1. What is the projected Compound Annual Growth Rate (CAGR) of the Online Food Ordering?

The projected CAGR is approximately XX%.

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.

Online Food Ordering

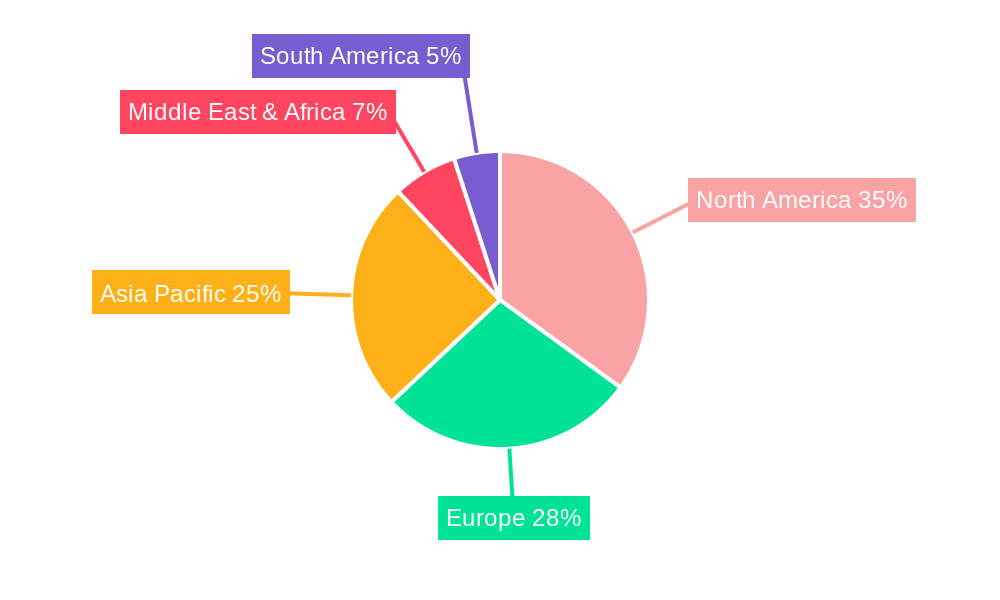

Online Food OrderingOnline Food Ordering by Type (Delivery Platform, Restaurant Delivery), by Application (B2C, B2B), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2025-2033

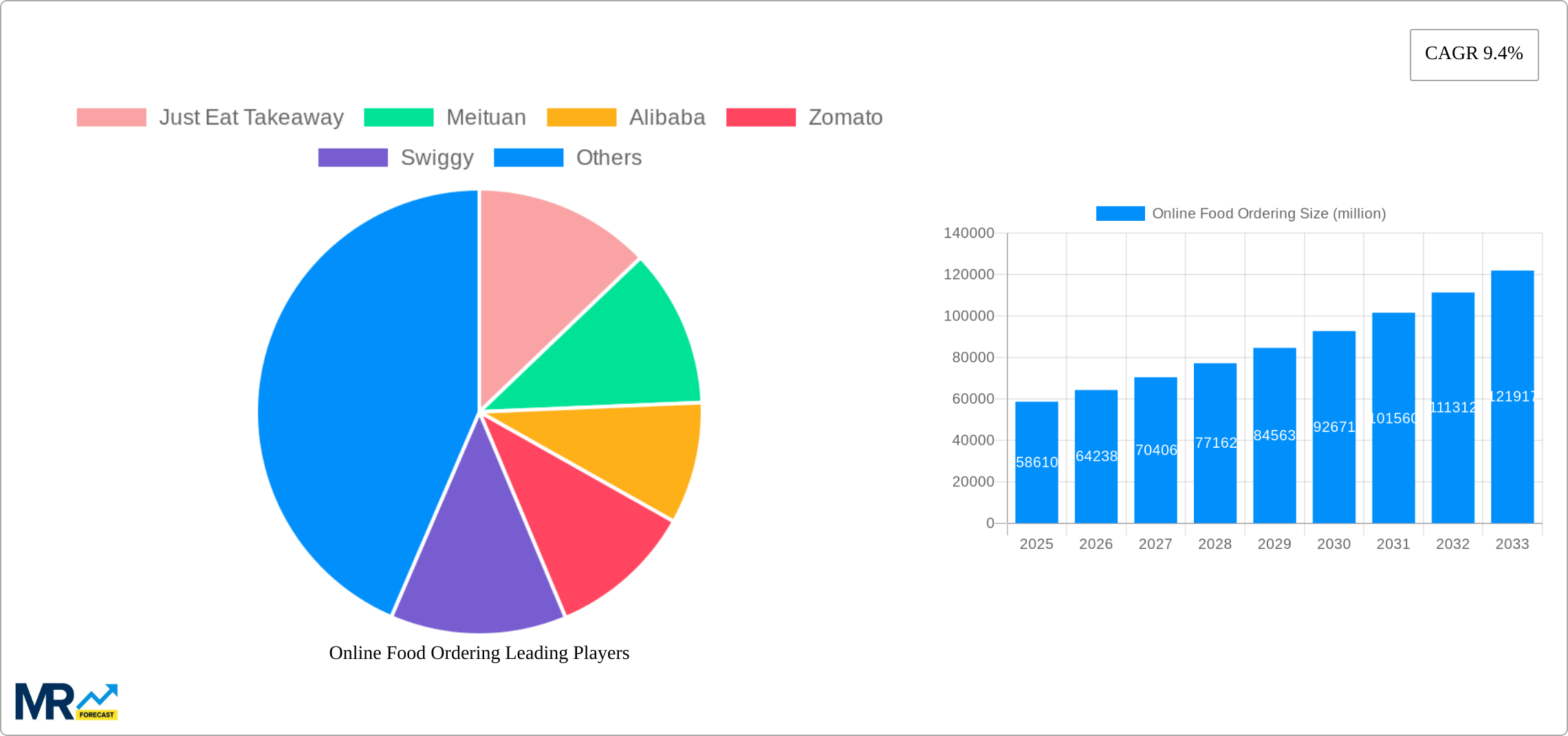

The online food ordering market, valued at $109.77 billion in 2025, is experiencing robust growth fueled by several key factors. The increasing adoption of smartphones and internet penetration, coupled with the convenience and diverse choices offered by online platforms, are driving significant market expansion. Consumer preference for contactless delivery, further amplified by recent global events, has cemented online ordering as a preferred method for food acquisition. The market is segmented by delivery platform (e.g., restaurant-specific apps vs. aggregators) and application (B2C and B2B), reflecting the diverse ways businesses and individuals interact with this ecosystem. Major players like DoorDash, Uber Eats, and Just Eat Takeaway are fiercely competitive, constantly innovating with features such as loyalty programs, personalized recommendations, and expanded delivery options (e.g., grocery, alcohol). Geographic variations exist, with North America and Asia-Pacific exhibiting the largest market shares, driven by high smartphone penetration and a burgeoning middle class with disposable income. However, regulatory hurdles and concerns regarding food safety and delivery worker rights pose challenges to sustained growth. Future growth will depend on continued technological advancements, improved logistics, and the ability of companies to adapt to changing consumer preferences and economic conditions.

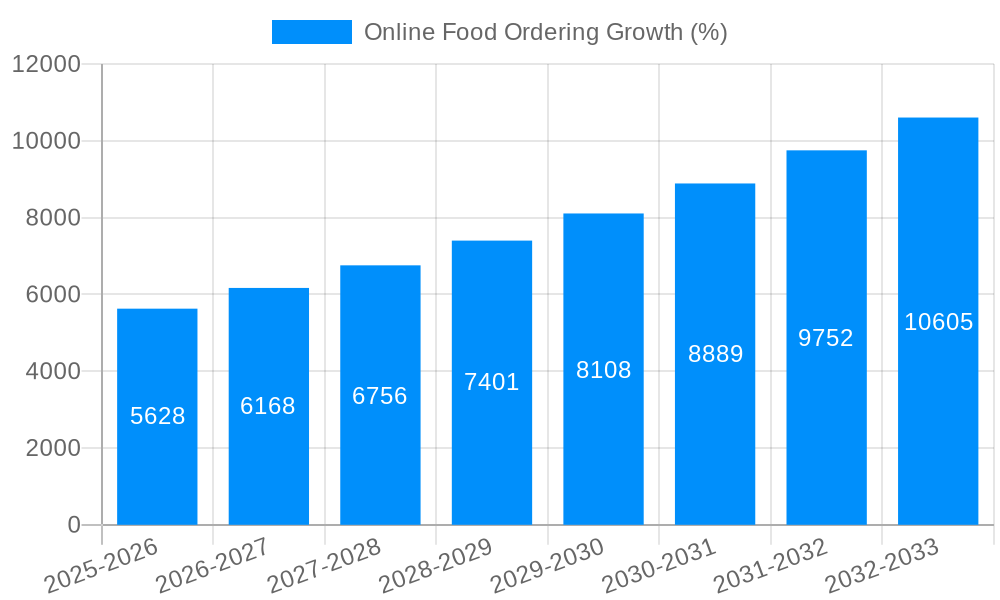

Growth projections for the next decade indicate a sustained upward trajectory. Considering the existing market size and the influence of accelerating digitalization and changing consumer behaviors, a conservative Compound Annual Growth Rate (CAGR) of 10% is plausible. This would translate to significant market expansion, driven particularly by emerging markets with rapidly increasing internet access and a growing preference for convenience. However, the market's success hinges on addressing current challenges. These include managing operational costs, enhancing delivery infrastructure in less developed regions, and navigating the evolving regulatory landscape surrounding the gig economy. Furthermore, the integration of advanced technologies, such as artificial intelligence for better order management and predictive analytics, will be crucial for competitive advantage. The consolidation of smaller players by larger corporations and the diversification of offerings beyond restaurant meals into grocery deliveries and other related services will likely shape the future competitive landscape.

The online food ordering market experienced explosive growth between 2019 and 2024, driven by the increasing adoption of smartphones, rising internet penetration, and a surge in demand for convenience. This trend shows no signs of slowing; our report projects the market to reach a valuation of XXX million by 2025, continuing its robust expansion through 2033. Key market insights reveal a shift towards diverse delivery options, beyond simple restaurant-to-consumer delivery. The rise of cloud kitchens, dark stores (warehouses optimized for online orders), and the integration of quick-commerce models (ultra-fast delivery) are reshaping the landscape. Consumer preferences are also evolving, with a growing demand for personalized recommendations, healthier options, and sustainable practices. This is driving innovation in areas such as AI-powered ordering systems, personalized meal planning, and environmentally friendly packaging. The market is also seeing consolidation, with larger players acquiring smaller companies to expand their market share and service offerings. Competition is intensifying, pushing companies to innovate and improve their services to retain customers in this increasingly saturated market. Geographical variations are also significant, with some regions experiencing faster growth than others, reflecting differences in infrastructure, technological adoption, and cultural preferences. Our analysis considers these factors to provide a comprehensive and accurate forecast for the market's future trajectory. Furthermore, the emergence of subscription models and loyalty programs is impacting customer behavior and increasing platform stickiness. The industry is becoming increasingly data-driven, using analytics to personalize the customer experience, optimize delivery routes, and predict demand more accurately. This data-driven approach is crucial for companies to stay ahead of the curve and maintain their competitiveness in this dynamic market.

Several factors are converging to propel the online food ordering market's continued growth. The ubiquitous nature of smartphones and widespread internet access have made ordering food online exceptionally convenient. Busy lifestyles and increasing disposable incomes provide the enabling factors for consumers to readily opt for this service. The rise of food delivery aggregators, providing a single platform to browse and order from various restaurants, has significantly simplified the process, removing the friction associated with individual restaurant websites or phone calls. Technological advancements, such as sophisticated GPS tracking for delivery drivers and AI-powered recommendation engines, enhance the user experience and optimize delivery efficiency. Furthermore, the expansion of restaurant partnerships, including partnerships with both established chains and independent eateries, expands consumer choice and ensures accessibility to a wider range of cuisines and price points. The development of specialized delivery infrastructure, such as dark kitchens and optimized delivery networks, supports the rapid and efficient fulfillment of online orders, improving customer satisfaction and encouraging repeat business. Marketing efforts and promotional campaigns by online food ordering platforms are further enhancing the visibility and appeal of this service to a broader customer base. Finally, the ongoing integration of various payment options, including digital wallets and mobile payments, streamlines the ordering and payment process, contributing to a seamless and positive user experience.

Despite its rapid expansion, the online food ordering industry faces several challenges and restraints. Maintaining food quality and safety during delivery remains a paramount concern, requiring stringent quality control measures throughout the process. The increasing reliance on gig-economy workers for delivery presents logistical complexities and concerns regarding worker rights and welfare. Competition is fierce, forcing companies to continuously innovate and differentiate their services to retain and attract customers. High operational costs, including commissions paid to restaurants and the expenses associated with delivery personnel, can impact profitability. Fluctuations in food costs and potential increases in fuel prices can affect pricing strategies and profitability. Regulatory hurdles and evolving government policies pertaining to food safety, hygiene, and labor practices can also influence operational efficiency. Negative online reviews and instances of poor delivery service can significantly impact a company's reputation and customer loyalty. Furthermore, the industry needs to address environmental concerns associated with packaging waste and delivery vehicle emissions. Tackling these challenges requires a comprehensive strategy incorporating technological improvements, sustainable practices, and a strong focus on customer service and satisfaction.

The online food ordering market exhibits significant geographical variations in its growth trajectory. Asia, particularly China and India, is projected to dominate the market due to their vast populations, rapidly expanding middle class, and increasing internet penetration. Within Asia, China, with its established giants like Meituan and Alibaba, is anticipated to continue to hold a significant share. North America, especially the United States, will also remain a major market, driven by high consumer spending power and the established presence of players like DoorDash and Uber Eats. Europe is anticipated to experience moderate but steady growth, with countries like the UK and Germany contributing significantly. The B2C segment is expected to dominate the market throughout the forecast period due to the sheer volume of individual consumers ordering food online. This segment's growth is fueled by increased consumer preference for convenience, diverse culinary options, and the wide availability of online ordering platforms. While the B2B segment also holds potential (e.g., corporate catering, office lunches), its growth is currently overshadowed by the dominance of B2C. This disparity is influenced by several factors, including the comparatively higher transaction values in the B2C segment and the need for specialized software and infrastructure to effectively serve the B2B market. However, as businesses increasingly embrace convenience and recognize the operational efficiencies of online catering solutions, the B2B segment is poised for substantial growth in the future.

Growth in specific cities within these regions will also play a significant role. Mega-cities with high population density and significant disposable incomes will generally see higher adoption rates of online food ordering services. The overall dominance of the B2C segment underscores the profound impact of individual consumer preferences on market growth. The key to success for companies will be to tailor their services and marketing efforts to the specific needs and preferences of this segment across diverse geographical regions.

Several key factors are catalyzing growth within the online food ordering industry. The continuous improvement of mobile applications, offering enhanced user interfaces and personalized recommendations, is crucial. Strategic partnerships between delivery platforms and restaurants are expanding access to diverse cuisines and facilitating efficient delivery networks. Technological advancements in areas such as AI-driven prediction of order demand and route optimization are improving operational efficiency and reducing delivery times. The increasing integration of payment options and loyalty programs further enhances the customer experience and increases platform stickiness. Finally, the rise of cloud kitchens and dark stores is reducing operational overhead and enabling greater delivery speed and efficiency, driving continued market expansion.

This report provides a comprehensive analysis of the online food ordering market, encompassing historical data (2019-2024), the current state (2025), and future projections (2025-2033). It delves into market trends, driving forces, challenges, key players, and significant developments, offering a detailed understanding of the industry's dynamics and growth trajectory. The report's insights are invaluable for businesses seeking to enter or expand within this rapidly evolving market. The detailed segmentation and regional analysis enable informed strategic decision-making and investment planning.

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of XX% from 2019-2033 |

| Segmentation |

|

Note*: In applicable scenarios

Primary Research

Secondary Research

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

The projected CAGR is approximately XX%.

Key companies in the market include Just Eat Takeaway, Meituan, Alibaba, Zomato, Swiggy, Uber Eats, Deliveroo, DoorDash, Delivery Hero, Goldbelly, Foodhub, Domino’s Pizza, HungryPanda, iFood, McDonalds, KFC, Pizza Hut, Demaecan, .

The market segments include Type, Application.

The market size is estimated to be USD 109770 million as of 2022.

N/A

N/A

N/A

N/A

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4480.00, USD 6720.00, and USD 8960.00 respectively.

The market size is provided in terms of value, measured in million.

Yes, the market keyword associated with the report is "Online Food Ordering," which aids in identifying and referencing the specific market segment covered.

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

To stay informed about further developments, trends, and reports in the Online Food Ordering, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.