1. What is the projected Compound Annual Growth Rate (CAGR) of the Military Grade Drone?

The projected CAGR is approximately 8.9%.

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.

Military Grade Drone

Military Grade DroneMilitary Grade Drone by Application (Investigate, Command, Monitor, Others), by Type (Fixed Wing UAV, Multi-rotor UAV, Vertical Takeoff and Landing UAV, Others), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2026-2034

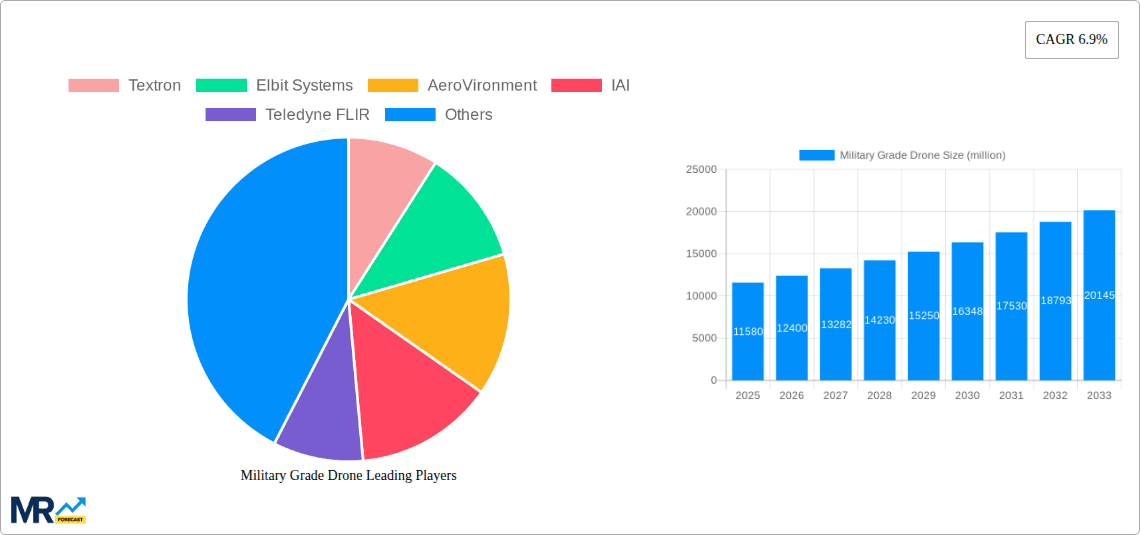

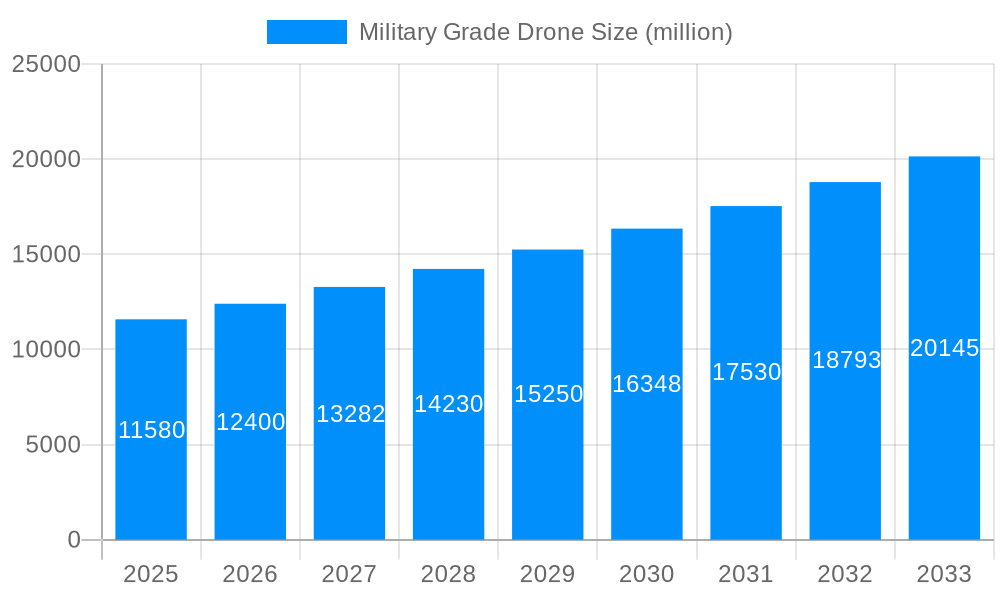

The military-grade drone market, valued at $11.58 billion in 2025, is projected to experience robust growth, driven by increasing defense budgets globally, the escalating demand for surveillance and reconnaissance capabilities, and the rising adoption of unmanned aerial vehicles (UAVs) in diverse military operations. The Compound Annual Growth Rate (CAGR) of 6.9% from 2025 to 2033 signifies a considerable expansion, indicating a market size exceeding $20 billion by the end of the forecast period. Key growth drivers include advancements in drone technology, such as improved payload capacity, extended flight endurance, and enhanced autonomous capabilities. Furthermore, the integration of artificial intelligence (AI) and machine learning (ML) is revolutionizing military drone applications, enabling more sophisticated tasks like target identification, precision strikes, and real-time data analysis. The market is segmented based on various factors, including drone type (fixed-wing, rotary-wing, hybrid), payload capacity, application (surveillance, reconnaissance, attack), and end-user (army, navy, air force). Leading companies like Textron, Elbit Systems, and Lockheed Martin are at the forefront of innovation, constantly developing advanced drone systems to meet the evolving needs of modern warfare.

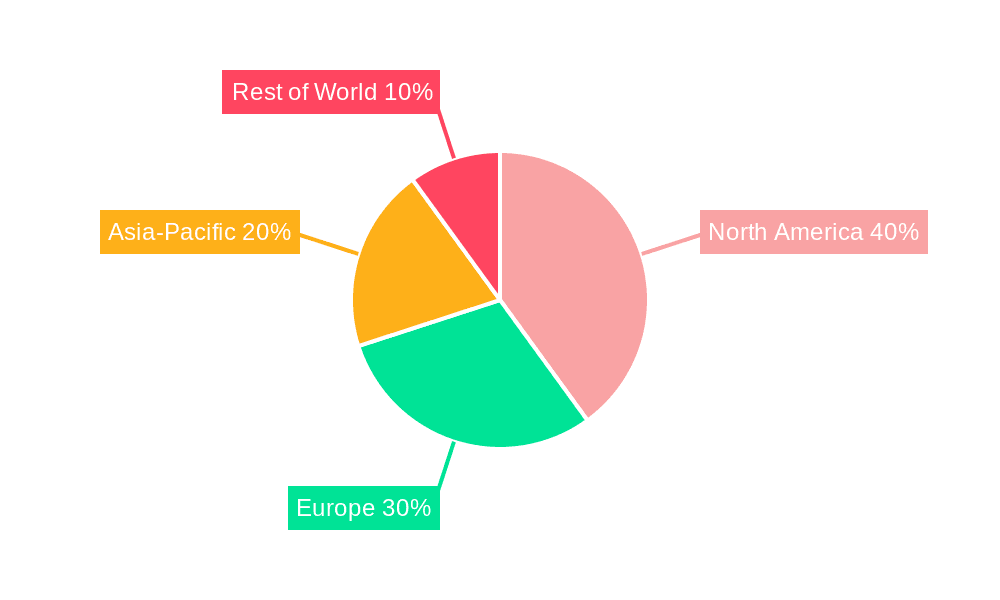

Despite the positive outlook, market growth faces some challenges. High initial investment costs associated with acquiring and maintaining sophisticated drone systems could hinder adoption, especially for smaller defense forces. Regulatory hurdles and concerns regarding data security and ethical implications of autonomous weapons systems also pose potential restraints. However, ongoing technological advancements, coupled with increased government investments in research and development, are expected to mitigate these challenges. The market is expected to witness a shift towards more affordable, yet highly capable, drone systems, making them accessible to a wider range of military organizations. The regional distribution of the market is likely to show a significant concentration in North America and Europe initially, but with increasing adoption rates in Asia-Pacific and other regions, a more balanced distribution is anticipated in the later years of the forecast period.

The global military grade drone market is experiencing a period of unprecedented growth, driven by escalating geopolitical tensions, technological advancements, and increasing defense budgets worldwide. The market, valued at several billion USD in 2024, is projected to reach tens of billions of USD by 2033, exhibiting a robust Compound Annual Growth Rate (CAGR). This surge is fueled by the increasing demand for unmanned aerial vehicles (UAVs) across various military applications, ranging from surveillance and reconnaissance to precision strikes and electronic warfare. Key market insights reveal a significant shift towards larger, more sophisticated drones capable of carrying heavier payloads and operating for extended durations. The integration of advanced technologies, such as artificial intelligence (AI), machine learning (ML), and improved sensor capabilities, is further enhancing the operational effectiveness and strategic value of these systems. Furthermore, the market is witnessing a diversification of drone platforms, with a rise in the adoption of both fixed-wing and rotary-wing UAVs catering to diverse mission requirements. The historical period (2019-2024) demonstrated a steady growth trajectory, establishing a strong base for the exponential expansion predicted during the forecast period (2025-2033). The base year of 2025 serves as a crucial benchmark to understand the market's current dynamics and project future trends. Competition among major players is intensifying, leading to continuous innovation and the development of cutting-edge technologies to secure a larger market share. This competitive landscape is also driving down costs and making military grade drones more accessible to various nations and branches of the military. The market’s evolution is not just about technological advancements; it also involves the strategic development of drone ecosystems, including ground control stations, data analytics platforms, and robust communication networks, further bolstering the overall market expansion.

Several key factors are propelling the remarkable growth of the military grade drone market. The increasing demand for cost-effective alternatives to manned aircraft is a significant driver. Drones offer substantial cost savings in terms of pilot training, maintenance, and operational expenses, making them an attractive investment for militaries with constrained budgets. Furthermore, the enhanced precision and accuracy offered by drones in targeting and surveillance tasks are invaluable advantages in modern warfare. The ability to deploy drones in dangerous or inaccessible areas minimizes the risk to human lives, representing a considerable ethical and strategic advantage. Technological advancements, particularly in AI, sensor technology, and autonomous navigation systems, are significantly improving drone capabilities, expanding their operational range and versatility. The integration of these advanced technologies enables drones to perform complex missions with greater autonomy and effectiveness. The ongoing geopolitical instability and conflicts worldwide have further fueled the demand for military grade drones, as nations seek to bolster their defense capabilities and maintain a strategic edge. Finally, the increasing adoption of drones for various military operations, beyond traditional surveillance and reconnaissance roles, is also contributing to the market’s expansion, including their use in electronic warfare, logistics support, and even delivering supplies to remote locations.

Despite the significant growth potential, the military grade drone market faces several challenges and restraints. Regulatory hurdles and stringent safety protocols imposed by various governments present a major obstacle to widespread drone adoption. The complexities surrounding air traffic management and airspace integration of drones require careful consideration and the development of robust regulatory frameworks. Concerns about data security and privacy, especially concerning the sensitive information gathered by drones, also necessitate the implementation of robust cybersecurity measures and data protection protocols. The potential for misuse of drones by non-state actors and terrorist organizations raises ethical and security concerns, necessitating the development of counter-drone technologies and effective security measures. Technological limitations, such as battery life, operational range, and vulnerability to electronic warfare, continue to be addressed through ongoing research and development efforts, but remain a factor impacting market growth. Furthermore, high initial investment costs and the need for specialized training and maintenance personnel can pose barriers to entry for smaller militaries and defense contractors. Finally, the need for continued innovation and adaptation to evolving technological landscapes is a constant pressure on the industry to maintain a competitive edge and remain at the forefront of defense technology.

North America: The region is expected to dominate the market due to significant defense spending, technological advancements, and a strong presence of major drone manufacturers. The United States, in particular, is a key driver of innovation and adoption of military-grade drones. The presence of major players like General Atomics and Northrop Grumman solidifies the region’s leading position.

Europe: Significant defense investments by European nations, coupled with a strong focus on technological advancement in drone technology, are driving market growth in this region. Countries like France, the United Kingdom, and Germany are actively investing in and developing advanced drone capabilities.

Asia-Pacific: This region is experiencing rapid growth due to increasing defense spending by countries like China, India, and Japan. The rising demand for surveillance and reconnaissance drones, driven by territorial disputes and border security concerns, fuels market expansion.

Segments:

Fixed-wing drones: These drones are particularly suited for long-range surveillance and reconnaissance missions, offering superior endurance and range compared to rotary-wing drones.

Rotary-wing drones: Rotary-wing drones are favored for close-range surveillance, search and rescue operations, and tactical deployments. Their agility and maneuverability in confined spaces make them highly valuable assets.

Medium-Altitude Long-Endurance (MALE) drones: These drones are extensively used for persistent surveillance and intelligence gathering, capable of operating for extended periods at higher altitudes. Their advanced sensor integration and long range make them critical assets for military operations.

High-Altitude Long-Endurance (HALE) drones: These drones offer exceptional surveillance capabilities over large geographical areas, providing crucial intelligence and reconnaissance information for long periods. Their high altitude also makes them difficult to detect.

The paragraph detailing the projected growth and market dominance of these regions and segments is intrinsically tied to the points listed above. The robust defense budgets, technological advancements, and specific military needs within each region and segment directly contribute to their projected market dominance. The continued investment in research and development within these sectors further solidifies their leading positions in the coming years.

The military grade drone industry is experiencing significant growth due to several catalysts. Firstly, the increasing demand for precise and cost-effective solutions in military operations is driving the widespread adoption of drones. Secondly, technological breakthroughs in AI, autonomous flight systems, and sensor technologies are making drones significantly more versatile and capable than ever before. Thirdly, governments and defense departments are investing heavily in drone technology as part of modernization programs to improve operational effectiveness and maintain a military advantage. The convergence of these factors presents a compelling growth story for the military drone industry in the coming years.

This report provides a comprehensive overview of the military grade drone market, offering detailed analysis of market trends, driving forces, challenges, key players, and significant developments. The report includes detailed forecasts for the period 2025-2033, based on a robust methodology and extensive market research. It provides valuable insights for businesses, investors, and military strategists seeking to understand the future of this rapidly evolving sector. The report also identifies key regions and segments poised for significant growth, providing a strategic roadmap for future investments and market expansion.

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 8.9% from 2020-2034 |

| Segmentation |

|

Note*: In applicable scenarios

Primary Research

Secondary Research

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

The projected CAGR is approximately 8.9%.

Key companies in the market include Textron, Elbit Systems, AeroVironment, IAI, Teledyne FLIR, Parrot, Lockheed Martin, Saab AB, General Atomics, Thales Group, BAE Systems Plc, Hindustan Aeronautics Ltd, Northrop Grumman Company, .

The market segments include Application, Type.

The market size is estimated to be USD XXX N/A as of 2022.

N/A

N/A

N/A

N/A

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3480.00, USD 5220.00, and USD 6960.00 respectively.

The market size is provided in terms of value, measured in N/A and volume, measured in K.

Yes, the market keyword associated with the report is "Military Grade Drone," which aids in identifying and referencing the specific market segment covered.

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

To stay informed about further developments, trends, and reports in the Military Grade Drone, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.