1. What is the projected Compound Annual Growth Rate (CAGR) of the Medical Absorbable Bone Fixation Device?

The projected CAGR is approximately 10.64%.

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.

Medical Absorbable Bone Fixation Device

Medical Absorbable Bone Fixation DeviceMedical Absorbable Bone Fixation Device by Type (Synthetic Material, Natural Material, World Medical Absorbable Bone Fixation Device Production ), by Application (Hospitals, Clinics, World Medical Absorbable Bone Fixation Device Production ), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2026-2034

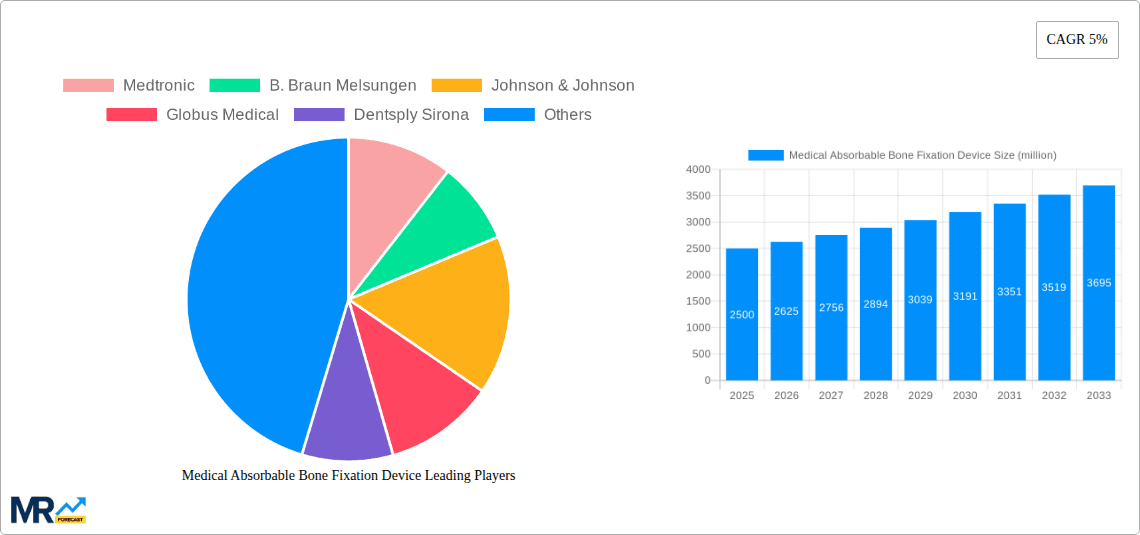

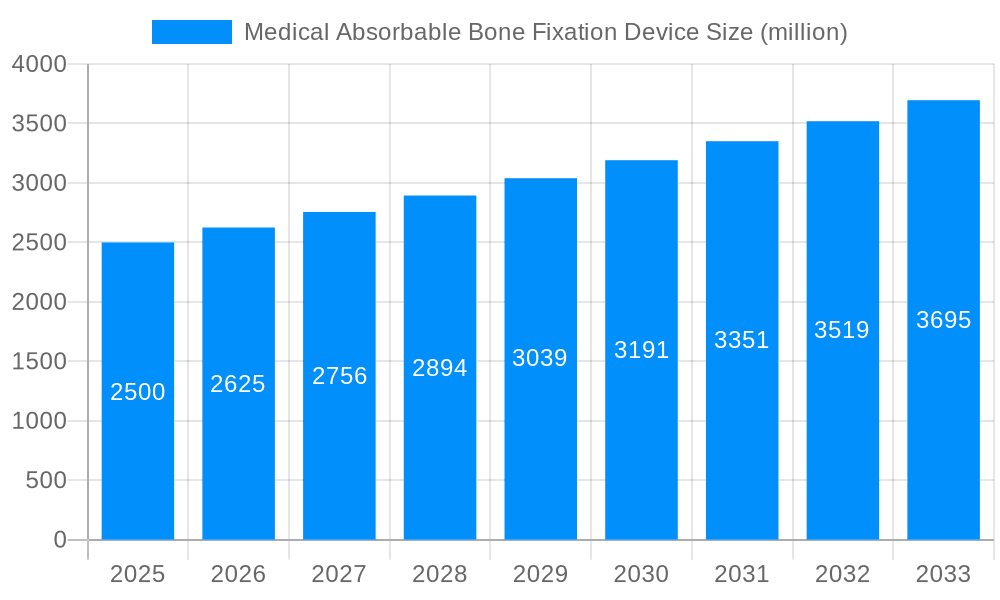

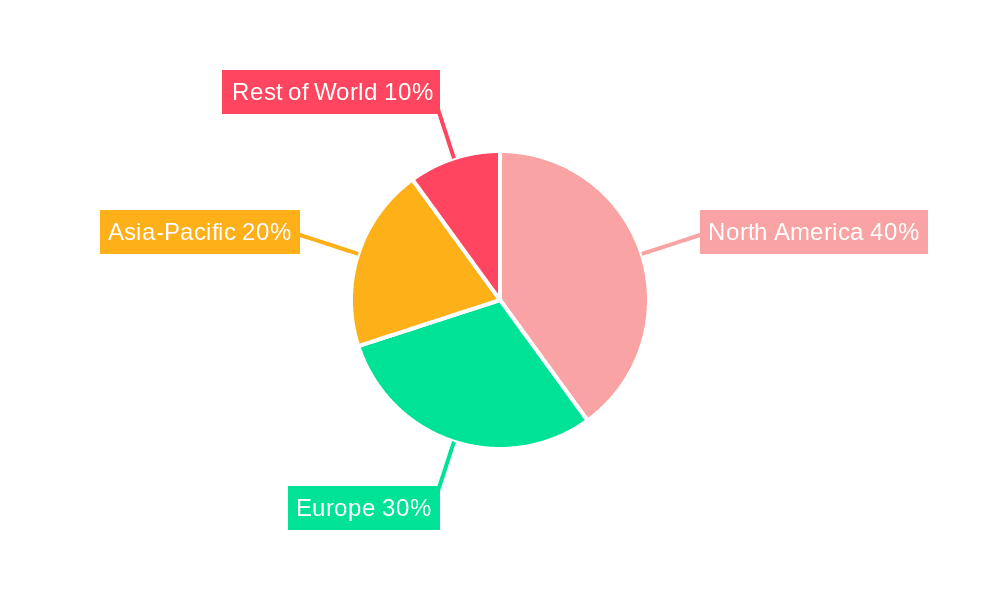

The global medical absorbable bone fixation devices market is projected for robust expansion, anticipating a Compound Annual Growth Rate (CAGR) of 10.64% from a market size of 7.35 billion in the base year 2025. This growth is propelled by the escalating incidence of orthopedic injuries and surgeries, alongside a growing elderly demographic prone to fractures and osteoporosis. The inherent benefits of absorbable implants, such as eliminating the need for removal surgeries, promoting faster healing, and reducing infection risks, are significantly driving their adoption. Continuous advancements in material science and device engineering are further enhancing biocompatibility and mechanical strength, contributing to market dynamism. Despite these advantages, higher initial costs compared to traditional implants and potential variability in absorption rates present ongoing challenges. The competitive arena is characterized by intense activity from key players including Medtronic, Johnson & Johnson, and Stryker, who are actively pursuing innovation and product diversification. The market is segmented by device type, material, application, and geography, with North America and Europe expected to lead due to well-established healthcare systems, while Asia-Pacific and Latin America show strong emerging market potential.

Future market trajectories for absorbable bone fixation devices indicate substantial growth, underpinned by technological innovation and favorable demographic trends. Strategic collaborations, M&A, and R&D efforts aimed at enhancing biocompatibility and mechanical performance are actively reshaping the competitive landscape. Regulatory approvals for novel devices remain a critical determinant of market entry and penetration. The increasing emphasis on minimizing surgical complications and optimizing patient outcomes will continue to fuel demand, though pricing and reimbursement policies may pose considerations. The market is set for expansion, with manufacturer success dependent on balancing cutting-edge innovation with cost-efficiency and addressing inherent device limitations.

The global medical absorbable bone fixation device market is experiencing robust growth, projected to reach multi-billion unit sales by 2033. Driven by an aging global population, increasing incidence of fractures and orthopedic injuries, and a rising preference for minimally invasive surgical techniques, the market shows significant promise. The historical period (2019-2024) witnessed steady expansion, setting the stage for accelerated growth during the forecast period (2025-2033). The estimated market size in 2025 stands at several hundred million units, reflecting the substantial adoption of these devices across various surgical procedures. Key market insights reveal a strong preference for biodegradable materials due to their reduced need for secondary surgeries for implant removal, coupled with improved patient outcomes and reduced healthcare costs. Technological advancements are continuously improving the biocompatibility and strength of these devices, further driving market expansion. Competition among key players is intense, with companies focusing on innovation and strategic partnerships to secure market share. This competitive landscape fuels continuous improvement in product design and efficacy, leading to improved patient care and market expansion. The shift towards personalized medicine also plays a role, with devices tailored to specific patient needs and anatomical structures gaining traction. This report provides a comprehensive analysis of this dynamic market, covering key trends, drivers, challenges, and leading players.

Several factors are propelling the growth of the medical absorbable bone fixation device market. Firstly, the global aging population is experiencing an increased prevalence of age-related bone fragility and fractures, necessitating more frequent bone fixation procedures. Secondly, the rising incidence of traumatic injuries from accidents and sports-related activities further contributes to the demand for effective and minimally invasive solutions. The advantages of absorbable fixation devices, such as the elimination of the need for a second surgical procedure to remove the implant, are major drivers of market expansion. This minimizes patient discomfort, reduces recovery time, and lowers overall healthcare costs. Furthermore, advancements in materials science are leading to the development of stronger and more biocompatible absorbable polymers, significantly improving the efficacy and safety of these devices. The increasing adoption of minimally invasive surgical techniques is also a crucial factor, as these devices are well-suited for these procedures, reducing surgical trauma and improving patient outcomes. Finally, the growing awareness among healthcare professionals and patients regarding the benefits of absorbable implants fuels market growth.

Despite the significant growth potential, the medical absorbable bone fixation device market faces certain challenges. The relatively higher cost compared to traditional non-absorbable implants can be a barrier to widespread adoption, particularly in resource-constrained healthcare settings. Concerns regarding the long-term biocompatibility and degradation rate of some absorbable materials remain a focus of ongoing research and development. The potential for inflammatory responses or delayed bone healing in certain patients necessitates careful patient selection and meticulous surgical techniques. Regulatory hurdles and stringent approval processes can also impede market entry for new products. Furthermore, the lack of standardized clinical guidelines and the absence of sufficient long-term clinical data on some newer devices present challenges in widespread adoption. Competition among established players and the emergence of new entrants further add to the challenges in the market. The need for further research into optimized material properties and improved clinical outcomes remains a key factor for sustainable market growth.

North America: This region is projected to hold a substantial market share due to high healthcare expenditure, advanced medical infrastructure, and early adoption of new technologies. The presence of major players and robust regulatory frameworks also contribute to its dominance.

Europe: The European market is anticipated to experience significant growth driven by increasing prevalence of osteoporosis and related fractures, alongside a focus on minimally invasive surgical procedures.

Asia-Pacific: This region demonstrates high growth potential fueled by a rapidly expanding elderly population, rising disposable incomes, and increasing awareness of advanced medical technologies. However, market penetration is influenced by varying healthcare infrastructure across different countries.

Segments: The segment of high-strength absorbable fixation devices is expected to lead the market due to enhanced biocompatibility and reduced post-operative complications compared to traditional implants. The Plates and Screws segment holds a larger market share due to their widespread application in various fracture types. The growing demand for minimally invasive surgical procedures is boosting the growth of the intramedullary nails segment.

The paragraph above provides an overview of the expected market dominance. Each region and segment mentioned possess unique characteristics influencing their market position. North America benefits from established infrastructure and high healthcare spending, while Asia-Pacific shows significant growth potential due to its large and aging population. The high-strength materials segment highlights the trend towards improved biocompatibility and patient outcomes, while the various fixation device types reflect the diverse applications in orthopedic surgery. Further research is required to better understand the intricate interplay of these factors.

The medical absorbable bone fixation device industry is propelled by several growth catalysts. These include the rising prevalence of osteoporosis and age-related bone fractures, advancements in biocompatible materials that offer superior strength and degradation profiles, the increasing adoption of minimally invasive surgical techniques, and a growing preference for reducing the need for secondary surgeries to remove implants. The focus on improved patient outcomes, reduced recovery time, and lower overall healthcare costs all contribute to the accelerating market growth.

This report offers an in-depth analysis of the medical absorbable bone fixation device market, covering historical data (2019-2024), the estimated year (2025), and a forecast period extending to 2033. The analysis includes market sizing, segmentation, competitive landscape, regional analysis, technological advancements, and growth drivers, providing a comprehensive overview for industry stakeholders. The report will provide valuable insights for businesses seeking to enter or expand their presence in this rapidly growing market.

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 10.64% from 2020-2034 |

| Segmentation |

|

Note*: In applicable scenarios

Primary Research

Secondary Research

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

The projected CAGR is approximately 10.64%.

Key companies in the market include Medtronic, B. Braun Melsungen, Johnson & Johnson, Globus Medical, Dentsply Sirona, Medartis, Smith & Nephew, Stryker, Wright Medical, Zimmer Biomet, Boston Scientific, Victrex, Orthopaedic Implant, Osteomed, Inion, Gunze, BD, Acumed, .

The market segments include Type, Application.

The market size is estimated to be USD 7.35 billion as of 2022.

N/A

N/A

N/A

N/A

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4480.00, USD 6720.00, and USD 8960.00 respectively.

The market size is provided in terms of value, measured in billion and volume, measured in K.

Yes, the market keyword associated with the report is "Medical Absorbable Bone Fixation Device," which aids in identifying and referencing the specific market segment covered.

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

To stay informed about further developments, trends, and reports in the Medical Absorbable Bone Fixation Device, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.