1. What is the projected Compound Annual Growth Rate (CAGR) of the Molded Fiber Egg Cartons?

The projected CAGR is approximately XX%.

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.

Molded Fiber Egg Cartons

Molded Fiber Egg CartonsMolded Fiber Egg Cartons by Type (10 Eggs, 20 Eggs, 30 Eggs, Others, World Molded Fiber Egg Cartons Production ), by Application (Household, Commercial, World Molded Fiber Egg Cartons Production ), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2025-2033

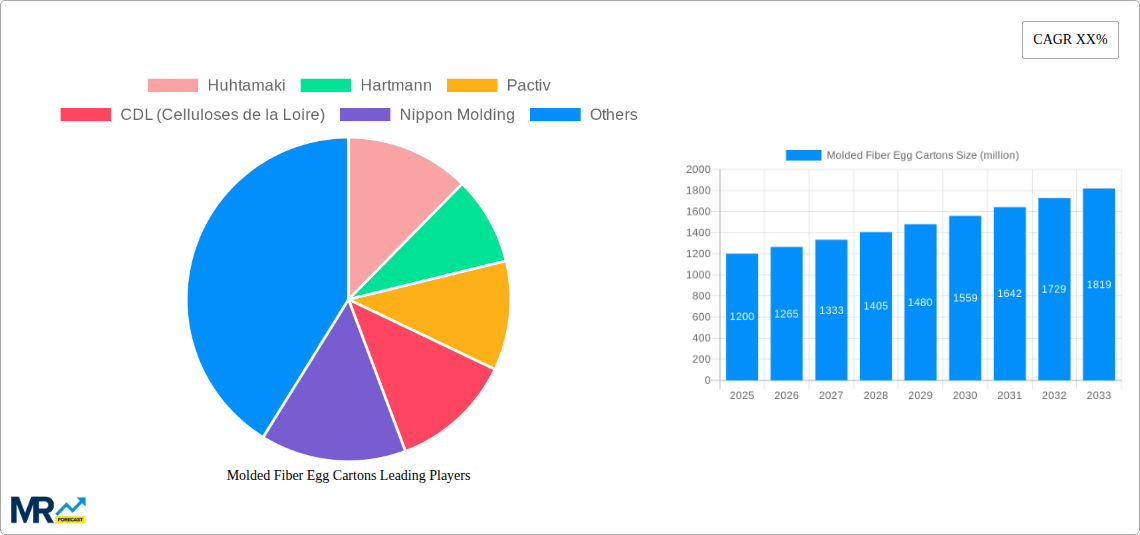

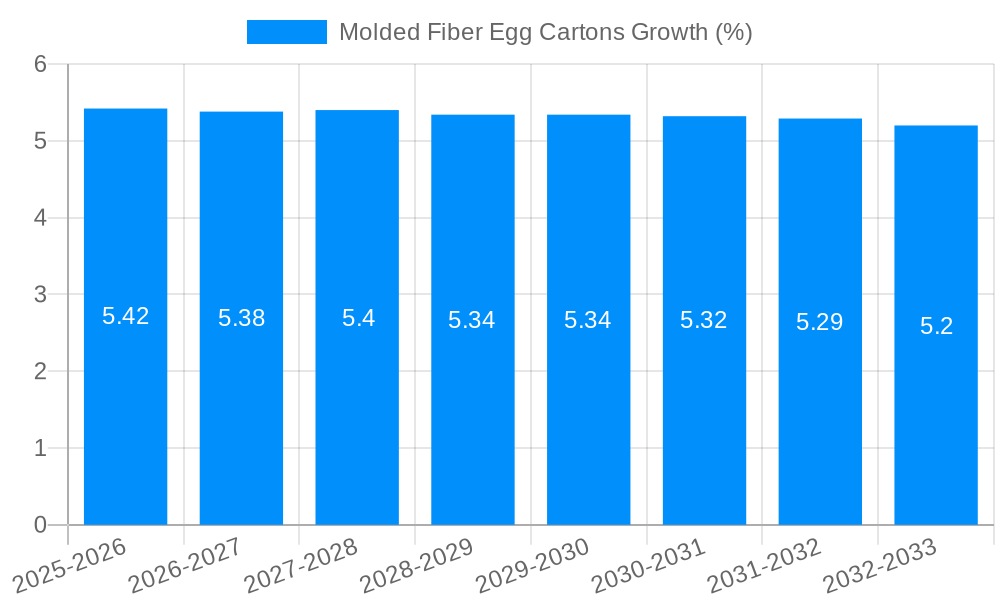

The global molded fiber egg carton market is poised for significant expansion, projected to reach a substantial market size of approximately $1.2 billion by 2025, with a robust Compound Annual Growth Rate (CAGR) of around 5.5% anticipated throughout the forecast period of 2025-2033. This growth is primarily fueled by the increasing consumer preference for sustainable and eco-friendly packaging solutions. Molded fiber, derived from recycled paper and cardboard, offers a biodegradable and compostable alternative to traditional plastic egg cartons, aligning with growing environmental consciousness and stricter regulations against single-use plastics. The burgeoning demand from the household sector for convenient and safe egg storage, coupled with the expanding commercial poultry industry and the need for bulk packaging, further propels market growth. Innovations in manufacturing processes, leading to enhanced carton durability and aesthetic appeal, are also contributing to market penetration.

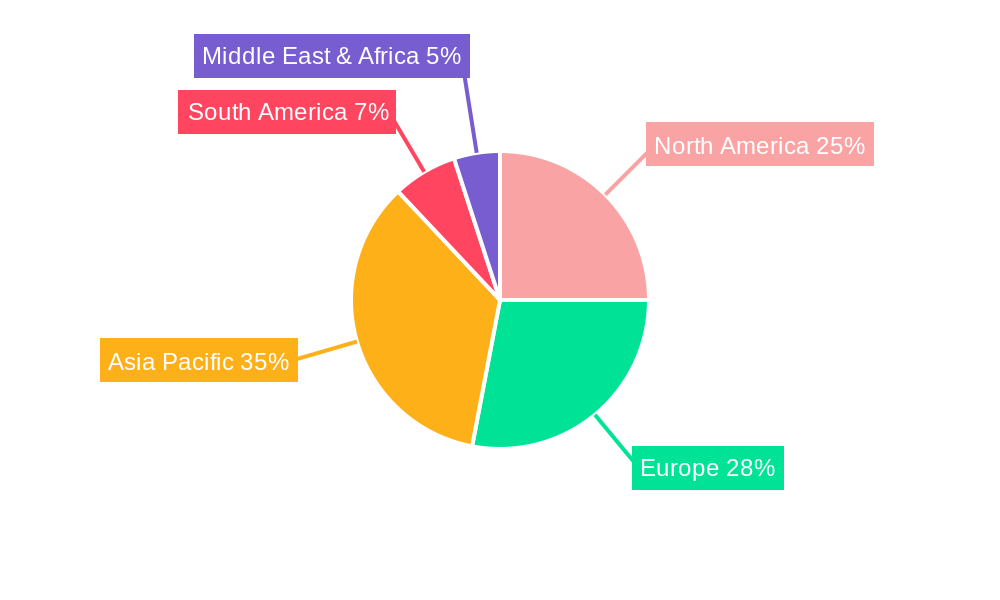

Despite the positive outlook, certain factors may present challenges. Fluctuations in the price of raw materials, particularly recycled paper pulp, could impact production costs and, consequently, market pricing. Intense competition among established players and emerging manufacturers, coupled with potential disruptions in the supply chain, may also influence market dynamics. However, the overarching trend towards sustainability and the inherent advantages of molded fiber packaging are expected to outweigh these restraints. The market is segmented by carton types, with 10-egg and 20-egg cartons dominating demand due to their widespread use in both retail and domestic settings. The "Others" category, encompassing larger pack sizes, is also expected to witness steady growth. Geographically, Asia Pacific, led by China and India, is anticipated to emerge as a key growth region, driven by its massive population, expanding food industry, and increasing adoption of sustainable packaging practices.

This report offers an in-depth analysis of the global Molded Fiber Egg Cartons market, covering the Study Period: 2019-2033, with the Base Year: 2025 and the Estimated Year: 2025. The Forecast Period: 2025-2033 will provide future projections based on robust market intelligence. Examining the Historical Period: 2019-2024, this report aims to decipher the intricate dynamics shaping the production, consumption, and innovation within this vital packaging sector. With an estimated global production reaching several hundred million units annually, the molded fiber egg carton market plays a crucial role in safeguarding one of the world's most consumed food products. The report delves into specific carton types, applications, and emerging industry developments, providing actionable insights for stakeholders.

The molded fiber egg carton market is currently experiencing a significant surge in demand, driven by a confluence of factors that are reshaping consumer preferences and industrial practices. A paramount trend is the escalating consumer awareness regarding environmental sustainability. As consumers become more discerning about the ecological footprint of their purchases, the appeal of molded fiber, derived from recycled paper and pulp, is amplified. This aligns perfectly with the global push towards circular economy principles, where waste reduction and resource optimization are prioritized. The inherent biodegradability and recyclability of molded fiber egg cartons position them as a superior alternative to conventional plastic or Styrofoam packaging. This shift is not merely an ethical consideration but is increasingly being codified in regulations and corporate social responsibility initiatives, further bolstering the adoption of these eco-friendly solutions. Furthermore, the visual appeal and tactile qualities of molded fiber are being leveraged by brands to enhance their product presentation. The natural, earthy aesthetic of these cartons can convey a sense of premium quality and artisanal production, particularly for organic or specialty eggs. This is contributing to a premiumization trend within the egg market, where packaging plays a vital role in brand differentiation and consumer perception. The structural integrity of molded fiber cartons also remains a critical factor, offering reliable protection for fragile eggs during transit and handling. Innovations in manufacturing processes are continually improving the strength and durability of these cartons, addressing potential concerns about breakage. The market is also witnessing a diversification in design and functionality, moving beyond the standard 10-egg configurations to cater to various consumer needs and commercial applications, including 20-egg and 30-egg formats, as well as specialized designs for niche markets. The estimated global production, reaching hundreds of millions of units, underscores the sheer scale of this market's importance and its ongoing evolution.

Several potent forces are collectively propelling the growth and expanding the reach of the molded fiber egg cartons market. At the forefront is the intensifying global commitment to environmental sustainability. Governments, consumers, and corporations alike are actively seeking alternatives to single-use plastics and non-biodegradable materials. Molded fiber, primarily produced from recycled paper and cardboard, perfectly fits this paradigm due to its biodegradability and high recyclability. This inherent eco-friendliness translates into a significant competitive advantage, making molded fiber egg cartons the preferred choice for environmentally conscious brands and consumers. The increasing regulatory pressure, including bans and restrictions on certain types of plastic packaging, is also a major catalyst. As legislative frameworks evolve to discourage polluting materials, the demand for sustainable alternatives like molded fiber is set to skyrocket. Furthermore, the growing popularity of farm-fresh and organic produce, including eggs, is creating a niche market where the natural aesthetic and perceived eco-friendliness of molded fiber packaging resonate strongly with consumers. Brands in these segments often associate molded fiber with quality, transparency, and ethical sourcing. The cost-effectiveness of molded fiber production, particularly when utilizing readily available recycled materials, also contributes to its widespread adoption, especially in high-volume markets. Innovations in manufacturing technologies have further enhanced the structural integrity and barrier properties of these cartons, addressing previous limitations and broadening their application scope. This continuous improvement in performance ensures they can effectively protect eggs throughout the supply chain, from farm to table.

Despite the robust growth trajectory, the molded fiber egg cartons market faces certain challenges and restraints that warrant careful consideration. One of the primary hurdles remains the susceptibility of molded fiber to moisture and its consequent impact on structural integrity. While advancements in manufacturing have improved water resistance, prolonged exposure to damp conditions can still compromise the cartons, potentially leading to spoilage or breakage. This can be a concern in regions with humid climates or during extended transportation periods. Another significant factor is the perceived aesthetic inferiority by some segments of the market, particularly when compared to the glossy finishes of plastic packaging. While the natural look is a selling point for some, others may associate it with lower quality or less hygienic presentation. This perception gap can limit adoption in certain premium or highly competitive retail environments. The cost of raw materials, primarily recycled paper pulp, can also fluctuate, impacting the overall production cost of molded fiber egg cartons. While generally cost-effective, significant spikes in pulp prices could temporarily hinder price competitiveness. Furthermore, the energy-intensive nature of the pulping and molding processes, though often offset by the use of recycled materials, can be a point of concern for manufacturers seeking to minimize their carbon footprint. The availability of high-quality recycled pulp can also be inconsistent, requiring manufacturers to manage their supply chains meticulously. Lastly, competition from alternative sustainable packaging solutions, such as biodegradable plastics or advanced paperboard, presents an ongoing challenge, necessitating continuous innovation and performance enhancements within the molded fiber segment.

The molded fiber egg cartons market is projected to witness significant dominance from specific regions and product segments, driven by a confluence of economic, environmental, and consumer-driven factors.

Key Segments Poised for Dominance:

The synergy between the widely adopted 10-egg format and the high-volume commercial application segment, coupled with the environmental consciousness prevalent in key regions like North America and Europe, will collectively shape the dominant forces within the global molded fiber egg cartons market.

The molded fiber egg cartons industry is poised for accelerated growth, fueled by several key catalysts. The escalating global focus on sustainability and the reduction of plastic waste is undeniably the most potent driver. Governments worldwide are implementing stricter regulations against single-use plastics, creating a fertile ground for biodegradable and recyclable alternatives like molded fiber. Consumers are increasingly demanding eco-friendly packaging, influencing purchasing decisions and pushing brands towards sustainable solutions. Furthermore, the rising popularity of organic, free-range, and specialty eggs, which often carry a premium perception, benefits from the natural and artisanal aesthetic of molded fiber cartons, further boosting their appeal and market penetration.

The molded fiber egg cartons market is characterized by the presence of several influential companies that drive innovation and production. These leading players are instrumental in shaping the market landscape and ensuring the availability of these essential packaging solutions.

The molded fiber egg cartons sector has witnessed a series of significant developments aimed at enhancing sustainability, functionality, and market reach.

This comprehensive report offers an exhaustive exploration of the molded fiber egg cartons market, providing unparalleled insights for industry stakeholders. It meticulously analyzes market trends, identifies key driving forces, and pinpoints potential challenges and restraints. The report delves deep into the key regions and dominant market segments, offering a granular understanding of where growth is most pronounced. Furthermore, it highlights crucial growth catalysts that are poised to shape the future trajectory of the industry. Detailed profiles of leading players and a chronological overview of significant developments equip readers with a strategic advantage. This report serves as an indispensable resource for understanding the global molded fiber egg cartons market, from historical performance to future projections, ensuring informed decision-making in this dynamic sector.

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of XX% from 2019-2033 |

| Segmentation |

|

Note*: In applicable scenarios

Primary Research

Secondary Research

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

The projected CAGR is approximately XX%.

Key companies in the market include Huhtamaki, Hartmann, Pactiv, CDL (Celluloses de la Loire), Nippon Molding, Vernacare, UFP Technologies, FiberCel, China National Packaging Corporation, Berkley International, Okulovskaya Paper Factory, DFM (Dynamic Fibre Moulding), EnviroPAK, Shaanxi Huanke, CEMOSA SOUL, Dentaş Paper Industry, Henry Moulded Products, Qingdao Xinya Molded Pulp Packaging Products Co., Ltd, Shandong Quanlin Group, Yulin Paper Products, Buhl Paperform, Cullen.

The market segments include Type, Application.

The market size is estimated to be USD XXX million as of 2022.

N/A

N/A

N/A

N/A

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4480.00, USD 6720.00, and USD 8960.00 respectively.

The market size is provided in terms of value, measured in million and volume, measured in K.

Yes, the market keyword associated with the report is "Molded Fiber Egg Cartons," which aids in identifying and referencing the specific market segment covered.

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

To stay informed about further developments, trends, and reports in the Molded Fiber Egg Cartons, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.