1. What is the projected Compound Annual Growth Rate (CAGR) of the Medical Sterile Protective Packaging?

The projected CAGR is approximately XX%.

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.

Medical Sterile Protective Packaging

Medical Sterile Protective PackagingMedical Sterile Protective Packaging by Application (Medical Supplies, Medical Instruments, Other), by Type (Pure Paper Packaging, Blister Paper Packaging, World Medical Sterile Protective Packaging Production ), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2025-2033

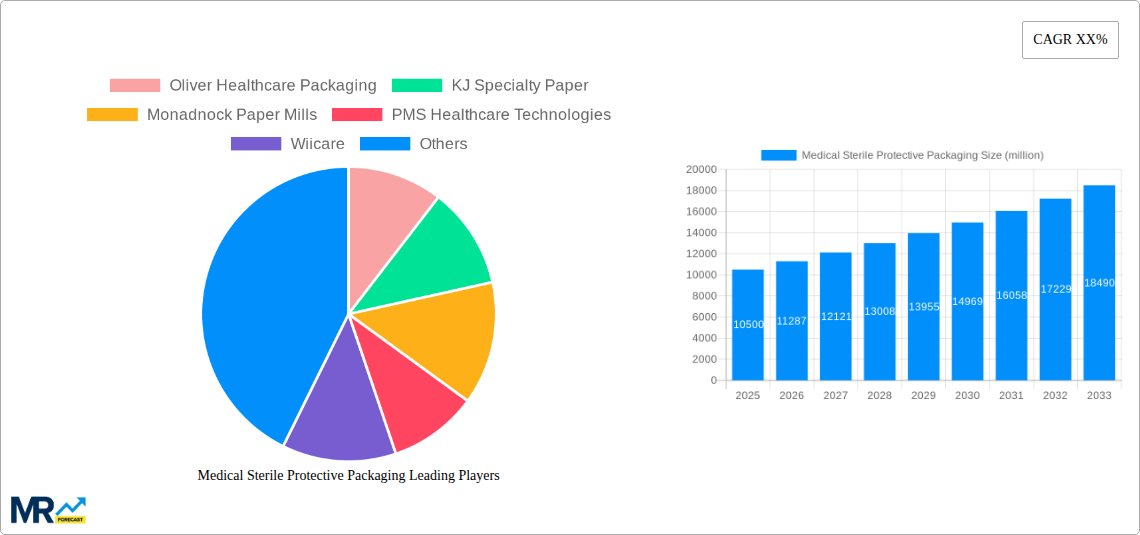

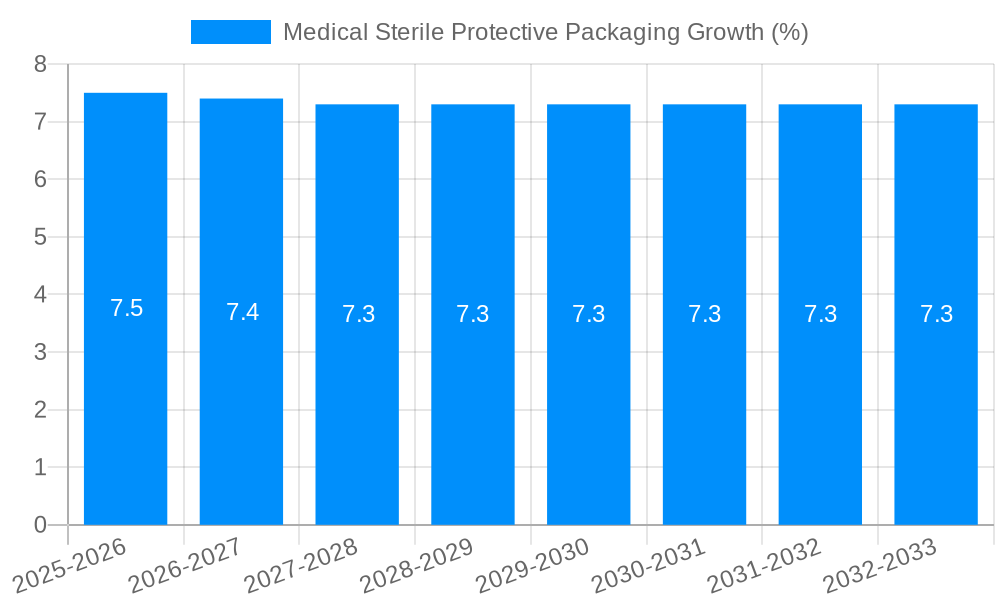

The global Medical Sterile Protective Packaging market is poised for robust expansion, projected to reach an estimated \$10,500 million by 2025 and expand significantly through 2033. Driven by the escalating demand for sterile medical supplies and instruments, coupled with a growing emphasis on patient safety and infection control, the market is experiencing a healthy Compound Annual Growth Rate (CAGR) of approximately 7.5%. This growth is primarily fueled by advancements in packaging materials and technologies that ensure product integrity and sterility throughout the supply chain. The increasing prevalence of chronic diseases and the continuous introduction of novel medical devices further bolster the demand for specialized protective packaging solutions. Furthermore, stringent regulatory requirements for medical device sterilization and packaging across major economies are acting as a significant catalyst for market growth, pushing manufacturers to adopt high-quality, compliant packaging.

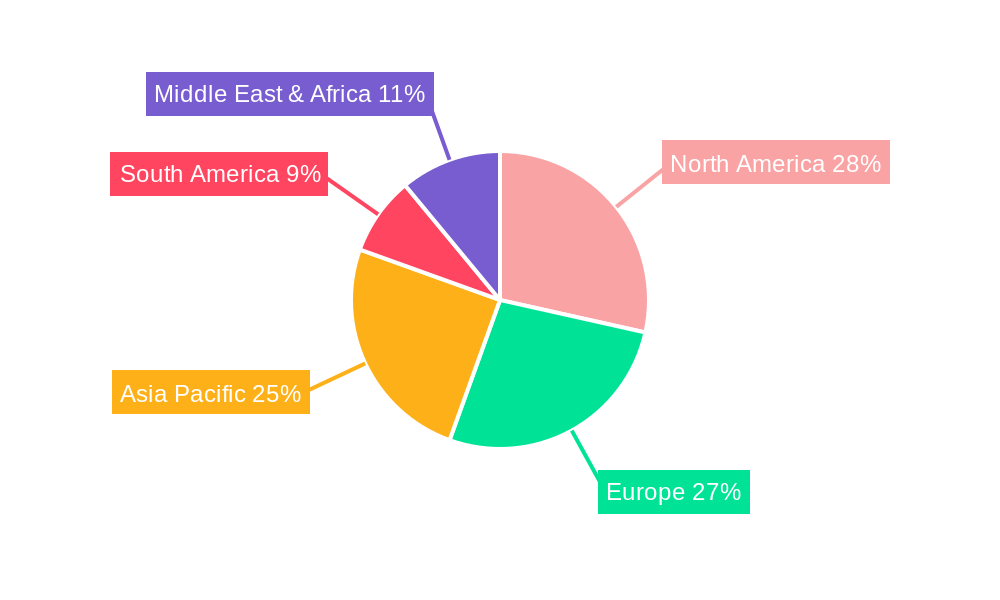

The market is segmented into Pure Paper Packaging and Blister Paper Packaging, with Pure Paper Packaging likely holding a dominant share due to its cost-effectiveness and suitability for a wide range of sterile products. Key applications include medical supplies and medical instruments, both of which are experiencing sustained demand. Regionally, Asia Pacific is expected to emerge as the fastest-growing market, propelled by a burgeoning healthcare infrastructure, increasing medical tourism, and a rising disposable income in countries like China and India. North America and Europe, with their well-established healthcare systems and high adoption rates of advanced medical technologies, will continue to represent significant market shares. While the market presents substantial opportunities, challenges such as the fluctuating costs of raw materials and the need for continuous innovation to meet evolving sterilization standards could temper growth to some extent. Nevertheless, the overarching trends of enhanced patient safety and the expanding global healthcare sector underscore a positive trajectory for the Medical Sterile Protective Packaging market.

This report offers an in-depth examination of the global Medical Sterile Protective Packaging market, meticulously analyzing its trajectory from the historical period of 2019-2024, through the base and estimated year of 2025, and projecting its growth through the forecast period of 2025-2033. With a focus on unit production, the report provides critical insights into market dynamics, growth drivers, prevailing challenges, and the strategic landscape of leading manufacturers and regions.

The global medical sterile protective packaging market is undergoing a significant transformation, driven by an escalating demand for safe and reliable containment solutions for a vast array of medical products. XXX, the market is witnessing a pronounced shift towards advanced materials and intelligent packaging designs that offer superior barrier properties, enhanced shelf-life extension, and improved user convenience. The stringent regulatory environment surrounding medical device and pharmaceutical packaging continues to be a pivotal factor, compelling manufacturers to adopt materials and processes that meet the highest standards of sterility assurance. We anticipate the total production volume to reach approximately 2,500 million units by 2025, with a projected Compound Annual Growth Rate (CAGR) of 6.8% during the forecast period, culminating in an estimated production of over 4,000 million units by 2033.

The application segment for Medical Supplies is expected to remain the dominant force in the market, accounting for an estimated 1,200 million units in 2025. This segment encompasses a broad spectrum of products including surgical gloves, syringes, bandages, and diagnostic kits, all of which necessitate robust sterile packaging to maintain their efficacy and prevent contamination. The increasing prevalence of minimally invasive surgeries and the growing home healthcare market further amplify the demand for sterile consumables, thus bolstering this segment. Concurrently, the Medical Instruments segment, projected to reach 850 million units in 2025, is witnessing a surge in demand for specialized packaging solutions that can accommodate complex and sensitive surgical tools, implants, and diagnostic equipment. The trend towards smaller, more intricate instruments, often requiring customized packaging, is driving innovation in this area. The "Other" application segment, which includes pharmaceuticals and biotechnology products, is also a significant contributor, with an estimated 450 million units in 2025, driven by advancements in drug delivery systems and the growing biopharmaceutical industry.

Regarding packaging types, Pure Paper Packaging is projected to be the leading segment, with an estimated production of 1,100 million units in 2025. This preference stems from the inherent breathability and cost-effectiveness of paper-based materials, coupled with advancements in barrier coatings that enhance their protective capabilities. Blister Paper Packaging, while a smaller segment, is anticipated to grow at a faster pace due to its superior visibility and tamper-evident features, making it ideal for high-value medical devices and pharmaceuticals. Its production is estimated to reach 900 million units in 2025. The increasing focus on sustainability is also influencing material choices, with a growing interest in recyclable and biodegradable paper-based solutions.

The global medical sterile protective packaging market is experiencing a sustained upward trajectory, fueled by a confluence of critical factors. Foremost among these is the ever-present and escalating global demand for healthcare services and products. As populations grow and age, and as access to healthcare expands, so too does the need for sterile medical supplies, instruments, and pharmaceuticals. This fundamental increase in healthcare consumption directly translates into a higher requirement for reliable sterile packaging to ensure product integrity and patient safety. Furthermore, the global emphasis on infection control and patient safety has intensified, with regulatory bodies worldwide imposing increasingly stringent standards on the sterility and traceability of medical products. This regulatory pressure compels manufacturers to invest in and adopt advanced sterile packaging solutions that meet or exceed these demanding requirements, thereby driving innovation and market growth. The burgeoning biotechnology and pharmaceutical industries, with their continuous development of novel therapeutics and advanced drug delivery systems, also represent a significant growth engine. These cutting-edge products often require highly specialized and robust sterile packaging to maintain their stability, efficacy, and sterility throughout their lifecycle, from manufacturing to patient administration.

Despite the robust growth prospects, the medical sterile protective packaging market is not without its inherent challenges and restraints. The paramount concern for any player in this sector is the unwavering commitment to sterility assurance and the prevention of microbial contamination. Any lapse in this regard can have severe consequences for patient safety and brand reputation, necessitating rigorous quality control measures, validated sterilization processes, and meticulous supply chain management. The inherent complexity of sterilization processes, whether it be gamma irradiation, ethylene oxide (EtO), or steam sterilization, can also present challenges. Each method has its own set of material compatibility issues, regulatory considerations, and cost implications, requiring careful selection and validation. Furthermore, the fluctuating costs of raw materials, particularly paper pulp and specialized polymers, can significantly impact the profitability of packaging manufacturers. Global supply chain disruptions, as witnessed in recent years, can also lead to material shortages, increased lead times, and price volatility, posing a significant hurdle to consistent production and timely delivery. The growing environmental consciousness and increasing regulatory pressure for sustainable packaging solutions also present a challenge. While sustainability is a long-term opportunity, the transition to greener alternatives requires significant investment in research and development, as well as the adoption of new manufacturing processes and materials that meet both sterilization and environmental performance criteria.

The global Medical Sterile Protective Packaging market is characterized by distinct regional strengths and segment dominance. The North America region is projected to be a dominant force, with an estimated market share of 30% in 2025, driven by a highly developed healthcare infrastructure, a large and aging population, and a strong presence of leading pharmaceutical and medical device companies. The United States, in particular, is a major consumer and producer of medical sterile protective packaging, with robust regulatory frameworks that encourage innovation and high-quality standards. The region's strong emphasis on advanced medical technologies and its proactive approach to public health initiatives further solidify its leading position.

Within North America, the Medical Supplies application segment is anticipated to be the primary driver of market growth, accounting for approximately 40% of the region's total packaging demand in 2025. This segment's dominance is attributed to the high volume of single-use medical items such as syringes, catheters, wound care products, and surgical disposables, all of which require sterile packaging for safe and effective use. The increasing number of surgical procedures, outpatient clinics, and home healthcare services directly contributes to the sustained demand for sterile medical supplies and, consequently, their packaging.

Furthermore, the Pure Paper Packaging type is expected to hold a significant market share within North America, representing an estimated 35% of the total packaging volume in 2025. This preference for paper-based solutions is driven by its cost-effectiveness, breathability, and the ongoing advancements in barrier coatings that enhance its protective properties. The growing focus on sustainability within the region also favors the adoption of recyclable and biodegradable paper packaging options.

Globally, the World Medical Sterile Protective Packaging Production volume is a critical indicator, projected to reach approximately 2,500 million units in 2025. The dominance of certain segments and regions is intrinsically linked to this overall production output. For instance, the robust demand for medical supplies in North America directly translates into a significant portion of this global production being dedicated to paper-based packaging solutions for these items. The trend towards blister paper packaging, while currently a smaller segment, is expected to witness substantial growth driven by its suitability for high-value and complex medical instruments that often require enhanced visibility and tamper-evidence, particularly in regions with advanced medical manufacturing capabilities.

The Asia Pacific region is also emerging as a formidable contender, with its rapidly expanding healthcare sector, increasing disposable incomes, and a growing domestic medical device manufacturing base. While currently holding a smaller share compared to North America, its projected growth rate is significantly higher, driven by factors such as government initiatives to improve healthcare access and the increasing adoption of advanced medical technologies in countries like China and India. The growing export market for medical devices from these countries further bolsters the demand for sterile protective packaging.

Several key factors are acting as catalysts, accelerating the growth of the medical sterile protective packaging industry. The continuous innovation in medical device technology, leading to more complex and sensitive instruments, necessitates sophisticated and specialized packaging solutions that can ensure their sterility and integrity. Furthermore, the increasing global healthcare expenditure, driven by aging populations and rising chronic disease prevalence, directly translates into a higher demand for sterile medical products and, consequently, their packaging. The growing emphasis on patient safety and infection control, reinforced by stringent regulatory mandates worldwide, is also a significant growth driver, pushing manufacturers towards higher quality and more reliable packaging materials and designs.

This comprehensive report delves into the intricacies of the global Medical Sterile Protective Packaging market, providing an exhaustive analysis of its current state and future trajectory. From its meticulous breakdown of market trends, including the paramount importance of sterility assurance and the adoption of advanced materials, to the identification of key driving forces such as the ever-increasing global demand for healthcare and stringent regulatory mandates, this report leaves no stone unturned. It critically examines the challenges and restraints, including the complexities of sterilization processes and raw material price volatility, while simultaneously highlighting the significant growth catalysts like technological advancements in medical devices and rising healthcare expenditure. With detailed regional and segment analysis, this report aims to equip stakeholders with the critical insights necessary for strategic decision-making in this dynamic and vital sector of the healthcare industry.

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of XX% from 2019-2033 |

| Segmentation |

|

Note*: In applicable scenarios

Primary Research

Secondary Research

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

The projected CAGR is approximately XX%.

Key companies in the market include Oliver Healthcare Packaging, KJ Specialty Paper, Monadnock Paper Mills, PMS Healthcare Technologies, Wiicare, Ahlstrom-Munksjö, Katsan Medical Devices, Mondi Group, Anhui YIPAK Medical Packaging, Ningbo Huali Medical Packaging, Anqing Kangmingna Packaging, Ningbo Jixiang Packaging, Nantong Fuhua Medical Packing, Anqing Tianrun Paper Packaging, .

The market segments include Application, Type.

The market size is estimated to be USD XXX million as of 2022.

N/A

N/A

N/A

N/A

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4480.00, USD 6720.00, and USD 8960.00 respectively.

The market size is provided in terms of value, measured in million and volume, measured in K.

Yes, the market keyword associated with the report is "Medical Sterile Protective Packaging," which aids in identifying and referencing the specific market segment covered.

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

To stay informed about further developments, trends, and reports in the Medical Sterile Protective Packaging, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.