines between the two as consumers seek holistic health solutions. This trend is evidenced by the increasing number of products positioned for both therapeutic benefits and nutritional enhancement. E-commerce platforms have become pivotal channels, revolutionizing accessibility and convenience. The Online Retailers segment, encompassing both dedicated health platforms and general marketplaces, is expected to witness exponential growth, potentially accounting for over 40% of total OTC sales by 2033, with unit sales projected to cross the 800 million mark. This digital shift is facilitated by advancements in logistics and a growing consumer trust in online pharmaceutical purchases, especially for repeat prescriptions and readily available over-the-counter medications. The rising disposable incomes in emerging economies are also contributing to market expansion, as a larger segment of the population can now afford these health products. Product innovation, particularly in areas like personalized nutrition and targeted symptom relief, is another key trend. Manufacturers are investing heavily in research and development to offer more specialized and effective OTC solutions, catering to a diverse range of consumer needs. The demand for natural and organic ingredients is also on the rise, pushing companies to reformulate products and explore new sourcing strategies, aligning with the growing consumer consciousness around sustainability and clean labels. The market is also being shaped by an increasing focus on convenience, with the development of easy-to-use formats like dissolvable tablets, chewables, and ready-to-drink supplements, further driving unit sales across various product categories. The penetration of these convenient formats is expected to contribute significantly to the overall volume growth in the coming years.

The OTC Consumer Healthcare market is being propelled by a confluence of powerful forces, primarily stemming from evolving consumer attitudes towards health and wellness. There is a palpable shift from a reactive approach to healthcare to a proactive one, with individuals actively seeking to prevent illnesses and maintain optimal health. This growing health consciousness is directly translating into increased demand for self-care solutions, including dietary supplements and readily available remedies for common ailments. The escalating healthcare costs and the desire to reduce reliance on physician consultations for minor issues further incentivize the adoption of OTC products. Consumers are increasingly empowered with information, thanks to the internet and social media, enabling them to research symptoms and available treatment options independently. This accessibility of knowledge fosters confidence in self-management. Moreover, the burgeoning elderly population globally presents a substantial market segment that requires ongoing management of chronic conditions and age-related health concerns. OTC products offer a convenient and affordable means for this demographic to manage their well-being. The rapid expansion of e-commerce and digital platforms has revolutionized accessibility, allowing consumers to purchase OTC products anytime, anywhere, significantly boosting sales volumes. The convenience offered by online retailers, coupled with competitive pricing and a wider product selection, is a major growth driver, projecting unit sales in this segment to exceed 800 million units by 2033. Furthermore, supportive government policies in many regions, aimed at promoting self-care and reducing the burden on public healthcare systems, also contribute positively to the market's expansion. The sustained innovation from key players, introducing new formulations and delivery systems, also plays a crucial role in attracting and retaining consumers, driving both value and volume growth.

Despite its robust growth, the OTC Consumer Healthcare market faces several challenges and restraints that could impede its full potential. One significant hurdle is the stringent regulatory environment governing pharmaceutical products, even those sold over-the-counter. Obtaining approvals for new formulations or making label claims requires extensive clinical trials and adherence to strict guidelines, which can be time-consuming and costly for manufacturers. This can slow down the introduction of innovative products into the market, impacting growth projections. Another restraint is the increasing consumer skepticism and misinformation circulating online, particularly regarding the efficacy and safety of certain supplements and remedies. Differentiating credible products from those making unsubstantiated claims is a constant battle for both manufacturers and consumers, potentially leading to market confusion and hesitation. Competition within the market is also fierce, with numerous established players and emerging brands vying for market share. This intense competition can lead to price wars and reduced profit margins, especially for generic OTC products. The reliance on traditional distribution channels, such as brick-and-mortar pharmacies, can also be a limitation in certain regions, especially where access to these stores is restricted. While online retail is booming, the digital divide in some areas means that a portion of the population still faces challenges in accessing these platforms. Furthermore, the economic sensitivity of discretionary spending can impact the OTC market. During economic downturns, consumers may cut back on non-essential purchases, including certain dietary supplements, affecting overall unit sales. The perception of OTC products as secondary to prescription medications for serious conditions can also be a restraint, limiting their uptake for more complex health issues, even if they offer supplementary benefits. The evolving landscape of health insurance and its coverage for OTC products also plays a role, as shifts in policy can influence consumer spending patterns.

Several key regions and segments are poised to dominate the OTC Consumer Healthcare market in the coming years, driven by a combination of demographic, economic, and behavioral factors.

Dominant Regions & Countries:

Dominant Segments:

The OTC Consumer Healthcare industry is propelled by several key growth catalysts. The increasing global health consciousness and a proactive approach to wellness are driving demand for self-care solutions. Escalating healthcare costs and a desire to reduce reliance on prescription medications for minor ailments further encourage self-medication. The rapidly expanding elderly population globally requires ongoing management of chronic conditions, fueling demand for accessible OTC products. Furthermore, the growing penetration of e-commerce and digital platforms is revolutionizing accessibility and convenience, significantly boosting sales volumes. Supportive government initiatives promoting self-care also contribute positively to market expansion.

This report offers a comprehensive look into the evolving OTC Consumer Healthcare landscape, providing invaluable insights for stakeholders. We delve into the key trends shaping consumer behavior, such as the growing emphasis on preventative health and the preference for self-care. The report identifies the driving forces behind market expansion, including rising disposable incomes, an aging global population, and the convenience offered by digital platforms. It also critically examines the challenges and restraints that could impede growth, such as regulatory hurdles and market competition. Our detailed regional analysis highlights the dominant markets and their specific growth drivers, while a deep dive into segment-specific performance, including OTC Pharmaceuticals and Dietary Supplements, offers a granular view. The report also emphasizes the transformative impact of Online Retailers as a key application segment. Furthermore, it forecasts significant unit sales across various product categories and distribution channels, providing a data-driven outlook for the years ahead, making it an essential resource for strategic decision-making.

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of XX% from 2019-2033 |

| Segmentation |

|

Note*: In applicable scenarios

Primary Research

Secondary Research

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

The projected CAGR is approximately XX%.

Key companies in the market include Sun Pharmaceutical Industries, Glenmark Pharmaceuticals, Johnson & Johnson, Pfizer, American Health, Abbott Laboratories, GlaxoSmithKline, Sanofi, Piramal Enterprises, Boehringer Ingelheim, Bayer, Teva Pharmaceutical Industries, Ipsen SA, Koninklijke DSM, Reckitt Benckiser, Lonza Group.

The market segments include Type, Application.

The market size is estimated to be USD XXX million as of 2022.

N/A

N/A

N/A

N/A

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4480.00, USD 6720.00, and USD 8960.00 respectively.

The market size is provided in terms of value, measured in million.

Yes, the market keyword associated with the report is "OTC Consumer Healthcare," which aids in identifying and referencing the specific market segment covered.

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

To stay informed about further developments, trends, and reports in the OTC Consumer Healthcare, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.