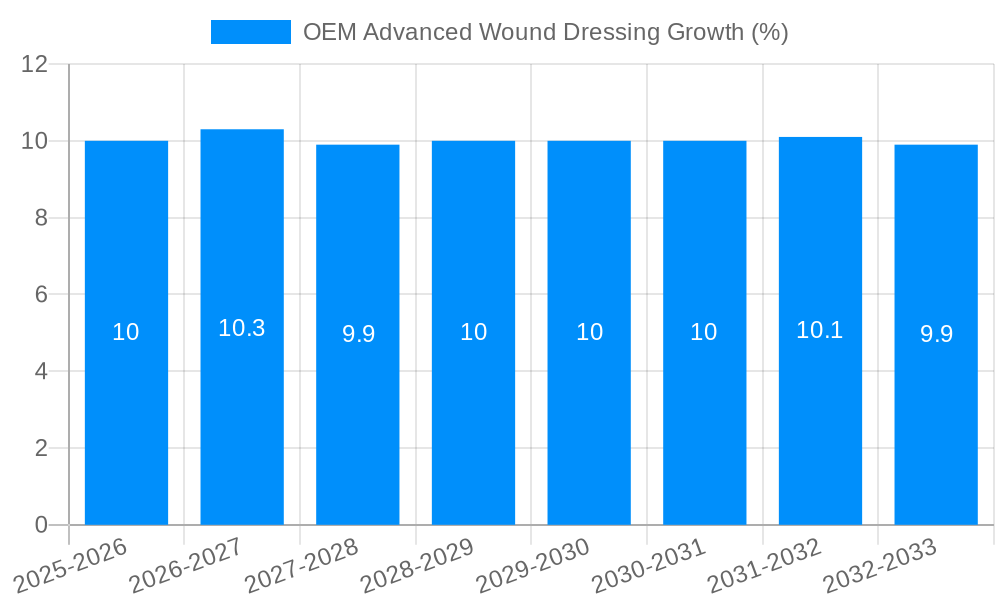

1. What is the projected Compound Annual Growth Rate (CAGR) of the OEM Advanced Wound Dressing?

The projected CAGR is approximately XX%.

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.

OEM Advanced Wound Dressing

OEM Advanced Wound DressingOEM Advanced Wound Dressing by Type (/> Hydrogel Dressing, Alginate Dressing, Foam Dressing, Hydrocolloid Dressing, Film Dressing, Super Absorbent Dressing, Dressings Containing Silver Ions, Others), by Application (/> Medical Institutions, Household, Pension Aagency), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2025-2033

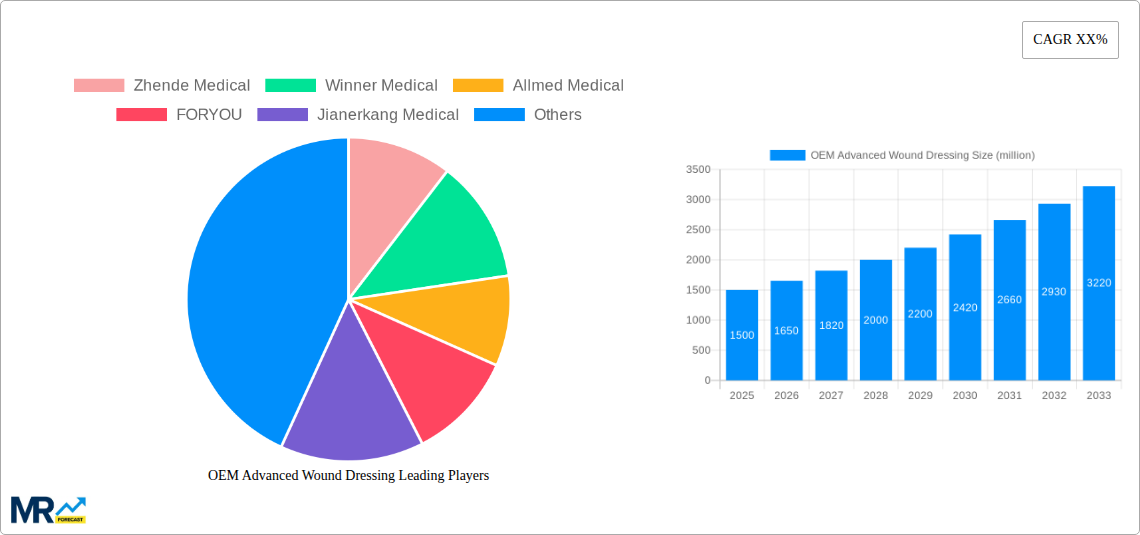

The OEM Advanced Wound Dressing market is poised for robust expansion, projected to reach an estimated USD XXX million by 2025, with a compelling Compound Annual Growth Rate (CAGR) of XX% through 2033. This significant growth is underpinned by a confluence of powerful drivers, including the escalating prevalence of chronic wounds, particularly those associated with diabetes and an aging global population. Advances in material science and wound care technology are continuously introducing more effective and patient-friendly dressing solutions, such as hydrogel, alginate, and silver ion-infused dressings, which are gaining traction for their superior healing properties and reduced infection rates. Furthermore, the increasing demand for home healthcare solutions and the growing awareness among patients and healthcare professionals about the benefits of advanced wound care are acting as significant catalysts for market penetration. The strategic focus of key players on research and development, alongside expanding manufacturing capabilities, will further fuel this upward trajectory.

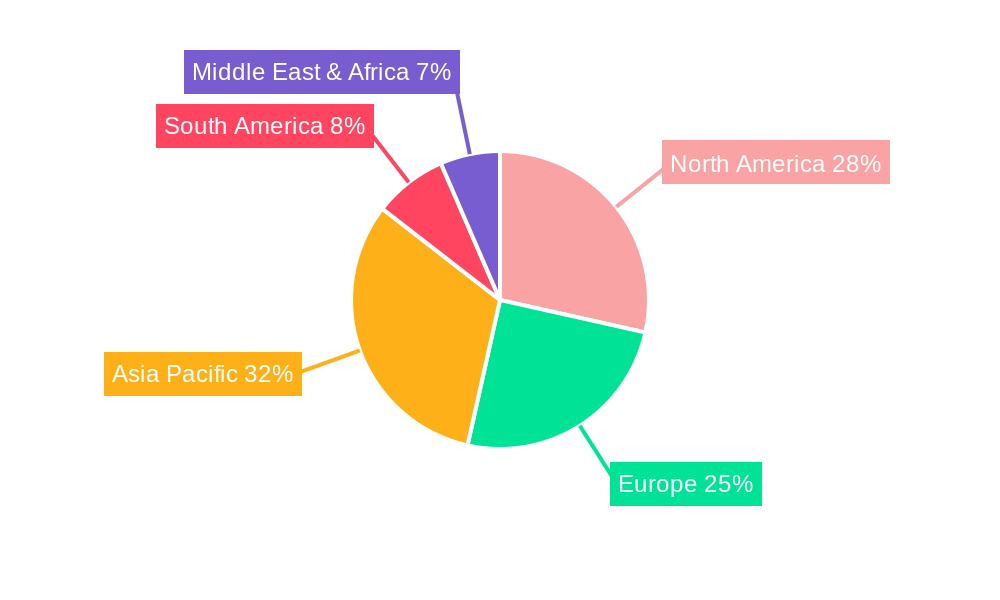

Despite the promising outlook, the market faces certain restraints. High manufacturing costs associated with specialized materials and complex production processes can impact affordability and adoption, especially in price-sensitive markets. Stringent regulatory approvals for new medical devices also present a hurdle, potentially delaying market entry for innovative products. However, the overwhelming trend towards minimally invasive procedures and the desire for improved patient outcomes are expected to outweigh these challenges. The market is segmented by dressing type, with Hydrogel, Alginate, and Foam Dressings anticipated to lead due to their versatility and efficacy across a broad spectrum of wound types. Application-wise, medical institutions will continue to dominate, but the burgeoning household and pension agency segments signal a growing shift towards decentralized wound care. Geographically, Asia Pacific, led by China and India, is projected to be a key growth engine, driven by increasing healthcare expenditure, a large patient pool, and a growing OEM manufacturing base. North America and Europe will remain significant markets, characterized by advanced healthcare infrastructure and a strong demand for innovative wound management solutions.

Here's a comprehensive report description for OEM Advanced Wound Dressing, incorporating the provided details:

XXX, the global OEM advanced wound dressing market is poised for substantial expansion, projected to reach an estimated [Insert Projected Market Value in Millions] million units by 2033. The study period from 2019-2033, with a base year of 2025, reveals a dynamic landscape shaped by technological advancements, an aging global population, and an increasing prevalence of chronic wounds. During the historical period (2019-2024), the market demonstrated consistent growth, fueled by rising healthcare expenditures and greater awareness of effective wound management solutions. Looking ahead to the forecast period (2025-2033), continued innovation in dressing materials and formulations, coupled with the growing demand for convenient and effective at-home care options, will be pivotal. The OEM segment, in particular, is experiencing a surge in demand as medical device manufacturers and healthcare providers seek specialized, high-quality wound care products that can be branded and distributed under their own names. This trend is driven by the need for cost-effectiveness, supply chain control, and the ability to tailor products to specific market needs. The market is witnessing a significant shift towards advanced wound care solutions that offer superior moisture management, infection control, and accelerated healing properties. Furthermore, the increasing focus on personalized medicine and patient comfort is pushing the development of innovative dressing designs and materials. The integration of smart technologies, such as biosensors, into wound dressings is also an emerging trend, promising real-time monitoring of wound status and treatment efficacy. The competitive landscape is characterized by a blend of established players and emerging innovators, all striving to capture market share through product differentiation, strategic partnerships, and a deep understanding of OEM requirements. The shift towards minimally invasive procedures and enhanced home healthcare settings further bolsters the demand for advanced wound dressings that are easy to apply and manage by both healthcare professionals and patients. The growing emphasis on reducing hospital stays and healthcare costs also positions advanced wound dressings as a critical component in optimizing patient outcomes and streamlining healthcare delivery.

The OEM advanced wound dressing market is experiencing robust growth propelled by several key driving forces. The escalating global prevalence of chronic diseases, such as diabetes and cardiovascular conditions, directly contributes to a higher incidence of chronic wounds, including diabetic foot ulcers, pressure ulcers, and venous leg ulcers. This demographic shift necessitates a continuous and expanding supply of advanced wound care solutions. Furthermore, the aging global population is a significant factor; older individuals are more susceptible to chronic wounds and require specialized care. Government initiatives and increasing healthcare awareness programs promoting effective wound management practices are also playing a crucial role in driving demand. The OEM model itself is a significant propellant; manufacturers are increasingly outsourcing production to specialized OEM providers who can deliver high-quality, cost-effective, and customized wound dressings. This allows original equipment manufacturers and healthcare companies to focus on their core competencies of research, development, marketing, and distribution, while leveraging the expertise of specialized manufacturers for product realization. The continuous innovation in wound dressing technologies, including the development of novel materials like hydrogels, alginates, and silver-infused dressings that offer improved healing properties and infection control, is another critical driver. The growing trend towards home healthcare and the increasing preference for self-management of wounds by patients further boost the demand for advanced, user-friendly wound dressings, which are often supplied through OEM channels.

Despite its promising growth trajectory, the OEM advanced wound dressing market faces several challenges and restraints that could temper its expansion. One of the primary concerns is the stringent regulatory landscape governing medical devices. Obtaining and maintaining regulatory approvals from various health authorities across different regions can be a complex, time-consuming, and expensive process for OEM manufacturers and their clients. This can hinder the speed of market entry and product diversification. The high cost associated with the research, development, and manufacturing of advanced wound dressings can also be a restraint. The specialized materials and technologies involved often translate to higher production costs, which can impact pricing and accessibility, especially in price-sensitive markets. Intense competition within the OEM segment can lead to price wars and margin erosion for manufacturers. Companies must continuously innovate and maintain product quality to differentiate themselves in a crowded marketplace. Furthermore, a lack of skilled professionals in wound care management, particularly in developing economies, can limit the effective utilization of advanced wound dressings, thereby impacting demand. Supply chain disruptions, as witnessed in recent global events, can also pose a significant challenge to the consistent availability of raw materials and finished products, affecting OEM production schedules and delivery commitments. Finally, limited reimbursement policies for advanced wound dressings in some healthcare systems can restrict their adoption by medical institutions and patients, thus hindering market growth.

The Medical Institutions segment is poised to dominate the OEM advanced wound dressing market due to its consistent and high volume demand. Hospitals, clinics, and specialized wound care centers represent the largest end-users, requiring a continuous supply of advanced dressings for a wide range of acute and chronic wounds. The inherent need for infection control, accelerated healing, and patient comfort in a clinical setting drives the adoption of sophisticated wound care solutions. Furthermore, medical professionals are more likely to utilize advanced dressings that have been rigorously tested and comply with strict healthcare standards, making OEM partnerships a logical choice for manufacturers aiming to serve this critical sector.

Among the various Type segments, Foam Dressing is expected to exhibit significant dominance. Foam dressings offer excellent absorbency, cushioning, and moisture management, making them highly versatile for various wound types, including moderate to heavily exuding wounds, pressure ulcers, and surgical wounds. Their ability to maintain a moist wound environment conducive to healing, while also preventing maceration, makes them a preferred choice for clinicians. The OEM sector benefits from the widespread application of foam dressings, allowing for bulk production and customization to meet the specific needs of different medical institutions and brands.

Another segment that will play a crucial role in market dominance is Dressings Containing Silver Ions. The increasing global concern over hospital-acquired infections and the rising prevalence of antibiotic-resistant bacteria have significantly propelled the demand for antimicrobial wound dressings. Dressings incorporating silver ions offer broad-spectrum antimicrobial activity, effectively reducing bacterial load and preventing infection in chronic and complex wounds. This segment's importance in combating infection aligns perfectly with the critical care needs of medical institutions, thereby solidifying its dominant position.

Geographically, Asia Pacific is anticipated to emerge as a leading region in the OEM advanced wound dressing market. This dominance is driven by several factors:

While other regions like North America and Europe currently hold significant market share due to their well-established healthcare systems and higher per capita healthcare spending, the rapid growth and expanding manufacturing capabilities in Asia Pacific, coupled with a burgeoning demand for advanced wound care solutions, position it for leadership in the coming years, especially within the OEM segment.

The OEM advanced wound dressing industry is experiencing a significant growth spurt fueled by several key catalysts. The increasing prevalence of chronic wounds, largely driven by an aging global population and the rising incidence of diseases like diabetes, creates a sustained demand for effective wound management solutions. The OEM model itself acts as a major catalyst, enabling smaller brands and healthcare providers to access high-quality, specialized wound dressings without the need for extensive in-house manufacturing capabilities. Furthermore, continuous technological innovation in dressing materials, such as the development of novel hydrogels, alginates, and antimicrobial formulations, offers enhanced healing properties and patient comfort, thereby driving market penetration. The growing trend of home healthcare and self-care also presents a significant opportunity, as individuals seek convenient and effective wound management options for use outside traditional medical settings.

This comprehensive report delves into the intricate dynamics of the OEM advanced wound dressing market, offering invaluable insights for stakeholders. It provides a detailed analysis of market size and growth projections, meticulously tracking the trajectory from the historical period (2019-2024) through the base year (2025) to an estimated [Insert Projected Market Value in Millions] million units by the forecast year (2033). The report meticulously dissects the market into key segments, including product Type such as Hydrogel, Alginate, Foam, Hydrocolloid, Film, Super Absorbent, Dressings Containing Silver Ions, and Others, and Application segments encompassing Medical Institutions, Household, and Pension Agency. Furthermore, it sheds light on the critical industry developments shaping the future of this sector, alongside an in-depth examination of the driving forces propelling its growth and the challenges that may impede it. The geographical landscape is thoroughly explored, identifying key regions and countries with significant market potential and dominance. A detailed profiling of leading OEM players and their contributions, coupled with a chronological breakdown of significant developments, equips readers with a holistic understanding of the competitive environment and future outlook.

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of XX% from 2019-2033 |

| Segmentation |

|

Note*: In applicable scenarios

Primary Research

Secondary Research

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

The projected CAGR is approximately XX%.

Key companies in the market include Zhende Medical, Winner Medical, Allmed Medical, FORYOU, Jianerkang Medical, Anhui Whywin International, Innomed, Sterigenics, Sino Protection (Hefei) Medical Products, Guangdong Baihe Medical, Zhejiang Top-medical Medical Dressing, Roosin Medical, Wuhan Huawei Technology, Tronjen Technology, Jiangsu WLD Medical.

The market segments include Type, Application.

The market size is estimated to be USD XXX million as of 2022.

N/A

N/A

N/A

N/A

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4480.00, USD 6720.00, and USD 8960.00 respectively.

The market size is provided in terms of value, measured in million.

Yes, the market keyword associated with the report is "OEM Advanced Wound Dressing," which aids in identifying and referencing the specific market segment covered.

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

To stay informed about further developments, trends, and reports in the OEM Advanced Wound Dressing, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.