1. What is the projected Compound Annual Growth Rate (CAGR) of the Molded Fiber Vegetable Trays?

The projected CAGR is approximately XX%.

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.

Molded Fiber Vegetable Trays

Molded Fiber Vegetable TraysMolded Fiber Vegetable Trays by Type (20 Lbs, 20-30 Lbs, Above 30 Lbs, World Molded Fiber Vegetable Trays Production ), by Application (Commercial, Residential, World Molded Fiber Vegetable Trays Production ), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2025-2033

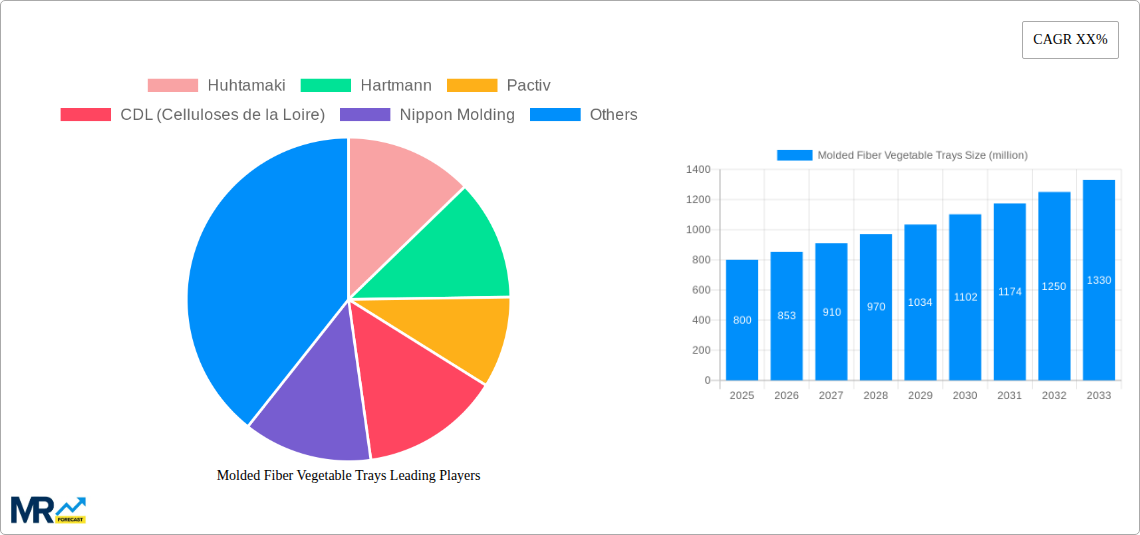

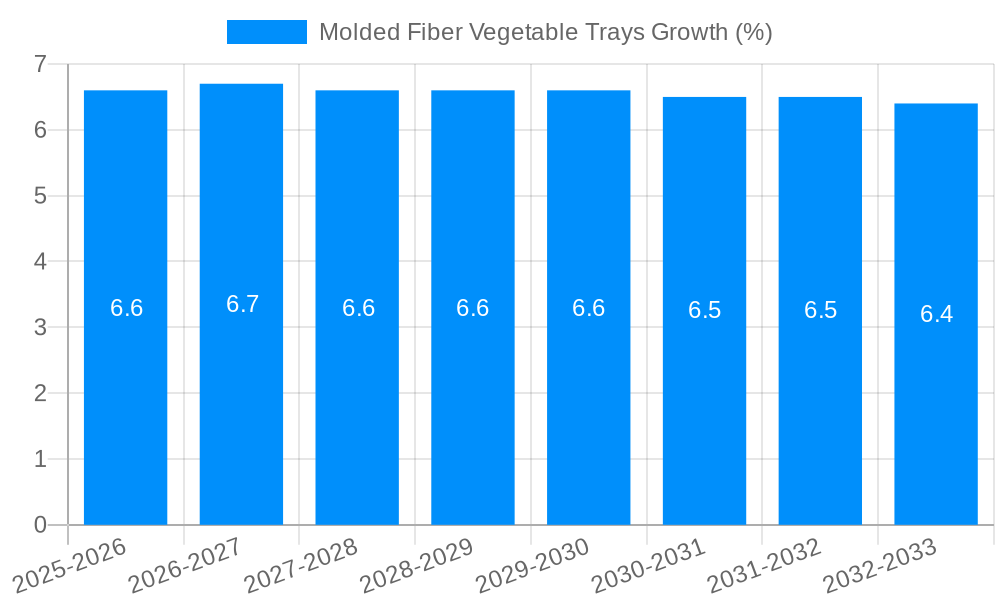

The global molded fiber vegetable trays market is poised for significant expansion, driven by an increasing consumer preference for sustainable and eco-friendly packaging solutions. With a projected market size of approximately \$800 million in 2025, the industry is set to experience a robust Compound Annual Growth Rate (CAGR) of around 6.5% through 2033. This upward trajectory is primarily fueled by the growing awareness of plastic pollution and regulatory pressures to adopt biodegradable alternatives. Commercial applications, particularly within the food service and retail sectors, are leading the demand, with businesses actively seeking packaging that aligns with their sustainability commitments. The "20-30 Lbs" segment is expected to witness the highest growth, reflecting the common packaging needs for various vegetables. Key players are investing in advanced manufacturing technologies to enhance product quality and production efficiency, further supporting market growth.

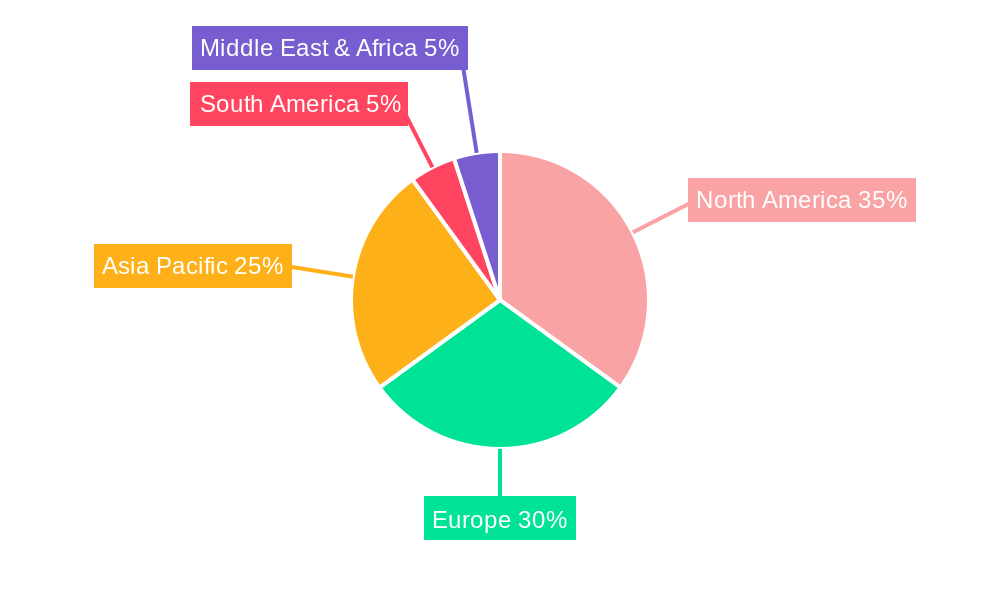

The market's growth, however, is not without its challenges. High initial investment costs for setting up molded fiber production facilities and fluctuations in raw material prices can act as restraints. Nevertheless, the inherent advantages of molded fiber – its compostability, recyclability, and biodegradability – continue to make it a compelling choice. North America and Europe are anticipated to remain the dominant regions, owing to stringent environmental regulations and established consumer demand for sustainable products. Emerging economies in Asia Pacific, particularly China and India, present substantial growth opportunities as their economies develop and environmental consciousness rises. Innovations in design and functionality, such as improved moisture resistance and enhanced structural integrity, are also contributing to the market's dynamism and appeal.

Here's a comprehensive report description for Molded Fiber Vegetable Trays, incorporating your specified parameters:

The global Molded Fiber Vegetable Trays market is witnessing a significant evolutionary trajectory, driven by a confluence of escalating consumer awareness regarding sustainability, evolving retail packaging standards, and the inherent functional benefits of molded fiber. Over the study period from 2019 to 2033, with a base year of 2025, the market has demonstrated robust growth, reflecting a paradigm shift away from conventional plastic and Styrofoam alternatives. In the estimated year of 2025, the production of molded fiber vegetable trays is projected to reach a substantial figure of over 2,500 million units, underscoring its growing market penetration. This surge is intrinsically linked to the increasing demand for eco-friendly packaging solutions across both commercial and residential applications. The commercial sector, in particular, accounts for a significant share of this demand, fueled by supermarkets, food service providers, and agricultural producers seeking cost-effective, yet environmentally responsible, containment for their produce. The report anticipates that by the end of the forecast period in 2033, the market will have expanded considerably, with projections indicating a production volume exceeding 4,500 million units. This growth is not merely quantitative; it is qualitative as well, with advancements in manufacturing technologies leading to improved tray designs, enhanced structural integrity, and greater customization options to cater to diverse vegetable types and quantities. The historical period from 2019 to 2024 laid the groundwork for this expansion, characterized by early adoption by environmentally conscious brands and increasing regulatory impetus towards sustainable packaging. Key market insights reveal a growing preference for molded fiber trays that are not only compostable and biodegradable but also offer superior cushioning and protection for delicate produce, thereby reducing food waste. The market is also seeing a diversification in raw material sourcing, with a greater emphasis on recycled paper pulp and agricultural waste fibers. This trend is a direct response to global sustainability goals and the circular economy initiatives gaining momentum.

The surge in the molded fiber vegetable trays market is propelled by a powerful combination of economic, environmental, and consumer-driven factors. Foremost among these is the intensified global imperative for sustainability. Consumers and regulatory bodies alike are increasingly scrutinizing the environmental footprint of packaging materials, leading to a marked preference for biodegradable and compostable alternatives like molded fiber. This ecological consciousness translates directly into demand, as businesses aim to align their brands with environmentally responsible practices. Furthermore, the inherent properties of molded fiber trays offer distinct advantages over traditional packaging. Their excellent shock absorption capabilities minimize damage during transit and handling, thereby reducing product spoilage and waste, a critical concern for the fresh produce industry. This reduction in waste, in turn, contributes to cost savings for businesses. Government regulations and initiatives promoting sustainable packaging are also playing a pivotal role. Bans and restrictions on single-use plastics are compelling manufacturers and retailers to explore viable alternatives, with molded fiber vegetable trays emerging as a frontrunner. The cost-effectiveness of molded fiber, especially when produced at scale using recycled materials, makes it an attractive option for businesses of all sizes. The market is projected to see production exceeding 2,500 million units in 2025, with a steady upward trend driven by these compelling forces.

Despite the promising growth trajectory, the molded fiber vegetable trays market is not without its challenges and restraints. One significant hurdle is the perception and performance comparison with established plastic packaging. While molded fiber offers sustainability benefits, certain applications might still require the barrier properties, such as moisture resistance or extended shelf life, that plastics can more readily provide. The initial capital investment required for advanced manufacturing machinery can also be a barrier for smaller players looking to enter the market. Furthermore, the availability and consistent quality of raw materials, particularly recycled paper pulp, can be subject to fluctuations in supply and demand, potentially impacting production costs and consistency. Consumer education remains another area requiring attention; while awareness of sustainability is growing, a deeper understanding of the specific benefits and disposal methods of molded fiber products is still needed. The logistical aspects of scaling up production to meet the projected demand of over 4,500 million units by 2033 also present complexities, including efficient supply chain management and waste management for the production process itself. Ensuring that the production of molded fiber trays aligns with circular economy principles, from sourcing to end-of-life disposal, is an ongoing challenge that the industry must address to maintain its sustainable appeal.

The global molded fiber vegetable trays market is poised for dominance by specific regions and segments, driven by distinct market dynamics and growth catalysts.

Dominant Regions and Countries:

Dominant Segments:

The synergy between these dominant regions and segments, fueled by increasing production volumes and evolving consumer preferences, will shape the landscape of the molded fiber vegetable trays market in the coming years. The continued innovation in tray design and material science within these areas will further solidify their market leadership.

The molded fiber vegetable trays industry is experiencing robust growth driven by several key catalysts. The intensifying global focus on environmental sustainability and the increasing consumer demand for eco-friendly packaging solutions are paramount. As governments worldwide implement stricter regulations against single-use plastics, molded fiber, being biodegradable and compostable, emerges as a preferred alternative. Furthermore, the functional benefits of these trays, such as excellent cushioning properties that reduce produce damage and spoilage, contribute significantly to their adoption by businesses aiming to minimize waste and enhance product integrity. The cost-effectiveness of molded fiber, especially with the utilization of recycled materials, also positions it as an economically viable option for a broad range of commercial and residential applications, further propelling its market penetration.

This report offers an exhaustive analysis of the global molded fiber vegetable trays market, spanning from 2019 to 2033, with a specific focus on the estimated year of 2025. It delves into the intricate details of market trends, dissecting the key insights that are shaping the industry's future, including the escalating demand for sustainable packaging and the functional advantages of molded fiber. The report meticulously examines the driving forces behind market expansion, such as environmental consciousness, regulatory support, and cost-effectiveness, while also addressing the inherent challenges and restraints, including perception barriers and raw material sourcing complexities. A granular segmentation analysis identifies the dominant regions and countries, alongside key segments like the "20-30 Lbs" type and the "Commercial" application, highlighting their pivotal roles in market growth. Furthermore, the report illuminates the crucial growth catalysts and provides a comprehensive list of leading players, alongside significant recent and projected developments. This in-depth coverage ensures a holistic understanding of the market's current state and its promising future.

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of XX% from 2019-2033 |

| Segmentation |

|

Note*: In applicable scenarios

Primary Research

Secondary Research

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

The projected CAGR is approximately XX%.

Key companies in the market include Huhtamaki, Hartmann, Pactiv, CDL (Celluloses de la Loire), Nippon Molding, Vernacare, UFP Technologies, FiberCel, China National Packaging Corporation, Berkley International, Okulovskaya Paper Factory, DFM (Dynamic Fibre Moulding), EnviroPAK, Shaanxi Huanke, CEMOSA SOUL, Dentaş Paper Industry, Henry Moulded Products, Qingdao Xinya Molded Pulp Packaging Products Co., Ltd, Shandong Quanlin Group, Yulin Paper Products, Buhl Paperform, Cullen.

The market segments include Type, Application.

The market size is estimated to be USD XXX million as of 2022.

N/A

N/A

N/A

N/A

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4480.00, USD 6720.00, and USD 8960.00 respectively.

The market size is provided in terms of value, measured in million and volume, measured in K.

Yes, the market keyword associated with the report is "Molded Fiber Vegetable Trays," which aids in identifying and referencing the specific market segment covered.

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

To stay informed about further developments, trends, and reports in the Molded Fiber Vegetable Trays, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.