1. What is the projected Compound Annual Growth Rate (CAGR) of the Medical Equipment Data Collector?

The projected CAGR is approximately XX%.

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.

Medical Equipment Data Collector

Medical Equipment Data CollectorMedical Equipment Data Collector by Type (Handheld, Fixed, World Medical Equipment Data Collector Production ), by Application (Hospital, Clinic, World Medical Equipment Data Collector Production ), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2025-2033

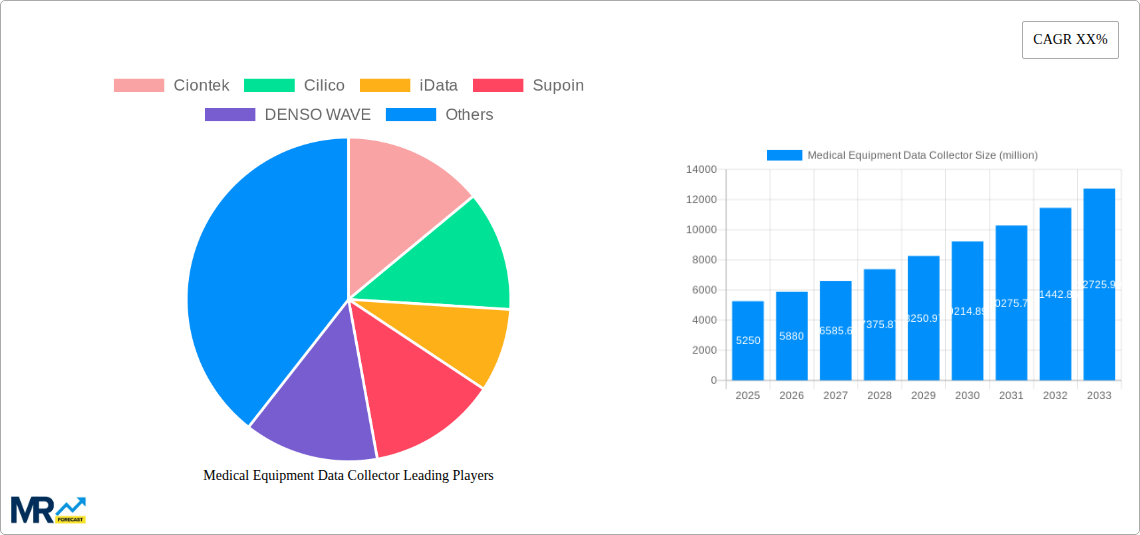

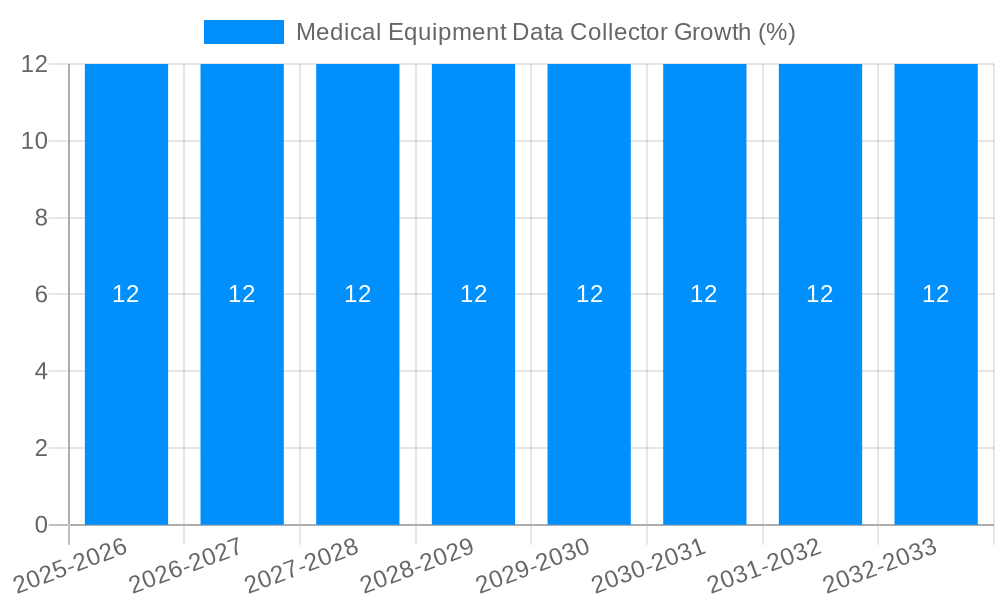

The global Medical Equipment Data Collector market is poised for significant expansion, projected to reach an estimated \$5,250 million by 2025. This growth is fueled by an anticipated Compound Annual Growth Rate (CAGR) of 12%, indicating robust demand and technological advancements within the healthcare sector. The primary drivers propelling this market include the increasing need for accurate patient data management, enhanced operational efficiency in healthcare facilities, and the growing adoption of digital health solutions. Hospitals and clinics, the dominant application segments, are increasingly investing in these devices to streamline workflows, improve diagnostic accuracy, and ensure compliance with stringent regulatory requirements. The proliferation of electronic health records (EHRs) and the push towards personalized medicine further amplify the demand for reliable medical equipment data collectors.

Further analysis reveals that the market is characterized by a dynamic interplay of innovation and adoption. While handheld data collectors offer flexibility and portability for bedside data entry and remote monitoring, fixed solutions are integral to centralized data acquisition in laboratories and imaging centers. Emerging trends such as the integration of AI and IoT capabilities into these devices are set to revolutionize data collection, enabling predictive analytics and real-time insights for better patient care and resource management. However, challenges such as high initial investment costs for advanced systems and concerns regarding data security and privacy could temper the market's growth trajectory. Despite these restraints, the overarching demand for improved healthcare outcomes and operational excellence positions the Medical Equipment Data Collector market for sustained and substantial growth throughout the forecast period.

Here's a unique report description for a Medical Equipment Data Collector market analysis, incorporating your specified elements:

This comprehensive report delves into the dynamic global market for Medical Equipment Data Collectors, offering an in-depth analysis of trends, drivers, challenges, and future projections from 2019 to 2033, with a particular focus on the base year 2025 and the forecast period 2025-2033. The study meticulously examines the market's evolution through the historical period of 2019-2024, identifying key shifts and foundational growth patterns. It provides a granular understanding of market segmentation by type (Handheld, Fixed) and application (Hospital, Clinic), alongside an analysis of the broader "World Medical Equipment Data Collector Production" segment. The report also highlights critical industry developments and their impact on market trajectories.

The global Medical Equipment Data Collector market is poised for robust expansion, driven by an escalating need for accurate, real-time data management within healthcare environments. During the historical period (2019-2024), we observed a significant uptick in the adoption of digital solutions for tracking and managing medical devices, spurred by increasing regulatory compliance demands and a growing awareness of the importance of operational efficiency. The estimated year, 2025, marks a pivotal point where integrated data collection systems are becoming standard, moving beyond basic inventory management to encompass performance monitoring, predictive maintenance, and patient outcome tracking. The forecast period (2025-2033) anticipates sustained high growth, fueled by advancements in connectivity, artificial intelligence (AI), and the Internet of Medical Things (IoMT). Handheld data collectors continue to dominate, offering flexibility and ease of use in diverse clinical settings, from bustling hospital wards to specialized clinics. However, fixed data collectors are gaining traction, particularly in areas requiring continuous, automated data streams, such as operating rooms and intensive care units. The overarching trend is towards intelligent, interconnected systems that not only collect data but also provide actionable insights, enabling healthcare providers to optimize resource allocation, enhance patient safety, and improve overall service delivery. The market size, estimated in the millions of units, is projected to experience a compound annual growth rate (CAGR) that will significantly increase its value over the forecast period. This growth is further amplified by the expanding scope of applications, moving from purely asset tracking to encompassing critical data points for clinical trials, research, and remote patient monitoring. The increasing integration of data collectors with electronic health records (EHRs) and other hospital information systems is also a defining trend, creating a more cohesive and data-driven healthcare ecosystem. Furthermore, the rising complexity of medical equipment necessitates sophisticated data collection methods to ensure proper maintenance, calibration, and uptime, directly contributing to the market's expansion. The emphasis on data security and privacy, while a consideration, is also driving innovation in secure data collection and transmission technologies, ensuring the integrity of sensitive patient and equipment information.

The rapid advancement and adoption of the Medical Equipment Data Collector market are propelled by a confluence of powerful forces. The increasing complexity and sophistication of modern medical devices necessitate robust data collection mechanisms for their effective management, maintenance, and performance monitoring. Hospitals and clinics are increasingly realizing the significant benefits of real-time data visibility, which translates into improved operational efficiency, reduced downtime, and ultimately, enhanced patient care. Stringent regulatory frameworks and compliance requirements, particularly concerning patient safety and device traceability, are compelling healthcare institutions to invest in reliable data collection solutions. The growing emphasis on cost containment within healthcare systems further fuels the demand for data collectors that can optimize inventory management, prevent overstocking, and identify areas for potential savings. The burgeoning field of IoMT is a significant catalyst, enabling seamless data flow between various medical devices and central collection systems. This interconnectedness facilitates remote monitoring, predictive analytics, and proactive maintenance, thereby reducing costly emergency repairs and service interruptions. Moreover, the growing adoption of electronic health records (EHRs) and hospital information systems (HIS) creates a fertile ground for integrating medical equipment data, providing a holistic view of patient care and operational performance. The drive towards evidence-based medicine and personalized treatment plans also necessitates accurate and comprehensive data on equipment usage and performance.

Despite the promising growth trajectory, the Medical Equipment Data Collector market faces several significant challenges and restraints. The initial cost of implementing advanced data collection systems can be a substantial barrier for smaller healthcare facilities or those with limited IT budgets. Integrating new data collection hardware and software with existing legacy systems within hospitals can be complex, time-consuming, and expensive, often requiring significant IT infrastructure upgrades and specialized expertise. Concerns surrounding data security and patient privacy are paramount; any breach or vulnerability can have severe legal and reputational consequences, necessitating robust security measures and compliance with stringent data protection regulations. The rapid pace of technological evolution in the healthcare sector means that data collection technologies can quickly become outdated, leading to concerns about obsolescence and the need for continuous investment in upgrades. A lack of skilled personnel capable of managing, analyzing, and interpreting the vast amounts of data generated by these systems can also hinder effective utilization and ROI. Resistance to change from healthcare professionals accustomed to manual processes or existing workflows can slow down adoption rates. Furthermore, the standardization of data formats and communication protocols across different medical devices and systems remains a challenge, impacting interoperability and data exchange. The complexity of the regulatory landscape, which varies significantly across different regions, adds another layer of challenge for manufacturers and adopters alike.

The Handheld segment, particularly within Hospital applications, is anticipated to lead the global Medical Equipment Data Collector market in terms of revenue and adoption. This dominance stems from the inherent flexibility and versatility of handheld devices, which are indispensable in the fast-paced and diverse environments of hospitals.

Dominant Segment: Handheld Medical Equipment Data Collectors.

Dominant Application: Hospitals.

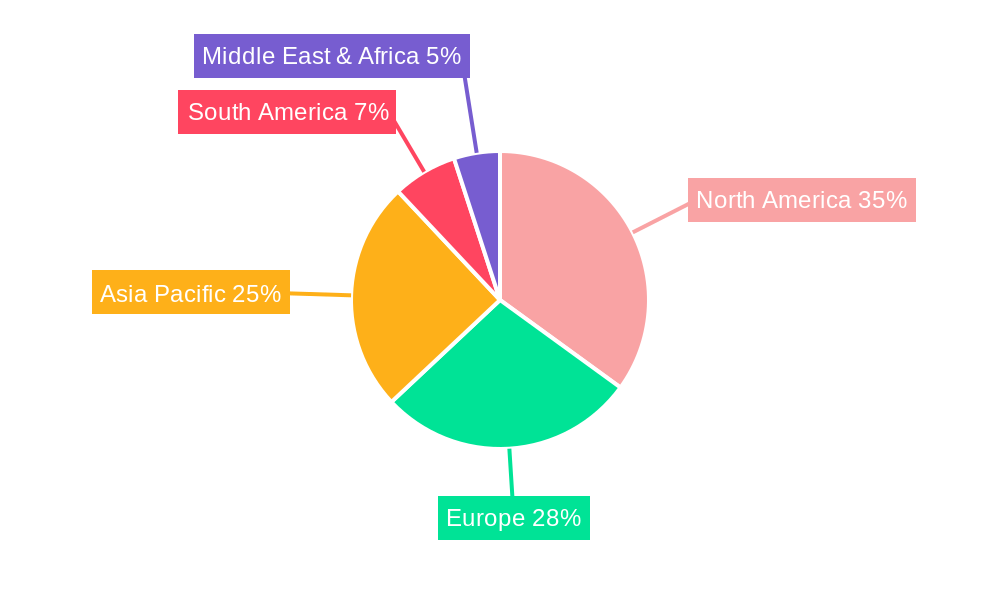

Key Region/Country: North America (specifically the United States).

The synergy between the versatility of handheld devices, the critical needs of hospital environments, and the technologically advanced and regulatory-driven landscape of North America positions these as the primary drivers of market dominance in the Medical Equipment Data Collector sector.

Several key catalysts are propelling the growth of the Medical Equipment Data Collector industry. The escalating demand for improved patient safety and the reduction of medical errors are paramount, as accurate equipment data ensures that devices are properly maintained and calibrated. The burgeoning trend of IoMT is a significant driver, enabling real-time data streaming and remote monitoring capabilities. Furthermore, government initiatives and regulatory mandates emphasizing device traceability and compliance are compelling healthcare providers to invest in these technologies. The increasing adoption of data analytics and AI for predictive maintenance and operational optimization further enhances the value proposition of data collectors.

This report provides a holistic view of the Medical Equipment Data Collector market, meticulously detailing market size estimations in the millions of units for the study period 2019-2033. It offers a deep dive into key trends, identifying market insights within XXX to paint a vivid picture of the sector's evolution. The analysis thoroughly examines the driving forces, challenges, and restraints shaping the market landscape. Furthermore, it highlights dominant regions and key segments, offering strategic guidance for market players. The report also identifies growth catalysts and provides an exhaustive list of leading players with their respective websites. Significant developments and their timelines are presented in detail, ensuring readers are abreast of the latest advancements. This comprehensive coverage empowers stakeholders with the knowledge to navigate and capitalize on the opportunities within this critical healthcare technology sector.

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of XX% from 2019-2033 |

| Segmentation |

|

Note*: In applicable scenarios

Primary Research

Secondary Research

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

The projected CAGR is approximately XX%.

Key companies in the market include Ciontek, Cilico, iData, Supoin, DENSO WAVE, Bar Code Data Ltd, Agaram InfoTech, Unitech Global, CipherLab, Zebra Technologies, Emdoor, Urovo World, Shanghai Xinlin Information Technology Co., Ltd., Hikvision, Biopac Systems, Recorders & Medicare Systems, Vyaire Medical.

The market segments include Type, Application.

The market size is estimated to be USD XXX million as of 2022.

N/A

N/A

N/A

N/A

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4480.00, USD 6720.00, and USD 8960.00 respectively.

The market size is provided in terms of value, measured in million and volume, measured in K.

Yes, the market keyword associated with the report is "Medical Equipment Data Collector," which aids in identifying and referencing the specific market segment covered.

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

To stay informed about further developments, trends, and reports in the Medical Equipment Data Collector, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.