1. What is the projected Compound Annual Growth Rate (CAGR) of the Orthopedic Casts and Splints?

The projected CAGR is approximately XX%.

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.

Orthopedic Casts and Splints

Orthopedic Casts and SplintsOrthopedic Casts and Splints by Application (Hospital, Clinic, Others, World Orthopedic Casts and Splints Production ), by Type (Casts, Splints, World Orthopedic Casts and Splints Production ), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2026-2034

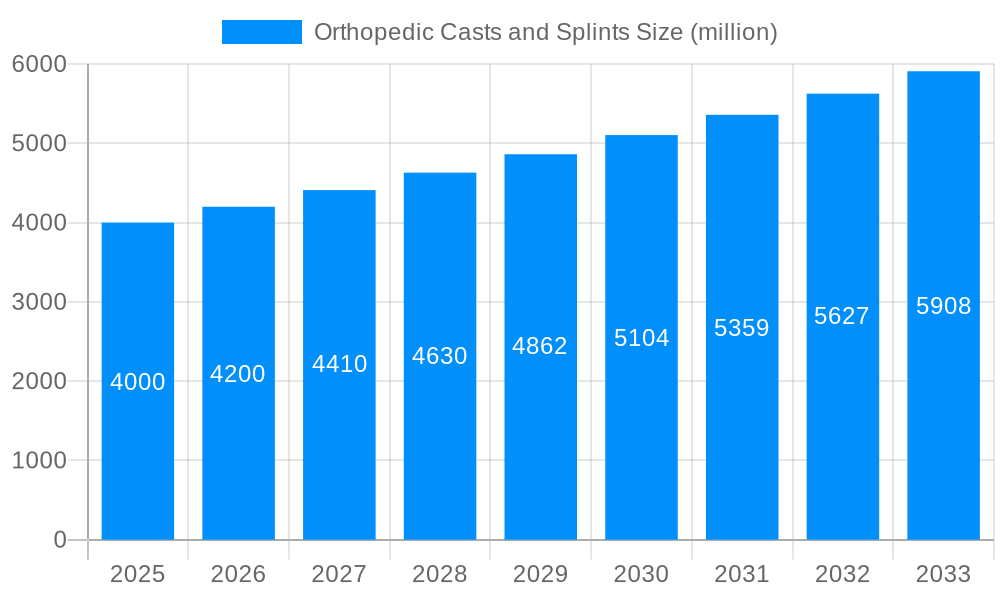

The global orthopedic casts and splints market is experiencing robust growth, driven by the rising prevalence of musculoskeletal injuries and fractures, an aging global population requiring more orthopedic care, and advancements in materials science leading to lighter, more comfortable, and functional devices. The market's expansion is further fueled by increasing surgical procedures and the rising demand for effective post-operative rehabilitation solutions. While precise market sizing for 2025 requires specific data points, considering a typical CAGR in the medical device sector (let's assume 5-7%), a reasonable estimate for the 2025 market size could fall between $3.5 billion and $4.5 billion USD, based on the available study period (2019-2033) and assuming the Base Year (2025) is near the midpoint of observed growth. Key players like 3M, BSN medical, and Stryker are significantly contributing to market growth through their diverse product portfolios and technological innovations.

However, the market faces certain restraints, including the high cost of advanced orthopedic casts and splints, potential complications associated with prolonged immobilization, and the availability of alternative treatment methods. The ongoing focus on minimally invasive surgical techniques and the development of biocompatible and biodegradable materials are expected to shape the future trajectory of the market. Segmentation within the market is likely influenced by material type (e.g., plaster, fiberglass, synthetic), product type (casts vs. splints), and end-user (hospitals, clinics, rehabilitation centers). Regional differences in healthcare infrastructure and spending will also determine market penetration across North America, Europe, Asia-Pacific, and other regions. Sustained innovation and improved patient outcomes will remain crucial for continued expansion in this vital medical technology sector.

The global orthopedic casts and splints market exhibited robust growth throughout the historical period (2019-2024), exceeding 100 million units annually by 2024. This expansion is projected to continue throughout the forecast period (2025-2033), driven by several factors. Increasing incidence of fractures and other musculoskeletal injuries, fueled by an aging global population and rising rates of sports-related injuries, is a major contributor. Furthermore, advancements in material science have led to the development of lighter, more comfortable, and more effective casts and splints, enhancing patient compliance and recovery times. The shift towards minimally invasive surgical procedures, while seemingly contradictory, also contributes positively. While reducing the need for extensive casting in some instances, minimally invasive techniques often still require post-operative immobilization, albeit for shorter durations, sustaining demand. The growing preference for outpatient procedures and the increasing adoption of advanced imaging technologies for accurate diagnosis further bolster market growth. The market is also experiencing a notable shift towards specialized casts and splints, tailored to specific injuries and patient needs, reflecting a trend towards personalized medicine. This segment represents a significant opportunity for growth, particularly in the high-value end of the market. The estimated market size in 2025 is projected to surpass 120 million units, indicating a substantial and sustained growth trajectory.

Several key factors are propelling the growth of the orthopedic casts and splints market. The aging global population is a primary driver, as older individuals are more susceptible to fractures and other bone-related injuries. This demographic shift is particularly impactful in developed nations with a larger elderly population. The rising prevalence of sports-related injuries, particularly among young adults and adolescents, contributes significantly to market demand. The increasing popularity of contact sports and participation in physically demanding activities fuels this trend. Technological advancements in materials science are also playing a pivotal role. The development of lighter, more breathable, and more durable materials is improving patient comfort and compliance, leading to better treatment outcomes and increased demand. Furthermore, the ongoing innovations in cast and splint designs—including the introduction of functional casts and splints that allow for limited movement—are driving market expansion. Finally, the increasing awareness of the importance of proper fracture management and rehabilitation, coupled with better access to healthcare in many regions, contributes to the overall growth of this market segment.

Despite the significant growth potential, the orthopedic casts and splints market faces several challenges. The high cost of advanced materials and specialized casts and splints can be a barrier to access, particularly in low- and middle-income countries. This price sensitivity limits market penetration in certain regions. Furthermore, potential complications associated with cast application and immobilization, such as skin irritation, pressure sores, and nerve damage, can deter patients and create challenges for healthcare providers. The increasing demand for more personalized and customized solutions adds complexity to manufacturing and distribution processes, potentially impacting cost-effectiveness. Stringent regulatory approvals and compliance requirements for new materials and designs can also pose a significant hurdle for manufacturers seeking to launch innovative products. Lastly, the ongoing development and adoption of alternative treatment methods, such as minimally invasive surgical techniques, may partially offset the demand for traditional casting in certain situations.

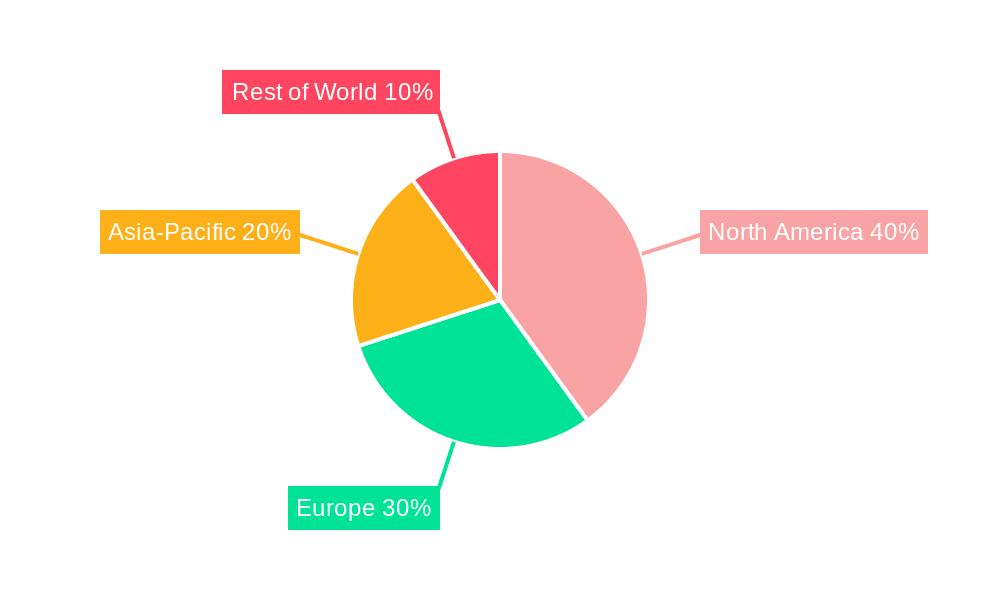

North America: The North American market is expected to hold a significant share due to high healthcare expenditure, advanced healthcare infrastructure, and a relatively large aging population. The region's high rate of sports-related injuries also contributes significantly to market demand.

Europe: Similar to North America, Europe demonstrates robust growth due to a sizeable aging population and well-established healthcare systems. However, differing regulatory landscapes across European nations may influence market dynamics.

Asia-Pacific: This region is experiencing rapid growth, driven by increasing healthcare expenditure, a large and growing population, and a rise in the prevalence of musculoskeletal injuries. However, challenges remain concerning healthcare infrastructure and accessibility in certain areas.

Segments: The segments of the market driven by advanced materials (e.g., lightweight composites, fiberglass) and specialized casts and splints (e.g., those with integrated therapeutic features) are projected to exhibit the highest growth rates. These segments cater to increasing demand for improved patient comfort and more effective treatment outcomes. The segment of functional casts and splints, allowing for controlled movement during healing, shows significant potential for growth, as these offer improved patient experience and recovery.

The dominance of these regions and segments is predicted to continue throughout the forecast period, driven by the factors outlined above, although emerging markets will show increasing growth. The shift toward advanced materials and specialized casts represents a key growth catalyst, with companies focusing on innovation in this area.

The orthopedic casts and splints market is propelled by several growth catalysts. Technological advancements, resulting in lighter, stronger, and more comfortable materials, are improving patient experience and compliance. The increasing prevalence of sports injuries and accidents, coupled with an aging global population prone to fractures, fuels demand. Furthermore, the rise of minimally invasive surgeries, although seemingly contradictory, actually sustains demand for post-operative immobilization. Finally, growing awareness of fracture management and rehabilitation improves treatment outcomes, further stimulating market expansion.

This report provides a detailed analysis of the orthopedic casts and splints market, covering market size, segmentation, trends, growth drivers, challenges, and key players. It offers comprehensive insights into the market dynamics and future outlook, enabling stakeholders to make informed strategic decisions. The report includes historical data (2019-2024), estimated data (2025), and forecast data (2025-2033), providing a complete view of the market's trajectory. The information presented encompasses various market segments, regional breakdowns, and detailed profiles of leading companies within the orthopedic casts and splints industry.

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of XX% from 2020-2034 |

| Segmentation |

|

Note*: In applicable scenarios

Primary Research

Secondary Research

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

The projected CAGR is approximately XX%.

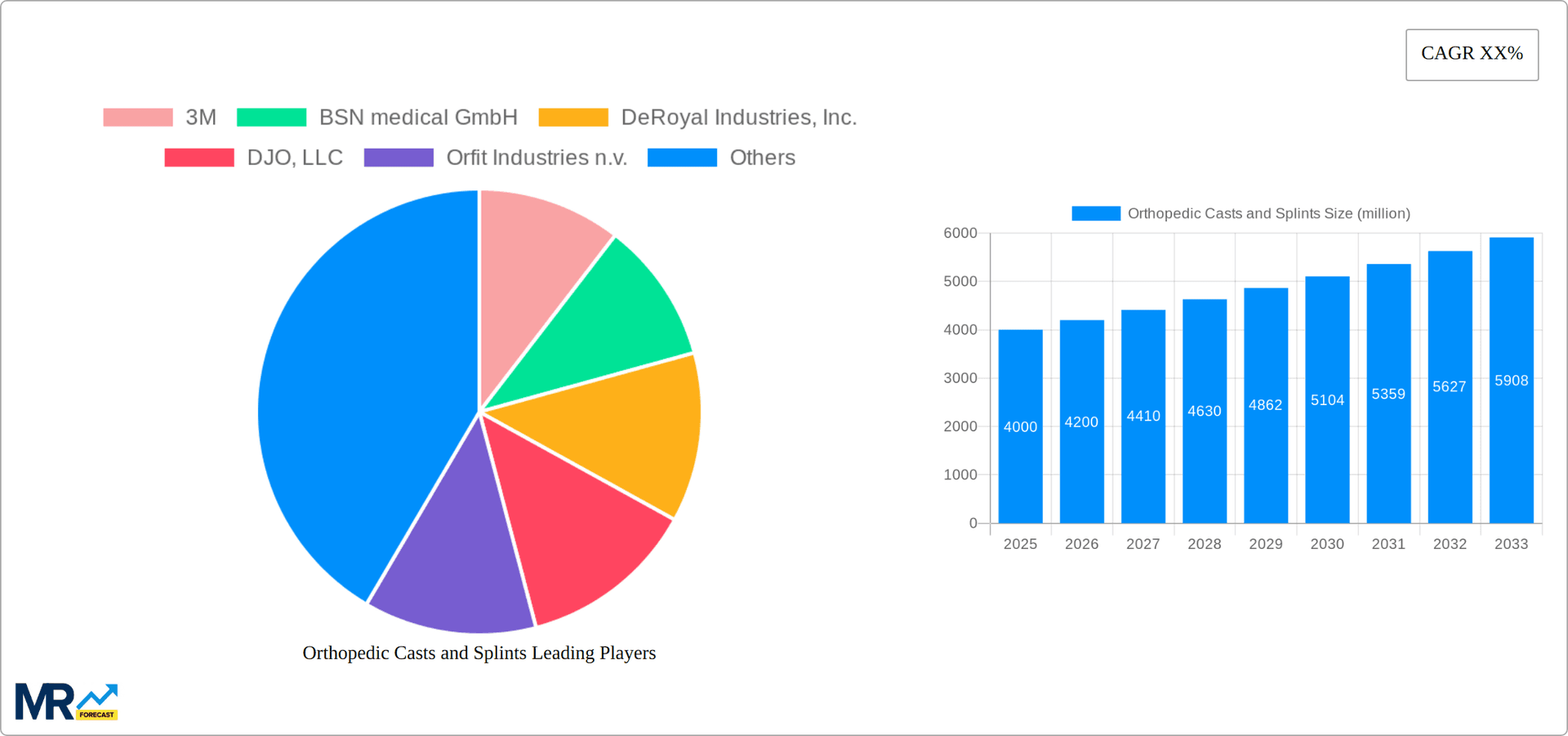

Key companies in the market include 3M, BSN medical GmbH, DeRoyal Industries, Inc., DJO, LLC, Orfit Industries n.v., Ossur hf., Prime Medical, Inc., Spencer Italia S.r.l., Stryker Corporation, Zimmer Holdings, Inc..

The market segments include Application, Type.

The market size is estimated to be USD XXX million as of 2022.

N/A

N/A

N/A

N/A

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4480.00, USD 6720.00, and USD 8960.00 respectively.

The market size is provided in terms of value, measured in million and volume, measured in K.

Yes, the market keyword associated with the report is "Orthopedic Casts and Splints," which aids in identifying and referencing the specific market segment covered.

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

To stay informed about further developments, trends, and reports in the Orthopedic Casts and Splints, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.