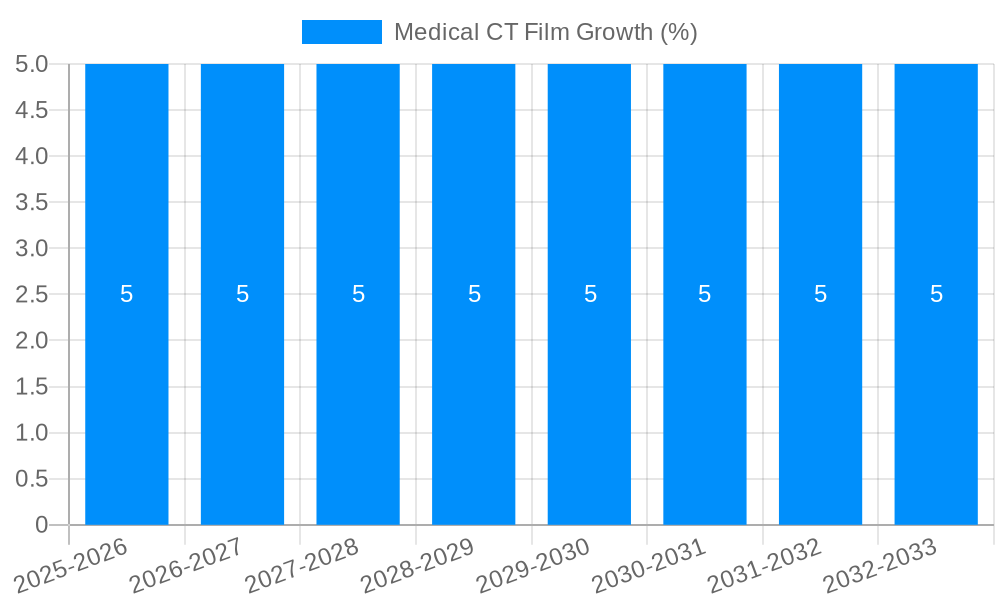

1. What is the projected Compound Annual Growth Rate (CAGR) of the Medical CT Film?

The projected CAGR is approximately 5%.

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.

Medical CT Film

Medical CT FilmMedical CT Film by Type (8×10 Inches, 10×12 Inches, 11×14 Inches, 14×17 Inches, World Medical CT Film Production ), by Application (MRI, Tomogram, Digital Subtraction, Isotope Radiation, Ultrasound Imaging, World Medical CT Film Production ), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2025-2033

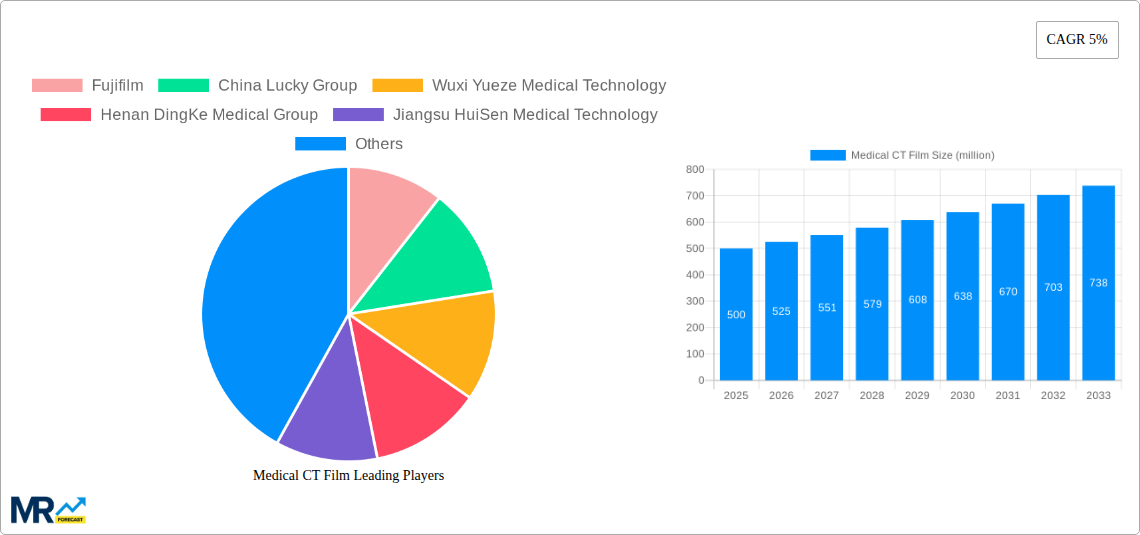

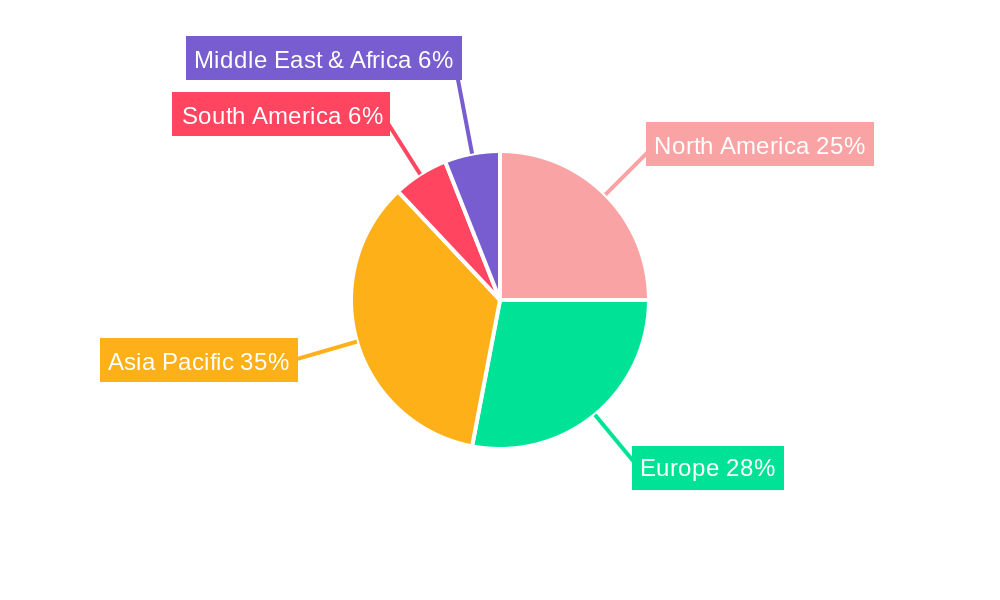

The medical CT film market, while facing challenges from digital imaging, maintains a steady presence, driven by its cost-effectiveness in certain healthcare settings and its established role in archiving. The market exhibits a Compound Annual Growth Rate (CAGR) of 5%, indicating consistent, albeit moderate, expansion. This growth is fueled by the increasing prevalence of chronic diseases necessitating CT scans in developing economies, where cost considerations often favor film-based imaging. However, constraints such as the high initial investment in film processing equipment and the cumbersome storage requirements limit market expansion. The market segmentation reveals a competitive landscape with key players like Fujifilm, China Lucky Group, and several Chinese medical technology companies dominating the market. Regional data (not provided) likely shows varied penetration depending on the economic development and healthcare infrastructure of different regions, with developing economies potentially exhibiting stronger growth compared to established markets where digital imaging is more prevalent. The forecast period of 2025-2033 suggests continued market existence, although potentially at a slower pace as digital technologies further gain traction.

The competitive landscape is largely shaped by the balance between established players like Fujifilm, leveraging their global presence and brand recognition, and regional Chinese manufacturers focused on price-competitive solutions. While the overall market size for 2025 is not provided, a reasonable estimation considering a 5% CAGR and assuming a conservative market size in 2019 (based on industry knowledge a reasonable estimation may be between $500 to $700 million), suggests a 2025 market size somewhere between $700 to $900 million. Future market growth will likely depend on factors such as the pace of digital imaging adoption, government healthcare policies, and the ongoing evolution of CT scan technology. Strategies for market players will need to focus on niche markets, cost-effective solutions, and potentially explore integration with digital archiving systems.

The global medical CT film market is experiencing a dynamic shift, transitioning from a dominant position to a niche player within the broader medical imaging landscape. While the market value reached several million units in 2024, the forecast for 2025-2033 indicates a slower growth trajectory compared to other medical imaging modalities. This is primarily attributed to the rapid adoption of digital imaging technologies, such as PACS (Picture Archiving and Communication Systems) and digital radiography. These digital alternatives offer superior image quality, enhanced diagnostic capabilities, easier storage and retrieval, and reduced costs associated with film processing and storage in the long run. However, despite this decline, a residual market for CT film persists, driven by factors like the availability of older equipment still reliant on film, budgetary constraints in some healthcare settings, and certain niche applications where film remains preferred for its immediate visual assessment. The market's future is likely to be characterized by a gradual decline in volume, with the continued focus shifting towards digital alternatives. Key market insights reveal a strong correlation between the rate of digitalization in healthcare systems and the decline in CT film usage, indicating that regions with slower digital adoption rates might show sustained, albeit modest, demand in the coming years. The market is also segmented by film type, size, and end-user, and this segmentation helps to illustrate variations in demand within specific niches. While overall market growth is limited, specialized applications and specific geographic regions may present opportunities for targeted market penetration. The competitive landscape is largely defined by established players in the medical imaging supplies sector, alongside smaller regional manufacturers catering to specific demands.

Despite the overall decline, several factors are still contributing to the continued, albeit limited, demand for medical CT film. Firstly, a substantial installed base of older CT scanners that rely on film processing remains operational, particularly in developing economies or smaller healthcare facilities with limited budgets for upgrades. These institutions are less likely to quickly switch to digital systems due to high initial capital expenditures. Secondly, some medical professionals, particularly those accustomed to working with film, find the immediate visual assessment and tactile experience of film more convenient and intuitive than digital screens. This familiarity factor can be a barrier to rapid adoption of digital technologies, especially in smaller clinics and private practices. Thirdly, in certain specialized applications, where immediate visual interpretation is critical, film may still be preferred. The need for immediate decision-making in emergency settings or situations with limited access to digital systems can sustain a residual market. However, it is crucial to acknowledge that these driving forces are counteracted by the far stronger pressures for digitalization, ultimately limiting the long-term prospects of the CT film market.

The medical CT film market faces significant challenges stemming from the aforementioned technological advancements and economic factors. The primary restraint is the overwhelming shift toward digital imaging technologies. Digital systems offer vastly improved image quality, efficient storage and retrieval through PACS, cost savings in the long run due to elimination of film processing and storage, and enhanced diagnostic capabilities facilitated by image manipulation and enhancement tools. This technological superiority is driving a worldwide transition away from film-based systems. Secondly, the high cost of film processing and storage, especially when compared to the relative affordability and space-saving nature of digital archiving, poses a considerable challenge for healthcare institutions. This cost disadvantage is particularly acute for larger hospitals and imaging centers, making digitalization economically compelling. Furthermore, concerns regarding environmental impact associated with film production and disposal are driving increased scrutiny of film-based technologies, fostering a preference for environmentally friendlier digital alternatives. These factors combine to present a significant headwind for the growth of the medical CT film market.

While the global market for medical CT film is contracting, certain regions and segments may display comparatively higher resilience.

Developing Economies: Countries with less developed healthcare infrastructures and slower rates of digital adoption may experience a longer period of demand for medical CT film due to budget constraints and the availability of older CT scanners. This includes many regions in Africa, parts of Asia, and some South American countries. These regions could still show a relatively higher volume of film usage during the forecast period.

Niche Applications: Specific medical applications demanding immediate image interpretation might retain a preference for film, particularly in emergency settings or situations with limited access to digital systems. This could be seen in ambulances or remote healthcare facilities.

Smaller Healthcare Providers: Smaller clinics and private practices may opt for film-based systems due to lower initial investment costs, despite higher operational expenses in the long run. This factor can disproportionately affect the market segments catering to these smaller-scale healthcare providers.

In summary, while the overall market shrinks, regions with slower technological adoption, specific niche applications, and smaller healthcare providers may maintain modest demand for medical CT film, although this demand is likely to decline gradually over the forecast period (2025-2033). The dominance is shifting, not necessarily toward specific geographic locations, but towards the more efficient and superior technologies.

Despite the overall downward trend, some factors could temporarily support the market. These include the continued operational life of older CT scanners requiring film and the ongoing requirement for film in specific niche applications prioritizing immediate visual assessment. However, it is crucial to recognize that these catalysts are weak and counterbalanced by the overwhelmingly dominant trend towards digitalization.

This report provides a comprehensive analysis of the Medical CT Film market, including historical data (2019-2024), base year estimates (2025), and detailed forecasts (2025-2033). It examines key market trends, driving forces, challenges, leading players, and significant developments. The report segments the market by region and application, providing granular insights into market dynamics and potential opportunities. It is a valuable resource for businesses, investors, and researchers seeking a deep understanding of the changing landscape of the medical CT film industry.

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 5% from 2019-2033 |

| Segmentation |

|

Note*: In applicable scenarios

Primary Research

Secondary Research

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

The projected CAGR is approximately 5%.

Key companies in the market include Fujifilm, China Lucky Group, Wuxi Yueze Medical Technology, Henan DingKe Medical Group, Jiangsu HuiSen Medical Technology, Shenzhen Juding Medical, .

The market segments include Type, Application.

The market size is estimated to be USD XXX million as of 2022.

N/A

N/A

N/A

N/A

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4480.00, USD 6720.00, and USD 8960.00 respectively.

The market size is provided in terms of value, measured in million and volume, measured in K.

Yes, the market keyword associated with the report is "Medical CT Film," which aids in identifying and referencing the specific market segment covered.

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

To stay informed about further developments, trends, and reports in the Medical CT Film, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.