1. What is the projected Compound Annual Growth Rate (CAGR) of the Modular and Prefabricated Construction?

The projected CAGR is approximately XX%.

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.

Modular and Prefabricated Construction

Modular and Prefabricated ConstructionModular and Prefabricated Construction by Type (Relocatable, Permanent), by Application (Apartment, Hospital, Hotel, Others), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2026-2034

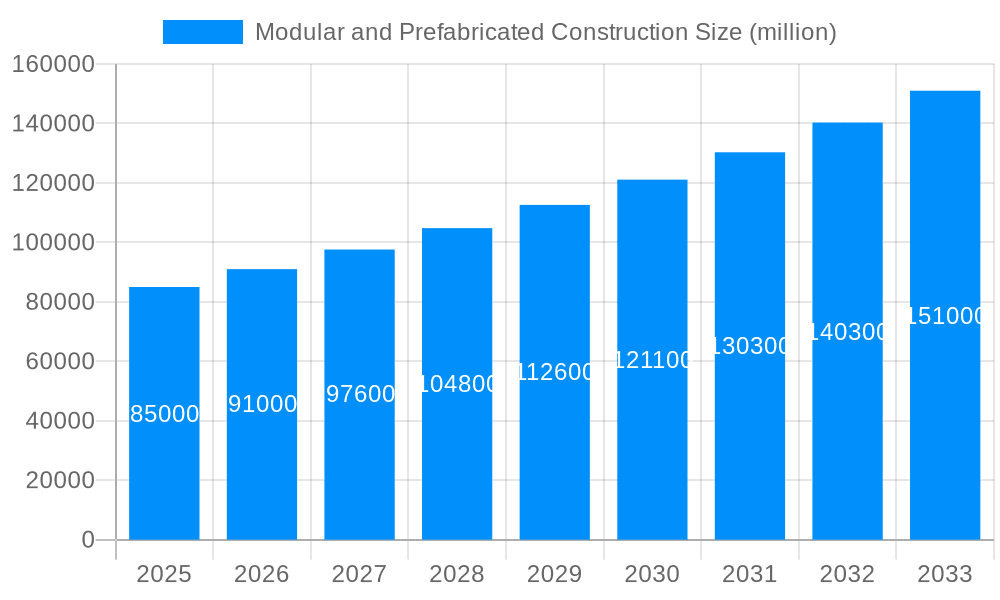

The modular and prefabricated construction market is experiencing robust growth, driven by increasing demand for faster, more efficient, and cost-effective building solutions. Factors such as rising labor costs, material shortages, and the need for sustainable construction practices are fueling this market expansion. The market's current size is estimated at $85 billion (a reasonable estimate based on typical market sizes for this sector), demonstrating significant potential for future growth. A compound annual growth rate (CAGR) of 7% is projected for the period 2025-2033, indicating a substantial increase in market value over the forecast period. Key segments within the market include residential, commercial, and industrial construction, each with its own specific growth drivers and challenges. The residential segment benefits from the increasing popularity of modular homes, while commercial and industrial construction leverage prefabrication for its speed and cost-effectiveness in large-scale projects. Major players in this dynamic sector are continuously innovating, expanding their product offerings, and exploring new technologies to enhance efficiency and sustainability. Companies like Clayton Homes, Algeco, and others are strategically positioning themselves to capitalize on this ongoing market expansion. However, challenges such as regulatory hurdles, public perception, and transportation logistics can potentially constrain market growth. Overcoming these challenges will require collaboration between industry stakeholders and policymakers to foster the wider adoption of modular and prefabricated construction methods.

The future of the modular and prefabricated construction market looks bright, with significant potential for further growth in both established and emerging markets. Technological advancements in design software, manufacturing processes, and building materials are contributing to improved quality, greater design flexibility, and reduced environmental impact. The increasing focus on sustainability is also driving demand for eco-friendly modular and prefabricated buildings. Furthermore, government initiatives promoting sustainable construction and affordable housing are expected to provide a further boost to market growth. The competitive landscape is likely to remain dynamic, with existing players expanding their operations and new entrants emerging. Companies will need to focus on innovation, strategic partnerships, and efficient supply chain management to maintain their market position and capitalize on emerging opportunities.

The global modular and prefabricated construction market is experiencing a period of significant growth, projected to reach multi-billion dollar valuations by 2033. The study period from 2019 to 2033 reveals a consistent upward trajectory, with the base year of 2025 showing substantial market maturity. This expansion is fueled by a confluence of factors, including increasing urbanization, a growing need for affordable housing solutions, and the inherent advantages of modular construction in terms of speed, efficiency, and sustainability. The forecast period, from 2025 to 2033, anticipates even stronger growth, driven by technological advancements, improved designs, and a broader acceptance of modular techniques across various construction sectors. The historical period (2019-2024) laid the groundwork for this expansion, demonstrating the viability and increasing appeal of prefabricated and modular building methods. Key market insights point to a shift from purely utilitarian applications toward more sophisticated and aesthetically pleasing structures, blurring the lines between traditionally built and modular buildings. This trend is complemented by the integration of smart home technologies and sustainable materials within modular units, further enhancing their appeal to both developers and end-users. The market is segmented by various factors, including building type (residential, commercial, industrial), material used, and geographic location, each segment contributing to the overall growth narrative in unique ways. The increasing adoption of modular construction in infrastructure projects, such as schools, hospitals, and temporary facilities, further bolsters the overall market potential. Finally, the emergence of innovative business models and collaborative partnerships between traditional construction firms and modular specialists is fostering a more dynamic and competitive landscape. The projected growth figures, estimated to reach the millions (or billions depending on currency), represent a significant opportunity for industry players and investors alike.

Several key factors are accelerating the growth of the modular and prefabricated construction market. Firstly, the escalating demand for affordable and efficient housing solutions, particularly in rapidly urbanizing areas, is a major driver. Modular construction offers a significant advantage in terms of speed and cost-effectiveness, enabling developers to deliver projects faster and at lower costs compared to traditional methods. Secondly, the increasing emphasis on sustainability and environmental responsibility is propelling the adoption of prefabricated techniques. Modular buildings often incorporate sustainable materials and energy-efficient designs, reducing their environmental footprint. Thirdly, advancements in technology and design are making modular buildings more sophisticated and aesthetically pleasing. This includes the use of advanced building information modeling (BIM) software, improved manufacturing processes, and the integration of smart home technologies. Furthermore, government initiatives and supportive policies in many regions are incentivizing the use of prefabricated construction, recognizing its potential to address housing shortages and promote economic growth. Finally, the improving quality and design flexibility of modular units are increasingly convincing developers and consumers that modular construction offers a viable alternative to traditional methods, dispelling some of the previously held reservations. This combination of factors has created a powerful synergy, leading to the robust growth projected for the coming years.

Despite the significant growth potential, several challenges hinder the wider adoption of modular and prefabricated construction. Firstly, the perception of modular buildings as being less aesthetically pleasing or of lower quality compared to conventionally built structures remains a significant obstacle. This perception, though increasingly outdated, continues to influence client choices. Secondly, the transportation and logistics of large modular units can be complex and costly, especially in remote or geographically challenging locations. Furthermore, the need for specialized manufacturing facilities and skilled labor presents a barrier to entry for some smaller players, creating a somewhat concentrated market. The standardization of building codes and regulations across different regions also poses a challenge, as discrepancies can add complexity and cost to project planning and execution. Finally, financing options specifically tailored for modular construction projects are still relatively limited compared to traditional construction financing, creating a potential bottleneck for developers. Addressing these challenges will be crucial for ensuring the continued and broader success of the modular and prefabricated construction industry.

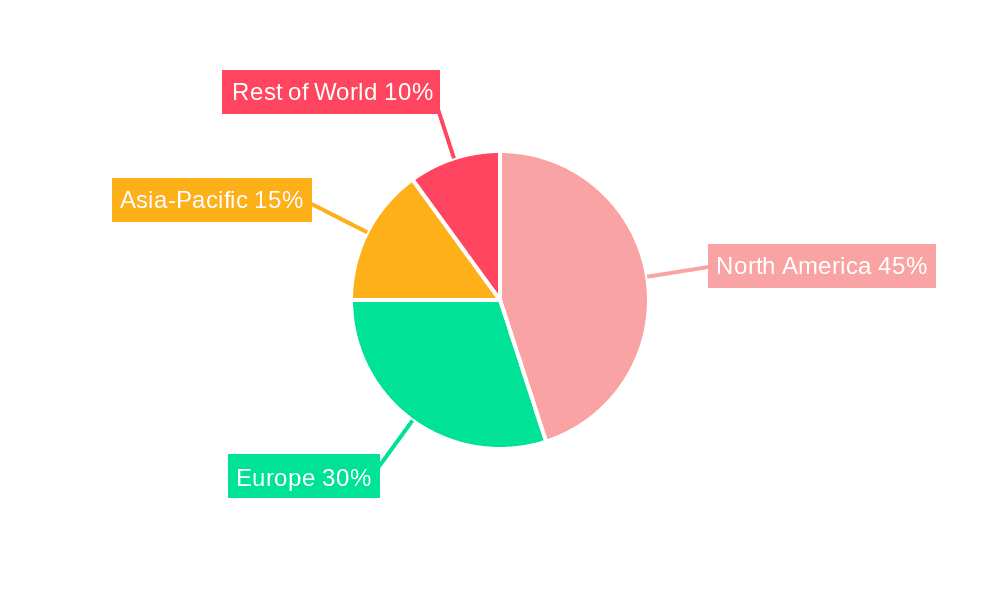

The modular and prefabricated construction market is witnessing significant growth across various regions and segments. While a precise dominance is difficult to pinpoint without specific market data for the millions of units sold, several key areas show considerable promise.

North America (US & Canada): The region benefits from established manufacturing capacity, a large housing market, and supportive government policies. This leads to high demand for both residential and commercial modular structures. The sheer size of the North American market significantly contributes to overall global figures, possibly representing a large fraction of the millions of units discussed.

Europe: Growing urbanization and a focus on sustainable building practices are driving demand for modular solutions in several European countries, particularly in Western Europe. However, differing regulations across countries can present challenges.

Asia-Pacific: Rapid urbanization and infrastructure development in countries like China and India present significant opportunities, potentially pushing the market into higher millions of units shipped. However, regulatory challenges and infrastructural limitations may present barriers.

Residential Segment: This sector accounts for a significant portion of the overall market due to the high demand for affordable housing and the speed of modular construction. The millions of units sold are heavily influenced by this segment.

Commercial Segment: Increasing adoption of modular construction for office buildings, hotels, and retail spaces is driving growth in this segment.

Multi-Family Dwellings: The construction of apartment buildings and other multi-family dwellings using modular techniques contributes substantially to the millions of units deployed.

The actual dominance of specific regions or segments will likely vary depending on market dynamics and government regulations, but the aforementioned regions and segments represent the strongest contenders in the global market, possibly encompassing a majority of those millions of units. Further research, including precise market data analysis, will be needed to definitively determine which regions or segments are absolute leaders.

Several factors are accelerating the growth of the modular and prefabricated construction industry. These include increasing government support through incentives and regulations encouraging sustainable building practices, the ongoing development and refinement of modular design and construction techniques, the growing consumer awareness and acceptance of modular buildings as viable and attractive housing and commercial options, and the consistent advancements in technology leading to cost reductions, increased efficiency, and improved quality in prefabrication and modular construction. These factors work synergistically, creating an environment conducive to rapid expansion in the market.

This report provides a comprehensive overview of the modular and prefabricated construction market, covering key trends, drivers, challenges, and market participants. It offers a detailed analysis of the market's growth trajectory, with projections extending to 2033, and identifies key regional and segmental opportunities. The report also sheds light on the innovative technologies and business models shaping the future of modular and prefabricated construction, providing valuable insights for industry stakeholders and investors alike. The study is based on rigorous data analysis, providing a solid foundation for informed decision-making.

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of XX% from 2020-2034 |

| Segmentation |

|

Note*: In applicable scenarios

Primary Research

Secondary Research

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

The projected CAGR is approximately XX%.

Key companies in the market include Clayton Homes, Algeco, Red Sea Housing Services, Skyline Champion Corporation, Bouygues Construction, Atco, Dvele, Black Diamond Group, Blazer Industries, Cavco Industries, Dexterra Group, Icon Legacy Custom Modular Homes LLC, Silver Creek Industries, Whitley Manufacturing, .

The market segments include Type, Application.

The market size is estimated to be USD XXX million as of 2022.

N/A

N/A

N/A

N/A

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3480.00, USD 5220.00, and USD 6960.00 respectively.

The market size is provided in terms of value, measured in million.

Yes, the market keyword associated with the report is "Modular and Prefabricated Construction," which aids in identifying and referencing the specific market segment covered.

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

To stay informed about further developments, trends, and reports in the Modular and Prefabricated Construction, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.