1. What is the projected Compound Annual Growth Rate (CAGR) of the Oral Fluid Laboratory Drug Testing?

The projected CAGR is approximately 16.36%.

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.

Oral Fluid Laboratory Drug Testing

Oral Fluid Laboratory Drug TestingOral Fluid Laboratory Drug Testing by Type (Consumables, Equipment), by Application (Workplace Testing, Criminal Justice Testing, Rehabilitation Therapy, Others), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2026-2034

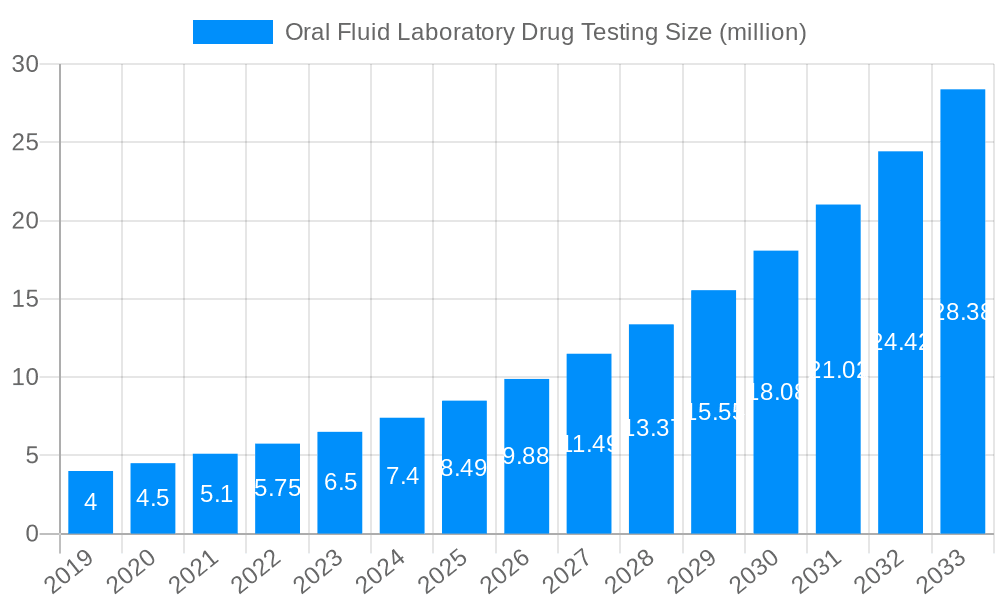

The global Oral Fluid Laboratory Drug Testing market is poised for remarkable expansion, projected to reach an estimated $8.49 billion by 2025, and is anticipated to grow at a robust Compound Annual Growth Rate (CAGR) of 16.36% through 2033. This significant upward trajectory is driven by a confluence of factors, chief among them the increasing demand for non-invasive and rapid drug detection methods across various sectors. The shift away from traditional urine-based testing, which can be prone to adulteration, is a key driver, fostering greater adoption of oral fluid testing due to its ease of collection and reduced privacy concerns. Furthermore, the escalating prevalence of drug abuse, coupled with stringent workplace drug policies and a growing emphasis on public safety, particularly within criminal justice and rehabilitation settings, are fueling market growth. The accessibility and cost-effectiveness of consumables, alongside advancements in equipment technology, further contribute to the market's positive outlook.

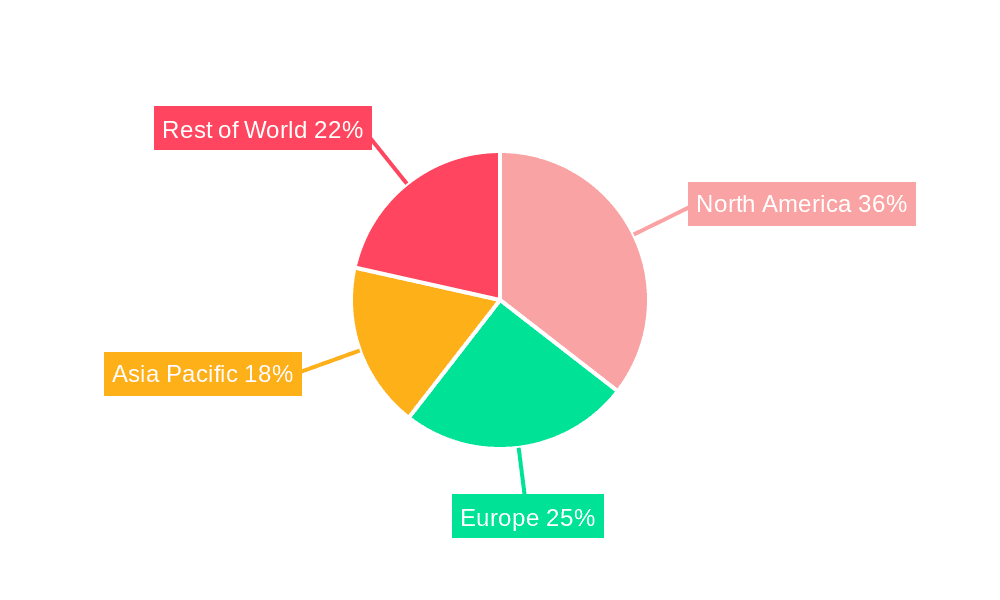

The market's segmentation reveals diverse application areas and product types. Consumables, including collection devices and assay kits, represent a significant portion of the market, driven by high-volume testing needs. Equipment, such as immunoassay analyzers and chromatography systems, also plays a crucial role, with ongoing innovation leading to more sensitive and efficient diagnostic tools. Workplace testing remains the dominant application, reflecting employers' commitment to maintaining drug-free environments and ensuring employee well-being. The criminal justice sector is a rapidly expanding segment, utilizing oral fluid testing for probation monitoring and parole supervision. Rehabilitation therapy also presents a growing opportunity, aiding in patient recovery and relapse prevention. While North America currently leads the market, driven by advanced healthcare infrastructure and strong regulatory frameworks, the Asia Pacific region is expected to witness the fastest growth, spurred by increasing healthcare investments and rising awareness of drug abuse issues.

This report provides an in-depth analysis of the global Oral Fluid Laboratory Drug Testing market, encompassing a detailed examination of its trajectory from 2019 to 2033. The market is projected to witness significant growth, fueled by evolving testing methodologies and an expanding application spectrum. The Study Period spans from 2019 to 2033, with a Base Year and Estimated Year of 2025, and a robust Forecast Period of 2025-2033. Historical performance from 2019-2024 has laid the groundwork for this anticipated expansion. The market size, currently valued in the billions of USD, is expected to continue its upward climb as regulatory landscapes shift and the demand for efficient, less invasive drug testing solutions intensifies. Key segments like Consumables and Equipment are critical components of this ecosystem, while applications in Workplace Testing, Criminal Justice Testing, and Rehabilitation Therapy are driving adoption. Industry developments are continuously shaping the competitive and technological forefront, ensuring a dynamic market environment. This report will delve into the intricate details of market trends, driving forces, challenges, key regional and segment dominance, growth catalysts, leading players, and significant developments, offering a comprehensive overview for stakeholders.

The global Oral Fluid Laboratory Drug Testing market is experiencing a robust expansion, projected to reach several billion USD by the end of the forecast period. This growth is underpinned by an increasing awareness of the advantages offered by oral fluid testing over traditional methods, particularly its non-invasive nature and the ability to detect recent drug use. The Study Period of 2019-2033, with a focus on the Base Year and Estimated Year of 2025, highlights a consistent upward trend. The Forecast Period (2025-2033) anticipates a sustained acceleration in market value, driven by advancements in assay sensitivity and specificity, alongside the development of more sophisticated laboratory analytical techniques. Historically, from 2019-2024, the market has seen steady adoption, but the next decade promises a more pronounced surge. Regulatory bodies globally are increasingly recognizing and approving oral fluid testing for various applications, including workplace safety, roadside sobriety checks, and post-accident investigations. This growing acceptance is a significant market insight. Furthermore, the evolution of technology has led to the development of multiplex oral fluid tests capable of detecting a wider range of drugs and drug metabolites simultaneously, reducing testing time and cost-effectiveness. The integration of point-of-care (POC) devices, while often associated with direct observation, is also influencing the laboratory testing landscape by standardizing sample collection and potentially improving sample integrity for subsequent laboratory confirmation. The emphasis on drug-free workplaces, particularly in safety-sensitive industries, continues to be a primary driver. Moreover, the increasing prevalence of substance abuse globally, coupled with greater societal acceptance of drug testing as a preventative and monitoring tool, contributes significantly to market expansion. The development of more sensitive detection limits allows for the identification of even trace amounts of drugs, enhancing the reliability of laboratory confirmations. This technological progression directly impacts the market's growth trajectory.

Several powerful forces are propelling the global Oral Fluid Laboratory Drug Testing market forward. Foremost among these is the inherent non-invasive nature of oral fluid collection, which significantly enhances donor comfort and compliance compared to traditional urine or blood tests. This ease of collection also translates to reduced specimen adulteration risks, a common concern with other sample types. The detection window of oral fluid testing, particularly for recent drug use within hours to a few days, aligns perfectly with the needs of many immediate safety and compliance protocols. This makes it an ideal choice for situations requiring rapid assessment of current impairment or recent exposure. Growing regulatory acceptance and standardization across various jurisdictions are also crucial drivers. As governmental bodies and industry associations develop clearer guidelines and protocols for oral fluid drug testing, confidence in its reliability and legal defensibility increases, leading to broader adoption in critical sectors. The increasing prevalence of drug abuse globally, coupled with heightened awareness campaigns and government initiatives to combat this issue, directly translates to a higher demand for effective and efficient drug testing solutions. Furthermore, the advancements in laboratory technology, including enhanced immunoassay sensitivity and sophisticated analytical techniques like LC-MS/MS, are continuously improving the accuracy and reliability of oral fluid drug testing, thereby expanding its applicability. The cost-effectiveness of oral fluid testing, when considering the entire process from collection to laboratory analysis, is another significant factor. Reduced collection costs, lower risk of specimen rejection due to adulteration, and faster turnaround times for preliminary screening contribute to its economic appeal.

Despite the promising growth trajectory, the Oral Fluid Laboratory Drug Testing market faces several challenges and restraints that could temper its expansion. A primary concern remains the detection window limitations compared to urine or hair testing. Oral fluid typically detects drug use within a shorter timeframe (hours to a few days), which may not be sufficient for identifying chronic or historical drug use, thus restricting its application in certain long-term monitoring scenarios. Variability in salivary flow rates and drug concentrations can also introduce challenges in achieving consistent and reliable test results. Factors such as hydration levels, food intake, and the timing of sample collection relative to drug administration can influence the amount of drug present in oral fluid, potentially leading to false negatives or positives if not meticulously managed. The sensitivity and specificity of some rapid screening devices can also be a point of concern, with a need for laboratory confirmation to ensure accuracy. While laboratory confirmation methods are highly accurate, the initial screening phase must be robust to avoid unnecessary follow-up procedures or misinterpretations. Furthermore, regulatory hurdles and differing legal precedents in various regions can create complexities for widespread adoption. The lack of universal standards or established legal frameworks for oral fluid testing in some jurisdictions can hinder its implementation in critical applications. Another restraint is the potential for donor tampering or sample contamination, although less prevalent than with urine, it still necessitates careful collection protocols and quality control measures. Finally, the perceived cost of laboratory analysis, when compared to some basic on-site screening tests, might be a deterrent for smaller organizations, despite the overall cost-effectiveness of accurate, confirmed testing.

The Workplace Testing segment is poised to be a dominant force in the Oral Fluid Laboratory Drug Testing market, driven by its widespread applicability and consistent demand. This segment encompasses pre-employment screening, random testing, post-accident investigations, and reasonable suspicion testing across a multitude of industries. The intrinsic advantages of oral fluid testing – its non-invasiveness, ease of collection, and ability to detect recent drug use – make it an ideal solution for maintaining safe and productive work environments. Companies are increasingly recognizing the importance of drug-free workplaces to mitigate risks, reduce absenteeism, and enhance overall employee well-being. The North America region, particularly the United States, is expected to lead the market in terms of revenue and adoption. This dominance is attributed to a combination of factors, including stringent workplace safety regulations, a proactive approach to substance abuse prevention, and the presence of major players in the drug testing industry. The US has a well-established framework for workplace drug testing, with ongoing efforts to refine and expand the use of oral fluid testing.

Dominant Segment: Workplace Testing

Dominant Region: North America

While other regions like Europe and Asia Pacific are also witnessing growth, North America's established infrastructure, regulatory support, and market demand for workplace safety solutions are expected to solidify its dominance in the Oral Fluid Laboratory Drug Testing market for the foreseeable future.

Several key factors are acting as powerful growth catalysts for the Oral Fluid Laboratory Drug Testing industry. The ongoing technological advancements in assay development and analytical instrumentation are continuously enhancing the sensitivity, specificity, and breadth of detection for various drugs and their metabolites. This leads to more accurate and reliable testing results, fostering greater trust and adoption. Furthermore, the increasing focus on workplace safety and employee well-being globally is a significant driver. Organizations are proactively implementing drug testing programs to mitigate risks associated with impairment, reduce accidents, and foster a healthier work environment. The expanding applications beyond traditional workplace settings, such as in criminal justice, probation monitoring, and even clinical settings for pain management verification, are opening up new market avenues. The growing awareness and acceptance of oral fluid testing as a viable and advantageous alternative to traditional methods, owing to its non-invasive nature and ease of collection, is also a crucial growth catalyst.

This comprehensive report delves into the intricacies of the Oral Fluid Laboratory Drug Testing market, providing a 360-degree view of its dynamics. It meticulously analyzes market size, segmentation by type (Consumables, Equipment) and application (Workplace Testing, Criminal Justice Testing, Rehabilitation Therapy, Others), and forecasts growth trajectories through 2033. The report highlights key industry developments and emerging trends, offering actionable insights into the factors driving market expansion. Furthermore, it identifies and profiles the leading players in the global arena, detailing their strategic initiatives and market positioning. The report also scrutinizes the driving forces and challenges that shape the market landscape, enabling stakeholders to navigate the competitive environment effectively. With a detailed examination of regional market shares and growth potential, this report serves as an indispensable resource for businesses seeking to understand and capitalize on the evolving opportunities within the Oral Fluid Laboratory Drug Testing sector.

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 16.36% from 2020-2034 |

| Segmentation |

|

Note*: In applicable scenarios

Primary Research

Secondary Research

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

The projected CAGR is approximately 16.36%.

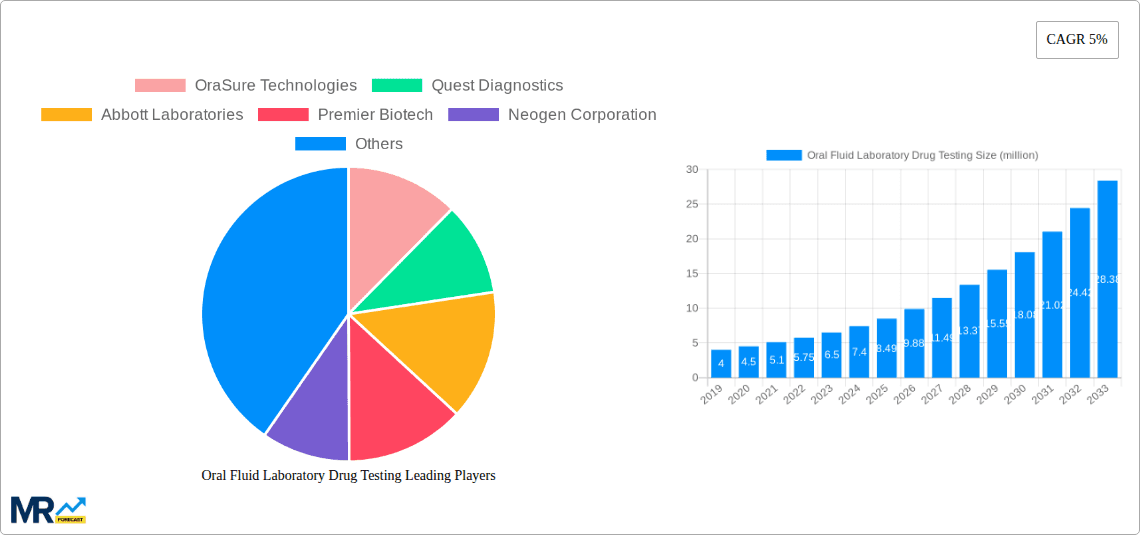

Key companies in the market include OraSure Technologies, Quest Diagnostics, Abbott Laboratories, Premier Biotech, Neogen Corporation, Guangzhou Wondfo Biotech, Salimetrics, Draeger, Securetec Detektions-Systeme, Oranoxis Inc, Lin-Zhi International, Oasis Diagnostics, Cell Projects, Prometheusbio, .

The market segments include Type, Application.

The market size is estimated to be USD XXX N/A as of 2022.

N/A

N/A

N/A

N/A

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3480.00, USD 5220.00, and USD 6960.00 respectively.

The market size is provided in terms of value, measured in N/A and volume, measured in K.

Yes, the market keyword associated with the report is "Oral Fluid Laboratory Drug Testing," which aids in identifying and referencing the specific market segment covered.

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

To stay informed about further developments, trends, and reports in the Oral Fluid Laboratory Drug Testing, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.