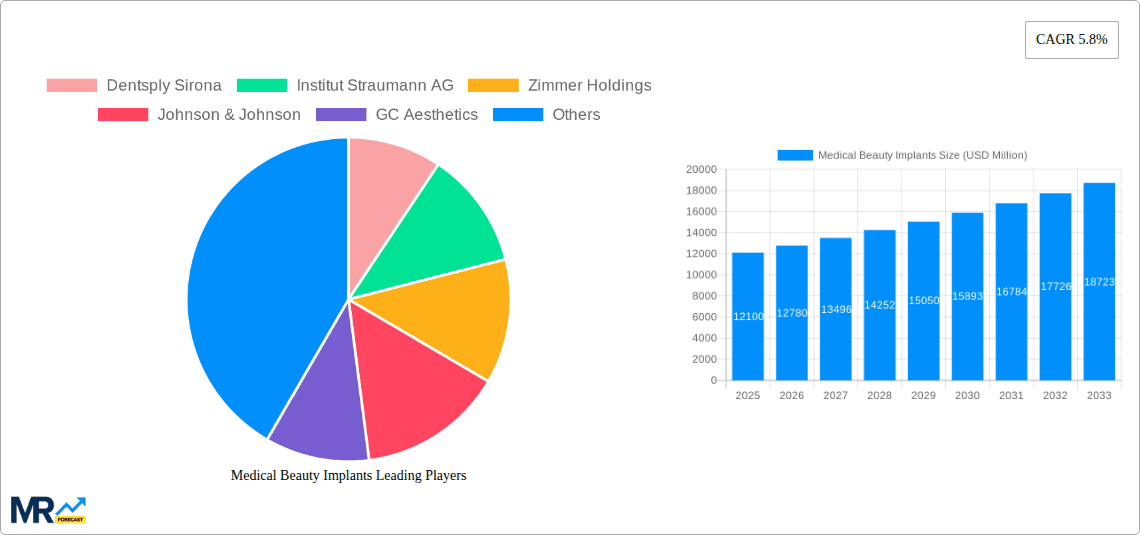

1. What is the projected Compound Annual Growth Rate (CAGR) of the Medical Beauty Implants?

The projected CAGR is approximately 5.8%.

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.

Medical Beauty Implants

Medical Beauty ImplantsMedical Beauty Implants by Type (Autologous Implants, Extracorporeal Implants, World Medical Beauty Implants Production ), by Application (Hospital, Plastic Surgery Institution, World Medical Beauty Implants Production ), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2026-2034

The global medical beauty implants market is poised for robust growth, projected to reach a substantial USD 12.1 billion in 2025 and expand at a Compound Annual Growth Rate (CAGR) of 5.8% through 2033. This upward trajectory is primarily fueled by increasing consumer demand for aesthetic enhancements, a growing awareness of minimally invasive procedures, and advancements in implant materials and technologies. The rising disposable incomes across various economies, particularly in emerging markets, are enabling a broader segment of the population to invest in cosmetic surgeries and treatments. Furthermore, the normalization of plastic surgery and the influence of social media in promoting aesthetic ideals are significant drivers contributing to market expansion. Key applications, such as breast augmentation, facial contouring, and reconstructive surgery, continue to see strong adoption, with hospitals and specialized plastic surgery institutions leading the demand for these advanced medical devices.

The market is characterized by a competitive landscape featuring prominent players like Dentsply Sirona, Institut Straumann AG, and Johnson & Johnson, alongside innovative companies focusing on specific niches. The market's segmentation into Autologous Implants and Extracorporeal Implants highlights distinct technological approaches and patient preferences. While the market presents immense opportunities, it also faces certain restraints, including stringent regulatory approvals, potential for implant-related complications, and evolving consumer perceptions regarding the long-term effects of cosmetic procedures. However, ongoing research and development efforts aimed at creating safer, more biocompatible, and aesthetically superior implants, coupled with the expanding reach of medical tourism, are expected to counterbalance these challenges, ensuring sustained market vitality and innovation.

Medical Beauty Implants Trends

The global medical beauty implants market is poised for substantial expansion, projected to surge from an estimated $25 billion in 2025 to a remarkable $55 billion by 2033. This growth is underpinned by a confluence of escalating aesthetic consciousness, advancements in biomaterials, and a broadening acceptance of minimally invasive and reconstructive procedures. During the study period of 2019-2033, the market has demonstrated consistent upward momentum, with the base year of 2025 serving as a pivotal point for projected future performance. The historical period from 2019 to 2024 laid the foundation for this anticipated surge, characterized by a steady increase in demand driven by demographic shifts and a growing disposable income, particularly in emerging economies. The forecast period of 2025-2033 is expected to witness an accelerated growth trajectory, fueled by innovations in implant design, enhanced patient safety profiles, and a wider range of therapeutic applications beyond purely aesthetic enhancements. The increasing demand for personalized treatments and the development of bio-integrated implants capable of promoting tissue regeneration are also significant trend indicators. Furthermore, the growing popularity of combination procedures, where implants are used alongside other aesthetic interventions, is expected to contribute significantly to market expansion. The report will delve deep into these underlying trends, providing granular insights into their impact on market dynamics, including regional variations and segment-specific growth patterns. The increasing sophistication of surgical techniques, coupled with the development of advanced imaging and pre-operative planning tools, will further bolster the adoption of medical beauty implants. The report will also address the evolving regulatory landscape, which, while posing challenges, also fosters innovation by ensuring product safety and efficacy. The overarching trend points towards a market that is not only growing in size but also diversifying in its offerings and applications, moving beyond traditional aesthetic augmentation to encompass more complex reconstructive and therapeutic purposes.

Driving Forces: What's Propelling the Medical Beauty Implants

The burgeoning medical beauty implants market is being propelled by a multifaceted array of driving forces. Foremost among these is the pervasive and intensifying global emphasis on personal appearance and aesthetic enhancement. As societal norms evolve and media platforms increasingly highlight idealized beauty standards, individuals across all age groups are seeking to improve their physical appearance through both surgical and non-surgical interventions. This heightened aesthetic consciousness directly translates into a greater demand for a diverse range of medical beauty implants, from facial contouring devices to breast augmentation prosthetics. Compounding this trend is the significant advancement in medical technology and biomaterials. The development of innovative, biocompatible, and highly durable materials has not only improved the safety and longevity of implants but has also enabled the creation of more sophisticated and natural-looking aesthetic outcomes. Furthermore, the growing disposable income in many developed and developing economies has empowered a larger segment of the population to invest in elective cosmetic procedures. This economic uplift, coupled with increased awareness of the available procedures and their positive impact on self-esteem and quality of life, acts as a powerful catalyst for market growth.

Challenges and Restraints in Medical Beauty Implants

Despite the robust growth trajectory, the medical beauty implants market is not without its challenges and restraints. A primary concern revolves around the stringent regulatory frameworks governing the approval and marketing of medical devices. Navigating these complex and often evolving regulations across different geographical regions can be a time-consuming and costly endeavor for manufacturers, potentially slowing down the introduction of new products. Another significant restraint is the inherent risk of complications and adverse events associated with surgical implants. While advancements have significantly improved safety, issues such as infection, implant rupture, capsular contracture, and patient dissatisfaction can lead to revision surgeries and a potential decline in consumer confidence. The high cost of these procedures, coupled with the expense of potential revision surgeries, can also act as a barrier for a considerable portion of the population, limiting market penetration in price-sensitive segments. Public perception and ethical considerations surrounding cosmetic surgery also play a role. Negative media portrayals of botched procedures or instances of implant-related health issues can create apprehension among potential patients, impacting demand. Finally, the availability of non-surgical alternatives, such as dermal fillers and minimally invasive treatments, offers consumers less permanent and potentially less risky options, which can divert some demand away from traditional implants.

Key Region or Country & Segment to Dominate the Market

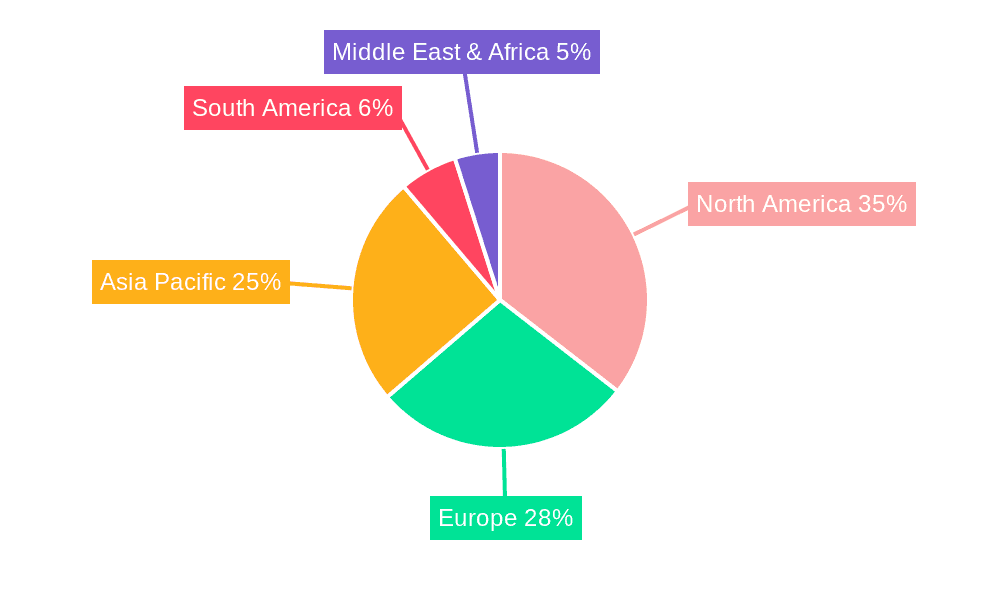

The North America region, particularly the United States, is projected to maintain its dominance in the global medical beauty implants market throughout the forecast period of 2025-2033. This leadership is attributed to a combination of factors including a highly developed healthcare infrastructure, substantial disposable income, and a deeply ingrained culture of aesthetic consciousness. The high prevalence of elective cosmetic surgeries, coupled with the early adoption of advanced medical technologies and innovative implant designs, positions North America as a powerhouse in this sector. Furthermore, the presence of a robust network of highly skilled plastic surgeons and aesthetic institutions contributes significantly to market growth.

Within the broader market segments, Extracorporeal Implants are expected to emerge as a significant growth driver and potentially a dominant force in terms of market share. This segment encompasses a wide array of implants used in aesthetic and reconstructive procedures, including but not limited to:

The dominance of Extracorporeal Implants is further bolstered by several factors:

While Autologous Implants, utilizing a patient's own tissue, offer a natural alternative and are important in specific reconstructive scenarios, their application is often more procedure-specific and may not command the same broad market volume as the diverse range of extracorporeal options. The market's focus on innovation and a wide array of aesthetic enhancement possibilities positions Extracorporeal Implants to continue their strong performance and likely market dominance in the coming years.

Growth Catalysts in Medical Beauty Implants Industry

The medical beauty implants industry is experiencing a significant surge, propelled by several key growth catalysts. The burgeoning global demand for aesthetic procedures, fueled by a heightened focus on personal appearance and improved self-esteem, is a primary driver. Technological advancements in biomaterials and surgical techniques are leading to safer, more effective, and natural-looking implants, thereby increasing patient confidence and acceptance. Furthermore, the expanding middle class in emerging economies, coupled with increased disposable income, is making these procedures more accessible to a wider demographic. The growing popularity of minimally invasive techniques, even in the context of implants, and the increasing integration of digital technologies for pre-operative planning and post-operative analysis are also contributing to market expansion.

Leading Players in the Medical Beauty Implants

Significant Developments in Medical Beauty Implants Sector

Comprehensive Coverage Medical Beauty Implants Report

This comprehensive report offers an in-depth analysis of the global medical beauty implants market, covering the period from 2019 to 2033, with 2025 serving as the estimated base year. It provides detailed insights into market trends, projecting a significant market size of $25 billion in 2025, escalating to $55 billion by 2033. The report meticulously examines the driving forces behind this growth, including the increasing emphasis on aesthetics and technological innovations. It also addresses the critical challenges and restraints, such as regulatory hurdles and the potential for complications. A key focus of the report is the identification of dominant regions and segments, with a detailed exploration of the factors contributing to their market leadership. Furthermore, the report highlights the significant growth catalysts that are poised to shape the future of the industry. With a comprehensive overview of leading players and a timeline of significant developments, this report serves as an indispensable resource for stakeholders seeking to understand and navigate the dynamic landscape of the medical beauty implants market.

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 5.8% from 2020-2034 |

| Segmentation |

|

Note*: In applicable scenarios

Primary Research

Secondary Research

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

The projected CAGR is approximately 5.8%.

Key companies in the market include Dentsply Sirona, Institut Straumann AG, Zimmer Holdings, Johnson & Johnson, GC Aesthetics, Allergan, Sientra, Allergan, Danaher Corporation, 3M Company, Polytech Health & Aesthetics GmbH.

The market segments include Type, Application.

The market size is estimated to be USD XXX N/A as of 2022.

N/A

N/A

N/A

N/A

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4480.00, USD 6720.00, and USD 8960.00 respectively.

The market size is provided in terms of value, measured in N/A and volume, measured in K.

Yes, the market keyword associated with the report is "Medical Beauty Implants," which aids in identifying and referencing the specific market segment covered.

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

To stay informed about further developments, trends, and reports in the Medical Beauty Implants, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.