1. What is the projected Compound Annual Growth Rate (CAGR) of the Orthopedics & Trauma Implants?

The projected CAGR is approximately 5.6%.

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.

Orthopedics & Trauma Implants

Orthopedics & Trauma ImplantsOrthopedics & Trauma Implants by Type (Reconstructive Joint Replacements, Orthobiologics, Trauma Implants), by Application (Hospitals, Ambulatory Settings, Clinics), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2025-2033

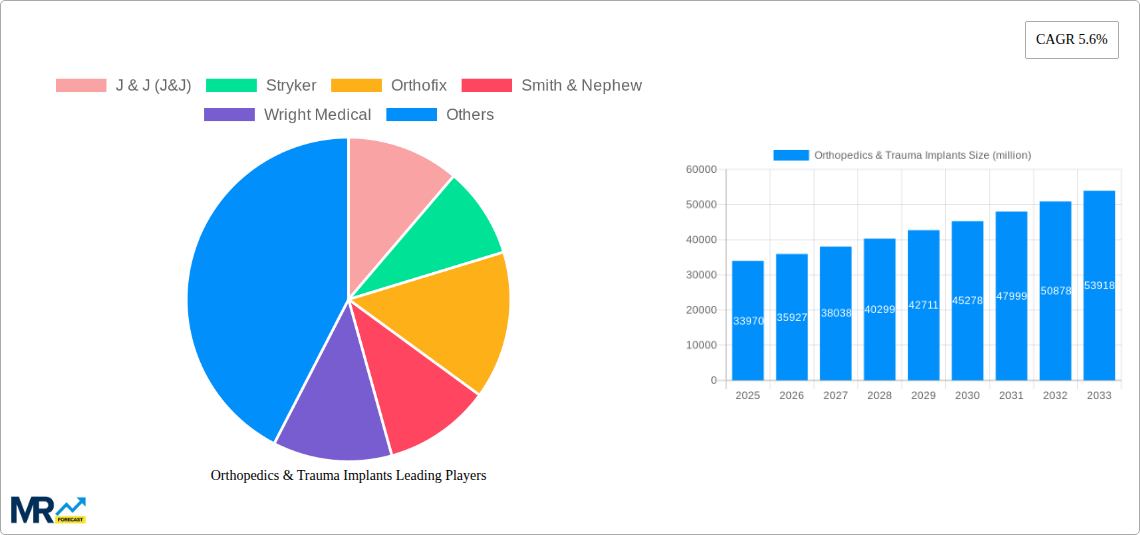

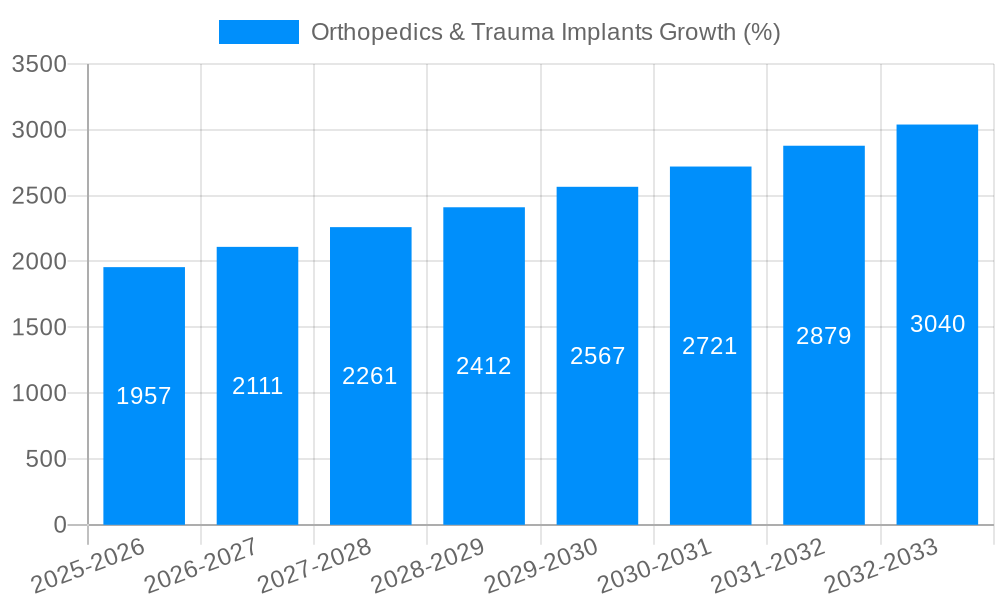

The global orthopedics and trauma implants market, valued at $33,970 million in 2025, is projected to experience robust growth, driven by a rising geriatric population, increasing prevalence of osteoarthritis and other musculoskeletal disorders, and advancements in implant technology. The 5.6% CAGR from 2019-2033 indicates a significant expansion, with the market expected to exceed $55,000 million by 2033. This growth is fueled by the development of minimally invasive surgical techniques, personalized implants, and improved implant materials that offer enhanced biocompatibility and durability. Technological innovations such as 3D printing and robotic surgery are further accelerating market expansion, allowing for more precise and efficient procedures. The increasing adoption of advanced imaging technologies for accurate diagnosis and surgical planning also contributes to the market's growth trajectory. However, factors such as high costs associated with implants and procedures, along with potential complications and risks associated with surgery, can act as restraints.

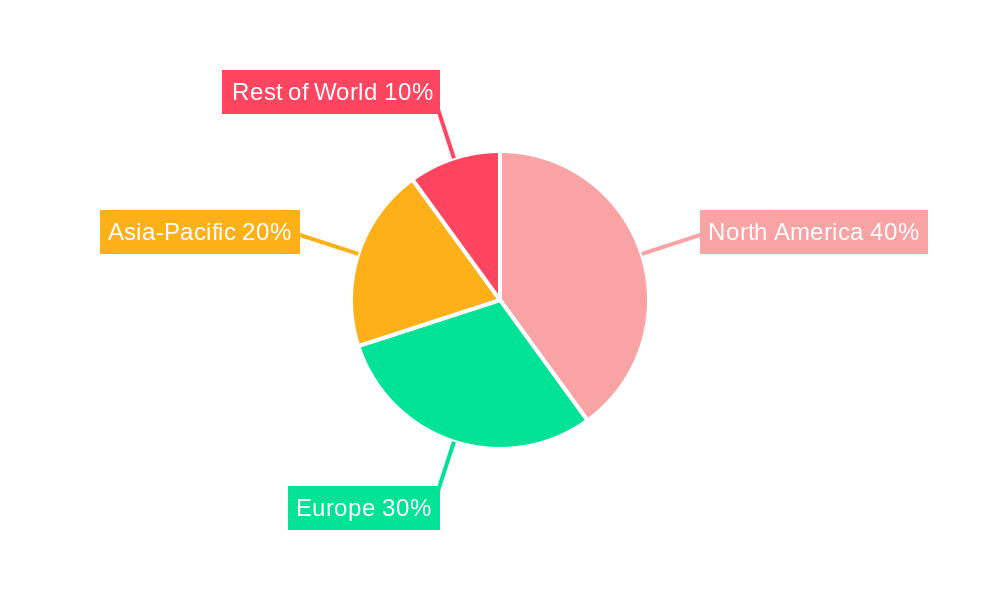

The market is dominated by key players such as Johnson & Johnson, Stryker, Zimmer Biomet, and Smith & Nephew, who are continuously engaged in research and development to improve their product portfolio. These companies are focused on developing innovative implants, expanding their geographic reach, and forging strategic partnerships to solidify their market position. The market is segmented by product type (hip implants, knee implants, trauma implants, etc.), material type (metal, ceramic, polymer), and end-user (hospitals, ambulatory surgical centers). Regional variations exist with North America and Europe currently holding significant market shares due to advanced healthcare infrastructure and high disposable incomes. However, emerging markets in Asia-Pacific and Latin America show promising growth potential owing to increasing healthcare expenditure and rising awareness about orthopedic solutions.

The global orthopedics & trauma implants market is experiencing robust growth, projected to surpass 100 million units by 2033. This expansion is fueled by a confluence of factors, including an aging global population, rising incidence of orthopedic conditions like osteoarthritis and osteoporosis, increasing trauma cases due to accidents and sports injuries, and advancements in implant technology leading to improved patient outcomes and longer implant lifespans. The market's growth is further spurred by the increasing affordability and accessibility of advanced surgical procedures, particularly in developing economies. However, this growth is not uniform across all segments. While certain segments, like hip and knee replacements, show consistent high demand, the adoption rate of newer, minimally invasive techniques and innovative implant materials varies geographically and is influenced by healthcare infrastructure and reimbursement policies. The market is also witnessing a significant shift towards value-based healthcare, pushing manufacturers to focus on cost-effective solutions and demonstrating improved long-term clinical efficacy. Competition is fierce, with established players constantly innovating to maintain their market share and newer entrants challenging the status quo with disruptive technologies and business models. The market's dynamic nature calls for strategic partnerships, acquisitions, and a keen understanding of evolving patient needs and regulatory landscapes to ensure long-term success. Overall, the forecast reflects a positive outlook, with substantial opportunities for growth and innovation within the orthopedics & trauma implants sector.

Several factors contribute significantly to the growth trajectory of the orthopedics and trauma implants market. The aging global population is a primary driver, as older individuals are more susceptible to age-related orthopedic conditions like osteoarthritis and osteoporosis, increasing the demand for implants. The rising incidence of trauma cases, resulting from accidents, sports injuries, and violence, also fuels market growth, particularly in regions with high road traffic accidents or higher rates of violent crime. Technological advancements play a crucial role; innovations in materials science have led to the development of stronger, lighter, and biocompatible implants that offer enhanced durability and reduced complications. Minimally invasive surgical techniques are becoming increasingly popular, resulting in faster recovery times and reduced hospital stays, thereby increasing patient satisfaction and driving demand. The expanding healthcare infrastructure, particularly in developing nations, is also contributing to increased accessibility of orthopedic surgeries. Finally, favorable reimbursement policies and insurance coverage in many countries further support the market’s growth. The convergence of these factors is propelling substantial market expansion throughout the forecast period.

Despite the considerable growth potential, the orthopedics and trauma implants market faces significant challenges. High costs associated with implants and surgical procedures are a major barrier, particularly in resource-constrained settings. Stringent regulatory requirements and lengthy approval processes can delay the introduction of new products and technologies into the market, hindering innovation. The risk of implant failure, infection, and other complications remains a concern, impacting patient outcomes and potentially leading to legal issues and reputational damage for manufacturers. The increasing prevalence of antibiotic-resistant infections poses a significant threat, demanding the development of new strategies to prevent infection and manage antibiotic resistance. Furthermore, intense competition among established players and the emergence of new entrants create a highly competitive landscape, putting pressure on pricing and profit margins. Finally, the rising focus on value-based healthcare necessitates the demonstration of improved clinical outcomes and cost-effectiveness, adding to the challenges faced by manufacturers in this dynamic market.

The paragraph below further elaborates on this. The substantial growth in the hip and knee replacement market is driven by the high prevalence of osteoarthritis, particularly in aging populations. The success rate and improved quality of life associated with these procedures continue to drive demand. The trauma segment, while experiencing growth, faces complexities related to the variability of injury types and the need for customized solutions. The Asia-Pacific region’s rapid expansion presents both opportunities and challenges. While its large aging population and rising middle class fuel demand, diverse healthcare infrastructure and affordability create variations in market penetration and growth trajectories across different countries within the region. North America and Europe, while mature markets, maintain significant shares driven by strong healthcare systems and high adoption rates of advanced technologies.

The orthopedics & trauma implants industry is propelled by several key factors. Advancements in biomaterials science are leading to stronger, lighter, and more biocompatible implants, improving patient outcomes and reducing complications. Minimally invasive surgical techniques are gaining popularity, allowing for shorter hospital stays and faster recovery times, creating increased patient demand. The rising prevalence of chronic diseases like osteoarthritis and osteoporosis among aging populations in developed and developing nations globally is directly fueling the demand for replacement surgeries. The increasing awareness of these conditions and improved access to healthcare are further contributing to the market's growth.

This report provides a comprehensive analysis of the orthopedics & trauma implants market, covering historical data, current market trends, future projections, and key players. The report meticulously assesses market drivers, challenges, and opportunities, offering valuable insights for stakeholders seeking to understand and navigate this dynamic industry. The detailed segmentation analysis allows for a granular understanding of the various sub-markets within the broader sector. The report's extensive coverage includes key market players, their strategies, and recent developments. This report serves as a crucial resource for strategic decision-making in the orthopedics & trauma implants market.

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 5.6% from 2019-2033 |

| Segmentation |

|

Note*: In applicable scenarios

Primary Research

Secondary Research

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

The projected CAGR is approximately 5.6%.

Key companies in the market include J & J (J&J), Stryker, Orthofix, Smith & Nephew, Wright Medical, Zimmer Biomet, Lima Corporate, Aap Implantate, B Braun, Medtronic, MicroPort, Globus Medical, NuVasive, Tornier, .

The market segments include Type, Application.

The market size is estimated to be USD 33970 million as of 2022.

N/A

N/A

N/A

N/A

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3480.00, USD 5220.00, and USD 6960.00 respectively.

The market size is provided in terms of value, measured in million and volume, measured in K.

Yes, the market keyword associated with the report is "Orthopedics & Trauma Implants," which aids in identifying and referencing the specific market segment covered.

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

To stay informed about further developments, trends, and reports in the Orthopedics & Trauma Implants, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.