1. What is the projected Compound Annual Growth Rate (CAGR) of the Medical Device CDMO and CRO?

The projected CAGR is approximately 10.9%.

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.

Medical Device CDMO and CRO

Medical Device CDMO and CROMedical Device CDMO and CRO by Type (/> Medical Device CDMO, Medical Device CRO), by Application (/> Cardiology, Diagnostic Imaging, Orthopedic, IVD, Ophthalmic, General and Plastic Surgery, Drug Delivery), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2026-2034

The global medical device contract development and manufacturing organization (CDMO) and contract research organization (CRO) market is experiencing significant expansion. This growth is propelled by the increasing trend of medical device companies outsourcing critical research, development, and manufacturing operations. Key drivers include the escalating complexity of medical devices, the demand for specialized expertise and advanced technologies, and the strategic focus of manufacturers on their core competencies. The market is segmented by service type (CDMO and CRO) and application areas such as cardiology, diagnostic imaging, orthopedics, in-vitro diagnostics (IVD), ophthalmics, general and plastic surgery, and drug delivery.

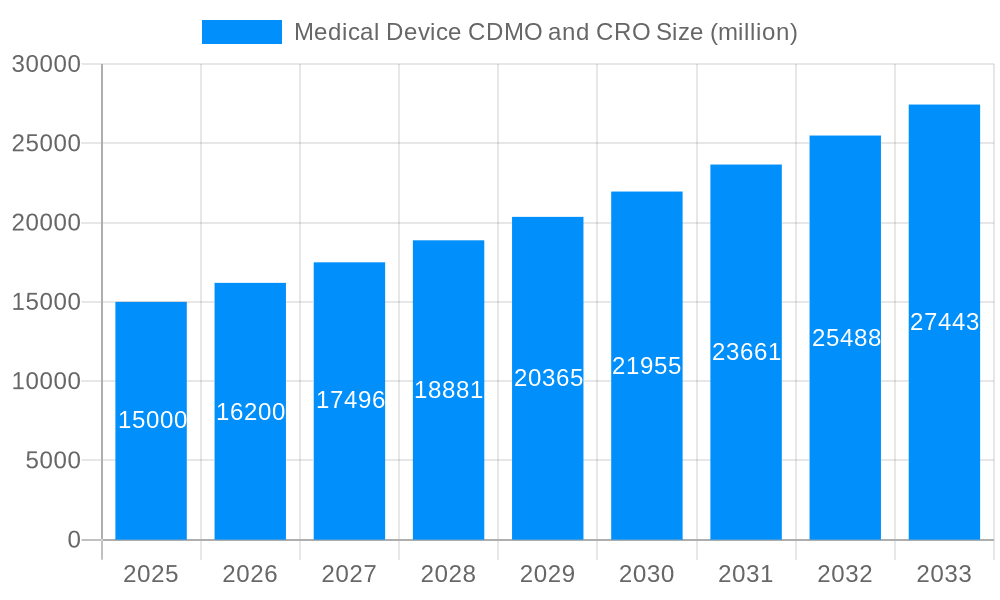

The market size was valued at approximately 83.77 billion in the 2025 base year, with a projected Compound Annual Growth Rate (CAGR) of 10.9% for the forecast period. This trajectory is expected to lead to a market valuation exceeding 150 billion by 2033.

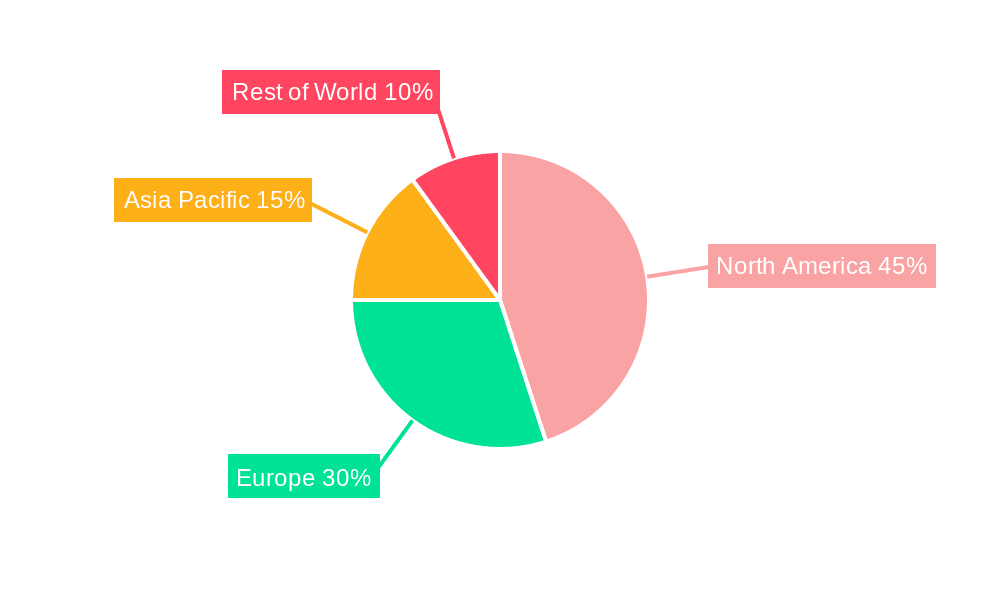

North America and Europe currently dominate market share, attributed to robust regulatory environments, mature medical device industries, and high adoption rates of cutting-edge technologies. However, the Asia-Pacific region is anticipated to witness substantial growth, fueled by rising healthcare expenditures, increasing chronic disease prevalence, and supportive government policies. Significant market restraints include stringent regulatory compliance, the necessity for stringent quality control, and potential supply chain vulnerabilities. The integration of digital health technologies, the advancement of personalized medicine, and the development of novel materials and manufacturing processes are poised to further influence market dynamics.

Leading industry players, including Hitachi, Beckman Coulter, and Integer Holdings, are making strategic investments to enhance their capabilities and expand their global presence, capitalizing on the considerable growth prospects in this dynamic sector. Future success within this market will hinge on companies' ability to deliver superior quality services, adapt to evolving regulatory frameworks, and drive innovation to address the escalating demands of the medical device industry.

The global medical device contract development and manufacturing organization (CDMO) and contract research organization (CRO) market is experiencing robust growth, projected to reach USD 65 billion by 2033 from USD 25 billion in 2025. This expansion is driven by several converging factors including the increasing complexity of medical devices, the rising demand for outsourcing by medical device companies, and the growing adoption of innovative technologies in the healthcare industry. The market shows a strong preference for CDMO services over CRO services, owing to the cost-effectiveness and efficiency CDMOs offer in handling the manufacturing aspects. However, the CRO segment also enjoys significant growth, especially in areas requiring specialized clinical trial expertise. Furthermore, the market is witnessing a shift towards integrated CDMO/CRO services, where a single provider handles both development and manufacturing, streamlining the entire product lifecycle and significantly impacting cost and efficiency. Geographic variations exist, with North America and Europe holding a significant share currently, but Asia-Pacific regions are anticipated to exhibit the most rapid growth due to increasing healthcare investments and the presence of several emerging CDMOs and CROs in this region. This dynamic market is shaped by stringent regulatory requirements and increasing pressure to reduce time-to-market, compelling companies to strategically leverage CDMO and CRO services for competitive advantage. The increasing prevalence of chronic diseases worldwide also adds fuel to the growth, as demand for novel medical devices continues to rise. The competitive landscape involves both large multinational corporations and smaller specialized firms, leading to market consolidation through acquisitions and mergers. This trend signifies ongoing efforts to enhance service capabilities and broaden geographical reach.

The medical device CDMO and CRO market's rapid growth is fueled by several key factors. Firstly, the escalating complexity of medical devices, particularly in areas like minimally invasive surgery and advanced diagnostics, necessitates specialized expertise and infrastructure that many smaller medical device companies lack. Outsourcing these functions to specialized CDMOs and CROs becomes an economically viable and efficient strategy. Secondly, the increasing focus on reducing time-to-market for new devices places considerable pressure on manufacturers. CDMOs and CROs, with their established infrastructure and streamlined processes, can significantly shorten development and manufacturing timelines, allowing companies to get innovative products to market faster. Thirdly, the stringent regulatory landscape governing medical devices necessitates adherence to complex guidelines and standards. Experienced CDMOs and CROs possess the expertise and resources to navigate these regulatory hurdles effectively, minimizing risks and ensuring compliance. Furthermore, the rising costs associated with internal research and development, manufacturing, and quality control are driving companies to explore outsourcing as a cost-effective alternative. This allows smaller companies to compete effectively with larger industry players by focusing on innovation and product development while relying on specialized firms to handle the more resource-intensive functions. Finally, the increasing demand for personalized medicine and the growth of advanced therapies contribute to the need for highly specialized CDMOs and CROs equipped to handle the unique challenges these sectors present.

Despite the robust growth, the medical device CDMO and CRO market faces several challenges. Stringent regulatory compliance requirements, varying across different geographies, present significant hurdles for both CDMOs and CROs. Maintaining high quality standards while managing cost pressures is also a key challenge. Ensuring intellectual property protection is crucial, and robust agreements are necessary to mitigate risks associated with outsourcing sensitive information. Competition is fierce, with many established players and new entrants vying for market share. This necessitates continuous innovation and investment in advanced technologies and expertise to remain competitive. Supply chain disruptions, particularly concerning raw materials and components, can significantly impact production timelines and profitability. The COVID-19 pandemic highlighted the vulnerability of global supply chains, underscoring the need for greater resilience. Moreover, finding and retaining skilled personnel with the necessary expertise in medical device development and manufacturing is an ongoing challenge. Lastly, the diverse nature of medical devices, ranging from simple to highly complex systems, requires CDMOs and CROs to possess broad capabilities and potentially specialize in niche areas.

The North American market currently holds a significant share of the medical device CDMO and CRO market, driven by a robust healthcare infrastructure, high research and development spending, and a large number of established companies. However, the Asia-Pacific region is poised for rapid expansion, primarily fueled by increasing healthcare expenditure, a growing middle class, and the emergence of several CDMOs and CROs offering competitive services.

Within segments:

The combination of these factors will drive growth across the entire market, with North America maintaining a strong position while Asia-Pacific exhibits the highest growth rates throughout the forecast period (2025-2033).

The increasing prevalence of chronic diseases and the aging global population significantly fuel demand for advanced medical devices, propelling the growth of the CDMO/CRO sector. Technological advancements in medical device design and manufacturing, combined with the growing adoption of personalized medicine, create significant opportunities for CDMOs and CROs to offer specialized services. Furthermore, regulatory initiatives encouraging innovation and streamlining the approval process for new medical devices further stimulate growth within the industry.

This report provides a comprehensive analysis of the Medical Device CDMO and CRO market, offering valuable insights into market trends, driving factors, challenges, and growth opportunities. It includes detailed profiles of leading players, segment-specific analysis, and regional market forecasts, providing a clear and actionable understanding of the market dynamics for strategic decision-making. The data presented covers the historical period (2019-2024), the base year (2025), the estimated year (2025), and the forecast period (2025-2033). The report is an essential resource for stakeholders involved in the medical device industry, including manufacturers, investors, and regulatory bodies.

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 10.9% from 2020-2034 |

| Segmentation |

|

Note*: In applicable scenarios

Primary Research

Secondary Research

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

The projected CAGR is approximately 10.9%.

Key companies in the market include Hitachi, Beckman, JEOL, Canon MEDICAL, Integer Holdings Corporation, ITL Group, Flexan(ILC Dover), SteriPack Group Ltd, TE Connectivity Ltd, Nortech Systems, Inc., OSMUNDA Medical Device Service Group, Jabil Inc, Flex Healthcare Solutions, Sanmina, Nordson Medical, ELOS Medtech, CIRS Group, OSMUNDA MEDICAL DEVICE SERVICE GROUP., Shanghai Hao Feng Medical Technology Co., Ltd., Juyi Science and Technology (Shanghai) Co., Ltd., Sanner Group, Wuhan Tacro Technology Co.,Ltd., Lingboyihui, Huitong Medical, Hangzhou Tigermed Consulting Co.,Ltd., Qingdao Novelbeam Technology Co.,ltd., Shengen (Beijing) Pharmaceutical Technology Co., Ltd., Medicalstrong (Beijing)Science and Technology Development Co., Ltd., TechMax Technical Group.

The market segments include Type, Application.

The market size is estimated to be USD 83.77 billion as of 2022.

N/A

N/A

N/A

N/A

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4480.00, USD 6720.00, and USD 8960.00 respectively.

The market size is provided in terms of value, measured in billion.

Yes, the market keyword associated with the report is "Medical Device CDMO and CRO," which aids in identifying and referencing the specific market segment covered.

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

To stay informed about further developments, trends, and reports in the Medical Device CDMO and CRO, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.