1. What is the projected Compound Annual Growth Rate (CAGR) of the Molded Pulp Egg Cartons?

The projected CAGR is approximately XX%.

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.

Molded Pulp Egg Cartons

Molded Pulp Egg CartonsMolded Pulp Egg Cartons by Type (Up to 15 Cell, 15-30 Cell, Above 30 Cell, World Molded Pulp Egg Cartons Production ), by Application (Transportation, Retailing, World Molded Pulp Egg Cartons Production ), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2025-2033

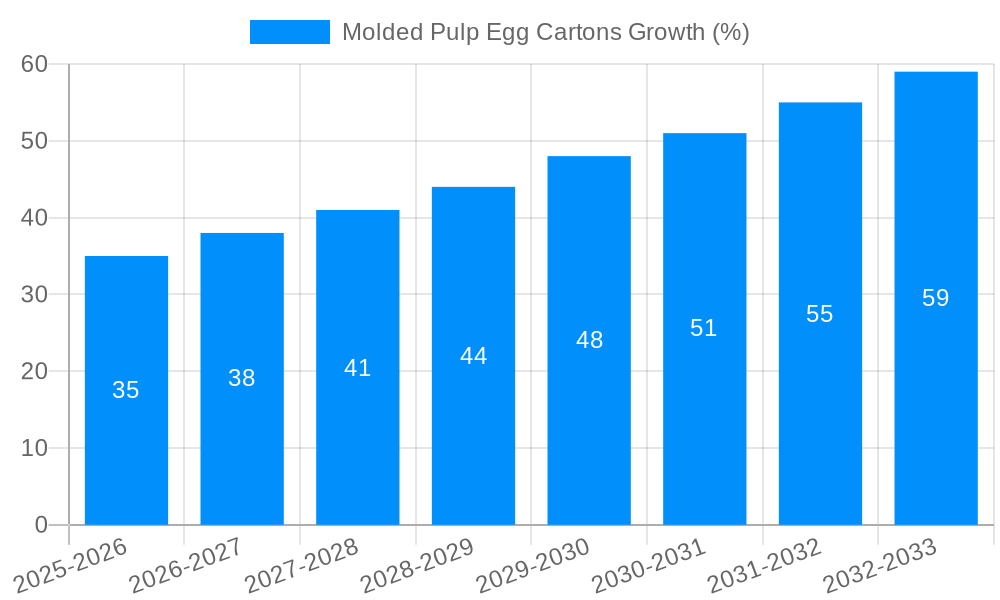

The global molded pulp egg cartons market is experiencing robust growth, driven by increasing consumer demand for sustainable and eco-friendly packaging solutions. The shift towards environmentally conscious practices within the food and beverage industry, coupled with stringent regulations regarding plastic waste, is significantly boosting the adoption of molded pulp egg cartons. These cartons offer a biodegradable and compostable alternative to traditional styrofoam and plastic packaging, appealing to both environmentally aware consumers and businesses seeking to improve their sustainability profiles. The market is segmented by carton cell count (up to 15, 15-30, above 30), reflecting varying needs for egg sizes and transportation methods. The transportation and retailing segments are key application areas, with considerable growth potential in emerging economies as consumer purchasing power increases and modern retail infrastructure expands. While the market faces challenges such as price competitiveness with traditional packaging and potential fluctuations in raw material costs (pulp), innovation in molded pulp technology and increasing partnerships between packaging manufacturers and egg producers are mitigating these constraints. Furthermore, government initiatives promoting sustainable packaging are further propelling market expansion. We estimate the market size in 2025 to be around $850 million, based on industry reports indicating a strong upward trend and considering the CAGR (Compound Annual Growth Rate) for similar sustainable packaging segments. This is projected to see substantial growth, reaching potentially over $1.2 billion by 2033.

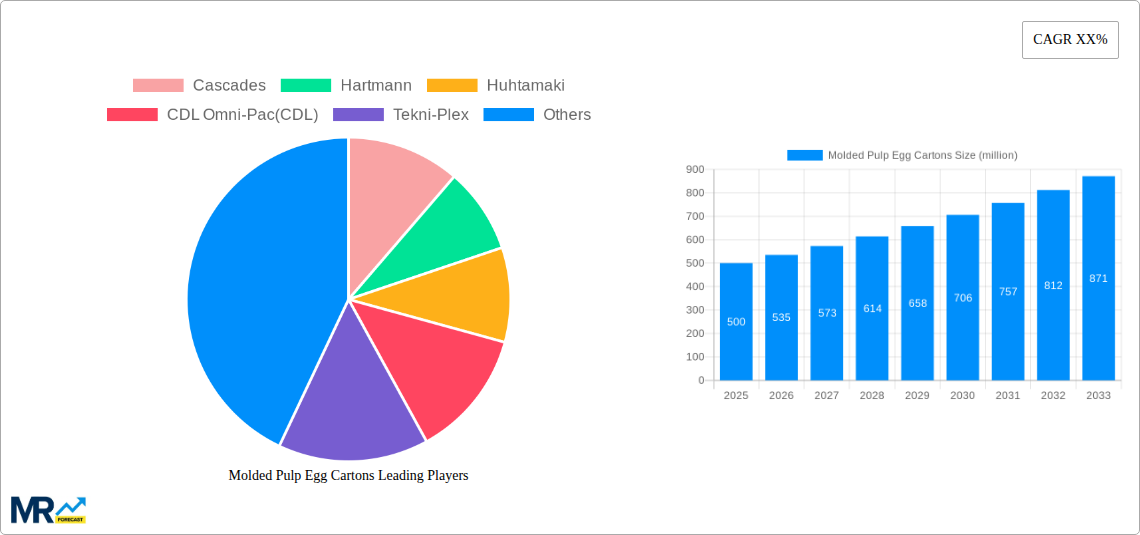

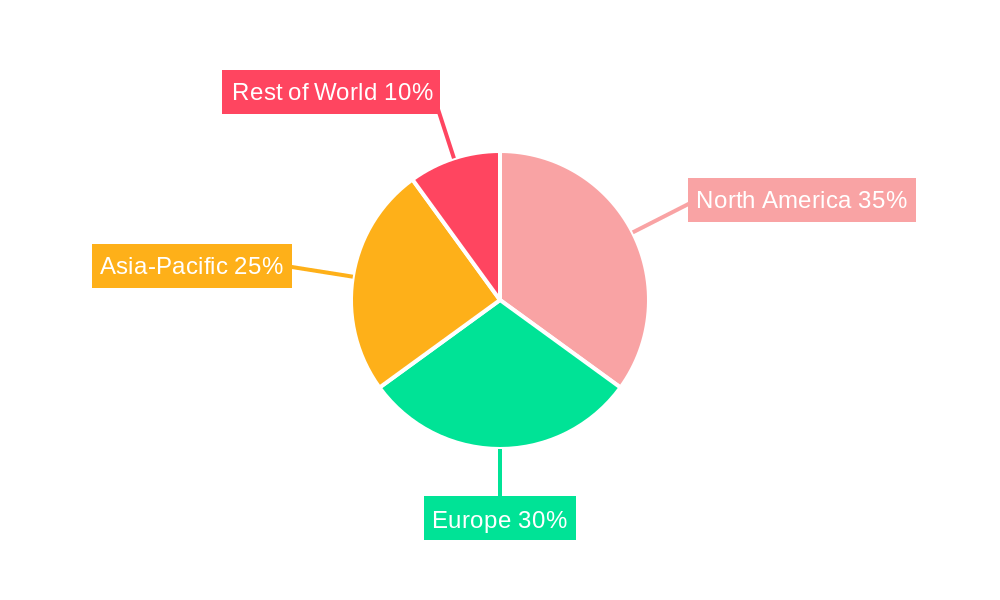

Major players in the market are actively investing in research and development to improve the strength, durability, and printability of molded pulp egg cartons, enhancing their appeal to a broader customer base. Regional variations exist, with North America and Europe holding substantial market shares due to established sustainability initiatives and high consumer awareness. However, the Asia-Pacific region is expected to demonstrate significant growth owing to rapid economic development and increasing adoption of sustainable packaging in developing countries. Key players like Cascades, Huhtamaki, and Pactiv are driving innovation and market penetration through strategic partnerships and product diversification, contributing to the overall market expansion. The continuous rise in consumer preference for eco-friendly alternatives and the expanding retail sector will solidify the long-term growth trajectory of the molded pulp egg cartons market.

The global molded pulp egg carton market is experiencing robust growth, driven by increasing consumer awareness of environmental sustainability and the inherent eco-friendliness of this packaging solution. Over the study period (2019-2033), the market witnessed a significant expansion, with production exceeding several billion units annually by 2025. This upward trajectory is projected to continue throughout the forecast period (2025-2033), fueled by several factors detailed below. The shift towards sustainable packaging is a major force, with consumers increasingly demanding eco-conscious alternatives to traditional plastic and polystyrene cartons. Molded pulp, derived from recycled paper, offers a biodegradable and compostable option, aligning perfectly with this trend. Furthermore, advancements in manufacturing technologies have led to improvements in the strength and durability of molded pulp cartons, effectively addressing past concerns about their fragility. This has expanded their applicability across various segments, boosting overall market demand. The increasing demand from the food and beverage industry, especially the egg sector, is also a significant driver. Major players are constantly innovating to offer diverse product options, catering to different packaging needs. The introduction of cartons with varying cell counts (up to 15 cell, 15-30 cell, above 30 cell) allows for customized solutions, appealing to both large-scale commercial operations and smaller local farms. The rising popularity of online grocery delivery services has also contributed to increased demand, as molded pulp cartons provide a suitable packaging solution for safe and efficient transportation. While the historical period (2019-2024) showcased strong growth, the estimated year (2025) signifies a pivotal moment, with production figures in the billions showcasing the market's maturity and significant contribution to the broader sustainable packaging industry. The forecast period promises sustained growth, fueled by these continuing trends.

Several key factors are accelerating the growth of the molded pulp egg carton market. The burgeoning focus on environmental sustainability is paramount. Consumers and businesses alike are actively seeking eco-friendly alternatives to traditional packaging materials. Molded pulp cartons, being biodegradable and often made from recycled materials, perfectly align with this demand, contributing to reduced environmental impact and landfill waste. The rising awareness of the negative consequences of plastic pollution and the increasing regulatory pressures to reduce plastic use further bolster this trend. In addition, advancements in manufacturing technology have resulted in stronger, more durable molded pulp cartons, enhancing their protective qualities and expanding their application across different segments of the egg industry. These improved designs address previous concerns about fragility and provide a more reliable packaging solution for transportation and storage. Furthermore, the expanding e-commerce sector and growth in online grocery delivery services have significantly increased the demand for effective and eco-conscious packaging, making molded pulp cartons an attractive option for businesses seeking to maintain product quality during shipping. The cost-effectiveness of molded pulp, particularly when considering its long-term environmental benefits and reduced waste management costs, further enhances its competitiveness in the market.

Despite the significant growth potential, the molded pulp egg carton market faces certain challenges. One major constraint is the relatively higher production cost compared to some traditional packaging materials like polystyrene. This price difference can make molded pulp less competitive in price-sensitive markets, especially in regions with less stringent environmental regulations. Fluctuations in the price of raw materials, primarily recycled paper pulp, also pose a challenge, impacting the overall production cost and profitability of molded pulp carton manufacturers. Maintaining the structural integrity and durability of molded pulp cartons, particularly for long-distance transportation, remains a key area of development. While technological advancements have improved strength, further improvements are needed to meet the demands of varied transportation conditions. Another challenge lies in expanding awareness and adoption among smaller producers and regional markets, which might be less familiar with the benefits of molded pulp cartons compared to readily available, though less environmentally friendly, alternatives. Finally, the competition from alternative sustainable packaging solutions, such as mushroom packaging or other biodegradable materials, needs to be considered, demanding continued innovation and cost optimization within the molded pulp industry.

The molded pulp egg carton market exhibits diverse growth patterns across regions and segments. While precise market share figures for each region and segment require in-depth data analysis, several key areas stand out. North America and Europe are expected to maintain significant market share due to heightened environmental awareness and stricter regulations on plastic packaging, driving a substantial shift towards sustainable solutions. Within Asia-Pacific, particularly in rapidly developing economies, the market is experiencing rapid expansion fueled by rising disposable incomes and increasing demand for convenient food packaging. The "15-30 cell" segment is currently leading in terms of volume, capturing a significant portion of the market due to its widespread use across various egg producers and retailers catering to the needs of different customer segments. This reflects the balance between accommodating different egg quantities and cost-effectiveness. The "Above 30 cell" segment shows notable growth potential, reflecting the needs of larger commercial operations and distributors handling high volumes of eggs, necessitating higher-capacity cartons. The "Up to 15 cell" segment will likely maintain its relevance, catering to smaller businesses, farm-to-table initiatives, and local markets. The "Retailing" application segment, characterized by direct consumer purchases, is demonstrating strong growth, driven by increased consumer preference for sustainable packaging. The "Transportation" segment, while vital, may show comparatively slower growth given that this is a necessity across all segments. Market dominance shifts based on these factors and ongoing technological advancements influence the demand for diverse packaging types across different geographies and market segments.

Region: North America and Europe are currently leading in terms of adoption and market size, primarily due to stringent environmental regulations and strong consumer demand for sustainable products. The Asia-Pacific region presents a large growth opportunity due to increasing disposable income and rising awareness regarding environmental issues.

Segment: The 15-30 cell segment currently dominates market share due to its versatility, satisfying the needs of a broad spectrum of consumers and businesses. The Above 30 cell segment, while smaller in terms of current market share, presents significant growth potential due to increasing demand from large-scale operations.

Application: Retailing displays robust growth due to growing consumer demand for eco-friendly packaging and the rise of environmentally conscious consumers. Transportation remains an essential application across all segments.

Several factors are accelerating growth within the molded pulp egg carton industry. Increased consumer awareness of environmental issues and the associated demand for sustainable packaging solutions are key drivers. Government regulations aimed at reducing plastic waste and promoting environmentally friendly alternatives further bolster this trend. Technological advancements leading to improved carton strength and durability are also crucial, addressing past limitations and expanding the applicability of molded pulp cartons. The rise of e-commerce and online grocery deliveries further enhances market demand for efficient and sustainable packaging.

Note: Website links are not consistently available for all listed companies.

This report provides a comprehensive overview of the molded pulp egg carton market, analyzing current trends, driving forces, challenges, and growth opportunities. It offers a detailed segmentation by carton type (cell count), application (retailing, transportation), and geographic region. Key market players are profiled, and significant industry developments are documented. The report provides valuable insights for businesses involved in the production, distribution, and consumption of molded pulp egg cartons, aiding informed decision-making and strategic planning. The comprehensive data presented allows for a complete understanding of this dynamic market and its future prospects.

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of XX% from 2019-2033 |

| Segmentation |

|

Note*: In applicable scenarios

Primary Research

Secondary Research

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

The projected CAGR is approximately XX%.

Key companies in the market include Cascades, Hartmann, Huhtamaki, CDL Omni-Pac(CDL), Tekni-Plex, Teo Seng Capital Berhad, HZ Corporation, Al Ghadeer Group, Pactiv, Green Pulp Paper, Dispak, Europack, DFM Packaging Solutions, Fibro Corporation, CKF Inc., Zellwin Farms Company, SIA V.L.T., GPM INDUSTRIAL LIMITED, Shenzhen Dragon Packing Products, Okulovskaya Paper Factory, .

The market segments include Type, Application.

The market size is estimated to be USD XXX million as of 2022.

N/A

N/A

N/A

N/A

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4480.00, USD 6720.00, and USD 8960.00 respectively.

The market size is provided in terms of value, measured in million and volume, measured in K.

Yes, the market keyword associated with the report is "Molded Pulp Egg Cartons," which aids in identifying and referencing the specific market segment covered.

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

To stay informed about further developments, trends, and reports in the Molded Pulp Egg Cartons, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.