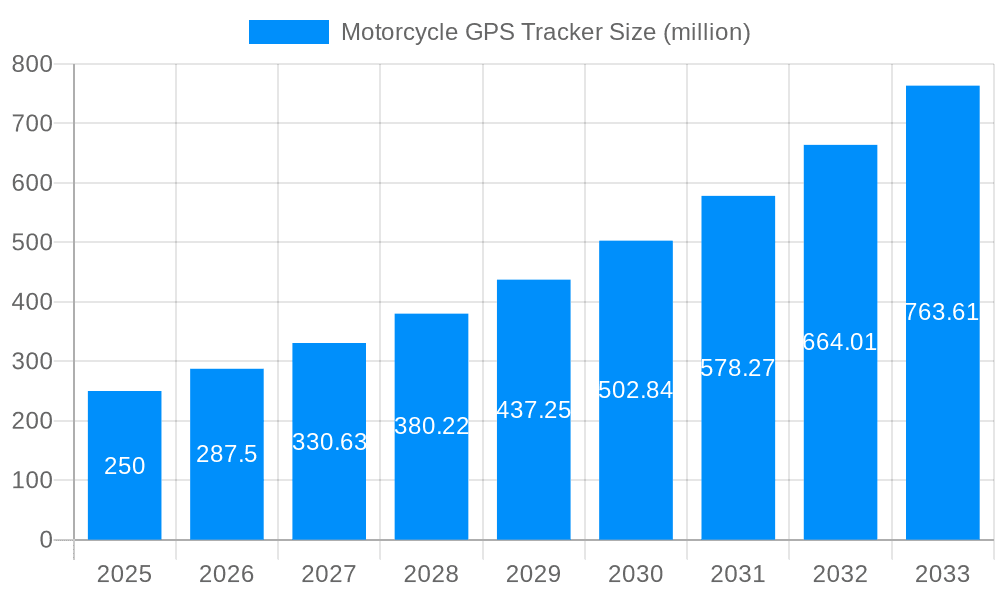

1. What is the projected Compound Annual Growth Rate (CAGR) of the Motorcycle GPS Tracker?

The projected CAGR is approximately 15%.

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.

Motorcycle GPS Tracker

Motorcycle GPS TrackerMotorcycle GPS Tracker by Type (Cellular Tracker, Satellite Tracker, World Motorcycle GPS Tracker Production ), by Application (Personal Use, Fleet Use, World Motorcycle GPS Tracker Production ), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2026-2034

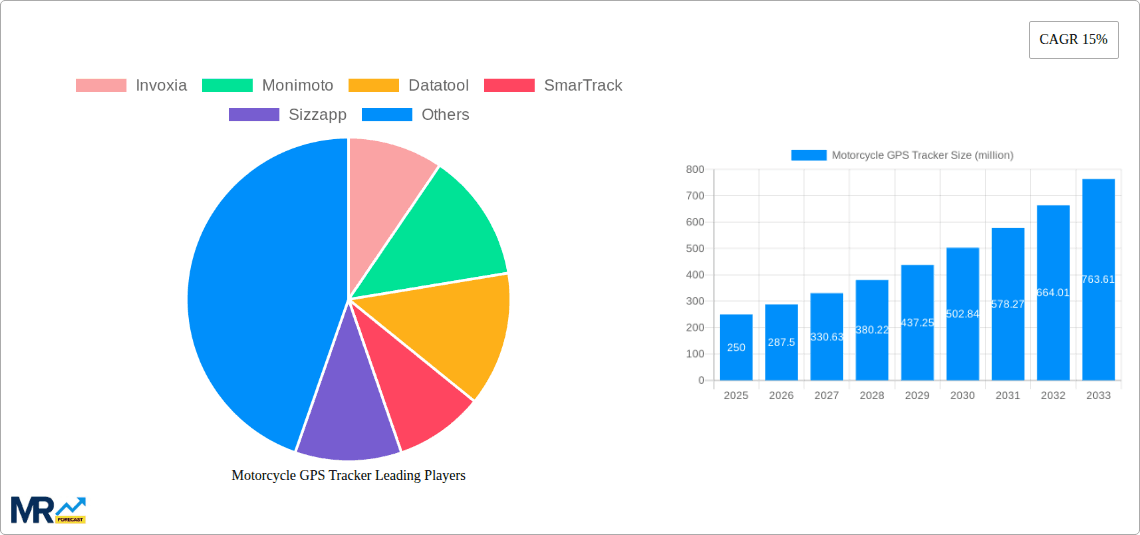

The global Motorcycle GPS Tracker market is poised for significant expansion, driven by an increasing awareness of vehicle security and the growing adoption of advanced tracking technologies. Valued at an estimated $250 million in 2025, the market is projected to experience a robust Compound Annual Growth Rate (CAGR) of 15% during the forecast period of 2025-2033. This substantial growth is fueled by a confluence of factors, including rising motorcycle ownership worldwide, a persistent concern over theft rates, and the increasing integration of IoT capabilities into vehicle security systems. Furthermore, the evolving technological landscape, characterized by miniaturization, enhanced battery life, and more sophisticated tracking algorithms, is making motorcycle GPS trackers more accessible and appealing to a wider consumer base. The demand is further bolstered by the growing need for fleet management solutions in commercial operations, where efficient tracking and monitoring are paramount for operational efficiency and asset protection.

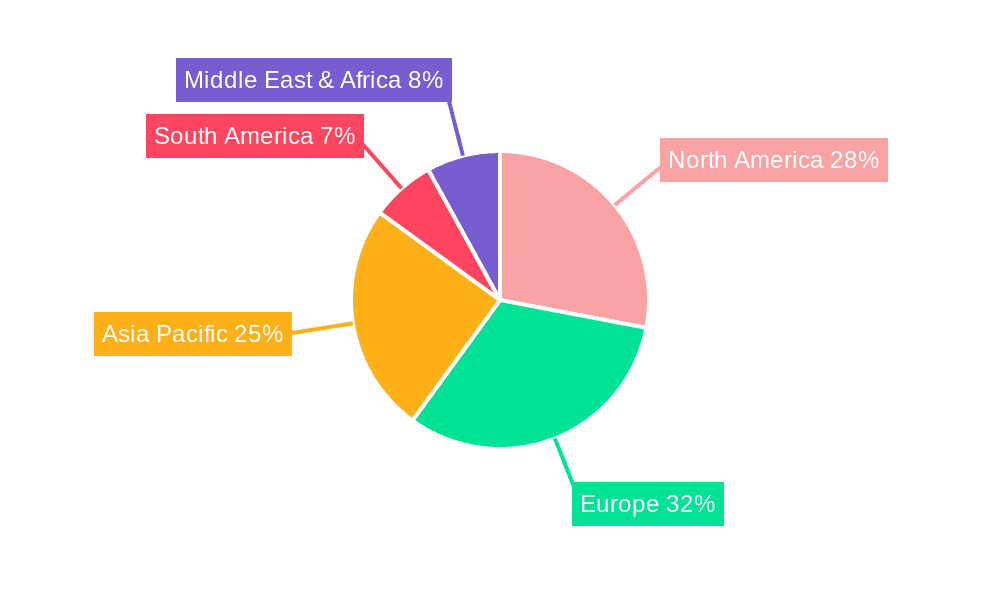

The market's trajectory is also shaped by the emergence of innovative solutions and strategic collaborations among key industry players. While the market benefits from strong demand drivers, certain challenges, such as the initial cost of installation and concerns regarding data privacy and cybersecurity, need to be addressed to ensure sustained growth. Geographically, Asia Pacific is expected to emerge as a key growth region, owing to the burgeoning motorcycle market and increasing disposable incomes. North America and Europe will continue to be significant markets, driven by a mature adoption of advanced security features and a strong regulatory push for vehicle safety. The segmentation of the market into Cellular Tracker and Satellite Tracker types, along with applications ranging from personal use to fleet management, indicates a diverse and dynamic market landscape ready to cater to varied consumer needs.

This report provides an in-depth analysis of the global Motorcycle GPS Tracker market, examining its trajectory from 2019 to 2033, with a base year of 2025. The study delves into various aspects of the market, including types of trackers, applications, regional dominance, driving forces, challenges, growth catalysts, and the competitive landscape. The estimated market size for Motorcycle GPS Trackers is expected to reach several million dollars by 2025 and continue its upward trend through 2033.

The Motorcycle GPS Tracker market is experiencing a significant surge, driven by escalating concerns over vehicle theft and an increasing adoption of smart technologies among motorcycle owners. During the historical period of 2019-2024, the market witnessed steady growth, fueled by a heightened awareness of the financial and emotional toll of motorcycle theft. As we move into the base year of 2025 and the forecast period extending to 2033, several key trends are shaping the market landscape. The shift towards more sophisticated and discreet tracking solutions is paramount, with manufacturers focusing on developing trackers that are not only effective but also blend seamlessly with the motorcycle’s aesthetics, making them harder for thieves to detect. Furthermore, the integration of advanced features like real-time location tracking, geofencing capabilities, movement alerts, and remote disabling functionalities are becoming standard offerings. The increasing affordability of these devices, coupled with a growing understanding of their long-term value proposition in preventing losses, is making them accessible to a broader spectrum of motorcycle enthusiasts. The market is also seeing a rise in demand for trackers with longer battery life and enhanced durability to withstand varying environmental conditions, essential for motorcycle usage. Beyond personal use, the application of motorcycle GPS trackers in fleet management for delivery services and ride-sharing platforms is also gaining traction, contributing to market expansion. The evolution of communication technologies, such as the widespread availability of 4G/5G networks, is enabling faster and more reliable data transmission for real-time tracking, a crucial factor for emergency response and recovery efforts. The market is poised for substantial growth, with projections indicating a market size in the millions of units by 2025 and a compound annual growth rate that will sustain this expansion throughout the forecast period. The report anticipates a continued innovation in miniaturization, power efficiency, and connectivity, further solidifying the importance of motorcycle GPS trackers in enhancing security and operational efficiency.

The escalating global concern regarding motorcycle theft is undoubtedly the primary driver for the motorcycle GPS tracker market. The financial implications of losing a prized possession, coupled with the inconvenience and emotional distress, compel owners to invest in robust security solutions. This fear of loss is further amplified by the increasing popularity of motorcycles as a primary mode of transportation in many urban and semi-urban areas, leading to a larger potential target base for thieves. Alongside security, the burgeoning demand for smart and connected devices is also significantly propelling the market. Motorcycle owners are increasingly seeking to leverage technology to enhance their riding experience and security. This includes features beyond mere tracking, such as ride data logging, remote diagnostics, and even integration with smartphone applications for seamless monitoring and control. The growth in organized crime, particularly vehicle theft rings, has also necessitated more advanced anti-theft measures, making GPS trackers an indispensable tool for both individuals and law enforcement agencies. Furthermore, the expanding motorcycle rental and sharing economy creates a demand for fleet management solutions, where GPS trackers play a crucial role in monitoring asset location, usage, and security, thereby boosting the market for fleet-oriented trackers. The continuous technological advancements, including miniaturization of devices, improved battery life, and enhanced connectivity options (like 4G/5G integration), are making motorcycle GPS trackers more effective, user-friendly, and affordable, further widening their appeal.

Despite the robust growth trajectory, the Motorcycle GPS Tracker market faces several challenges and restraints that could potentially temper its expansion. One significant hurdle is the perceived cost of these devices. While prices have become more accessible over the years, some potential buyers may still consider the upfront investment as a barrier, especially in price-sensitive markets or for owners of lower-value motorcycles. The issue of battery life remains a concern for some users, particularly for trackers that do not have direct power connections to the motorcycle’s battery. Frequent recharging or battery replacement can be inconvenient and may lead to a lapse in tracking if not managed properly. Privacy concerns associated with location tracking technology are also a potential restraint. While designed for security, some users might be wary of their location data being accessible, even if secured. Manufacturers need to ensure robust data protection measures and transparent privacy policies to build trust. The complexity of installation and setup for some advanced trackers can also deter less tech-savvy users. While many products are designed for DIY installation, others might require professional assistance, adding to the overall cost and effort. Furthermore, the effectiveness of GPS trackers can be hampered by signal interference in certain environments, such as underground parking garages or areas with dense urban canyons, leading to temporary loss of tracking capabilities. Finally, the evolving tactics of professional thieves who are adept at detecting and disabling tracking devices pose an ongoing challenge, necessitating continuous innovation from tracker manufacturers to stay ahead of these threats.

The global Motorcycle GPS Tracker market is poised for substantial growth, with certain regions and segments expected to lead the charge. Among the key regions, North America is projected to dominate the market. This dominance stems from a combination of factors including a high per capita income, a strong culture of motorcycle ownership for both leisure and commuting, and a well-established awareness of the need for vehicle security. The presence of a robust aftermarket accessories industry, coupled with stringent regulations and insurance incentives for anti-theft devices, further bolsters the demand for motorcycle GPS trackers in this region. Countries like the United States and Canada are key contributors to this leadership, with a significant number of motorcycle enthusiasts and a high rate of adoption for advanced security technologies.

Within the segments, Cellular Trackers are expected to emerge as the dominant type, driven by their widespread network coverage and the increasing availability of affordable cellular plans. These trackers utilize cellular networks (2G, 3G, 4G, and increasingly 5G) to transmit location data, making them highly effective in urban and suburban environments where cellular signals are consistently strong. Their ease of use and relatively lower cost compared to satellite trackers make them an attractive option for a broad consumer base. The Personal Use application segment is also anticipated to hold a significant market share. The growing concern among individual motorcycle owners about theft prevention, coupled with the desire for enhanced personal security and the ability to monitor their valuable assets, fuels this segment's dominance. As motorcycle ownership continues to rise globally, particularly in emerging economies, the demand for personal security solutions like GPS trackers will only intensify.

Furthermore, the World Motorcycle GPS Tracker Production itself, encompassing the manufacturing capabilities and technological advancements, will be a critical factor in market dominance. Regions with advanced manufacturing infrastructure, strong research and development capabilities, and a skilled workforce are likely to lead in producing high-quality and innovative GPS tracking solutions. This includes the development of miniaturized, power-efficient, and feature-rich devices that cater to diverse market needs. The integration of these trackers into motorcycles as standard or optional equipment by manufacturers will also play a crucial role in their widespread adoption and market leadership. The report anticipates that the synergy between strong regional demand, the prevalence of cost-effective and reliable tracking technologies like cellular trackers, and the overarching personal security concerns of motorcycle owners will solidify North America's leadership, with the Personal Use application segment and the production of advanced cellular trackers being key drivers of this market dominance over the forecast period. The global market size is projected to be in the millions of units annually, with these dominant forces shaping its trajectory.

The Motorcycle GPS Tracker industry is experiencing several potent growth catalysts. The increasing proliferation of smart devices and the growing consumer preference for connected technologies are significantly driving adoption. Advancements in IoT (Internet of Things) technology are enabling more sophisticated tracking solutions with enhanced communication capabilities and real-time data exchange. Furthermore, rising insurance premium discounts for motorcycles equipped with GPS trackers are incentivizing owners to invest in these security devices, acting as a significant financial motivator. The expansion of the motorcycle aftermarket industry, with a focus on safety and security, is also fostering innovation and accessibility of these trackers.

This comprehensive report offers a thorough examination of the Motorcycle GPS Tracker market, providing invaluable insights for stakeholders. It delves into the market dynamics, analyzing the historical performance from 2019-2024 and presenting detailed forecasts through 2033, with a focus on the base year of 2025. The report meticulously details the various types of trackers, including Cellular and Satellite Trackers, and examines their market penetration and future potential. It also explores the application segments of Personal Use and Fleet Use, highlighting their respective growth drivers and market share. Furthermore, the report identifies the leading companies operating in this sector, their product portfolios, and their strategic initiatives. The analysis extends to identifying key regional markets and countries that are expected to dominate the global landscape. The report also scrutinizes the crucial driving forces propelling the market forward, such as the rising incidence of motorcycle theft and the increasing adoption of smart technology. Conversely, it addresses the challenges and restraints that the industry faces, including cost sensitivities and privacy concerns. The growth catalysts that will shape the future of the market, such as technological advancements and insurance incentives, are also thoroughly discussed. This in-depth coverage ensures that readers gain a holistic understanding of the Motorcycle GPS Tracker market, enabling informed decision-making and strategic planning.

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 15% from 2020-2034 |

| Segmentation |

|

Note*: In applicable scenarios

Primary Research

Secondary Research

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

The projected CAGR is approximately 15%.

Key companies in the market include Invoxia, Monimoto, Datatool, SmarTrack, Sizzapp, Tracker, CanTrack, BikeTrac, Americaloc, Optimus, Primetracking, Carlock, Spytec, Tile, Solid GPS, LandAirSea, Tkstar, Motomox, Fleetminder, Stopanik, Rewire Security, LoneStar, .

The market segments include Type, Application.

The market size is estimated to be USD 250 million as of 2022.

N/A

N/A

N/A

N/A

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4480.00, USD 6720.00, and USD 8960.00 respectively.

The market size is provided in terms of value, measured in million and volume, measured in K.

Yes, the market keyword associated with the report is "Motorcycle GPS Tracker," which aids in identifying and referencing the specific market segment covered.

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

To stay informed about further developments, trends, and reports in the Motorcycle GPS Tracker, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.