1. What is the projected Compound Annual Growth Rate (CAGR) of the Metal Beverage Packaging?

The projected CAGR is approximately XX%.

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.

Metal Beverage Packaging

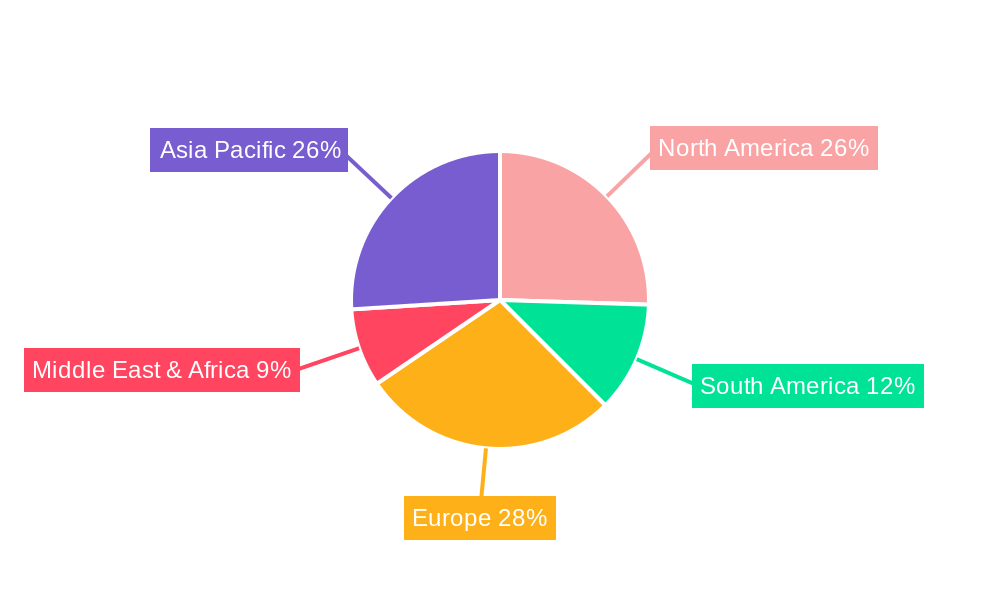

Metal Beverage PackagingMetal Beverage Packaging by Type (Steel, Aluminum, World Metal Beverage Packaging Production ), by Application (Beer, Carbonated Drinks, Others, World Metal Beverage Packaging Production ), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2025-2033

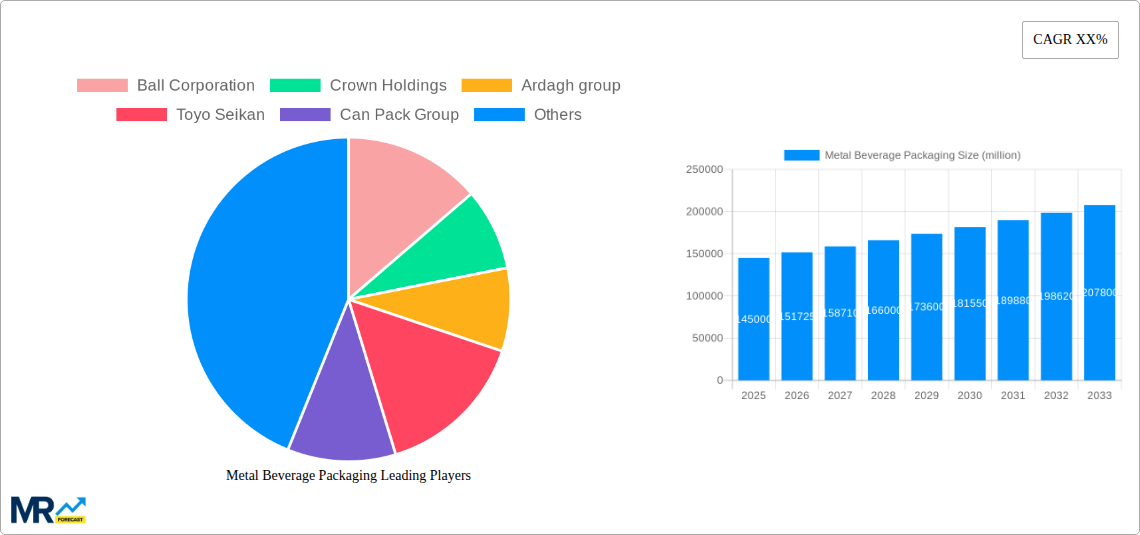

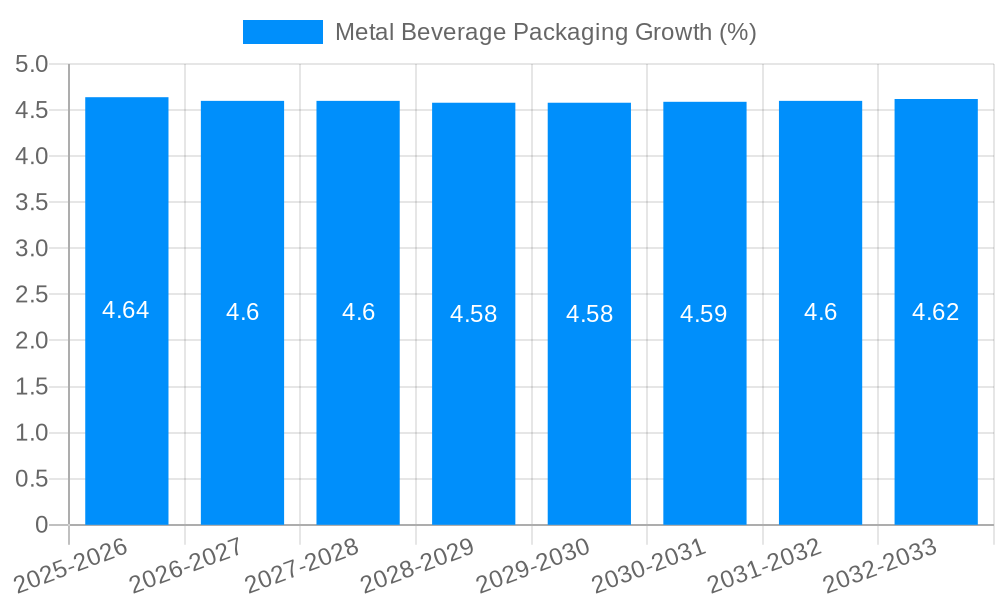

The global metal beverage packaging market is poised for substantial growth, with an estimated market size of approximately $145 billion in 2025, projecting a Compound Annual Growth Rate (CAGR) of around 4.5% through 2033. This robust expansion is primarily fueled by the increasing consumer preference for canned beverages, driven by convenience, portability, and perceived sustainability benefits over plastic alternatives. Key growth drivers include the burgeoning demand for beer and carbonated soft drinks, particularly in emerging economies across Asia Pacific and Latin America. The inherent recyclability and extended shelf-life offered by metal packaging further bolster its appeal amidst growing environmental consciousness. Innovations in can design, such as lightweighting and advanced coating technologies, are also contributing to market dynamism, enabling manufacturers to reduce material costs and enhance product appeal.

The market's trajectory, however, is not without its challenges. Fluctuations in raw material prices, particularly for aluminum and steel, present a significant restraint, impacting production costs and profit margins for key players like Ball Corporation, Crown Holdings, and Ardagh Group. Intense competition from alternative packaging materials, including glass and advanced plastics, necessitates continuous innovation and strategic pricing to maintain market share. Geopolitical factors and trade policies can also influence the cost and availability of raw materials, creating a complex operational landscape. Despite these headwinds, the strong underlying demand for metal beverage packaging, coupled with ongoing technological advancements and a focus on circular economy principles, indicates a healthy and expanding market outlook for the foreseeable future. The dominant segments are expected to remain steel and aluminum, with beer and carbonated drinks as the primary applications.

Here's a unique report description for Metal Beverage Packaging, incorporating your specified elements:

This report delves deep into the dynamic world of metal beverage packaging, offering a granular analysis of production, consumption, and innovation across a critical study period. From the historical trends observed between 2019 and 2024 to the projected trajectory through 2033, we provide an unparalleled view of this essential industry. With 2025 serving as our base and estimated year, our projections are grounded in robust data and expert insights, encompassing both global production volumes in millions of units and intricate market segmentation.

XXX The global metal beverage packaging market is experiencing a profound transformation driven by a confluence of shifting consumer preferences, escalating environmental consciousness, and technological advancements. The inherent sustainability of metal, particularly aluminum, as a highly recyclable material, is a significant tailwind, positioning it as a preferred choice over less environmentally friendly alternatives. This trend is further amplified by regulatory pressures and corporate sustainability initiatives aiming to reduce single-use plastic waste. We are witnessing a pronounced shift towards premiumization within beverage categories, leading to increased demand for aesthetically appealing and innovative packaging designs, often realized through advanced printing techniques and unique can formats. The convenience factor also remains paramount, with the single-serve can format continuing its dominance, catering to on-the-go consumption patterns. Furthermore, the beverage industry's continuous innovation, with the introduction of new product lines ranging from functional beverages and craft beers to plant-based drinks and ready-to-drink cocktails, directly fuels the demand for diverse metal packaging solutions. The report will meticulously detail these evolving trends, examining how they are reshaping production capacities and influencing material choices, with a particular focus on the increasing dominance of aluminum cans due to their superior recyclability and lightweight properties. The interplay between these macro trends and micro-market shifts will be a central theme, providing actionable intelligence for stakeholders.

The metal beverage packaging market is propelled by a powerful combination of factors that underscore its enduring relevance and growth potential. Foremost among these is the escalating global demand for beverages across all categories, from traditional carbonated soft drinks and beer to burgeoning segments like functional beverages, energy drinks, and ready-to-drink (RTD) cocktails. This surge in consumption directly translates into a higher requirement for packaging solutions. Crucially, the inherent sustainability of metal, especially aluminum, is a significant driver. With growing consumer awareness and stringent government regulations targeting plastic waste, the high recyclability and circular economy potential of metal cans are increasingly favored. This environmental advantage not only appeals to eco-conscious consumers but also aligns with the corporate social responsibility goals of beverage manufacturers. Furthermore, the robust innovation within the beverage industry, characterized by the constant launch of new flavors, formulations, and product types, necessitates adaptable and sophisticated packaging. Metal offers versatility in terms of form factors, sizes, and decorative capabilities, allowing brands to differentiate themselves effectively on the shelf and cater to diverse consumer needs. The convenience and portability associated with metal cans, particularly for single-serve options, also play a vital role in capturing impulse purchases and supporting active lifestyles, further solidifying their market position.

Despite its robust growth, the metal beverage packaging sector faces several significant challenges and restraints that temper its full potential. A primary concern is the volatility in raw material prices, particularly for aluminum and steel. Fluctuations in global commodity markets can directly impact production costs, squeezing profit margins for manufacturers and potentially leading to increased pricing for beverage producers. Geopolitical events, supply chain disruptions, and shifts in mining or smelting capacities can exacerbate these price instabilities. Another considerable hurdle is the intense competition from alternative packaging materials. While metal boasts strong sustainability credentials, plastics, glass, and emerging bio-based materials continue to vie for market share, often offering cost advantages or unique perceived benefits for specific beverage types. The capital-intensive nature of metal packaging production also presents a barrier to entry and can limit the agility of smaller players to respond to rapid market shifts. Furthermore, energy consumption during the manufacturing process, particularly for aluminum, remains an area of focus, with ongoing efforts to improve energy efficiency and utilize renewable energy sources to mitigate its environmental footprint and associated costs. Finally, evolving consumer preferences, while often favoring sustainability, can also lead to a demand for lighter-weight packaging or those with enhanced functionalities that metal may not always readily offer, requiring continuous innovation to stay competitive.

Dominant Regions and Countries:

Dominant Segments:

The metal beverage packaging industry is fueled by several key growth catalysts. The escalating global demand for beverages across diverse categories, coupled with the inherent sustainability and high recyclability of aluminum, positions metal as a preferred choice. The rapid expansion of the ready-to-drink (RTD) segment, including hard seltzers, RTD cocktails, and functional beverages, directly benefits metal packaging due to its portability and convenience. Furthermore, advancements in printing and decoration technologies allow for enhanced brand differentiation and premiumization, appealing to consumers. The growing environmental consciousness among consumers and stringent regulations against single-use plastics are also powerful drivers, pushing manufacturers towards more sustainable packaging solutions.

This report provides an all-encompassing view of the metal beverage packaging market, meticulously detailing production volumes in millions of units, and analyzing key trends, drivers, and challenges. Our comprehensive coverage extends to regional market dynamics, with a specific focus on dominating regions and countries, as well as in-depth segmentation analysis of types (Steel, Aluminum) and applications (Beer, Carbonated Drinks, Others). The report highlights significant industry developments, including technological innovations and strategic moves by leading players. We also present a forward-looking perspective, offering detailed forecasts for the period 2025-2033, building upon our base year of 2025. This extensive research equips stakeholders with the insights necessary to navigate the evolving landscape and capitalize on future growth opportunities within the global metal beverage packaging sector.

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of XX% from 2019-2033 |

| Segmentation |

|

Note*: In applicable scenarios

Primary Research

Secondary Research

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

The projected CAGR is approximately XX%.

Key companies in the market include Ball Corporation, Crown Holdings, Ardagh group, Toyo Seikan, Can Pack Group, Silgan Holdings Inc, Daiwa Can Company, Baosteel Packaging, ORG Technology, ShengXing Group, CPMC Holdings, Hokkan Holdings, Showa Aluminum Can Corporation, United Can (Great China Metal), Kingcan Holdings, Jiamei Food Packaging, Jiyuan Packaging Holdings, .

The market segments include Type, Application.

The market size is estimated to be USD XXX million as of 2022.

N/A

N/A

N/A

N/A

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4480.00, USD 6720.00, and USD 8960.00 respectively.

The market size is provided in terms of value, measured in million and volume, measured in K.

Yes, the market keyword associated with the report is "Metal Beverage Packaging," which aids in identifying and referencing the specific market segment covered.

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

To stay informed about further developments, trends, and reports in the Metal Beverage Packaging, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.