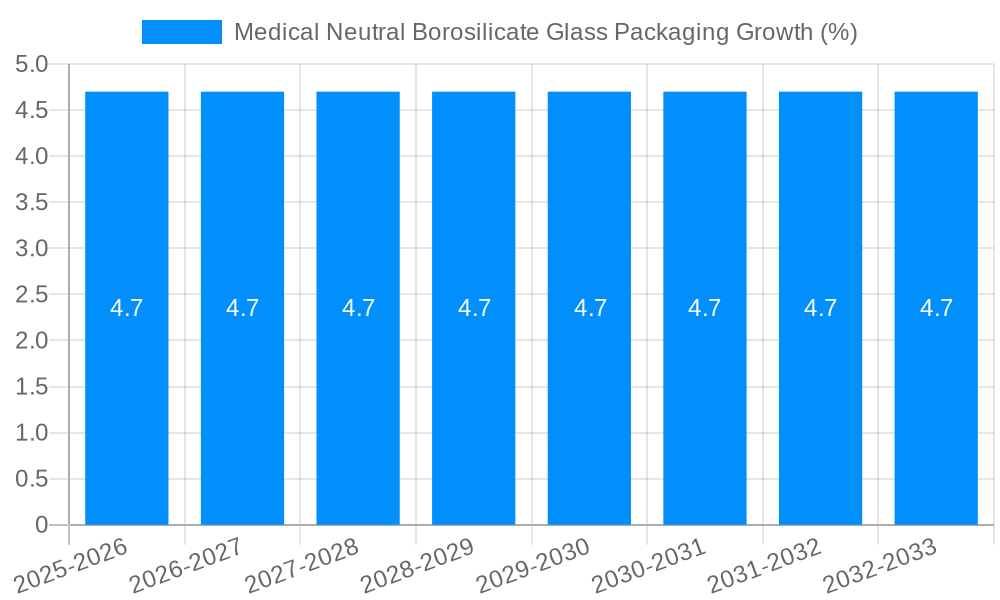

1. What is the projected Compound Annual Growth Rate (CAGR) of the Medical Neutral Borosilicate Glass Packaging?

The projected CAGR is approximately 4.7%.

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.

Medical Neutral Borosilicate Glass Packaging

Medical Neutral Borosilicate Glass PackagingMedical Neutral Borosilicate Glass Packaging by Type (Injection Bottle, Ampoule, Oral Bottle, Other), by Application (Pharma, Vaccine, Other), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2025-2033

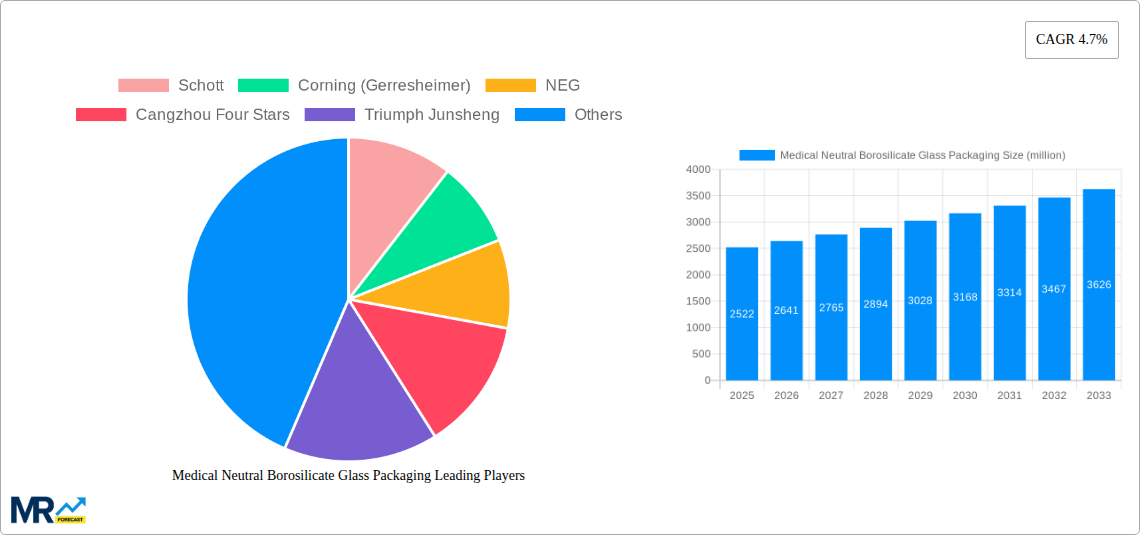

The global Medical Neutral Borosilicate Glass Packaging market is poised for substantial growth, projected to reach approximately USD 2522 million by 2025, with an anticipated Compound Annual Growth Rate (CAGR) of 4.7% through 2033. This robust expansion is primarily fueled by escalating global healthcare demands, increasing pharmaceutical production, and a growing emphasis on patient safety and drug integrity. The inherent chemical inertness, thermal resistance, and mechanical strength of neutral borosilicate glass make it the preferred material for a wide array of critical pharmaceutical applications, including injection bottles, ampoules, and oral bottles. The pharmaceutical sector stands as the dominant application segment, driven by the continuous development of new drugs and the need for secure, reliable packaging solutions to maintain therapeutic efficacy and prevent contamination. Similarly, the burgeoning vaccine market, especially in light of recent global health events, significantly contributes to the demand for high-quality glass packaging that ensures vaccine stability and shelf-life.

The market is characterized by a competitive landscape with established players like Schott, Corning (Gerresheimer), and NEG, alongside emerging regional manufacturers, fostering innovation and a focus on advanced manufacturing techniques. Key trends shaping the market include the adoption of sustainable packaging solutions, advancements in glass coating technologies to enhance barrier properties, and the increasing automation in packaging lines to meet stringent regulatory requirements and improve production efficiency. While the market demonstrates strong growth potential, certain restraints such as the fluctuating raw material costs for glass production and the need for substantial capital investment in specialized manufacturing facilities could pose challenges. However, the undeniable superiority of neutral borosilicate glass in preserving drug quality and safety, coupled with its recyclability, is expected to propel its market dominance and ensure its continued relevance in the pharmaceutical packaging ecosystem, particularly in the high-growth regions of Asia Pacific and North America.

This comprehensive report delves into the dynamic global market for medical neutral borosilicate glass packaging, offering an in-depth analysis from the historical period of 2019-2024 to a projected forecast up to 2033, with a base year of 2025. The study meticulously examines market trends, driving forces, challenges, regional dominance, growth catalysts, leading players, and significant industry developments. With an estimated market size in the millions of units, this report provides actionable insights for stakeholders navigating this critical sector of the pharmaceutical and healthcare industries.

The global medical neutral borosilicate glass packaging market is poised for substantial expansion, driven by an escalating demand for high-quality, inert, and safe containment solutions for pharmaceuticals and vaccines. Throughout the study period, from 2019 to 2033, a consistent upward trajectory is anticipated, with the base year of 2025 serving as a crucial reference point for understanding current market dynamics and future projections. Key market insights reveal a growing preference for Type I borosilicate glass due to its superior chemical resistance, thermal shock resistance, and low coefficient of thermal expansion, making it the material of choice for sensitive drug formulations. This inherent stability minimizes the risk of leachables and extractables, ensuring the integrity and efficacy of the packaged medicinal products.

The market is witnessing a pronounced shift towards advanced manufacturing techniques, emphasizing precision, purity, and sustainability. Innovations in glass formulation and production processes are leading to the development of thinner yet stronger glass containers, reducing material waste and transportation costs. Furthermore, the increasing stringency of regulatory standards worldwide regarding pharmaceutical packaging safety and quality is a significant contributor to the adoption of neutral borosilicate glass. Regions with robust pharmaceutical manufacturing hubs and a high prevalence of chronic diseases are expected to exhibit the highest consumption rates. The estimated market size, measured in the millions of units, reflects the sheer volume of drug and vaccine production globally, with neutral borosilicate glass packaging playing an indispensable role in safeguarding public health. The forecast period, 2025-2033, anticipates continued innovation and market growth, underscoring the long-term importance of this packaging material in the evolving healthcare landscape. The estimated market in 2025 is projected to reach XXX million units, highlighting the current scale of production and demand.

The global medical neutral borosilicate glass packaging market is experiencing robust growth, propelled by a confluence of critical factors that underscore its indispensable role in modern healthcare. Foremost among these drivers is the unwavering surge in pharmaceutical production, fueled by an aging global population, increasing prevalence of chronic diseases, and the continuous development of novel therapeutics. As the volume of drugs and vaccines requiring sterile, inert, and reliable containment escalates, so too does the demand for neutral borosilicate glass, known for its exceptional inertness and resistance to chemical interactions. This inherent stability is paramount in preventing drug degradation, ensuring product efficacy, and safeguarding patient safety, making it the preferred choice for high-value and sensitive medications.

Moreover, stringent regulatory landscapes worldwide, mandating the highest standards for pharmaceutical packaging, further bolster the market. Regulatory bodies continuously emphasize the need for packaging that minimizes the risk of leachables and extractables, and neutral borosilicate glass consistently meets these demanding requirements. The material's proven track record in maintaining drug integrity over extended shelf lives, coupled with its ability to withstand sterilization processes without compromising its chemical composition, solidifies its position as a gold standard. The increasing focus on biologics and complex drug formulations, which are particularly susceptible to degradation, also contributes significantly to the demand for the superior protective properties offered by neutral borosilicate glass. The market size in millions of units reflects this broad-based demand across various therapeutic areas and dosage forms. The estimated market in 2025 is projected to reach XXX million units, underscoring the substantial and growing need for this critical packaging material.

Despite the promising growth trajectory, the medical neutral borosilicate glass packaging market faces several inherent challenges and restraints that warrant careful consideration. One of the primary hurdles is the fragility associated with glass packaging. While advancements in manufacturing have led to stronger glass, accidental breakages during handling, transportation, and administration can still lead to product loss, increased costs, and potential patient safety risks. This necessitates robust packaging and handling protocols, adding to the overall supply chain complexity and expense.

Another significant restraint is the higher cost of production compared to alternative packaging materials such as plastics. The energy-intensive manufacturing processes, the need for specialized equipment, and the quality control measures required for medical-grade borosilicate glass contribute to a premium price point. This can be a deterrent for manufacturers producing high-volume, lower-margin medications, especially in price-sensitive markets. Furthermore, environmental concerns and sustainability pressures are also coming to the forefront. While glass is recyclable, the energy required for its production and recycling can be substantial. Growing advocacy for more sustainable packaging solutions, including the development of lighter-weight and more environmentally friendly materials, presents a long-term challenge that the industry must address through innovation in recycling and energy efficiency. The market size in millions of units, while indicative of demand, also highlights the scale of these production and cost considerations. The estimated market in 2025 is projected to reach XXX million units, emphasizing the volume of production where these cost and fragility factors play a significant role.

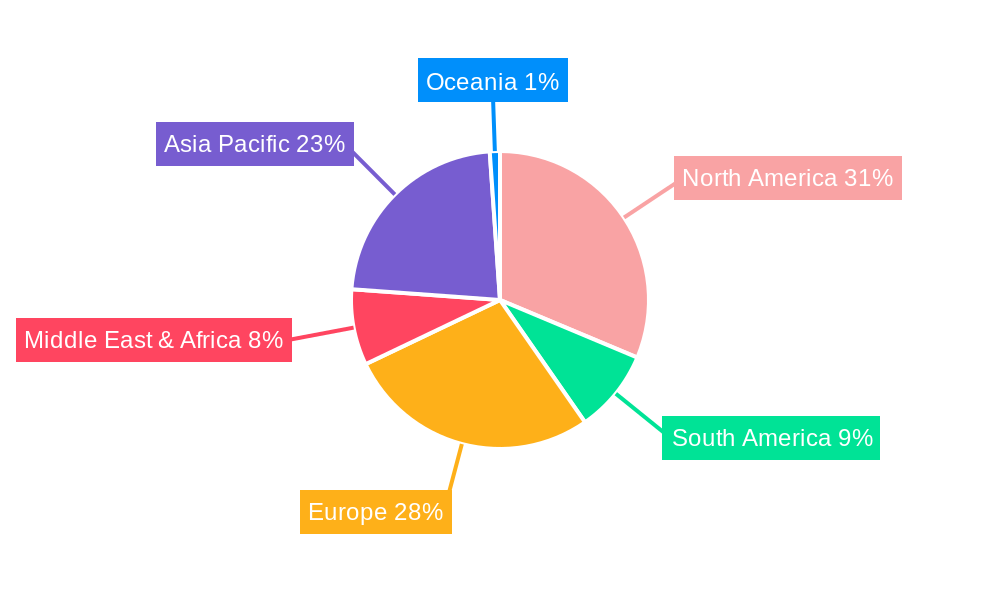

The global medical neutral borosilicate glass packaging market is characterized by distinct regional strengths and segment dominance, with Asia Pacific emerging as a key region poised for significant growth and potential market leadership. This dominance is driven by a confluence of factors including the region's rapidly expanding pharmaceutical manufacturing capabilities, a burgeoning domestic demand for healthcare services, and increasing investments in research and development of novel drugs and vaccines. Countries like China and India, with their substantial pharmaceutical production capacities, are major consumers and manufacturers of medical neutral borosilicate glass packaging. The sheer volume of generics and biosimilars produced in these nations contributes significantly to the market size, measured in millions of units.

Within the Pharma application segment, particularly for Injection Bottles and Ampoules, the dominance of Asia Pacific is even more pronounced. These types of packaging are critical for the delivery of a vast array of injectable medications, including antibiotics, biologics, and vaccines, which are in high demand due to large populations and the rising incidence of infectious diseases and chronic conditions. The increasing sophistication of pharmaceutical manufacturing in the region, coupled with the adoption of international quality standards, further solidifies the demand for high-quality borosilicate glass.

Furthermore, the Vaccine application segment is a significant contributor to the market's growth, especially in light of global health initiatives and the ongoing need for widespread vaccination programs. Asia Pacific, with its large population density and increasing focus on public health, represents a substantial market for vaccine vials and syringes. The estimated market in 2025 is projected to reach XXX million units, with Injection Bottles and Ampoules within the Pharma application, primarily in the Asia Pacific region, accounting for a substantial portion of this volume. The region's cost-effectiveness in manufacturing, combined with its growing technical expertise, positions it as a critical hub for both production and consumption of medical neutral borosilicate glass packaging.

Other regions, such as North America and Europe, maintain significant market share due to their established pharmaceutical industries, high per capita healthcare spending, and strong emphasis on innovation and quality. However, the rate of growth in Asia Pacific is anticipated to outpace these mature markets, driven by evolving healthcare infrastructure and increasing access to advanced medical treatments. The Oral Bottle segment, while important, tends to have a more dispersed demand across regions, often catering to over-the-counter medications and oral formulations where plastic alternatives might also be prevalent.

The medical neutral borosilicate glass packaging industry is propelled by several key growth catalysts. A primary driver is the continuous expansion of the global pharmaceutical market, fueled by an aging population and the increasing prevalence of chronic diseases, leading to a sustained demand for effective drug containment solutions. Furthermore, the growing importance of biologics and complex drug formulations, which are highly sensitive to environmental factors, necessitates the use of inert and stable packaging materials like neutral borosilicate glass. The increasing stringency of regulatory requirements globally for pharmaceutical packaging safety and quality also acts as a significant catalyst, as borosilicate glass consistently meets these rigorous standards.

This report provides an exhaustive analysis of the medical neutral borosilicate glass packaging market, offering unparalleled coverage of key industry aspects. It meticulously details market size estimations and projections in millions of units, from the historical period (2019-2024) through the base year (2025) to the forecast period (2025-2033). The study dissects the market by product type, including Injection Bottles, Ampoules, Oral Bottles, and Other segments, as well as by application, such as Pharma, Vaccine, and Other. Furthermore, it delves into critical industry developments, identifies leading companies, and analyzes the driving forces, challenges, and regional dynamics shaping the market landscape. This comprehensive approach ensures stakeholders gain a deep understanding of current trends and future opportunities.

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 4.7% from 2019-2033 |

| Segmentation |

|

Note*: In applicable scenarios

Primary Research

Secondary Research

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

The projected CAGR is approximately 4.7%.

Key companies in the market include Schott, Corning (Gerresheimer), NEG, Cangzhou Four Stars, Triumph Junsheng, Nipro, Chengdu Golden Drum Pharmaceutical Packaging, Chongqing Zhengchuan Pharmaceutical, Shandong Linuo, Ningbo Zhengli, Shandong Pharmaceutical Glass, Wuhu Yangtze River Glass, Anhui Huaxin Medicinal Glass, .

The market segments include Type, Application.

The market size is estimated to be USD 2522 million as of 2022.

N/A

N/A

N/A

N/A

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3480.00, USD 5220.00, and USD 6960.00 respectively.

The market size is provided in terms of value, measured in million and volume, measured in K.

Yes, the market keyword associated with the report is "Medical Neutral Borosilicate Glass Packaging," which aids in identifying and referencing the specific market segment covered.

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

To stay informed about further developments, trends, and reports in the Medical Neutral Borosilicate Glass Packaging, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.