1. What is the projected Compound Annual Growth Rate (CAGR) of the Manual Agricultural Tractor?

The projected CAGR is approximately XX%.

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.

Manual Agricultural Tractor

Manual Agricultural TractorManual Agricultural Tractor by Application (Harvesting, Seed Sowing, Spraying, Others), by Type (Electric, Gasoline, Diesel, Others), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2026-2034

The global manual agricultural tractor market, while exhibiting slower growth compared to its automated counterparts, remains a significant segment, particularly in developing economies with smaller landholdings and labor-intensive farming practices. The market is driven by increasing demand for affordable and reliable farming equipment in these regions, coupled with rising food production needs and government initiatives promoting agricultural mechanization. However, factors like the rising popularity of more efficient and technologically advanced tractors, limited access to credit and financing in certain areas, and a potential lack of skilled labor to operate and maintain these tractors, act as restraints on market expansion. Key players like Deere, Mahindra, and Kubota, while predominantly focused on advanced models, still cater to this segment, either through subsidiary brands or by offering basic manual models tailored to specific market needs. The market is segmented by horsepower, tractor type (e.g., two-wheel drive, four-wheel drive), application (e.g., tilling, plowing, harvesting), and region. A notable trend involves the integration of some basic technology, such as improved engine efficiency and enhanced durability, to make manual tractors more productive and longer lasting.

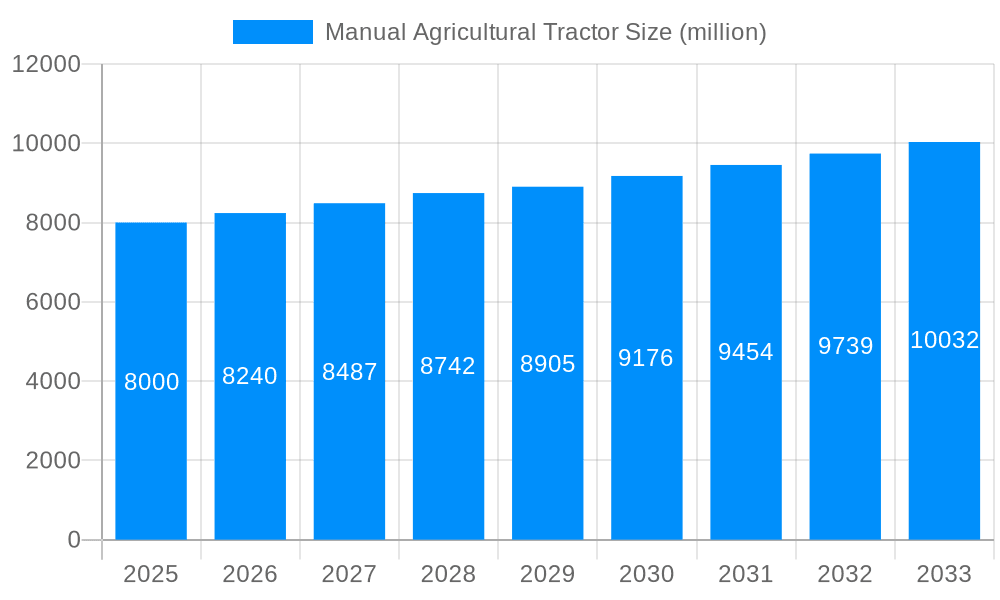

Based on a reasonable estimation considering the industry's growth trajectory and the dominance of automated tractors in developed markets, we can project a total market size of approximately $8 billion USD in 2025, growing at a CAGR of 3% through 2033. This comparatively lower CAGR reflects the market’s maturity and the competition from more sophisticated alternatives. While the North American and European markets constitute a smaller percentage of overall sales, substantial growth is predicted in regions like Asia-Pacific and Africa, driven by the factors outlined above. The study period of 2019-2033 allows for a complete analysis of market behavior during both pre- and post-pandemic periods, giving a more holistic view of its future prospects. Companies are investing in upgrading their manual tractor offerings by focusing on reliability and affordability, rather than complex technological advancements.

The global manual agricultural tractor market, while a niche segment compared to its motorized counterpart, exhibits unique trends driven by specific geographical and socioeconomic factors. Over the historical period (2019-2024), the market experienced moderate growth, largely influenced by the continued prevalence of small-scale farming in developing economies. These regions often rely on human-powered assistance to supplement the limited capabilities of smaller, less powerful tractors. The base year of 2025 shows a continued albeit slower expansion, projected at approximately X million units globally. This reflects a complex interplay of factors, including increasing labor costs in some regions pushing farmers to invest in more efficient (even if partially mechanized) solutions, while simultaneously facing constraints of affordability and access to newer technology.

The forecast period (2025-2033) anticipates a compounded annual growth rate (CAGR) of Y%, reaching Z million units by 2033. However, this projection is contingent on several factors such as the sustained demand from developing nations, improvements in the design and affordability of manual tractors to address ergonomic concerns and increase productivity, and the ongoing evolution of agricultural practices. The market will continue to witness a significant geographic disparity, with the highest concentration in regions characterized by high labor intensity in agriculture and limited access to advanced machinery. This regional focus is expected to shape product development strategies of leading players, with a focus on cost-effectiveness and durability rather than advanced features prevalent in motorized tractors. Furthermore, governmental policies promoting sustainable and affordable agricultural practices could positively influence market growth. Overall, the market, while smaller than its powered counterpart, demonstrates resilience and growth potential based on its niche appeal and relevance in specific contexts.

Several key factors contribute to the continued relevance of manual agricultural tractors. Firstly, the affordability factor remains paramount. In many developing countries, the cost of purchasing and maintaining a motorized tractor is prohibitive for smallholder farmers, rendering manual tractors a far more accessible option. This is particularly true in regions with limited access to credit and financial resources. Secondly, the ease of maintenance and repair contributes to their widespread adoption. Manual tractors are significantly less complex than their motorized counterparts, meaning farmers can often fix basic malfunctions themselves using readily available tools and skills, reducing downtime and operational costs. Thirdly, the suitability for specific tasks and terrains plays a critical role. Manual tractors, often lighter and more maneuverable, are better suited to working on small plots of land or navigating challenging terrain where larger, motorized tractors might struggle or cause damage. Finally, the lower environmental impact, compared to fuel-intensive motorized tractors, is another driver, albeit a less prominent one in many contexts. The relative simplicity and lack of reliance on fossil fuels contribute to a lower carbon footprint, although this consideration is often secondary to affordability and practicality for the typical user.

Despite their advantages, several factors hinder the growth of the manual agricultural tractor market. Firstly, the increasing labor costs in some developing nations are gradually making manual labor less competitive compared to mechanization, even with motorized tractors. As wages rise, the labor savings achieved by using manual tractors are reduced, making motorized options more appealing. Secondly, the limitations in terms of productivity and efficiency compared to motorized tractors constitute a significant restraint. Manual operation is physically demanding and time-consuming, limiting the overall output and potentially reducing the farm's competitiveness. Thirdly, the ergonomic limitations of manual tractors are a significant concern. Prolonged use can lead to physical strain and injuries for operators, a key factor that needs to be addressed through improved design. Finally, the lack of technological advancements is a constraint. Unlike motorized tractors, advancements and innovation in manual tractors are limited, impacting the overall efficiency and appeal to potential buyers. This stagnation makes them less appealing to farmers seeking more efficient methods to boost production.

Asia (Specifically South Asia and Southeast Asia): These regions have a large population of smallholder farmers who rely heavily on manual labor in agriculture. The vast number of small farms makes the market for manual tractors quite large. Additionally, these areas frequently experience constraints on access to credit and technology, making manual tractors a more financially viable option.

Africa (Sub-Saharan Africa): Similar to Asia, Sub-Saharan Africa possesses a substantial agricultural sector with numerous smallholder farmers operating in challenging terrain. The economic realities in these areas consistently favor affordable and readily maintainable solutions. Additionally, the limited infrastructure in several areas necessitates the use of equipment that can operate effectively in less-than-ideal conditions.

Latin America: Certain regions within Latin America, characterized by small-scale farming and diverse terrain, also present a market for manual agricultural tractors. The affordability and ease of maintenance are prominent factors in this market.

Segment Dominance: The primary segment driving this market is the smaller-sized manual tractors, intended for use on smaller plots of land. These are also more affordable than larger models, furthering their appeal to the target demographic. These tractors are most commonly used for tasks such as tilling, planting, and weeding.

The dominance of these regions and segments stems from a confluence of factors: limited access to finance and mechanization; the prevalence of small-scale farming; and the adaptability of manual tractors to varied terrain and agricultural practices. However, future shifts in labor costs, agricultural practices, and access to credit will have a direct impact on the sustained dominance of these markets.

The growth of the manual agricultural tractor market is fueled by a combination of factors. Increased government support for smallholder farmers through subsidies and initiatives promoting sustainable farming practices provides a boost to demand. Furthermore, the continuous improvement in the design and ergonomics of manual tractors, addressing issues like operator fatigue and increased efficiency, enhances their appeal. Finally, the growing awareness of the environmental benefits associated with reduced fuel consumption compared to motorized tractors contributes to market growth, particularly in regions prioritizing sustainability.

This report provides a detailed analysis of the manual agricultural tractor market, incorporating historical data, current market dynamics, and future projections. It covers key market segments, regional trends, competitive landscape, and significant industry developments. The insights provided are valuable for businesses, investors, and policymakers seeking a comprehensive understanding of this niche but resilient sector within the broader agricultural machinery industry.

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of XX% from 2020-2034 |

| Segmentation |

|

Note*: In applicable scenarios

Primary Research

Secondary Research

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

The projected CAGR is approximately XX%.

Key companies in the market include Deere, Mahindra Group, Kubota Corporation, Massey Ferguson, New Holland, SDF Group, CNH Industrial N.V., Eicher Motors Limited, Escorts Limited, Force Motors Limited, Mahindra & Mahindra Limited, International Tractors Limited (Sonalika), TAFE Limited, .

The market segments include Application, Type.

The market size is estimated to be USD XXX million as of 2022.

N/A

N/A

N/A

N/A

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3480.00, USD 5220.00, and USD 6960.00 respectively.

The market size is provided in terms of value, measured in million and volume, measured in K.

Yes, the market keyword associated with the report is "Manual Agricultural Tractor," which aids in identifying and referencing the specific market segment covered.

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

To stay informed about further developments, trends, and reports in the Manual Agricultural Tractor, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.