1. What is the projected Compound Annual Growth Rate (CAGR) of the New Energy Vehicle Powertrain Test Equipment?

The projected CAGR is approximately XX%.

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.

New Energy Vehicle Powertrain Test Equipment

New Energy Vehicle Powertrain Test EquipmentNew Energy Vehicle Powertrain Test Equipment by Type (Motor Test, Transmission Test, End of Line Test, Other), by Application (Automotive Manufacturer, Automotive Parts Manufacturer, Other), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2025-2033

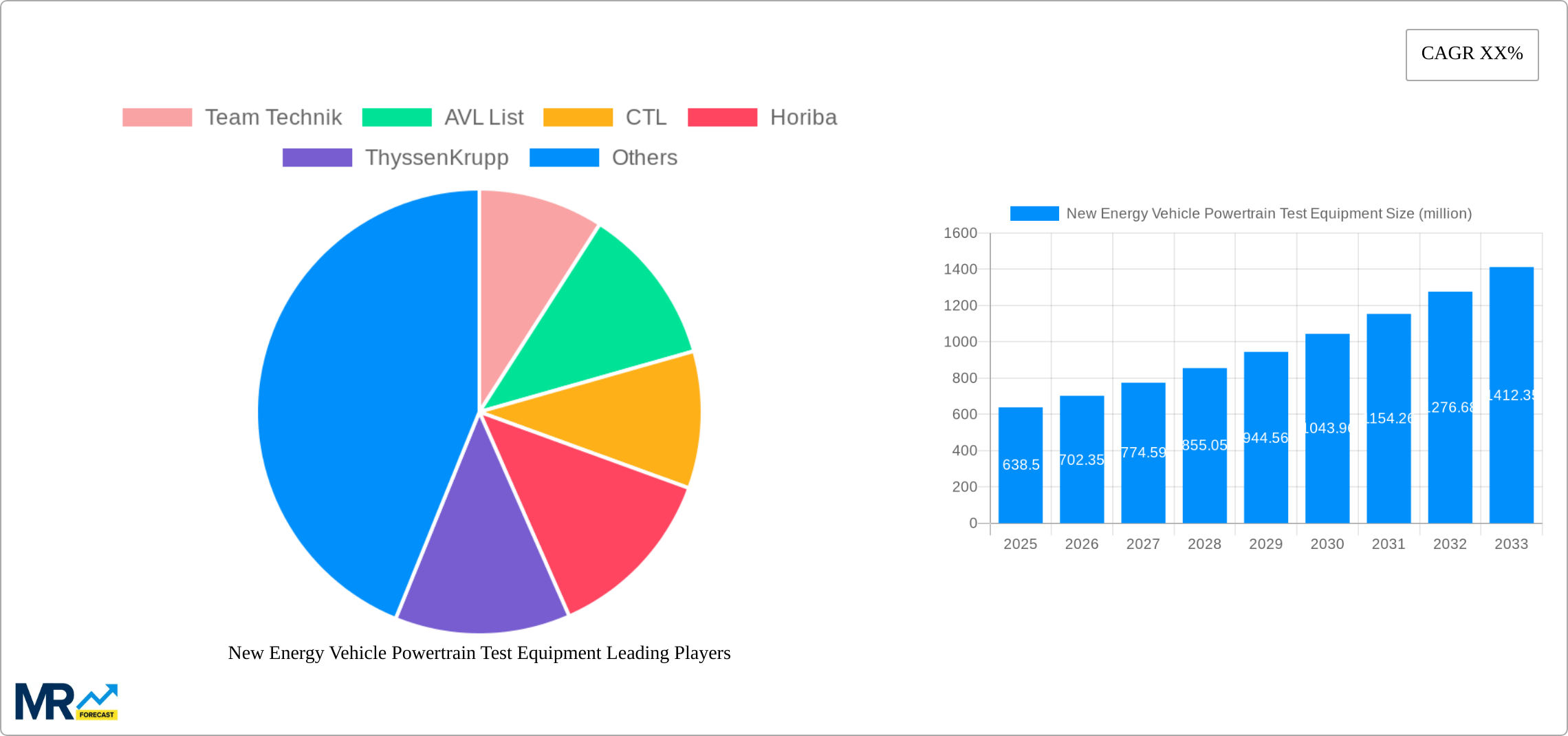

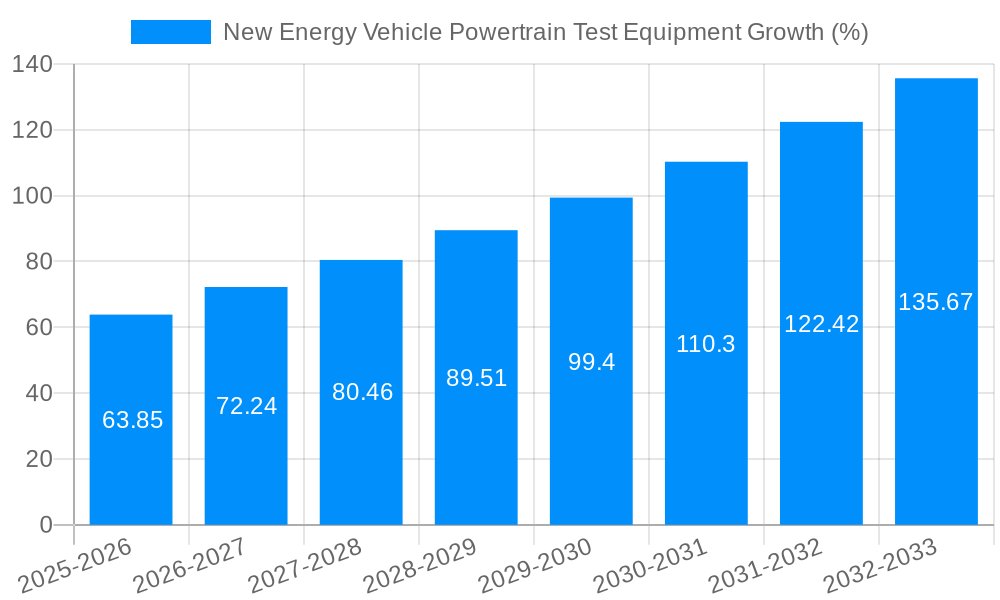

The New Energy Vehicle (NEV) Powertrain Test Equipment market is poised for significant expansion, driven by the accelerating global shift towards electric and hybrid mobility. Valued at an estimated $1,500 million in 2025, the market is projected to grow at a robust Compound Annual Growth Rate (CAGR) of 12% through 2033. This substantial growth is primarily fueled by escalating vehicle electrification mandates, increasing consumer adoption of EVs, and the continuous evolution of NEV powertrain technologies, including advanced battery systems, sophisticated electric motors, and complex transmission architectures. Key market players are investing heavily in research and development to offer more comprehensive, accurate, and efficient testing solutions. The demand for specialized equipment that can validate the performance, safety, and durability of these intricate powertrains is paramount for automotive manufacturers and parts suppliers alike.

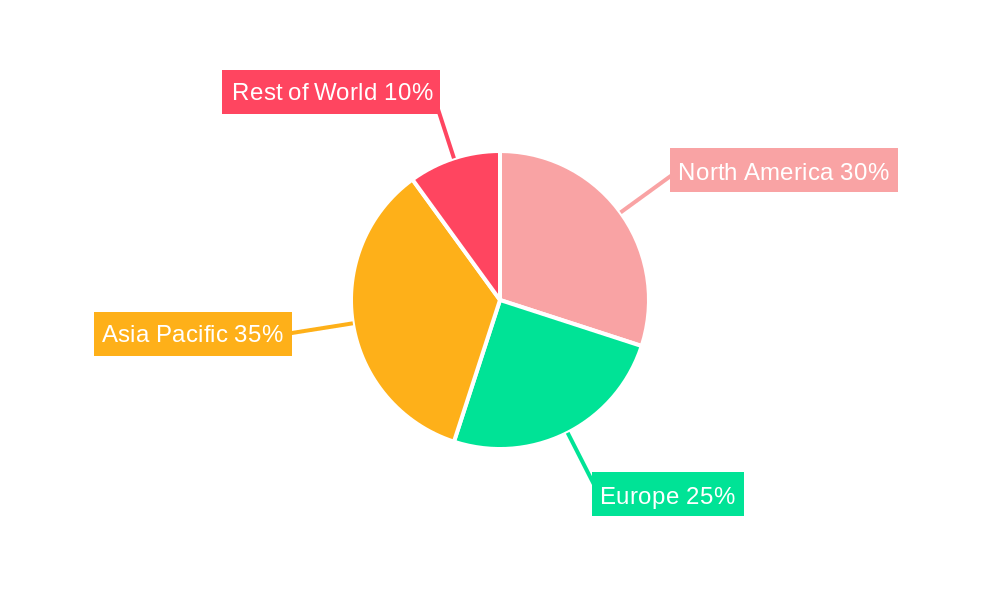

The market is segmented into Motor Test, Transmission Test, and End-of-Line Test, with the Motor Test segment expected to lead due to the increasing complexity and performance requirements of electric motors. Automotive manufacturers represent the largest application segment, followed by automotive parts manufacturers. Geographically, Asia Pacific, particularly China, is anticipated to dominate the market, owing to its status as the largest NEV market globally and its extensive manufacturing base. North America and Europe are also significant contributors, driven by stringent emission regulations and growing consumer preference for sustainable transportation. However, the market faces some restraints, including the high initial investment costs for advanced testing equipment and the need for skilled personnel to operate and maintain them. Nevertheless, the overarching trend of electrification and the drive for improved NEV performance and reliability ensure a dynamic and promising future for the NEV Powertrain Test Equipment market.

This report provides an in-depth analysis of the global New Energy Vehicle (NEV) Powertrain Test Equipment market, offering valuable insights into market trends, driving forces, challenges, regional dominance, growth catalysts, and leading players. The study encompasses a detailed examination from the historical period of 2019-2024, with a base year of 2025, and extends through a comprehensive forecast period of 2025-2033. The report leverages extensive research and expert analysis to deliver a robust understanding of this rapidly evolving sector.

The global New Energy Vehicle (NEV) Powertrain Test Equipment market is poised for substantial expansion, projected to reach a valuation exceeding $5,500 million by the end of the forecast period. This remarkable growth is underpinned by several significant trends that are reshaping the industry. The increasing adoption of electrified powertrains, including battery electric vehicles (BEVs) and hybrid electric vehicles (HEVs), is a primary driver. As NEVs become more prevalent, the demand for sophisticated and reliable testing equipment to validate the performance, safety, and durability of their unique powertrains escalates. This includes specialized equipment for testing electric motors, power electronics, battery management systems, and integrated powertrain units. Furthermore, stringent government regulations and emissions standards worldwide are compelling automotive manufacturers to invest heavily in NEV technology, consequently boosting the demand for advanced testing solutions. The report highlights a growing emphasis on simulation and digital twin technologies within powertrain testing, enabling manufacturers to virtually validate designs and reduce the need for extensive physical prototypes. This trend is particularly pronounced in the Motor Test segment, which is expected to witness significant innovation and market share growth. The increasing complexity of NEV powertrains, with multiple interconnected components and sophisticated control systems, necessitates highly integrated and versatile testing platforms. This drives demand for solutions that can perform comprehensive end-to-end testing, encompassing various functional and performance parameters. The rise of autonomous driving features, which often integrate with NEV powertrains for enhanced efficiency and performance, also contributes to the demand for more advanced and interconnected testing equipment. Moreover, the report identifies a growing trend towards modular and scalable test systems, allowing manufacturers to adapt their testing infrastructure to evolving powertrain architectures and production volumes. The increasing focus on battery performance and longevity also fuels the demand for specialized battery testing equipment that can be integrated into comprehensive powertrain test setups. The push towards higher efficiency and longer range for NEVs means that powertrain components are being pushed to their limits, requiring more rigorous and detailed testing to ensure reliability and performance under various operating conditions. Finally, the emergence of new entrants and startups in the NEV space, particularly in emerging markets, is creating new pockets of demand for accessible and cost-effective powertrain testing solutions.

The New Energy Vehicle (NEV) Powertrain Test Equipment market is experiencing robust growth fueled by a confluence of powerful driving forces. Foremost among these is the escalating global imperative to reduce carbon emissions and combat climate change. Governments worldwide are implementing ambitious policies and offering substantial incentives to accelerate the adoption of NEVs, directly translating into increased demand for the equipment required to develop and validate these advanced powertrains. The continuous innovation in battery technology, leading to improved energy density, faster charging capabilities, and reduced costs, makes NEVs increasingly attractive to consumers and businesses alike. This technological advancement necessitates equally advanced testing equipment to ensure the reliable performance and safety of these evolving battery systems and their integration with electric motors and other powertrain components. Furthermore, the evolving regulatory landscape, with increasingly stringent safety and emissions standards for vehicles, compels manufacturers to rigorously test their NEV powertrains to meet compliance requirements. This includes comprehensive validation of motor performance, transmission efficiency, and overall system integration. The sheer pace of technological development in the NEV sector, with new architectures and components emerging regularly, creates a persistent need for manufacturers to invest in flexible and adaptable testing solutions. The competitive landscape among automotive manufacturers, all vying to capture market share in the rapidly expanding NEV segment, also drives investment in cutting-edge testing capabilities. This ensures they can bring high-performing, reliable, and safe NEV powertrains to market efficiently.

Despite the promising growth trajectory, the New Energy Vehicle (NEV) Powertrain Test Equipment market faces several significant challenges and restraints that could temper its expansion. The high initial cost of sophisticated powertrain testing equipment presents a substantial barrier, particularly for smaller automotive parts manufacturers or startups with limited capital. The intricate nature of NEV powertrains, involving complex electronic control units, high-voltage systems, and advanced thermal management, requires highly specialized and often bespoke testing solutions, which can be prohibitively expensive to procure and maintain. Moreover, the rapid pace of technological evolution within the NEV sector creates a constant demand for upgrades and replacements of existing test equipment. Manufacturers must continuously invest in new technologies to stay competitive, leading to significant capital expenditure. The shortage of skilled personnel with expertise in both electrical engineering and powertrain testing can also hinder market growth. Developing, operating, and interpreting results from advanced test equipment requires specialized knowledge, and the availability of such talent is limited. Another restraint is the standardization challenge. While efforts are underway, the lack of universally adopted standards for NEV powertrain testing can lead to fragmented approaches and compatibility issues between different manufacturers' equipment and vehicle systems. The long development cycles for some NEV components and the need for extensive validation can also impact the speed at which new test equipment technologies are adopted. Finally, global supply chain disruptions, particularly for critical electronic components used in test equipment, can lead to production delays and increased costs, impacting the availability and affordability of these essential tools.

The Automotive Manufacturer segment, particularly within the Type: Motor Test and Type: Transmission Test, is poised to dominate the New Energy Vehicle Powertrain Test Equipment market during the forecast period. This dominance is expected to be most pronounced in Asia Pacific, with China leading the charge, followed by North America and Europe.

Asia Pacific (Dominant Region): China is the undisputed global leader in NEV production and sales. This leadership is driven by strong government support, favorable policies, and a rapidly growing domestic market. Consequently, Chinese automotive manufacturers and their extensive supply chains are investing heavily in state-of-the-art NEV powertrain test equipment. The sheer volume of NEV production necessitates a robust and scalable testing infrastructure. The region also benefits from a strong presence of indigenous test equipment manufacturers, such as Liance Electromechanical and Xiang Yi Power Testing, which offer competitive and often customized solutions. The rapid evolution of Chinese NEV technology, with a strong focus on innovation in motor efficiency, battery management, and integrated powertrain systems, further amplifies the demand for advanced testing capabilities. The presence of numerous automotive parts manufacturers specializing in electric powertrains also contributes significantly to the regional market. The continued government push for electrification, coupled with ambitious targets for NEV adoption, ensures sustained demand for powertrain testing solutions in this region. The scale of the automotive industry in China, encompassing both established players and emerging startups, creates a massive and consistent market for a wide array of test equipment.

Automotive Manufacturer (Dominant Segment): Automotive manufacturers are the primary end-users of NEV powertrain test equipment. They are responsible for the entire powertrain development, validation, and production process. Their demand spans from initial research and development testing of individual components like electric motors and transmissions to end-of-line testing of complete powertrain assemblies before they are installed in vehicles. The need to ensure the performance, reliability, safety, and efficiency of their NEV offerings drives significant investment in advanced testing solutions. They require equipment that can simulate various driving conditions, environmental factors, and fault scenarios to guarantee product quality and customer satisfaction. The integration of complex software and control systems within NEV powertrains further necessitates sophisticated diagnostic and validation tools. The scale of their operations, with millions of vehicles produced annually, translates into a substantial and continuous demand for high-throughput and accurate testing equipment.

Type: Motor Test (Key Segment): Electric motors are the heart of NEV powertrains, and their performance directly impacts vehicle efficiency, range, and driving dynamics. Consequently, the demand for specialized motor test equipment is exceptionally high. This includes equipment for measuring torque, speed, efficiency, thermal performance, noise, vibration, and harshness (NVH). The increasing power density and complexity of electric motors, as well as the development of new motor topologies, necessitate advanced and adaptable motor testing solutions. This segment is characterized by significant technological advancements, with a growing emphasis on dynamic testing and the integration of simulation tools to replicate real-world operating conditions.

Type: Transmission Test (Key Segment): While simpler than traditional internal combustion engine transmissions, NEV transmissions (including single-speed gearboxes, multi-speed transmissions, and e-axles) still require rigorous testing to ensure efficiency, durability, and quiet operation. Testing focuses on gear meshing, lubrication, thermal management, and overall power transfer efficiency. As NEV powertrains become more sophisticated, with integrated multi-speed gearboxes for improved performance and efficiency, the demand for advanced transmission test benches will continue to rise. The development of compact and lightweight transmissions also requires specialized testing equipment to validate their performance under demanding conditions.

The synergy between the dominance of the Automotive Manufacturer segment and the critical need for robust Motor Test and Transmission Test solutions, particularly within the high-volume NEV production hubs of Asia Pacific, solidifies their leading position in the global NEV Powertrain Test Equipment market.

The NEV Powertrain Test Equipment industry is propelled by several powerful growth catalysts. The unwavering global push for decarbonization and stringent emissions regulations worldwide is a primary driver, compelling greater investment in NEV technology and, consequently, its testing infrastructure. Rapid advancements in battery technology and electric motor efficiency are creating demand for more sophisticated and precise testing solutions. The increasing complexity of NEV powertrains, often featuring integrated systems, necessitates comprehensive testing capabilities to ensure optimal performance and safety. Furthermore, the expanding global NEV market, fueled by growing consumer acceptance and falling battery costs, directly translates to increased demand for production-scale testing equipment.

This comprehensive report delves into the intricacies of the global New Energy Vehicle (NEV) Powertrain Test Equipment market, projecting a substantial market size exceeding $5,500 million by 2033. It meticulously analyzes key segments, including Motor Test, Transmission Test, and End of Line Test, with a particular focus on their growth trajectories. The report further examines the critical Application segments, highlighting the dominance of Automotive Manufacturers and Automotive Parts Manufacturers. By dissecting the Industry Developments and understanding the nuances of each Type and Application, stakeholders gain a granular view of market dynamics. The report provides actionable intelligence, enabling informed strategic decisions for companies operating within this dynamic sector.

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of XX% from 2019-2033 |

| Segmentation |

|

Note*: In applicable scenarios

Primary Research

Secondary Research

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

The projected CAGR is approximately XX%.

Key companies in the market include AVL List, Liance Electromechanical, CTL, Horiba, ThyssenKrupp, W-Ibeda, Xiang Yi Power Testing, LangDi Measurement, Chengbang Haoran Measurement, .

The market segments include Type, Application.

The market size is estimated to be USD XXX million as of 2022.

N/A

N/A

N/A

N/A

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3480.00, USD 5220.00, and USD 6960.00 respectively.

The market size is provided in terms of value, measured in million and volume, measured in K.

Yes, the market keyword associated with the report is "New Energy Vehicle Powertrain Test Equipment," which aids in identifying and referencing the specific market segment covered.

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

To stay informed about further developments, trends, and reports in the New Energy Vehicle Powertrain Test Equipment, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.