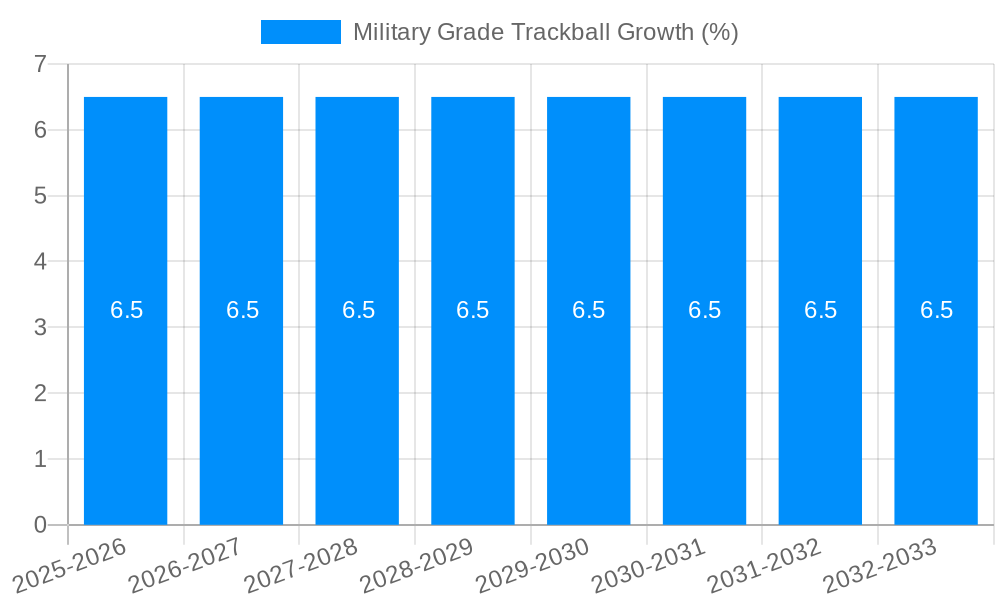

1. What is the projected Compound Annual Growth Rate (CAGR) of the Military Grade Trackball?

The projected CAGR is approximately XX%.

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.

Military Grade Trackball

Military Grade TrackballMilitary Grade Trackball by Type (Desktop Standalone, Panel Mount), by Application (Military Helicopter, Military Vehicles, Other), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2025-2033

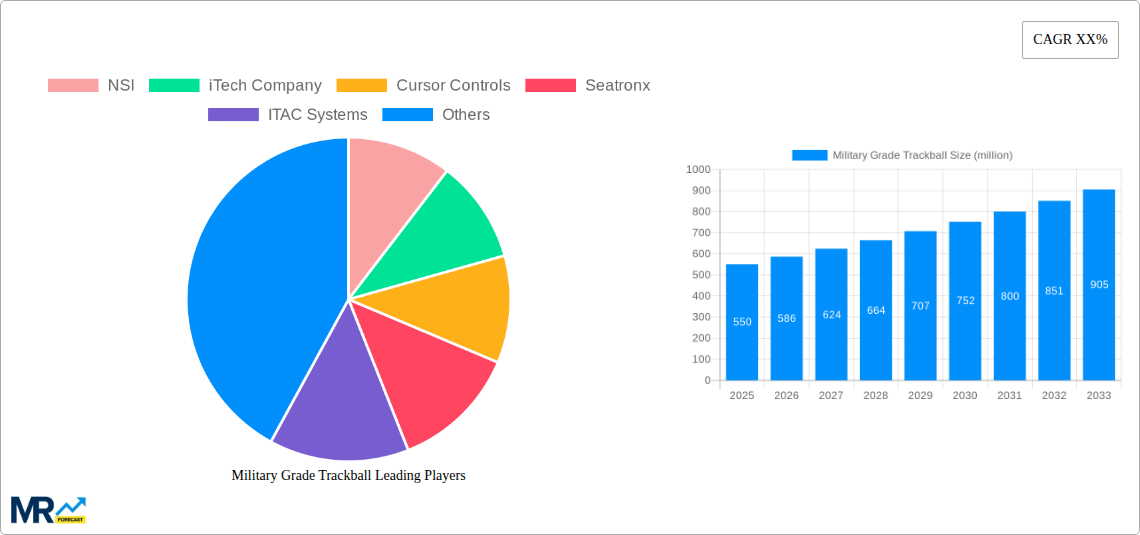

The global Military Grade Trackball market is poised for significant growth, projected to reach approximately $550 million by 2025, with a robust Compound Annual Growth Rate (CAGR) of around 6.5% through 2033. This expansion is primarily fueled by the escalating demand for advanced and reliable input devices in modern military operations. Key drivers include the increasing adoption of sophisticated defense systems, the continuous need for enhanced situational awareness, and the requirement for durable, high-performance components that can withstand harsh environments. The market will witness a substantial influx of investment as defense forces globally prioritize technological upgrades to maintain a strategic advantage. The growing complexity of combat scenarios and the reliance on integrated digital platforms necessitate trackballs that offer precision, speed, and resilience, making them indispensable for operators in naval vessels, aircraft, ground vehicles, and command centers.

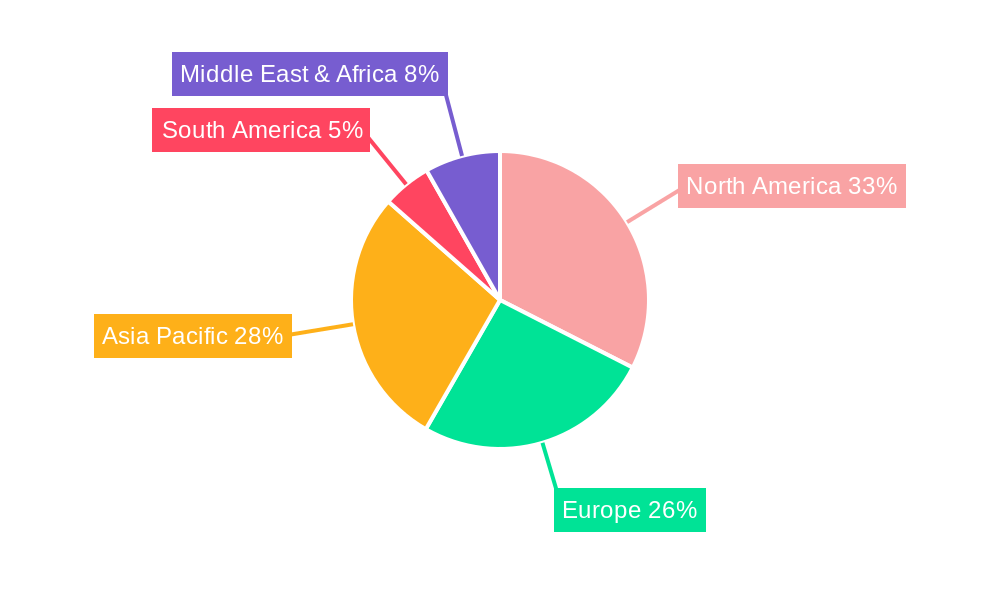

The market is segmented into Desktop Standalone and Panel Mount types, with Panel Mount trackballs expected to capture a larger market share due to their space-saving design and seamless integration into existing military hardware, particularly in helicopters and armored vehicles. Geographically, North America and Asia Pacific are anticipated to lead market growth, driven by substantial defense spending and ongoing modernization programs in countries like the United States, China, and India. Emerging trends include the integration of advanced features such as customizable buttons, enhanced tactile feedback, and improved sealing against dust and water. However, the market faces restraints such as the high cost of research and development for specialized military-grade components and the lengthy qualification processes for new technologies within defense procurement cycles. Despite these challenges, innovation in materials science and miniaturization is expected to drive product development and expand the application scope of military-grade trackballs.

This report delves into the intricate market dynamics of military-grade trackballs, projecting a robust trajectory fueled by escalating defense spending and the increasing sophistication of military hardware. The study period from 2019 to 2033, with a base year of 2025, will meticulously analyze historical trends and forecast future market expansion. We anticipate the global military-grade trackball market to reach 1.2 million units by the end of 2025, exhibiting sustained growth throughout the forecast period of 2025-2033. This growth is intrinsically linked to the persistent demand for reliable and rugged input devices capable of withstanding extreme environmental conditions and rigorous operational demands inherent in military applications. The report will unpack the strategic imperatives driving this expansion, the technological advancements shaping product development, and the evolving competitive landscape. Furthermore, it will dissect the challenges that could potentially impede market growth, offering a nuanced and forward-looking perspective for stakeholders.

The military-grade trackball market is characterized by a significant upward trend, driven by a confluence of technological advancements, increasing defense budgets, and the continuous evolution of military operational requirements. Over the historical period of 2019-2024, the market witnessed steady adoption as defense agencies globally recognized the superior durability and precision offered by these specialized input devices. As we move into the estimated year of 2025, the market is projected to stand at 1.2 million units, a testament to the growing reliance on robust human-machine interfaces in modern warfare. The forecast period from 2025-2033 is expected to see this figure climb substantially, with an estimated compound annual growth rate (CAGR) that reflects the ongoing integration of these trackballs into an ever-wider array of military platforms. A key insight is the increasing demand for trackballs with enhanced cybersecurity features, driven by the growing threat landscape. Manufacturers are investing heavily in developing trackballs that offer robust data encryption and tamper-proof functionalities to safeguard sensitive operational data. Furthermore, the miniaturization and ergonomic enhancements of trackballs are becoming paramount. As military personnel operate in increasingly confined spaces and for extended durations, the need for compact, lightweight, and intuitively designed input devices is critical. This trend is pushing innovation towards sleeker designs, reduced power consumption, and improved haptic feedback to enhance user comfort and operational efficiency. The rise of "smart" trackballs, incorporating advanced sensing technologies and customizable functionality, is also a significant trend. These devices are moving beyond basic cursor control to offer integrated capabilities like gesture recognition and programmable buttons, allowing for more dynamic and streamlined interaction with complex military systems. The integration of these trackballs into networked battlefield systems, enabling seamless data flow and control across multiple platforms, further solidifies their importance. The ongoing exploration of augmented and virtual reality (AR/VR) applications in military training and mission planning also presents a burgeoning opportunity for advanced trackball solutions, capable of supporting immersive and interactive experiences. The inherent reliability of military-grade trackballs, their resistance to shock, vibration, dust, and moisture, remains a foundational driver, ensuring uninterrupted operation in the harshest environments.

The propulsion of the military-grade trackball market is a multifaceted phenomenon, deeply rooted in the evolving nature of global defense strategies and technological integration. A primary driver is the escalating global geopolitical instability, compelling nations to invest more heavily in modernizing their defense infrastructure and equipping personnel with advanced, reliable technology. This surge in defense spending directly translates into increased procurement of sophisticated military hardware, which in turn necessitates high-performance input devices. Military trackballs, with their inherent ruggedness and precision, are indispensable components in everything from command and control systems to advanced targeting systems. Furthermore, the increasing complexity of modern military operations demands intuitive and efficient human-machine interfaces. As weapon systems, communication networks, and surveillance technologies become more sophisticated, the need for input devices that can be operated quickly and accurately under high-stress conditions becomes critical. Military-grade trackballs excel in this regard, offering superior control compared to traditional mice, especially in environments with limited space or when operators are wearing gloves. The continuous technological advancements in material science and engineering are also playing a crucial role. Innovations in sensor technology, for instance, are leading to more precise and responsive trackballs, capable of handling finer movements and offering greater customization. The focus on ergonomic design and user comfort, driven by the need for prolonged operational efficiency, is also a significant propellant, ensuring that operators can perform their duties without fatigue.

Despite the robust growth trajectory, the military-grade trackball market faces several inherent challenges and restraints that could temper its expansion. A significant hurdle is the exceptionally long procurement cycles and stringent qualification processes within defense organizations. Introducing new technologies or suppliers into military systems requires extensive testing, validation, and bureaucratic approvals, which can significantly delay market penetration. The high cost associated with military-grade components, due to the specialized materials and rigorous testing required, also presents a restraint. This can make them less accessible for some budgetary-constrained defense programs. Furthermore, the increasing prevalence of touch-based interfaces in consumer electronics has led to a perception among some end-users that alternative input methods might be more intuitive. While military-grade trackballs offer superior performance in demanding environments, overcoming this perception and ensuring widespread adoption of touch-resistant and glove-friendly alternatives can be a challenge. The evolving threat landscape also necessitates continuous innovation in cybersecurity. As military systems become more interconnected, trackballs must integrate advanced security features to prevent unauthorized access or data breaches, which adds complexity and cost to development. Supply chain disruptions, particularly for specialized electronic components, can also pose a significant restraint, impacting production timelines and availability. Lastly, the limited number of specialized manufacturers capable of producing true military-grade components means that market competition can sometimes be less dynamic than in broader consumer electronics sectors.

The Panel Mount segment is poised to be a dominant force within the military-grade trackball market, exhibiting significant growth and adoption across various applications. This segment's ascendancy is directly linked to its inherent design advantage for integration into existing and new military platforms. Panel mount trackballs are specifically engineered for seamless integration into the dashboards, control consoles, and communication systems of military vehicles and aircraft. Their robust construction and sealed designs ensure protection against environmental hazards such as dust, water, and vibration, which are commonplace in operational theaters. The ease of installation and secure mounting provided by this design makes them ideal for retrofitting older systems and incorporating into the design of next-generation military hardware.

Applications such as Military Vehicles are expected to be a primary driver for the panel mount segment. Modern military vehicles, ranging from armored personnel carriers to advanced command and control vehicles, rely heavily on integrated electronic systems. The trackball serves as a critical human-machine interface for operating navigation systems, communication suites, weapon targeting, and sensor management. The need for reliable, glove-compatible, and fatigue-resistant input devices in these mobile command centers makes the panel mount trackball a superior choice. The increasing sophistication of sensor fusion and battlefield management systems within military vehicles further necessitates precise and responsive control, which panel mount trackballs are designed to deliver.

In terms of Regional Dominance, North America is anticipated to lead the military-grade trackball market. This is underpinned by the substantial defense budgets allocated by countries like the United States and Canada, coupled with their continuous investment in technological modernization of their armed forces. The region boasts a mature defense industry with a strong emphasis on research and development, leading to the adoption of cutting-edge technologies. Furthermore, the presence of major defense contractors and a well-established ecosystem for military hardware manufacturing facilitates the widespread integration of military-grade trackballs. The ongoing operational requirements and training exercises in diverse and challenging environments within North America further drive the demand for robust and reliable input devices. The commitment to equipping personnel with the most advanced and dependable tools for mission success solidifies North America's position as a key market for military-grade trackballs, particularly within the panel mount segment catering to its vast fleet of military vehicles and its expansive aerospace programs.

The military-grade trackball industry is experiencing significant growth catalysts, primarily driven by the escalating modernization of defense forces worldwide. Increased government spending on advanced military equipment, coupled with the demand for highly reliable human-machine interfaces in harsh operational environments, fuels this expansion. The continuous development of sophisticated military systems, including advanced avionics, vehicle control systems, and communication platforms, necessitates robust and precise input devices. Furthermore, technological advancements in trackball design, such as enhanced ergonomics, miniaturization, and the integration of advanced sensing capabilities, are making these devices more attractive and efficient for military personnel.

This comprehensive report provides an in-depth analysis of the military-grade trackball market, projecting a substantial growth trajectory driven by the increasing demand for rugged and reliable input devices in modern defense systems. With a projected market size of 1.2 million units by 2025, the report meticulously examines the factors propelling this expansion, including escalating geopolitical tensions, substantial defense modernization efforts, and the growing complexity of military operations. It also addresses the inherent challenges, such as long procurement cycles and high costs, while highlighting key market drivers like technological advancements in ergonomics and sensor technology. The report offers invaluable insights for stakeholders seeking to navigate this dynamic sector.

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of XX% from 2019-2033 |

| Segmentation |

|

Note*: In applicable scenarios

Primary Research

Secondary Research

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

The projected CAGR is approximately XX%.

Key companies in the market include NSI, iTech Company, Cursor Controls, Seatronx, ITAC Systems, Kessler-Ellis Products (KEP), CTI Electronics Corporation, Key Technology (China) Limited, Tianjin Northtop Information Technology Co.,Ltd, Mate Technology Shenzhen Limited.

The market segments include Type, Application.

The market size is estimated to be USD XXX million as of 2022.

N/A

N/A

N/A

N/A

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3480.00, USD 5220.00, and USD 6960.00 respectively.

The market size is provided in terms of value, measured in million and volume, measured in K.

Yes, the market keyword associated with the report is "Military Grade Trackball," which aids in identifying and referencing the specific market segment covered.

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

To stay informed about further developments, trends, and reports in the Military Grade Trackball, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.