1. What is the projected Compound Annual Growth Rate (CAGR) of the Online Dating?

The projected CAGR is approximately XX%.

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.

Online Dating

Online DatingOnline Dating by Type (18 to 24 Years, 25 to 34 Years, 35 to 44 Years, 45 to 54 Years, Others), by Application (Male, Female), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2025-2033

The online dating market is experiencing robust growth, driven by increasing smartphone penetration, evolving social norms around online interactions, and a desire for convenience and wider dating pools. While precise figures for market size and CAGR are unavailable from the provided data, a reasonable estimation based on industry reports suggests a 2025 market size in the billions, reflecting a consistently high growth rate. This expansion is fueled by several key trends: the rise of niche dating apps catering to specific demographics (age, interests, lifestyle), the increasing integration of AI-powered matching algorithms to enhance user experience, and a shift towards greater emphasis on safety and verification features within apps. However, challenges remain, including concerns around data privacy, scams, and the potential for superficial interactions. The market's segmentation by age and gender highlights the diverse user base, with significant participation across various age groups. Furthermore, geographic variations exist, with North America and Europe currently holding substantial market share, although the Asia-Pacific region presents significant untapped potential. The competitive landscape is dynamic, featuring both established players like Match Group and emerging niche platforms, driving innovation and competition. Future growth will likely depend on continued technological advancements, effective addressal of user safety concerns, and successful expansion into new markets.

The competitive landscape is characterized by a mix of established international players and emerging niche apps. Established players leverage brand recognition and extensive user bases, while niche apps focus on specific demographics or interests. This competition fuels innovation in user experience, matching algorithms, and safety features. Market success will depend on factors such as the effectiveness of matching algorithms, app design, and marketing strategies. The increasing emphasis on safety and verification protocols reflects a response to user concerns and changing regulatory environments. Successful players will be those who prioritize user safety, provide diverse features, and adapt to evolving user preferences and technologies. Continued growth will be driven by factors such as increasing smartphone penetration, particularly in developing regions, and the sustained popularity of online dating as a way to meet potential partners. The evolution of the market will likely be shaped by further technological advancements and a more sophisticated understanding of user needs and preferences.

The online dating market, valued at several billion dollars globally, exhibits robust growth fueled by shifting societal norms and technological advancements. The historical period (2019-2024) witnessed a significant surge in user adoption, particularly amongst younger demographics. The estimated market value in 2025 is projected to be in the tens of billions, reflecting the increasing prevalence of online dating as a legitimate and accepted method of relationship formation. This trend is expected to continue throughout the forecast period (2025-2033), driven by factors discussed later. The market's dynamism is evident in the diverse range of platforms catering to specific niches, from those focusing on casual encounters (Grindr) to others emphasizing long-term relationships (eharmony). Competition is fierce, with established players like Match Group Inc. continually innovating and smaller, niche platforms vying for market share. The incorporation of AI-powered matching algorithms, sophisticated user profiles, and enhanced safety features are key differentiators. Geographic variations are also noteworthy, with market penetration and usage patterns differing across regions, reflecting cultural nuances and technological accessibility. Premium subscription models have proven highly successful, generating substantial revenue streams, and the incorporation of in-app purchases further diversifies income sources. Data privacy and security concerns remain a significant consideration for both users and regulators.

Several key factors are driving the phenomenal growth of the online dating market. Firstly, the increasing normalization of online dating, particularly amongst younger generations, has significantly reduced the social stigma previously associated with using such platforms. People view it as a convenient and efficient way to meet potential partners, bypassing the traditional methods of social circles and chance encounters. Secondly, the widespread adoption of smartphones and readily available high-speed internet access has created a fertile ground for the proliferation of mobile dating apps. These platforms offer unparalleled accessibility, allowing users to connect with others anytime and anywhere. Thirdly, the advancement of technology, including sophisticated matching algorithms and AI-powered features, has enhanced the user experience, improving the likelihood of successful matches. The development of features that promote safer interactions also contributes to wider adoption. Finally, the evolving societal landscape, characterized by increased urbanization, busy lifestyles, and a decline in traditional community structures, contributes to the increased reliance on online dating as a means to build meaningful connections.

Despite the rapid growth, the online dating industry faces several challenges. Firstly, the pervasive issue of catfishing and fake profiles poses a significant threat to user trust and safety. While platforms are constantly improving verification processes, the problem persists, potentially deterring potential users. Secondly, concerns surrounding data privacy and security are paramount. Users are increasingly cautious about sharing personal information online, and data breaches could significantly impact user trust and platform reputation. Thirdly, the highly competitive market landscape necessitates constant innovation and investment to maintain a competitive edge. Attracting and retaining users in a saturated market requires significant marketing efforts and the development of unique features. Fourthly, the inherent difficulty in accurately predicting compatibility through algorithms and profile information presents a challenge. While algorithms can improve the matching process, they are not foolproof and may not adequately capture the complexities of human relationships. Finally, the potential for negative experiences, such as unsuccessful matches or even harassment, can deter users and affect overall satisfaction.

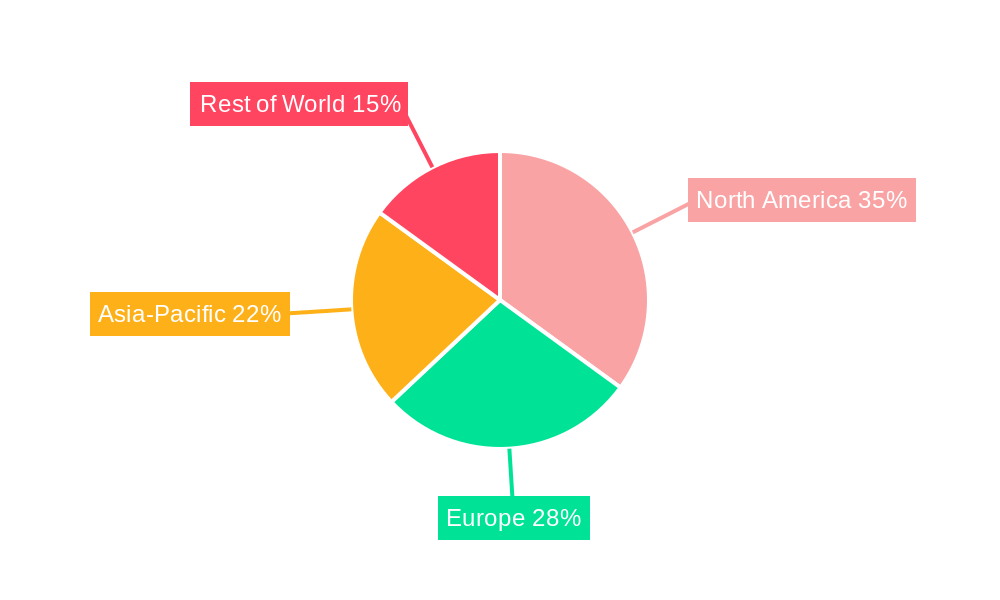

The online dating market shows significant variations across geographic regions and user segments. While precise market share figures require detailed market research analysis, general trends are observable.

Age Segment Dominance: The 25-34 age group historically represents the largest segment within the online dating market. This is likely due to this demographic's greater technological comfort, active social lives, and desire to find romantic partners. The 18-24 age group is also a significant segment, constantly growing with higher levels of mobile app adoption.

Gender Distribution: While initially showing a more significant male user base, the gap between male and female participation is narrowing as online dating becomes increasingly mainstream and platforms address safety concerns for female users.

Geographic Regions: North America and Europe have historically been leading markets due to high internet penetration, tech-savviness, and a more accepting social environment regarding online dating. However, rapid growth is observed in Asia-Pacific regions as internet and smartphone penetration increases and social norms evolve.

The paragraph below focuses on the 25-34 year old demographic's dominance: The 25-34 age group's dominance is a consistent observation across many online dating platforms. This demographic displays higher disposable income, more technological proficiency, and a stronger willingness to use technology for relationship-building. Their engagement rates are higher, translating to greater revenue generation for platforms targeting this segment.

Continued technological advancements, particularly in AI-powered matching algorithms and personalized user experiences, will significantly drive industry growth. The increasing acceptance and normalization of online dating, alongside the expansion into new geographical markets with growing internet penetration, will further fuel expansion. Enhanced safety features and measures to combat fraudulent profiles will improve user trust, bolstering market confidence and user base growth.

This report provides a detailed analysis of the online dating market, covering key trends, driving forces, challenges, and significant players. It offers valuable insights into market segmentation, geographic variations, and growth projections for the forecast period (2025-2033), making it an invaluable resource for businesses operating in or considering entry into this rapidly expanding sector. The report's comprehensive coverage provides a holistic understanding of this dynamic market landscape.

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of XX% from 2019-2033 |

| Segmentation |

|

Note*: In applicable scenarios

Primary Research

Secondary Research

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

The projected CAGR is approximately XX%.

Key companies in the market include Badoo, Coffee Meets Bagel, eharmony Inc., EliteMate.com LLC, Grindr LLC, Happn SAS, Love Group Global Ltd., Match Group Inc., rsvp.com.au Pty Ltd., Spark Networks SE, Spice of Life, Tastebuds Media Ltd., The Bumble Group, The Meet Group Inc., Zoosk Inc, .

The market segments include Type, Application.

The market size is estimated to be USD XXX million as of 2022.

N/A

N/A

N/A

N/A

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3480.00, USD 5220.00, and USD 6960.00 respectively.

The market size is provided in terms of value, measured in million.

Yes, the market keyword associated with the report is "Online Dating," which aids in identifying and referencing the specific market segment covered.

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

To stay informed about further developments, trends, and reports in the Online Dating, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.