1. What is the projected Compound Annual Growth Rate (CAGR) of the Marine Dynamic Positioning Systems?

The projected CAGR is approximately 10.58%.

Marine Dynamic Positioning Systems

Marine Dynamic Positioning SystemsMarine Dynamic Positioning Systems by Type (/> Control System, Power System, Thruster System), by Application (/> Commercial Vessel, Naval Vessels, Offshore Vessels, Passenger Vessels), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2026-2034

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.

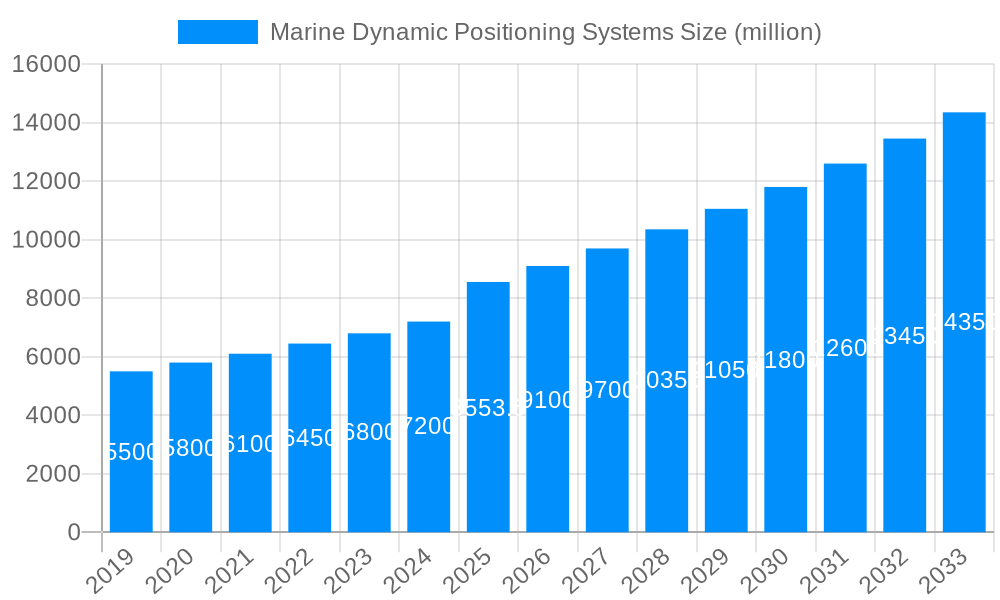

The global Marine Dynamic Positioning Systems (DPS) market is poised for significant expansion, projected to reach an estimated USD 9.09 billion by 2025, with a robust Compound Annual Growth Rate (CAGR) of 10.58% expected to drive its trajectory through 2033. This impressive growth is underpinned by the escalating demand for enhanced operational efficiency, safety, and precision in maritime operations. Key market drivers include the burgeoning offshore oil and gas exploration activities, the increasing deployment of renewable energy infrastructure like offshore wind farms, and the expanding global trade necessitating advanced navigation and station-keeping capabilities for a diverse range of commercial vessels. Furthermore, the growing emphasis on autonomous shipping and the integration of sophisticated digital technologies within the maritime sector are fueling innovation and adoption of advanced DPS solutions. The market is also benefiting from increased defense spending, leading to a greater demand for advanced DPS in naval vessels for critical missions.

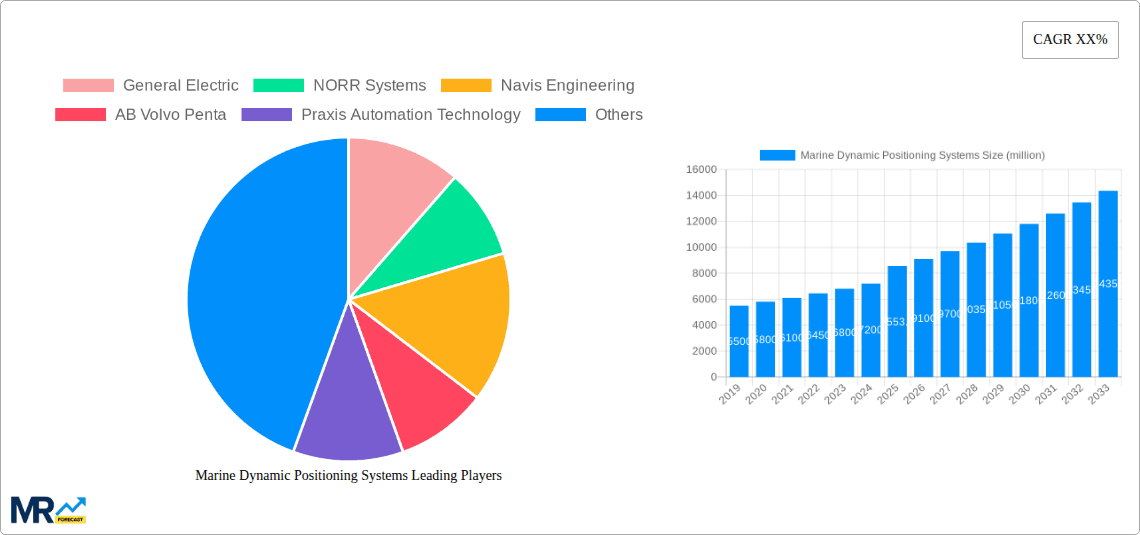

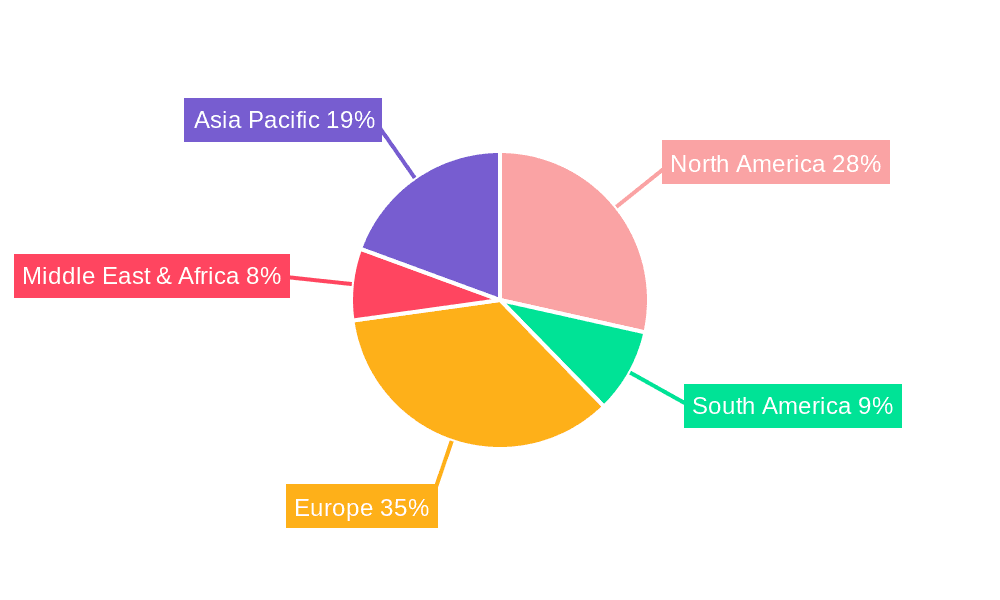

The Marine Dynamic Positioning Systems market is segmented into Control Systems, Power Systems, and Thruster Systems, each contributing to the overall functionality and performance of DPS. Applications span across Commercial Vessels, Naval Vessels, and Offshore Vessels, highlighting the versatility and essential nature of DPS in modern maritime endeavors. Geographically, Asia Pacific, particularly China and India, is emerging as a significant growth engine due to rapid industrialization and substantial investments in maritime infrastructure and offshore energy projects. Europe and North America continue to be dominant markets, driven by their established maritime industries, stringent safety regulations, and ongoing technological advancements. Key players such as General Electric, NORR Systems, Navis Engineering, and AB Volvo Penta are actively engaged in research and development, offering innovative solutions that cater to the evolving needs of the maritime industry. The market is characterized by a strong trend towards the development of integrated and intelligent DPS solutions that offer enhanced automation, energy efficiency, and remote monitoring capabilities.

The global Marine Dynamic Positioning (DP) Systems market is poised for substantial growth, with projections indicating a market size exceeding $15 billion by 2033. This impressive expansion, driven by escalating demand for precision and safety in maritime operations, paints a vibrant picture for the industry. Over the Study Period (2019-2033), the market has witnessed a consistent upward trajectory, with the Base Year (2025) expected to mark a significant point of acceleration. The Forecast Period (2025-2033) will be characterized by robust technological advancements and the increasing adoption of sophisticated DP systems across a wide spectrum of marine applications. During the Historical Period (2019-2024), initial adoption was primarily concentrated in high-stakes offshore exploration and production activities, where the inherent risks and complexities necessitate unwavering positional accuracy. However, the past few years have seen a broadening of this adoption curve. The Estimated Year (2025) is projected to see a more widespread integration, driven by evolving regulatory landscapes and a growing appreciation for the operational efficiencies offered by advanced DP technology. Key market insights reveal a strong preference for integrated DP solutions that combine advanced control systems, reliable power management, and highly responsive thruster systems. The focus is shifting from standalone components to holistic, intelligent platforms capable of predictive maintenance and enhanced situational awareness. The increasing complexity of offshore operations, coupled with the growing number of ultra-deepwater projects, is a primary driver for this trend. Furthermore, the burgeoning renewable energy sector, particularly offshore wind farm construction and maintenance, is creating new avenues for DP system deployment. The need for precise positioning during the installation of turbines, substations, and subsea cables, along with the ongoing maintenance requirements of these facilities, is fueling demand. The trend towards larger and more sophisticated offshore construction vessels and specialized support vessels further amplifies the requirement for advanced DP capabilities. Beyond offshore, even commercial shipping segments are exploring DP for enhanced maneuverability in congested ports and for specialized cargo handling operations. This indicates a paradigm shift where DP is no longer solely a niche technology but an increasingly integrated component of modern maritime operations, contributing to enhanced safety, efficiency, and environmental stewardship.

Several potent forces are collectively driving the significant growth anticipated in the Marine Dynamic Positioning Systems market. Foremost among these is the relentless expansion and diversification of offshore energy exploration and production activities. As the world's energy demands continue to rise, companies are venturing into increasingly challenging environments, including ultra-deepwater and harsh weather regions. These operations necessitate an unparalleled level of positional accuracy and stability, which only advanced DP systems can reliably provide. This includes critical tasks such as drilling, subsea construction, pipe laying, and the precise maneuvering of supply vessels in close proximity to offshore platforms. Furthermore, the burgeoning offshore wind energy sector represents a colossal growth catalyst. The construction, installation, and ongoing maintenance of offshore wind farms involve intricate operations that demand extreme precision. DP systems are indispensable for the accurate positioning of installation vessels, turbine components, and for maintaining stable platforms for repair and maintenance crews in often turbulent seas. The growing emphasis on enhanced safety and reduced operational risks across all maritime sectors is another significant propellant. DP systems minimize the need for traditional anchoring, thereby reducing the risk of seabed damage and improving safety margins in crowded shipping lanes and environmentally sensitive areas. They enable vessels to maintain a fixed position relative to a target without the use of anchors, significantly reducing the potential for accidents. Regulatory mandates and industry best practices are also increasingly favoring or even requiring the use of DP systems for certain types of operations, further bolstering market adoption. The continuous evolution of technology, particularly in areas like sensor accuracy, control algorithms, and integration with other vessel systems, is making DP systems more capable, reliable, and cost-effective, thereby broadening their appeal and driving their widespread implementation.

Despite the overwhelmingly positive growth trajectory, the Marine Dynamic Positioning Systems market is not without its inherent challenges and restraints. A primary concern remains the substantial initial investment required for the acquisition and installation of advanced DP systems. These sophisticated technologies, encompassing complex control systems, high-performance power management, and responsive thruster systems, represent a significant capital outlay for vessel owners and operators. This can be a deterrent, particularly for smaller companies or those operating in segments with tighter profit margins. The need for highly skilled and trained personnel to operate and maintain these intricate systems also presents a hurdle. The complex algorithms, integrated hardware, and real-time decision-making inherent in DP operation require specialized expertise, leading to training costs and potential shortages of qualified crew. Moreover, the stringent regulatory environment surrounding DP systems, while ultimately beneficial for safety, can also be a source of complexity and cost. Compliance with international standards and certifications requires significant documentation and rigorous testing, adding to the overall project timeline and expense. The reliability and redundancy of DP systems are paramount, and any failure can have catastrophic consequences. This necessitates expensive redundant systems and rigorous maintenance protocols, further increasing operational costs. Cybersecurity threats also pose an emerging challenge. As DP systems become more integrated with networked operations and rely on digital communication, they become potential targets for cyberattacks, which could disrupt operations or compromise vessel safety. Finally, the economic cyclicality of the offshore oil and gas industry, a major consumer of DP technology, can lead to fluctuating demand and investment in new DP installations, creating periods of uncertainty for market growth.

The global Marine Dynamic Positioning Systems market is projected to witness significant dominance by specific regions and segments over the Forecast Period (2025-2033).

Dominant Region: North America, particularly the United States, is expected to continue its stronghold on the market. This is primarily attributed to its extensive offshore oil and gas exploration activities in the Gulf of Mexico, coupled with a strong presence of pioneering offshore wind farm development projects along its Atlantic and Pacific coastlines. The country's robust technological infrastructure, coupled with significant government and private sector investment in maritime and energy sectors, provides a fertile ground for the adoption of advanced DP systems. The stringent safety regulations and the presence of major offshore service companies further reinforce North America's leading position.

Dominant Segment: Within the Type segmentation, the Offshore Vessels application segment is poised for unparalleled growth and market dominance. This is intrinsically linked to the continued expansion of offshore energy exploration, production, and increasingly, the renewable energy sector.

The increasing complexity and scale of offshore projects, coupled with the global push towards renewable energy sources, will continue to drive the demand for highly capable DP-equipped offshore vessels. The technological advancements in DP systems, making them more reliable and efficient for these demanding applications, further solidify this segment's dominance. The global market for DP systems within the offshore vessel segment is projected to exceed $10 billion by the end of the forecast period, reflecting its pivotal role in the industry's future. The integration of advanced DP functionalities within the Control System of these vessels, coupled with powerful Power Systems and highly responsive Thruster Systems, is crucial for their operational success.

The Marine Dynamic Positioning Systems industry is experiencing significant growth catalysts that are propelling its expansion. The escalating complexity and depth of offshore oil and gas exploration activities, demanding precise positioning, is a primary driver. Furthermore, the rapid growth of the offshore wind energy sector, with its intricate installation and maintenance requirements, necessitates highly accurate DP capabilities. Technological advancements in sensor technology, control algorithms, and automation are enhancing the performance and reliability of DP systems, making them more attractive for a broader range of applications. Evolving safety regulations and industry best practices are also increasingly mandating or encouraging the adoption of DP systems, contributing to market growth.

This comprehensive report delves deep into the global Marine Dynamic Positioning Systems market, offering an in-depth analysis across its entire value chain. It meticulously examines market trends, driving forces, and key challenges, providing a holistic understanding of the industry's dynamics. The report offers detailed insights into key regional markets and dominant segments, with a particular focus on the critical Offshore Vessels application, highlighting its substantial market share and growth potential. It analyzes the technological landscape, including advancements in Control Systems, Power Systems, and Thruster Systems, crucial for the effective functioning of DP solutions. The report also identifies and profiles leading market players, their strategies, and recent developments, painting a clear picture of the competitive environment. With a robust Study Period (2019-2033), including a Base Year (2025) and detailed projections for the Forecast Period (2025-2033), this report provides invaluable data for strategic decision-making, investment planning, and understanding the future trajectory of this vital maritime technology.

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 10.58% from 2020-2034 |

| Segmentation |

|

Note*: In applicable scenarios

Primary Research

Secondary Research

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

The projected CAGR is approximately 10.58%.

Key companies in the market include General Electric, NORR Systems, Navis Engineering, AB Volvo Penta, Praxis Automation, Technology, .

The market segments include Type, Application.

The market size is estimated to be USD 9.09 billion as of 2022.

N/A

N/A

N/A

N/A

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4480.00, USD 6720.00, and USD 8960.00 respectively.

The market size is provided in terms of value, measured in billion.

Yes, the market keyword associated with the report is "Marine Dynamic Positioning Systems," which aids in identifying and referencing the specific market segment covered.

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

To stay informed about further developments, trends, and reports in the Marine Dynamic Positioning Systems, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.