1. What is the projected Compound Annual Growth Rate (CAGR) of the MAP Trays?

The projected CAGR is approximately XX%.

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.

MAP Trays

MAP TraysMAP Trays by Type (PP, PET, PETG, Other), by Application (Food Factory, Other), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2025-2033

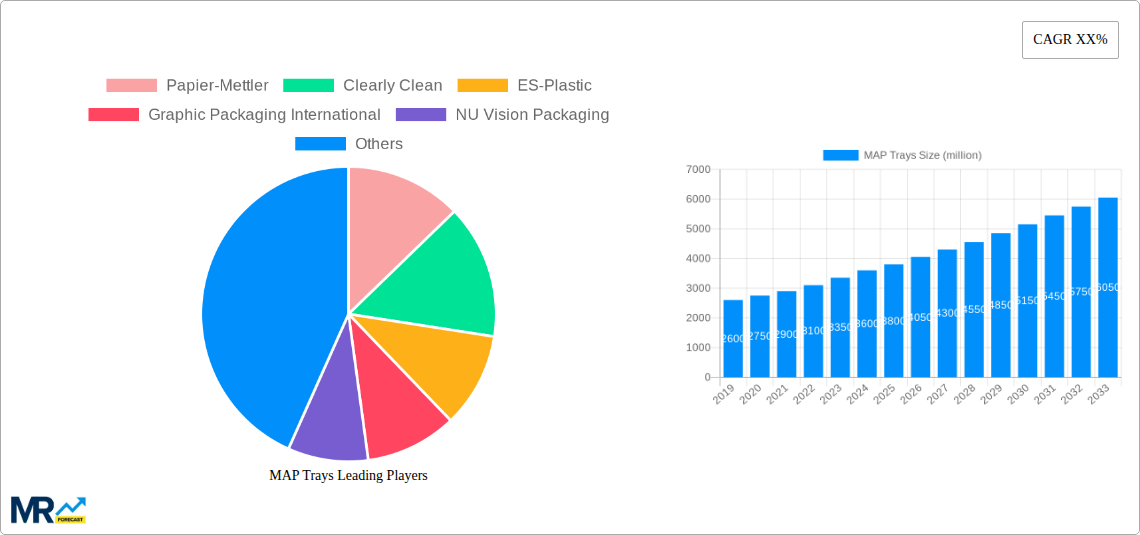

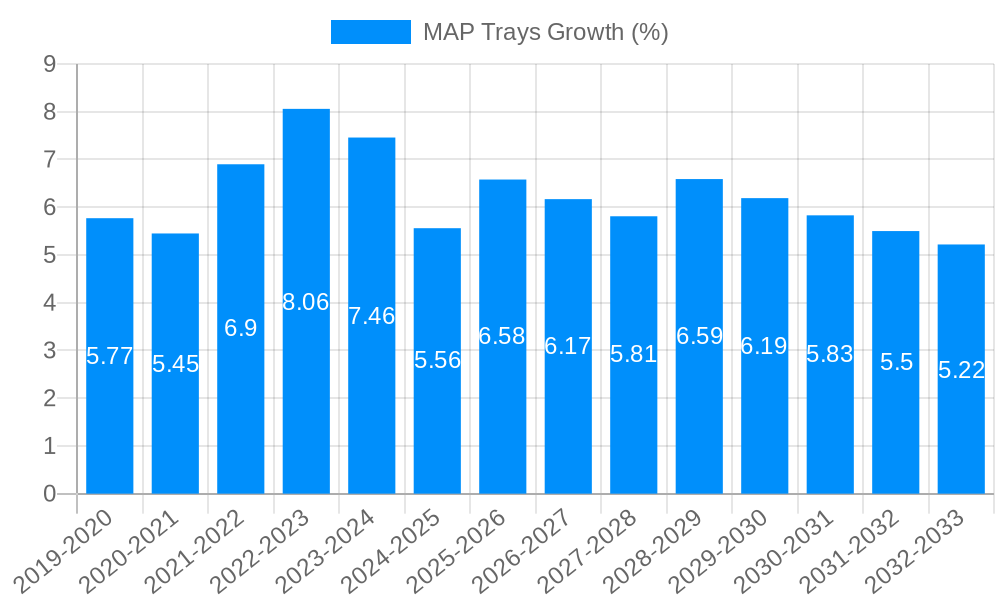

The global Modified Atmosphere Packaging (MAP) Trays market is experiencing robust growth, projected to reach approximately $3,800 million by 2025, with an impressive Compound Annual Growth Rate (CAGR) of around 7.5% through 2033. This expansion is fueled by a growing consumer demand for extended shelf-life and fresher food products, coupled with increasing awareness of the benefits of MAP technology in reducing food waste. The market's dynamism is further propelled by significant investments in advanced packaging solutions that enhance product appeal and safety. Key drivers include the rising disposable incomes in emerging economies, leading to greater consumption of processed and packaged foods, and the stringent regulations surrounding food safety and preservation, which encourage the adoption of sophisticated packaging like MAP trays. The convenience offered by pre-packaged meals and ready-to-eat food items further amplifies the demand for these specialized trays.

The MAP Trays market is characterized by a diverse range of applications, with the Food Factory segment dominating due to its widespread use in preserving perishable goods like meats, poultry, fish, dairy, and baked goods. Within material types, PETG is emerging as a highly favored material, offering excellent clarity, barrier properties, and recyclability, aligning with the increasing focus on sustainable packaging solutions. However, the market is not without its challenges. High initial investment costs for MAP machinery and the need for specialized knowledge in gas mixtures and sealing technologies can act as restraints, particularly for smaller players. Despite these hurdles, the overarching trend towards improved food quality, reduced spoilage, and enhanced consumer convenience is setting a strong trajectory for the MAP Trays market, with significant opportunities expected in regions like Asia Pacific and Europe.

This report offers an in-depth analysis of the global Modified Atmosphere Packaging (MAP) trays market, meticulously tracing its trajectory from 2019 to 2033. Leveraging a robust study period encompassing historical data from 2019-2024, a base year of 2025, and an extensive forecast period from 2025-2033, this research provides unparalleled insights into market dynamics, growth drivers, and future opportunities. We delve into key segments including material types such as Polypropylene (PP), Polyethylene Terephthalate (PET), and Polyethylene Terephthalate Glycol (PETG), alongside niche 'Other' materials. Furthermore, the report scrutinizes application sectors, with a particular focus on the 'Food Factory' segment, while also acknowledging the influence of 'Other' applications. Our analysis is underpinned by a thorough examination of industry developments, providing a holistic view of the MAP trays landscape. With an estimated market size reaching several hundred million USD in the base year of 2025, this report is an indispensable resource for stakeholders seeking to navigate and capitalize on the evolving MAP trays industry.

The global MAP trays market is experiencing a significant transformation, driven by evolving consumer preferences, technological advancements, and a growing emphasis on food safety and shelf-life extension. The **estimated market size for MAP trays is projected to reach *tens of millions USD* by 2033**, showcasing a robust growth trajectory throughout the forecast period. A key trend is the increasing adoption of advanced barrier materials, offering superior protection against oxygen and moisture, thus significantly extending the shelf-life of perishable food products. This directly addresses consumer demand for fresher, longer-lasting food options, reducing waste at both the retail and household levels. The market is also witnessing a paradigm shift towards sustainable and recyclable materials. With growing environmental consciousness, manufacturers are actively exploring and implementing eco-friendly alternatives to traditional plastics, with a notable increase in the use of PET and PP-based MAP trays, which offer better recyclability profiles. The integration of intelligent packaging features, such as indicators that signal spoilage or temperature deviations, is another burgeoning trend, enhancing consumer confidence and product safety. Furthermore, the convenience factor is paramount, leading to a rise in demand for single-serving and ready-to-eat meal MAP trays, particularly within the food factory segment, catering to busy lifestyles. The technological advancements in sealing technologies, including advanced heat sealing and ultrasonic sealing, are also playing a crucial role in ensuring the integrity and effectiveness of MAP trays, contributing to a more secure and efficient packaging ecosystem. The continuous innovation in gas flushing technologies and the development of specialized barrier films are further shaping the market by optimizing gas compositions for specific food products, thereby preserving their quality, texture, and nutritional value for extended periods. The increasing complexity of supply chains also necessitates robust packaging solutions that can withstand transportation and handling, further bolstering the demand for high-performance MAP trays.

The MAP trays market is experiencing a dynamic growth phase, propelled by a confluence of powerful driving forces that are reshaping its landscape. Foremost among these is the escalating consumer demand for extended shelf-life and enhanced food freshness. In an era where convenience and reduced food waste are paramount, MAP technology stands out as a critical solution. By carefully controlling the atmosphere within the packaging, MAP trays significantly inhibit spoilage, allowing perishable goods like fresh produce, meats, and dairy products to remain fresh for longer periods. This directly translates to fewer product returns for retailers and less food wastage in homes, aligning with both economic and environmental imperatives. Furthermore, the growing global population and the subsequent increase in demand for packaged foods are substantial market drivers. As urbanization continues and dietary habits evolve, the need for safe, convenient, and readily available food options intensifies, placing MAP trays at the forefront of food packaging solutions. The ever-increasing stringency of food safety regulations globally also acts as a significant catalyst. MAP trays provide an effective barrier against contaminants, ensuring the integrity and safety of food products throughout the supply chain, thereby helping manufacturers comply with evolving regulatory standards and maintain consumer trust. The advancements in material science and packaging technology are also crucial. Innovations in barrier films, sealing techniques, and printing technologies are enabling the development of more effective, cost-efficient, and aesthetically appealing MAP trays, further stimulating market growth. The rising disposable incomes in emerging economies are contributing to an increased purchasing power for packaged foods, opening up new avenues for MAP tray manufacturers. This demographic shift is leading to greater adoption of pre-packaged meals and convenience foods, where MAP trays play a pivotal role in maintaining product quality and extending shelf life.

Despite the robust growth trajectory of the MAP trays market, several challenges and restraints warrant careful consideration. A primary hurdle is the perceived higher cost of MAP packaging compared to conventional alternatives. While the extended shelf-life and reduced spoilage offer long-term economic benefits, the initial investment in MAP technology, including specialized equipment and materials, can be a deterrent for smaller businesses or those operating on tighter margins. This cost factor can limit widespread adoption, especially in price-sensitive markets. Another significant challenge is the complexity and specialized nature of MAP technology. Achieving optimal atmospheric conditions requires precise control of gas mixtures, sealing integrity, and material selection, which necessitates specialized knowledge and technical expertise. This can create a barrier to entry for new players and pose operational challenges for existing ones if not managed effectively. The environmental concerns and the increasing push for sustainable packaging solutions present a dual-edged sword. While there is a growing demand for recyclable and biodegradable MAP trays, the development and widespread availability of such materials that can meet the stringent barrier requirements for various food products remain a work in progress. The disposal of multi-layered MAP trays, which often combine different plastic types, can also pose recycling challenges, leading to scrutiny from regulators and consumers alike. Furthermore, the potential for gas leakage and inadequate sealing remains a constant concern, as any compromise in the packaging's integrity can lead to premature spoilage and product recalls, severely damaging brand reputation and leading to financial losses. The volatility in raw material prices, particularly for polymers like PET and PP, can also impact the profitability of MAP tray manufacturers, creating unpredictability in production costs and pricing strategies. Finally, consumer education and awareness regarding the benefits and proper handling of MAP products are still areas that require further attention to ensure optimal product performance and consumer satisfaction.

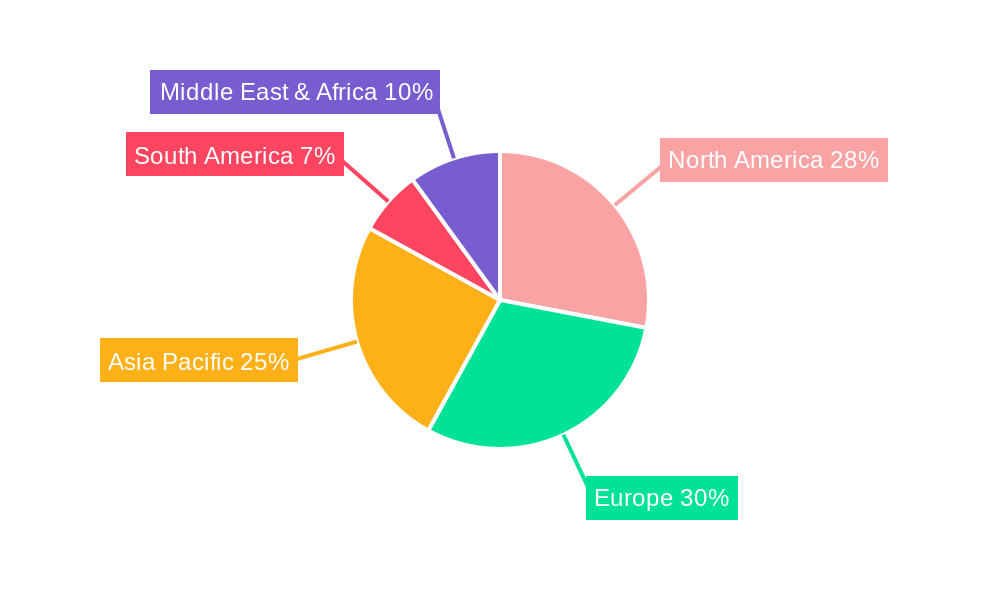

The global MAP trays market exhibits a complex interplay of regional dominance and segment leadership, with North America and Europe currently standing out as key regions poised for significant market share and growth. Within these regions, the Food Factory segment, particularly those involved in the processing and packaging of fresh meats, poultry, fish, and ready-to-eat meals, is expected to be the dominant application.

Dominant Segments and Regions:

Detailed Analysis:

The dominance of PET in the MAP trays market is attributed to its balanced properties. It offers good gas and moisture barrier capabilities, which are essential for maintaining the quality of packaged foods. Moreover, its inherent recyclability aligns with the growing global emphasis on sustainable packaging, making it an attractive choice for manufacturers and consumers alike. While PP also offers excellent barrier properties and is often more cost-effective, PET's clarity provides a significant aesthetic advantage, allowing consumers to visually inspect the product, a crucial factor in purchasing decisions for many food items.

The Food Factory segment is the bedrock of the MAP trays market. These facilities are at the forefront of innovation and adoption of MAP technology. They process vast quantities of perishable goods and require packaging solutions that can extend shelf-life, reduce spoilage, and meet rigorous safety standards. The demand from this segment is driven by the need to optimize supply chain efficiency, minimize product loss, and cater to the ever-increasing consumer appetite for fresh, ready-to-consume food products. The ability of MAP trays to keep products like fresh red meats, poultry, and fish visually appealing and safe for consumption for extended periods is a critical advantage for food factories.

North America's leadership is underpinned by its highly developed food processing industry and a consumer base that values convenience and quality. The region's robust regulatory framework, which prioritizes food safety and hygiene, compels food manufacturers to invest in advanced packaging solutions like MAP trays. Furthermore, the established supermarket chains in North America are key partners for MAP tray suppliers, as they demand high-quality, long-shelf-life products to manage their inventory effectively and minimize waste. The region's strong economic growth also translates to higher disposable incomes, enabling consumers to opt for premium, pre-packaged food options that utilize MAP technology.

Similarly, Europe presents a significant market due to its strong commitment to environmental sustainability. The European Union's stringent directives on packaging waste and the promotion of circular economy principles are pushing manufacturers towards more recyclable and eco-friendly packaging materials. MAP trays made from PET are particularly well-received in this region due to their recyclability. The sophisticated food retail landscape and the discerning European consumer, who places a high premium on food quality, safety, and transparency, further fuel the demand for MAP trays that ensure product integrity and extend freshness. The European market is also characterized by a diverse range of food products, requiring specialized MAP solutions tailored to specific needs, from delicate pastries to fresh seafood.

The growth of the MAP trays industry is significantly catalyzed by the escalating consumer preference for extended shelf-life and enhanced food freshness. This demand is directly addressed by MAP technology, which minimizes spoilage and reduces food waste. Furthermore, increasing global population and urbanization drive higher consumption of packaged foods, making MAP trays indispensable for maintaining product quality throughout complex supply chains. The continuous evolution of material science, leading to more efficient barrier films and sustainable packaging options, also plays a crucial role in driving market expansion.

This comprehensive report on the MAP trays market provides an exhaustive overview, detailing market size projections in the tens of millions USD by 2033, alongside historical data analysis from 2019 to 2024 and detailed forecasts from 2025 to 2033. It meticulously dissects key segments, including material types like PP, PET, and PETG, and application areas, with a strong emphasis on the 'Food Factory' segment. The report offers a deep dive into the market's trends, driving forces, and challenges, providing actionable insights for strategic decision-making for all stakeholders.

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of XX% from 2019-2033 |

| Segmentation |

|

Note*: In applicable scenarios

Primary Research

Secondary Research

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

The projected CAGR is approximately XX%.

Key companies in the market include Papier-Mettler, Clearly Clean, ES-Plastic, Graphic Packaging International, NU Vision Packaging, Silgan Plastic Food Containers, Küchmann, Mannok.

The market segments include Type, Application.

The market size is estimated to be USD XXX million as of 2022.

N/A

N/A

N/A

N/A

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4480.00, USD 6720.00, and USD 8960.00 respectively.

The market size is provided in terms of value, measured in million and volume, measured in K.

Yes, the market keyword associated with the report is "MAP Trays," which aids in identifying and referencing the specific market segment covered.

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

To stay informed about further developments, trends, and reports in the MAP Trays, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.