1. What is the projected Compound Annual Growth Rate (CAGR) of the Non-Contact Solder Paste Thickness Gauges?

The projected CAGR is approximately XX%.

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.

Non-Contact Solder Paste Thickness Gauges

Non-Contact Solder Paste Thickness GaugesNon-Contact Solder Paste Thickness Gauges by Type (Portable, Online, World Non-Contact Solder Paste Thickness Gauges Production ), by Application (PCB Manufacturing, Electronics Assembly, Others, World Non-Contact Solder Paste Thickness Gauges Production ), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2025-2033

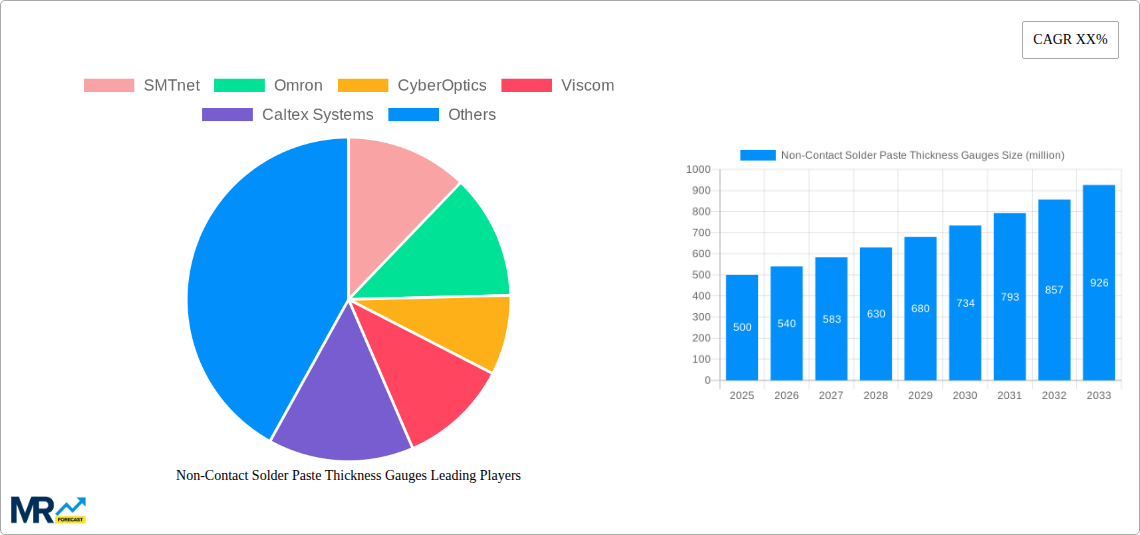

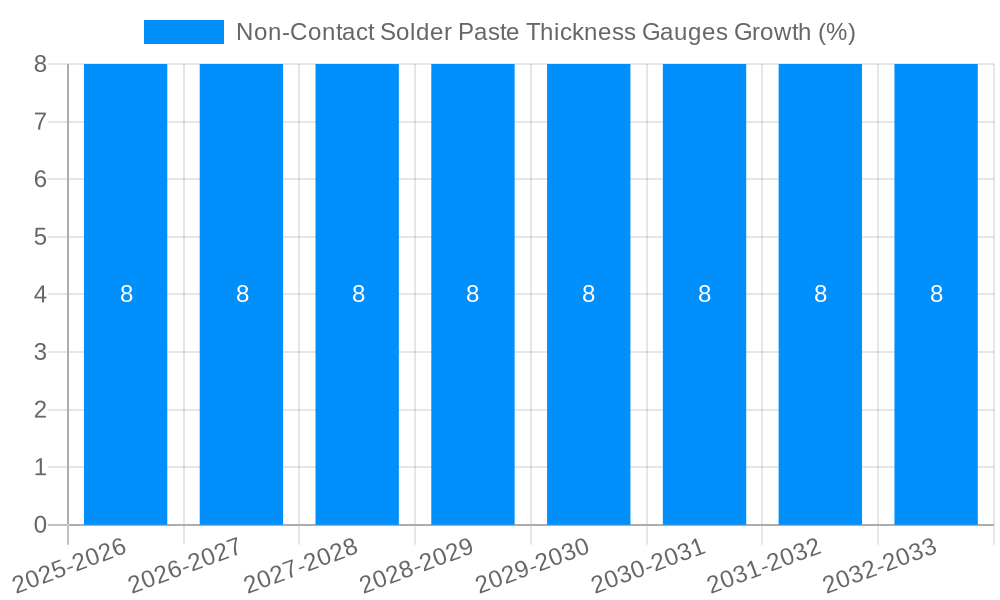

The global market for Non-Contact Solder Paste Thickness Gauges is experiencing robust growth, projected to reach approximately $500 million by 2025 with a Compound Annual Growth Rate (CAGR) of around 8% during the forecast period of 2025-2033. This expansion is primarily driven by the increasing demand for high-precision electronic components and the escalating complexity of Printed Circuit Board (PCB) manufacturing processes. As miniaturization trends continue to dominate the electronics industry, the need for accurate and reliable solder paste deposition has become paramount, directly fueling the adoption of advanced non-contact measurement solutions. The transition towards Industry 4.0 principles, emphasizing automation and quality control, further bolsters the market, as these gauges are integral to ensuring process consistency and minimizing defects in high-volume production environments.

The market segments are broadly categorized by type into Portable and Online gauges, with Online systems likely capturing a larger share due to their seamless integration into automated production lines. In terms of application, PCB Manufacturing and Electronics Assembly represent the dominant segments, reflecting the core usage of these devices in the industry. Key market players like SMTnet, Omron, CyberOptics, Viscom, and Caltex Systems are actively innovating, introducing sophisticated technologies that enhance measurement accuracy, speed, and data analysis capabilities. Geographically, the Asia Pacific region, particularly China, is expected to lead market growth due to its status as a global electronics manufacturing hub. North America and Europe also represent significant markets, driven by stringent quality standards and a strong focus on advanced manufacturing techniques in sectors like automotive electronics and medical devices. The market's growth trajectory is largely unhindered by significant restraints, as the benefits of improved product quality, reduced waste, and enhanced throughput associated with non-contact solder paste thickness gauges outweigh any potential cost barriers for manufacturers.

This report offers a comprehensive analysis of the global non-contact solder paste thickness gauges market, projecting a robust growth trajectory driven by increasing demand for high-precision electronics manufacturing. The study encompasses a detailed examination of market trends, driving forces, challenges, regional dominance, growth catalysts, leading players, and significant developments. The analysis spans the Study Period: 2019-2033, with the Base Year: 2025 and Estimated Year: 2025, followed by a detailed Forecast Period: 2025-2033 and insights from the Historical Period: 2019-2024. The global market is projected to reach a substantial valuation, with an estimated market size in the millions unit by the end of the forecast period, reflecting the critical role these advanced metrology tools play in modern electronics production.

The global non-contact solder paste thickness gauges market is experiencing a significant evolution, characterized by a shift towards higher precision, increased automation, and enhanced data management capabilities. The continuous miniaturization of electronic components and the rising complexity of printed circuit boards (PCBs) necessitate stringent quality control measures, with solder paste deposition being a critical step. This trend is driving the adoption of non-contact gauging solutions as they offer superior accuracy, repeatability, and speed compared to traditional contact-based methods. The World Non-Contact Solder Paste Thickness Gauges Production is witnessing a surge in demand for technologies that can reliably measure solder paste volume, height, and alignment with micron-level precision. Factors such as the increasing prevalence of surface-mount technology (SMT) across various industries, including automotive, consumer electronics, and telecommunications, are further amplifying this demand. The market is also seeing a growing emphasis on integrated inspection solutions where solder paste thickness gauging is combined with other automated optical inspection (AOI) functionalities, creating a more holistic approach to quality assurance. Furthermore, the advent of Industry 4.0 principles is pushing for smart manufacturing environments, where data generated by these gauges is seamlessly integrated into broader production workflows for real-time process monitoring and optimization. The increasing demand for advanced packaging techniques, such as wafer-level packaging and 3D ICs, which require incredibly precise solder paste deposition, is another key trend shaping the market. The adoption of cloud-based data analytics and AI-powered defect prediction algorithms is also on the rise, enabling manufacturers to proactively identify and address potential issues in the solder paste application process. The market is poised for substantial growth, with the global non-contact solder paste thickness gauges market expected to achieve a significant valuation in the millions unit in the coming years, reflecting its indispensable role in ensuring the reliability and performance of modern electronic devices.

The non-contact solder paste thickness gauges market is being propelled by a confluence of technological advancements and evolving industry demands. The relentless pursuit of higher miniaturization and increased functionality in electronic devices directly translates to a need for more precise solder paste deposition. As components shrink and PCB densities increase, even minute variations in solder paste height or volume can lead to significant yield losses and device failures. Non-contact gauges, utilizing technologies like laser triangulation, optical profilometry, and 3D vision, offer unparalleled accuracy in measuring these critical parameters. Furthermore, the growing adoption of advanced manufacturing techniques, such as high-speed SMT lines and complex multi-layer PCBs, demands inspection tools that can keep pace with production throughput without compromising on accuracy. The increasing emphasis on quality and reliability in sectors like automotive electronics, medical devices, and aerospace, where product failure can have severe consequences, is a significant driver. These industries have stringent quality control requirements, and non-contact solder paste thickness gauges play a crucial role in meeting these standards, thereby reducing scrap rates and warranty claims. The proactive approach to defect detection and prevention, facilitated by real-time monitoring and data analysis from these gauges, is another key impetus. By identifying deviations in solder paste deposition early in the manufacturing process, companies can optimize their stencil printing and reflow soldering processes, leading to improved overall production efficiency and cost savings. The global market is projected to continue its upward trajectory, with the World Non-Contact Solder Paste Thickness Gauges Production expected to expand considerably in the coming years, reaching a substantial value in the millions unit.

Despite the promising growth prospects, the non-contact solder paste thickness gauges market faces certain challenges and restraints that could temper its expansion. One of the primary hindrances is the high initial investment associated with acquiring advanced non-contact gauging systems. These sophisticated instruments often come with a considerable price tag, which can be a deterrent for small and medium-sized enterprises (SMEs) or manufacturers in price-sensitive markets. The complexity of operation and maintenance can also pose a challenge. While designed for automation, these systems still require skilled personnel for setup, calibration, and troubleshooting. A shortage of adequately trained technicians could limit their widespread adoption. Furthermore, the variability in solder paste properties can impact the accuracy and reliability of measurements. Different solder paste formulations, including variations in particle size, flux content, and viscosity, can affect how light or other sensing mechanisms interact with the paste, potentially leading to inconsistent readings. Manufacturers need to ensure their chosen gauging system is compatible with the diverse range of solder pastes they employ. Integration challenges with existing production lines can also be a bottleneck. Retrofitting advanced gauging systems into older or less automated manufacturing setups can be technically demanding and costly, requiring significant modifications to existing equipment and workflows. Finally, the evolving standards and evolving technological landscape necessitate continuous updates and upgrades to gauging equipment, adding to the total cost of ownership and potentially creating obsolescence concerns for older models. These factors, while not insurmountable, require careful consideration and strategic planning by both manufacturers and end-users to ensure optimal utilization and return on investment in the non-contact solder paste thickness gauges market.

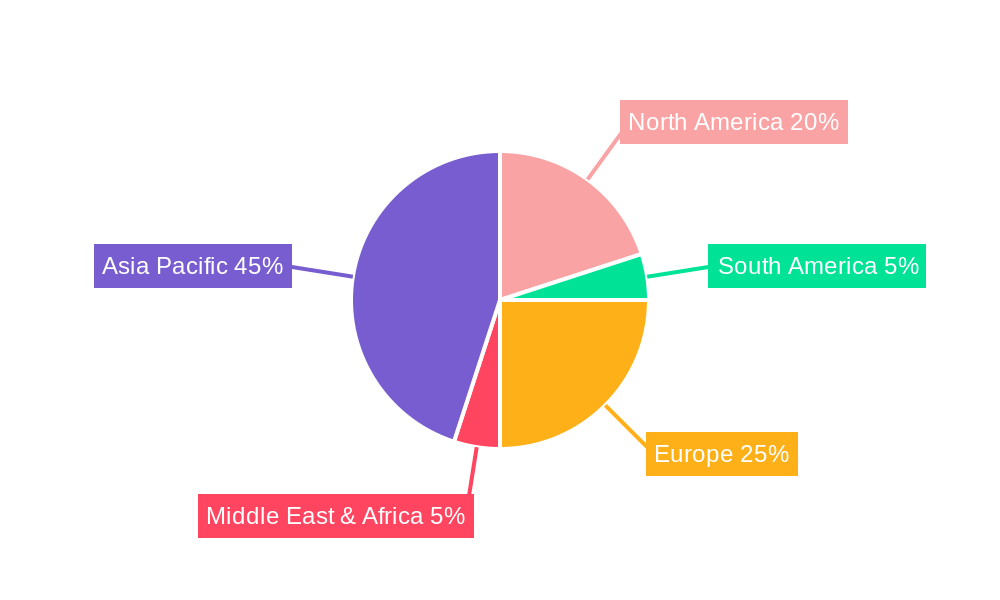

The global non-contact solder paste thickness gauges market is characterized by significant regional variations in demand and adoption, with certain regions and segments poised for dominant growth.

Dominant Regions:

Asia-Pacific: This region is expected to be a powerhouse in the non-contact solder paste thickness gauges market, driven by its status as the global manufacturing hub for electronics. Countries like China, South Korea, Taiwan, and Japan are home to a vast number of PCB manufacturers and electronics assembly plants, all of whom are increasingly investing in advanced metrology to maintain competitiveness. The sheer volume of electronics production, coupled with the presence of major Original Equipment Manufacturers (OEMs) and their extensive supply chains, fuels a continuous demand for high-precision inspection equipment. Furthermore, the rapid adoption of advanced manufacturing technologies and the government's push towards Industry 4.0 initiatives in countries like China are accelerating the adoption of non-contact solder paste thickness gauges. The World Non-Contact Solder Paste Thickness Gauges Production is heavily concentrated in this region, with a significant portion of the global output being manufactured and consumed here. The increasing demand for consumer electronics, automotive electronics, and telecommunications infrastructure in emerging economies within Asia-Pacific further solidifies its dominant position. The market size in this region, measured in the millions unit, is projected to be the largest globally.

North America: The North American market, particularly the United States, remains a significant player due to its strong presence in high-end electronics manufacturing, including aerospace, defense, and medical devices. These sectors demand the highest levels of quality and reliability, making non-contact solder paste thickness gauges indispensable. The ongoing trend of reshoring manufacturing back to North America, driven by supply chain resilience concerns and technological advancements, is also contributing to increased investment in advanced inspection equipment. The focus on innovation and the development of cutting-edge technologies in this region further supports the demand for sophisticated gauging solutions.

Europe: Europe, with its robust automotive industry and growing demand for advanced consumer electronics and industrial automation, also represents a substantial market for non-contact solder paste thickness gauges. Countries like Germany, France, and the UK are leading the adoption of sophisticated manufacturing processes, necessitating precise quality control measures. The increasing emphasis on product safety and regulatory compliance in sectors like automotive and medical devices further drives the demand for reliable metrology solutions.

Dominant Segments:

Online Segment (Type): The Online segment of non-contact solder paste thickness gauges is expected to dominate the market. This is primarily due to the increasing need for real-time, in-line inspection in high-volume production environments. Online systems are integrated directly into the SMT production line, enabling continuous monitoring of solder paste deposition as it occurs. This allows for immediate detection of defects, reducing rework, scrap, and overall production costs. The efficiency gains from real-time feedback and process correction make online solutions highly attractive for large-scale manufacturers aiming for optimal throughput and yield. The World Non-Contact Solder Paste Thickness Gauges Production is increasingly geared towards online solutions to meet the demands of modern automated manufacturing. The market size for the online segment, estimated in the millions unit, is projected to outpace that of portable systems.

PCB Manufacturing (Application): The PCB Manufacturing application segment will continue to be the largest consumer of non-contact solder paste thickness gauges. The quality of solder paste deposition directly impacts the reliability and performance of the final electronic device. As PCBs become more complex, with finer pitch components and multi-layer designs, the precision required in solder paste application becomes paramount. Non-contact gauges are crucial for ensuring accurate solder paste volume, height, and placement, preventing bridging, insufficient solder, and other critical defects. This segment's dominance is intrinsically linked to the overall growth of the electronics industry. The continuous innovation in PCB design and the expanding applications of PCBs across various sectors will sustain the demand for advanced solder paste thickness gauging solutions.

The interplay between these dominant regions and segments, driven by technological advancements and the ever-increasing demands of the electronics industry, will shape the future landscape of the non-contact solder paste thickness gauges market.

Several key factors are acting as significant growth catalysts for the non-contact solder paste thickness gauges industry. The relentless trend towards miniaturization in electronics, leading to finer pitch components and higher component density on PCBs, necessitates extremely precise solder paste deposition. This directly fuels the demand for non-contact gauging technologies that can achieve micron-level accuracy. The increasing adoption of advanced packaging techniques and 3D integration in electronics also requires highly controlled solder paste application, further driving market growth. The expansion of high-growth sectors like automotive electronics, medical devices, and aerospace, which prioritize exceptional quality and reliability, mandates the use of advanced metrology solutions like non-contact solder paste thickness gauges to minimize defects and ensure product longevity. The global drive towards Industry 4.0 and smart manufacturing environments encourages real-time process monitoring and data-driven decision-making, making these gauges integral to achieving greater automation and efficiency in electronics assembly.

The non-contact solder paste thickness gauges market is served by a competitive landscape of innovative companies dedicated to providing advanced metrology solutions. Key players driving advancements and market growth include:

The non-contact solder paste thickness gauges sector has witnessed several crucial advancements that have shaped its trajectory:

This report offers an all-encompassing view of the non-contact solder paste thickness gauges market, providing in-depth insights crucial for strategic decision-making. It delves into the intricate market dynamics, analyzing both the macro and micro factors influencing growth. The report meticulously examines the Study Period: 2019-2033, establishing a strong historical context and projecting future trends. Detailed analysis of the Base Year: 2025 and Estimated Year: 2025 provides a clear snapshot of the market's current standing. The comprehensive Forecast Period: 2025-2033 offers actionable insights into the market's future trajectory, including projected growth in the millions unit. Furthermore, the report dissects key market segments, including Type (Portable, Online) and Application (PCB Manufacturing, Electronics Assembly, Others), highlighting their respective growth potentials. An extensive review of World Non-Contact Solder Paste Thickness Gauges Production and its key players, coupled with an analysis of Industry Developments, ensures a holistic understanding of the market ecosystem. This report serves as an invaluable resource for manufacturers, suppliers, investors, and end-users seeking to navigate and capitalize on the opportunities within this dynamic market.

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of XX% from 2019-2033 |

| Segmentation |

|

Note*: In applicable scenarios

Primary Research

Secondary Research

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

The projected CAGR is approximately XX%.

Key companies in the market include SMTnet, Omron, CyberOptics, Viscom, Caltex Systems, ASC International, Dongguan Tianhong Electronic Technology.

The market segments include Type, Application.

The market size is estimated to be USD XXX million as of 2022.

N/A

N/A

N/A

N/A

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4480.00, USD 6720.00, and USD 8960.00 respectively.

The market size is provided in terms of value, measured in million and volume, measured in K.

Yes, the market keyword associated with the report is "Non-Contact Solder Paste Thickness Gauges," which aids in identifying and referencing the specific market segment covered.

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

To stay informed about further developments, trends, and reports in the Non-Contact Solder Paste Thickness Gauges, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.