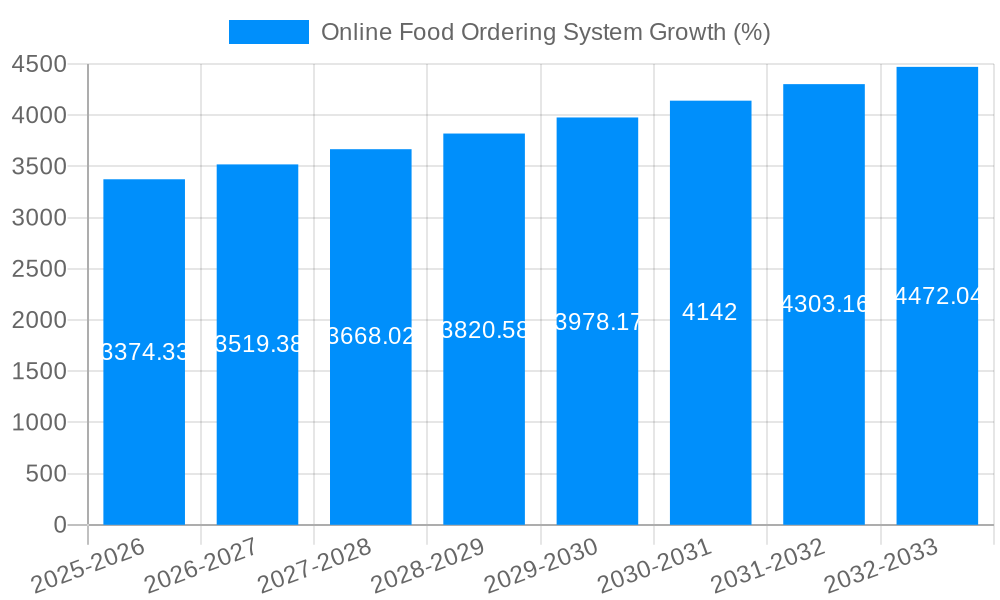

1. What is the projected Compound Annual Growth Rate (CAGR) of the Online Food Ordering System?

The projected CAGR is approximately 4.7%.

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.

Online Food Ordering System

Online Food Ordering SystemOnline Food Ordering System by Type (Restaurant-controlled, Independent), by Application (B2B, B2C, Others), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2025-2033

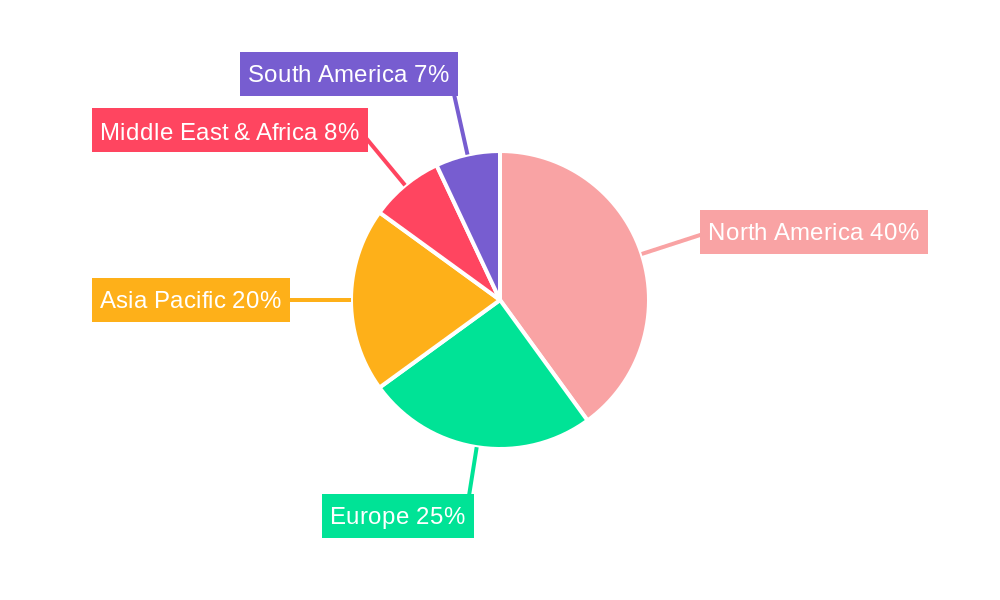

The online food ordering system market, valued at $71.99 billion in 2025, is experiencing robust growth, projected to expand at a Compound Annual Growth Rate (CAGR) of 4.7% from 2025 to 2033. This expansion is driven by several key factors. The increasing penetration of smartphones and internet access globally, particularly in emerging economies, fuels the adoption of convenient online ordering platforms. Changing consumer lifestyles, with a preference for convenience and time-saving solutions, are significantly impacting market growth. Furthermore, the continuous innovation in online ordering platforms, including enhanced user interfaces, personalized recommendations, and seamless payment integrations, contributes to market expansion. The rise of cloud-based solutions and sophisticated data analytics also enables businesses to optimize operations and personalize the customer experience, further bolstering market growth. The competitive landscape features both large multinational chains (McDonald's, KFC, Starbucks) and smaller independent restaurants leveraging these platforms, leading to continuous innovation and market diversification. Restaurant-controlled ordering systems and B2C applications currently dominate, however, B2B applications are showing strong growth potential. Geographic expansion is also a key driver, with North America currently holding a significant market share, but developing economies in Asia-Pacific and emerging markets in other regions presenting significant opportunities for future growth.

The market segmentation reveals dynamic trends. While restaurant-controlled and B2C applications currently hold larger shares, independent restaurants and B2B platforms are demonstrating significant potential for growth, indicating a shift toward diverse business models. Geographic disparities are notable, with North America leading the market due to high internet penetration and consumer spending power. However, rapid digitalization in Asia-Pacific and other regions indicates substantial future market growth in these areas. Challenges remain, including issues of food safety and quality control, maintaining platform reliability, and adapting to constantly evolving consumer preferences. Addressing these concerns will be crucial for sustaining the market's growth trajectory. The competitive intensity, with numerous established players and new entrants, necessitates continuous innovation and strategic adaptation for success in this dynamic market.

The online food ordering system market is experiencing explosive growth, projected to reach multi-billion dollar valuations by 2033. From 2019 to 2024 (historical period), we witnessed a dramatic shift in consumer behavior, with millions more embracing the convenience of ordering meals online. This trend, fueled by technological advancements and changing lifestyles, shows no signs of slowing down. The forecast period (2025-2033) anticipates even more significant expansion, driven by factors such as increasing smartphone penetration, expanding internet access, and the rising popularity of food delivery apps. By 2025 (estimated year), the market is expected to surpass several billion dollars in revenue, a clear indication of its enduring appeal. This report, covering the study period 2019-2033 with a base year of 2025, delves into the key market insights shaping this dynamic sector. The rise of cloud-based solutions, improved order management systems, and sophisticated data analytics are transforming the industry, empowering restaurants and delivery services to better understand customer preferences and optimize operations. The integration of AI and machine learning is further enhancing the customer experience, predicting demand, personalizing recommendations, and streamlining the entire ordering and delivery process. Competition is fierce, with both established players and nimble startups vying for market share. This competitive landscape is driving innovation and pushing boundaries in terms of service offerings, delivery speed, and technological integration. The market’s growth isn't uniform; geographical variations exist, with some regions witnessing faster adoption than others, influenced by factors like infrastructure development, economic growth, and cultural preferences. The interplay of these factors paints a complex yet compelling picture of a market poised for sustained growth throughout the forecast period.

Several key factors are driving the phenomenal growth of online food ordering systems. The increasing penetration of smartphones and ubiquitous internet access has made ordering food online incredibly convenient for millions of consumers. This ease of access, combined with busy lifestyles and a preference for convenience, is a major driver. The rise of dedicated food delivery apps, such as Uber Eats, DoorDash, and Swiggy, has further fueled the market's expansion. These platforms offer a wide selection of restaurants and cuisines, enabling users to easily browse menus, compare prices, and place orders with a few taps on their smartphones. Furthermore, attractive promotions, discounts, and loyalty programs offered by both restaurants and delivery platforms incentivize online ordering. Restaurant chains like McDonald's, KFC, and Pizza Hut have also recognized the importance of a robust online presence, investing heavily in their own ordering systems and partnering with third-party delivery services to reach a broader customer base. The evolving consumer expectations are demanding more choices, customized options, and seamless ordering experiences, pushing the industry to innovate and adapt. The ability to track orders in real time, receive notifications, and provide feedback enhances transparency and customer satisfaction, further reinforcing the positive feedback loop driving the market's growth. Finally, the cost-effectiveness of online ordering for restaurants, allowing them to reach wider audiences and reduce overhead, is also a powerful contributor to this sector’s success.

Despite its rapid growth, the online food ordering system faces significant challenges. One major hurdle is maintaining food quality and temperature during delivery. Ensuring that food arrives fresh and hot (or cold, as appropriate) is crucial for customer satisfaction, and this poses a logistical challenge, especially during peak hours or in congested urban areas. High delivery fees and service charges can also deter some customers, particularly those on a budget. Competition is extremely intense, forcing businesses to constantly innovate and offer competitive pricing to retain market share. Managing customer expectations concerning delivery time and accuracy is also critical; delays or incorrect orders can significantly impact customer satisfaction and reputation. Data security and privacy are paramount; protecting sensitive customer information is essential to maintain trust and comply with regulations. Regulatory hurdles, varying across jurisdictions, can complicate operations and increase costs. Finally, the reliance on gig economy workers for delivery can create challenges in terms of workforce management, consistency, and maintaining consistent service levels. Addressing these challenges is vital for sustainable growth and long-term success in this competitive market.

The B2C segment of the online food ordering system is poised to dominate the market throughout the forecast period. This segment caters directly to individual consumers, representing the largest portion of online food orders. This dominance is fueled by the aforementioned factors driving overall market growth, including increasing smartphone penetration, convenient app usage, and promotional offers.

Asia-Pacific Region: This region is expected to experience the most significant growth, driven by burgeoning economies, rising disposable incomes, and high smartphone penetration in countries like India and China. Millions of consumers in these markets are increasingly embracing online food ordering, creating a massive opportunity for both established players and new entrants. The success of platforms like Swiggy (India) and MEITUAN (China) demonstrates the significant potential in this region. The sheer volume of consumers adopting online ordering, fueled by rapid urbanization and a preference for convenience, positions Asia-Pacific as a key growth area.

North America: This region also presents a substantial market, although growth may be comparatively slower due to the already high level of online food ordering adoption. However, ongoing innovation and expansion of existing players, along with the continuous refinement of delivery services and technological improvements, are expected to contribute to market growth.

Restaurant-controlled Platforms: While third-party platforms enjoy significant market share, restaurant-controlled platforms are also showing strong growth, particularly among established chains. These platforms offer restaurants greater control over their brand image, customer data, and pricing strategies, making it an attractive option for many. However, the investment required in developing and maintaining these systems can be significant, creating a barrier to entry for smaller restaurants.

The B2C segment's dominance is underpinned by the sheer volume of individual consumers using these services. While the B2B segment (catering to businesses) will see steady growth, the scale and immediate impact of the individual consumer market make it the key area of focus for most market players. This dominance is not solely geographic; it’s driven by consumer behavior and the inherent accessibility and convenience offered by this segment.

The online food ordering system industry's growth is fueled by several key catalysts. Technological advancements, such as improved app functionalities and enhanced delivery logistics, are continuously enhancing the user experience and efficiency. The rise of cloud-based solutions allows for scalability and streamlined operations, enabling businesses to better manage orders and customer data. The increasing popularity of contactless delivery, particularly heightened by recent global events, emphasizes the importance of safety and hygiene, boosting adoption. Furthermore, the integration of artificial intelligence (AI) and machine learning (ML) allows for better demand forecasting and personalized recommendations, optimizing resource allocation and enhancing customer satisfaction. The expansion into new markets and the introduction of innovative services, such as subscription models and customized meal options, will further accelerate industry growth.

This report provides a comprehensive overview of the online food ordering system market, offering in-depth analysis of market trends, driving forces, challenges, and growth opportunities. It profiles key players and significant developments, presenting a valuable resource for businesses and investors seeking to understand and navigate this dynamic sector. The report’s detailed segmentation, geographical analysis, and forecast projections provide a holistic view, assisting strategic decision-making. The focus on the B2C segment and its dominant role highlights the key area of consumer-driven growth.

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 4.7% from 2019-2033 |

| Segmentation |

|

Note*: In applicable scenarios

Primary Research

Secondary Research

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

The projected CAGR is approximately 4.7%.

Key companies in the market include McDonalds, KFC, Subway, Pizzahut, Starbucks, Burger King, Domino’s Pizza, Dunkin Donuts, Dairy Queen, Papa John’s, Wendy’s, Just Eat, Takeaway, Alibaba Group(Ele.me), GrubHub, OLO, Swiggy, MEITUAN, Uber Eats, DoorDash, Caviar, .

The market segments include Type, Application.

The market size is estimated to be USD 71990 million as of 2022.

N/A

N/A

N/A

N/A

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3480.00, USD 5220.00, and USD 6960.00 respectively.

The market size is provided in terms of value, measured in million.

Yes, the market keyword associated with the report is "Online Food Ordering System," which aids in identifying and referencing the specific market segment covered.

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

To stay informed about further developments, trends, and reports in the Online Food Ordering System, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.