1. What is the projected Compound Annual Growth Rate (CAGR) of the Luxury Vehicles?

The projected CAGR is approximately XX%.

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.

Luxury Vehicles

Luxury VehiclesLuxury Vehicles by Type (Compact Car, Mid-size Car, Full-size Car, Larger Car, SUV/Crossover, Super Sport Car, World Luxury Vehicles Production ), by Application (Financing/Loan, Cash Payment, Leasing, World Luxury Vehicles Production ), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2025-2033

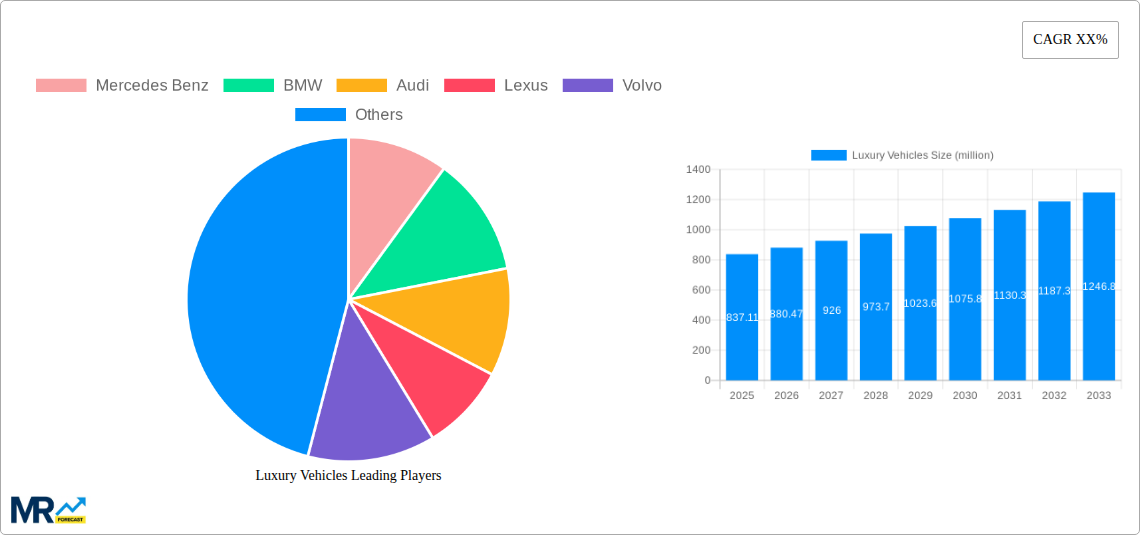

The luxury vehicle market, valued at $837.11 million in 2025, is poised for significant growth over the next decade. This market segment, dominated by established players like Mercedes-Benz, BMW, Audi, and Tesla, is driven by increasing disposable incomes in emerging markets, a growing preference for sophisticated technology and personalized experiences, and the ongoing appeal of status symbols. The market's expansion is further fueled by the introduction of electric and hybrid luxury vehicles, catering to environmentally conscious consumers while maintaining the premium experience. However, economic downturns and increasing regulatory pressures on emissions could pose challenges to sustained growth. The competitive landscape is intense, with both established manufacturers and new entrants vying for market share through innovation and aggressive marketing strategies. Future growth will likely depend on the successful adaptation to technological advancements and the evolving needs and preferences of discerning luxury car buyers.

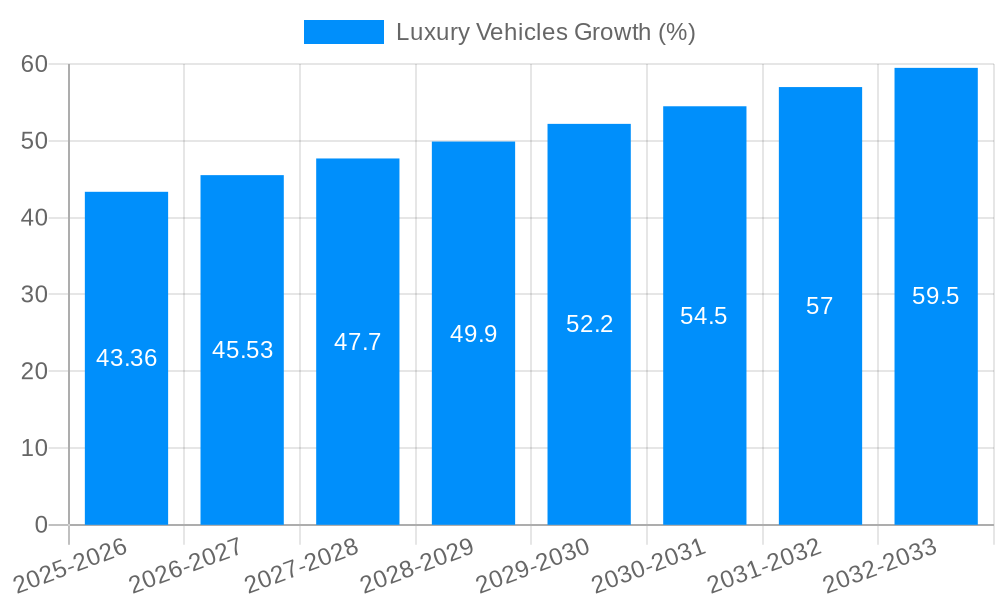

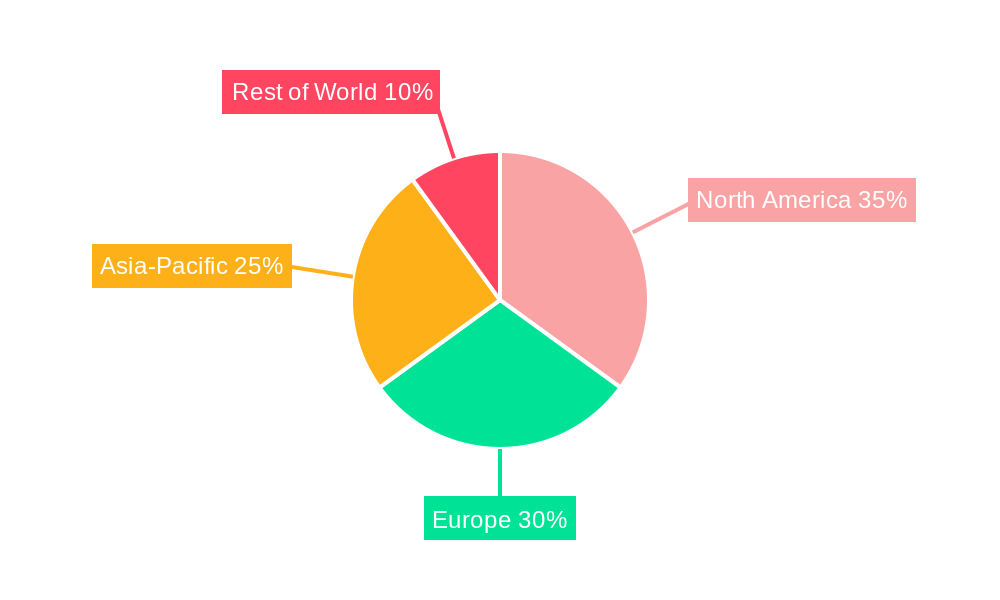

The segment is witnessing a gradual shift towards sustainable luxury, with electric vehicles (EVs) gaining traction. This transition presents both opportunities and challenges. While EVs align with growing environmental awareness, their higher initial cost and range anxiety remain potential barriers to widespread adoption. Nevertheless, the continuous improvement in battery technology and charging infrastructure is likely to alleviate these concerns. The regional distribution of the luxury car market is heavily influenced by economic factors, with North America and Europe traditionally holding substantial market shares. However, regions like Asia-Pacific are rapidly gaining ground as their economies expand and consumer preferences evolve. Effective market penetration strategies, considering these regional disparities, will be crucial for achieving sustainable growth in the coming years. We estimate a compound annual growth rate (CAGR) of 5% for the forecast period 2025-2033, driven by factors discussed above.

The global luxury vehicle market, valued at approximately $1.2 trillion in 2024, is projected to experience robust growth, reaching an estimated $2.5 trillion by 2033. This surge reflects a confluence of factors, including escalating disposable incomes in emerging economies, a growing preference for premium vehicles among affluent consumers worldwide, and continuous technological advancements enhancing the luxury driving experience. The historical period (2019-2024) witnessed a steady increase in sales, punctuated by temporary dips due to global economic fluctuations and supply chain disruptions. However, the market demonstrated remarkable resilience, indicating a strong underlying demand for luxury vehicles. The estimated year 2025 shows a consolidation of market share amongst established players, with a noticeable shift towards electric and hybrid models. This transition is driven by increasingly stringent emission regulations and growing consumer awareness of environmental concerns. The forecast period (2025-2033) anticipates significant growth, particularly in the segments offering advanced driver-assistance systems (ADAS), autonomous driving features, and personalized in-car experiences. Furthermore, the rise of subscription models and shared luxury services is reshaping consumer perceptions and consumption patterns, impacting the traditional ownership model. The market is also witnessing diversification, with niche players focusing on specific luxury segments like electric SUVs or high-performance sports cars further fragmenting the landscape. The competition is intense, with established manufacturers innovating to maintain their positions while new entrants challenge the status quo, particularly in the burgeoning electric vehicle (EV) sector. This competitive intensity is pushing the boundaries of design, technology, and sustainability within the industry.

Several key factors are propelling the luxury vehicle market's growth. Firstly, the expanding global middle class, particularly in Asia-Pacific and other developing regions, is fueling demand for premium goods and experiences, including luxury cars. This demographic shift represents a significant untapped market potential. Secondly, technological advancements are continuously improving the luxury vehicle experience. Features like advanced driver-assistance systems, enhanced infotainment systems, and autonomous driving capabilities are becoming increasingly sought after, pushing up demand and justifying higher price points. Thirdly, the increasing preference for personalization and customization is driving growth. Consumers are seeking unique and bespoke vehicles that reflect their individual tastes and lifestyles, prompting manufacturers to offer a wider range of options and customization services. Lastly, brand prestige and status symbolism remain powerful drivers. Luxury car brands represent a powerful aspirational element for many consumers, contributing to strong brand loyalty and consistent demand even during economic uncertainty. The blend of technological innovation, increasing affluence, and the enduring appeal of luxury brands ensures the continued momentum of this market segment.

Despite the strong growth potential, the luxury vehicle market faces several challenges. Firstly, economic downturns and fluctuations in currency exchange rates can significantly impact consumer spending on discretionary items like luxury cars. Recessions or periods of economic uncertainty often see a decline in sales, highlighting the cyclical nature of the market. Secondly, stringent emission regulations globally are pushing manufacturers to invest heavily in the development of electric and hybrid vehicles, increasing production costs and potentially impacting profitability in the short term. Meeting these regulations requires substantial research and development efforts, adding a significant layer of complexity and cost. Thirdly, increasing raw material costs, particularly for precious metals and advanced materials used in luxury car manufacturing, add pressure on profit margins and pricing strategies. This volatility in input costs makes precise cost management and efficient supply chain management paramount for success. Finally, intensifying competition, both from established players and new entrants, particularly in the electric vehicle segment, is forcing manufacturers to constantly innovate and enhance their offerings to retain market share. The pressure to differentiate while also managing costs is a significant ongoing challenge.

North America: Remains a dominant market due to high disposable incomes and a strong preference for luxury vehicles. The US, in particular, continues to be a key market driver.

China: Shows explosive growth potential, with a rapidly expanding affluent population and increasing demand for premium vehicles, especially SUVs.

Europe: Established luxury car manufacturers from this region maintain a significant market share globally and benefit from a well-established premium automotive ecosystem.

Electric SUVs: This segment is expected to experience exceptional growth due to the convergence of environmental awareness, technological advancements, and the practicality of SUVs.

High-Performance Sports Cars: Though a smaller segment, this niche continues to exhibit robust growth driven by affluent consumers' desire for high-performance vehicles.

The paragraph below details further insights into the dominating regions and segments:

The North American and Chinese markets demonstrate contrasting yet equally significant growth drivers. North America's mature market exhibits steady demand fueled by strong consumer confidence and a sophisticated automotive infrastructure. China, on the other hand, is experiencing an unprecedented boom fueled by rapid economic growth and a massive surge in the affluent class. Within segments, electric SUVs are poised for explosive growth due to their combination of practicality, environmental responsibility, and the technological advancements available in the luxury electric vehicle space. High-performance sports cars, while representing a smaller niche, continue to attract a dedicated and affluent customer base, underpinning their sustained market presence. The confluence of these geographic and segment-specific factors suggests a dynamic and evolving market landscape with significant opportunities for growth across multiple regions and within diverse product categories.

Several factors are catalyzing growth within the luxury vehicle industry. The increasing adoption of electric and hybrid powertrains, driven by environmental concerns and government regulations, is opening up new market segments and technological advancements. The integration of advanced driver-assistance systems and autonomous driving features is enhancing the luxury experience and driving consumer demand. Furthermore, the rising popularity of subscription models and shared luxury services is altering consumer behavior and expanding access to luxury vehicles. Finally, continuous innovations in materials, design, and personalization options are providing consumers with ever-more exclusive and tailored experiences.

This report provides a comprehensive analysis of the luxury vehicle market, covering historical trends, current market dynamics, future projections, and key players. It offers valuable insights into market segmentation, growth drivers, challenges, and significant developments. The data presented allows for informed strategic decision-making within the luxury vehicle industry, offering a holistic view of this dynamic and evolving sector.

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of XX% from 2019-2033 |

| Segmentation |

|

Note*: In applicable scenarios

Primary Research

Secondary Research

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

The projected CAGR is approximately XX%.

Key companies in the market include Mercedes Benz, BMW, Audi, Lexus, Volvo, Land Rover, MINI, Cadillac, Porsche, Infiniti, Acura, Jaguar, Smart, Lincoln, Tesla, Maserati, Bentley, Ferrari, Rolls-Royce, Lamborghini, McLaren, Aston Martin, .

The market segments include Type, Application.

The market size is estimated to be USD 837110 million as of 2022.

N/A

N/A

N/A

N/A

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4480.00, USD 6720.00, and USD 8960.00 respectively.

The market size is provided in terms of value, measured in million and volume, measured in K.

Yes, the market keyword associated with the report is "Luxury Vehicles," which aids in identifying and referencing the specific market segment covered.

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

To stay informed about further developments, trends, and reports in the Luxury Vehicles, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.