1. What is the projected Compound Annual Growth Rate (CAGR) of the Online Dating?

The projected CAGR is approximately XX%.

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.

Online Dating

Online DatingOnline Dating by Type (/> 18 to 24 Years, 25 to 34 Years, 35 to 44 Years, 45 to 54 Years, Others), by Application (/> Male, Female), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2025-2033

The online dating market is experiencing robust growth, driven by increasing smartphone penetration, evolving social norms around dating, and the convenience offered by digital platforms. While precise market sizing data is unavailable, industry reports suggest a substantial market value, likely exceeding several billion dollars globally in 2025, based on observed growth in similar sectors. A Compound Annual Growth Rate (CAGR) of, let's assume, 10% (a conservative estimate given market dynamics), is projected over the forecast period (2025-2033), indicating significant future expansion. Key drivers include the rising adoption of mobile dating apps, innovative features like video chat and AI-powered matching algorithms, and a growing acceptance of online dating across diverse demographics. Furthermore, niche dating apps catering to specific interests or communities contribute to market diversification.

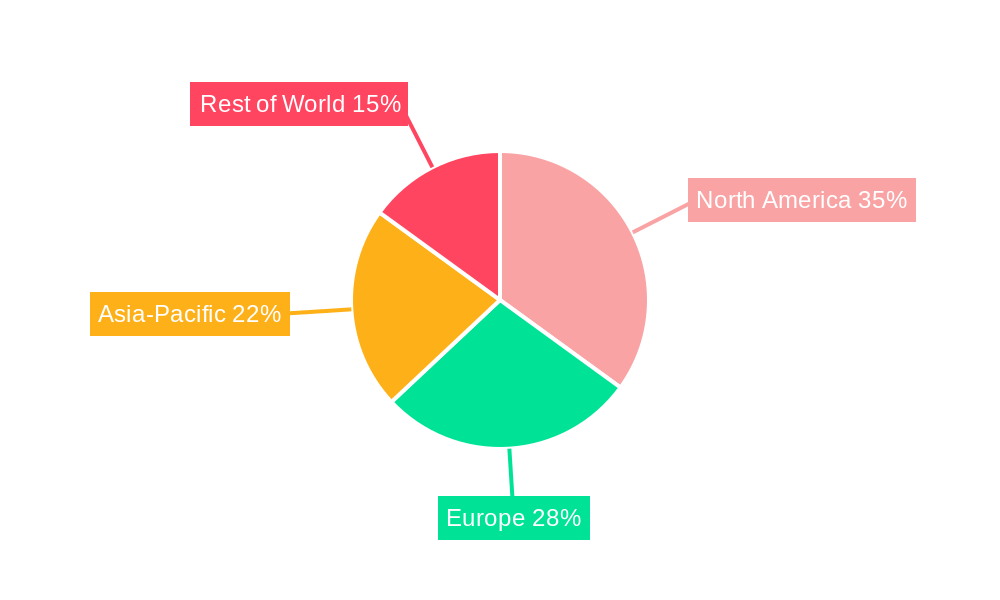

However, challenges exist. Competition is fierce, with established players like Match Group and Bumble facing competition from newer entrants and niche platforms. Concerns around data privacy and security, along with the potential for scams and misinformation, act as significant restraints. Market segmentation is evident, with different apps targeting various demographics (age, location, interests, etc.). The regional distribution likely reflects varying levels of internet penetration and cultural acceptance of online dating, with North America and Europe currently commanding significant market share. Future growth will likely be influenced by technological advancements, regulatory changes addressing data privacy, and evolving user expectations regarding online interaction and safety. The increasing integration of artificial intelligence for enhanced matching and user experience will be a key differentiator in the coming years.

The online dating market, a multi-billion dollar industry, has witnessed explosive growth over the past decade, transforming how people connect and form relationships. From 2019 to 2024 (Historical Period), the industry experienced significant expansion, driven by increasing smartphone penetration, changing societal attitudes towards online dating, and the development of sophisticated matching algorithms. This report, covering the period 2019-2033 (Study Period), with 2025 as the base and estimated year, projects continued robust growth, fueled by several key trends. The rise of niche dating apps catering to specific demographics (e.g., LGBTQ+ communities, religious groups, or those with shared interests) is a prominent feature. These apps offer users a more focused and potentially successful experience, leading to increased user engagement and market segmentation. Simultaneously, mainstream platforms continuously evolve their features, incorporating AI-powered matching systems, enhanced safety protocols, and virtual dating tools to remain competitive. The integration of video and live-streaming capabilities is also becoming increasingly common, allowing for more meaningful interactions before in-person meetings. Furthermore, the increasing acceptance of online dating as a legitimate way to find partners has broadened the user base, encompassing diverse age groups and social backgrounds. This demographic expansion fuels market expansion across geographical regions. The market is also seeing the emergence of subscription models offering premium features and better matching algorithms, boosting revenue streams for dating apps. Competition is fierce, with established giants alongside numerous innovative startups vying for market share, resulting in constant product improvements and user experience optimization. The forecast period (2025-2033) predicts a continuation of these trends, with the market expected to reach tens of millions of users globally. The industry’s trajectory showcases its adaptability and resilience, continuously reinventing itself to meet the evolving needs and preferences of its user base.

Several factors are propelling the remarkable growth of the online dating market. Firstly, the increasing prevalence of smartphones and readily accessible internet connectivity provides a convenient and ubiquitous platform for individuals to engage in online dating. This ease of access removes geographical barriers and increases the pool of potential partners significantly. Secondly, a shift in societal attitudes towards online dating has normalized the practice, making it increasingly acceptable and even preferred by many. This change in perception has contributed to a substantial growth in user numbers across all age demographics. Thirdly, advancements in technology have led to the development of sophisticated matching algorithms and AI-powered features. These algorithms improve the quality of matches, increasing user satisfaction and retention rates. Furthermore, the incorporation of features like video calls and virtual dating experiences enhances user engagement and offers a more interactive experience compared to traditional text-based interactions. Finally, the continuous innovation in the industry, with new apps and features constantly emerging, keeps the market dynamic and attractive to users. This competitive landscape pushes platforms to refine their services, creating a virtuous cycle of improvement and growth.

Despite its rapid expansion, the online dating market faces several challenges and restraints. One significant hurdle is the prevalence of fake profiles and scams. Users are vulnerable to fraud, catfishing, and unwanted advances, impacting trust and confidence in the platform. Addressing these issues through robust verification processes and improved safety measures is crucial for maintaining user engagement. Secondly, privacy concerns and data security remain significant obstacles. Users are apprehensive about sharing personal information online, and any data breach can severely damage a platform's reputation and user base. Maintaining transparency and implementing stringent security protocols are vital for mitigating these risks. Thirdly, the competitive landscape is exceptionally challenging, with numerous companies competing for users' attention. Standing out requires continuous innovation, substantial marketing investments, and a user-friendly experience. Furthermore, the effectiveness of matching algorithms, despite advancements, remains a challenge. Finding a genuine connection requires more than just algorithmic matches, and the inherent complexities of human relationships continue to pose difficulties for dating apps. Lastly, societal biases and prejudice can manifest in online dating, with users experiencing discrimination based on various factors like age, race, or appearance. Addressing these biases through inclusive policies and algorithms is essential for building a truly equitable and positive user experience.

The online dating market demonstrates significant regional variations in growth and adoption. North America and Europe currently hold substantial market shares, driven by higher internet penetration, disposable incomes, and a more established acceptance of online dating. However, Asia-Pacific is experiencing rapid growth, fueled by increasing smartphone usage and a young, tech-savvy population.

Beyond geography, several segments contribute to market dominance:

The projected dominance shifts towards Asia-Pacific in the forecast period (2025-2033) due to increasing smartphone usage and the region's considerable population size. The premium subscription and niche dating app segments will continue to thrive due to their value proposition and targeted user bases.

Several factors are driving growth in the online dating industry. The increasing mobile penetration globally creates readily accessible platforms for individuals to connect. Technological advancements in matching algorithms and AI significantly enhance user experience and increase user satisfaction. A shift in societal norms towards online dating also contributes substantially to the industry's growth, as it becomes increasingly normalized and widely accepted. Finally, innovative app features like video calls and virtual dates enhance engagement and provide a more realistic connection before in-person meetings. These factors collectively contribute to the continued expansion of the online dating market.

This report provides a comprehensive analysis of the online dating market, encompassing historical data, current market dynamics, and future projections. The report includes detailed insights into market trends, driving forces, challenges, key players, and significant developments within the sector. It also provides regional and segment-specific analyses, forecasting market growth and identifying key opportunities for players within the industry. The report serves as a valuable resource for businesses, investors, and stakeholders seeking a detailed understanding of the online dating landscape.

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of XX% from 2019-2033 |

| Segmentation |

|

Note*: In applicable scenarios

Primary Research

Secondary Research

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

The projected CAGR is approximately XX%.

Key companies in the market include Badoo, Coffee Meets Bagel, eharmony Inc., EliteMate.com LLC, Grindr LLC, Happn SAS, Love Group Global Ltd., Match Group Inc., rsvp.com.au Pty Ltd., Spark Networks SE, Spice of Life, Tastebuds Media Ltd., The Bumble Group, The Meet Group Inc., Zoosk Inc.

The market segments include Type, Application.

The market size is estimated to be USD XXX million as of 2022.

N/A

N/A

N/A

N/A

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4480.00, USD 6720.00, and USD 8960.00 respectively.

The market size is provided in terms of value, measured in million.

Yes, the market keyword associated with the report is "Online Dating," which aids in identifying and referencing the specific market segment covered.

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

To stay informed about further developments, trends, and reports in the Online Dating, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.