1. What is the projected Compound Annual Growth Rate (CAGR) of the Luxury Sports Car?

The projected CAGR is approximately XX%.

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.

Luxury Sports Car

Luxury Sports CarLuxury Sports Car by Type (Fuel Car, Electric Car, Hybrid Car, World Luxury Sports Car Production ), by Application (Private, Commercial Lease, World Luxury Sports Car Production ), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2025-2033

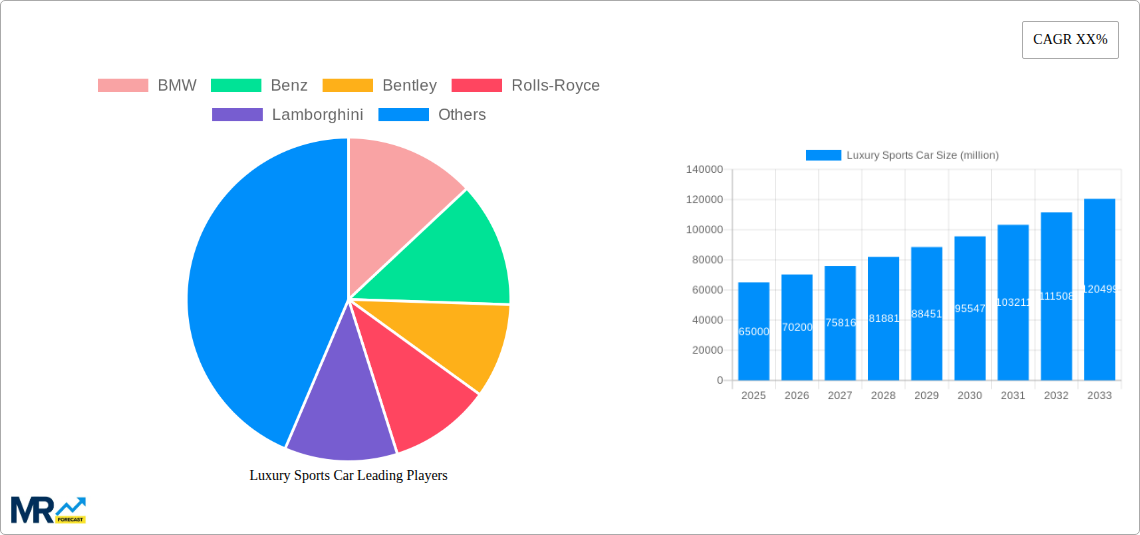

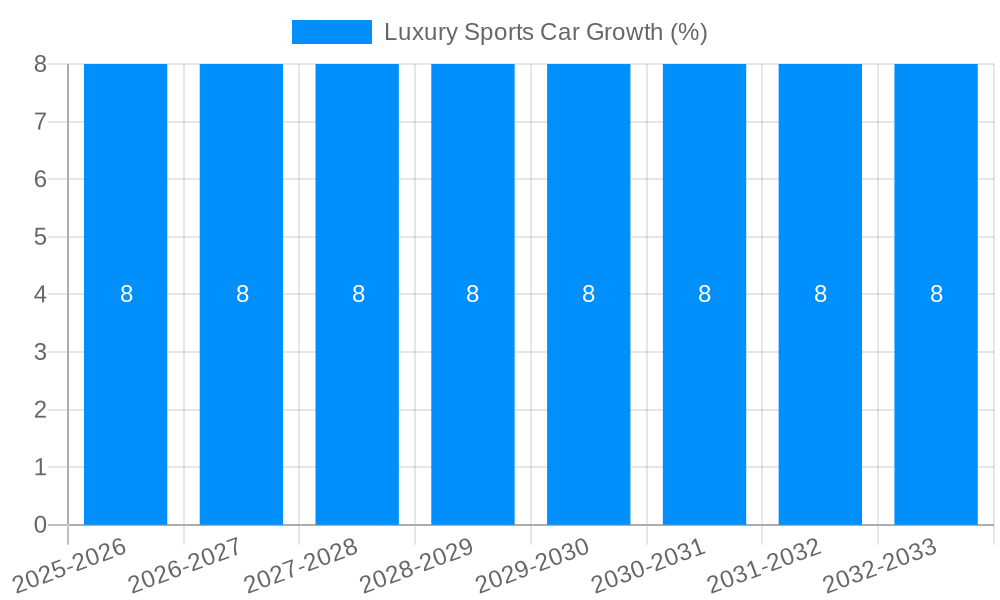

The global luxury sports car market is poised for substantial growth, with an estimated market size of \$65 billion in 2025, projected to expand at a Compound Annual Growth Rate (CAGR) of 8% through 2033. This robust expansion is fueled by a confluence of factors, chief among them being rising disposable incomes in emerging economies and a growing consumer appreciation for high-performance, premium automotive experiences. The increasing demand for cutting-edge technology, such as advanced driver-assistance systems, electrification, and sophisticated infotainment, further propels the market forward. Furthermore, the inherent aspirational appeal of luxury sports cars, coupled with their status as symbols of success and exclusivity, continues to drive consumer desire. The market is also benefiting from a steady stream of innovative product launches and a focus on personalization, allowing manufacturers to cater to the increasingly discerning tastes of affluent consumers.

However, the luxury sports car segment faces certain headwinds that could temper its growth trajectory. Stringent environmental regulations and a global push towards sustainable mobility are creating significant pressure for manufacturers to transition towards electric and hybrid powertrains, which can involve substantial R&D investments and production retooling. The high cost of these vehicles, coupled with potential economic downturns or geopolitical instabilities, can also lead to fluctuations in consumer spending on discretionary luxury goods. Despite these challenges, the market's core drivers remain strong. The segmentation by vehicle type indicates a significant shift towards Electric Cars and Hybrid Cars, reflecting the broader automotive industry's electrification trend. In terms of application, Private use will continue to dominate, underscoring the personal ownership and recreational aspect of luxury sports cars.

This in-depth report delves into the dynamic and exhilarating world of luxury sports cars, providing a comprehensive market analysis from the historical period of 2019-2024 to an estimated future trajectory up to 2033. With a base year of 2025, the report meticulously dissects the market's evolution, key growth drivers, prevailing challenges, and dominant segments, projecting a future where innovation and exclusivity continue to define this high-value sector. We will explore the impact of technological advancements, shifting consumer preferences, and evolving regulatory landscapes on an industry where vehicles are often valued in the millions.

The global luxury sports car market is experiencing a seismic shift, marked by a confluence of technological innovation, evolving consumer desires, and a renewed focus on sustainability, even within the realm of high-performance vehicles. XXX The historical period (2019-2024) witnessed a robust recovery post-pandemic, fueled by pent-up demand and a surge in disposable income among the ultra-high-net-worth individuals. While traditional internal combustion engine (ICE) powered supercars continue to command significant interest due to their visceral performance and heritage, a significant trend observed is the accelerating adoption of electrification. This is not merely a response to environmental concerns but also a quest for even more exhilarating performance figures. Electric powertrains, with their instantaneous torque delivery, are enabling a new breed of hypercars that redefine speed and acceleration, often pushing the boundaries of what was previously thought possible. The market is witnessing a bifurcation, with established manufacturers like Ferrari and Lamborghini introducing hybrid powertrains and dedicated electric performance models, while newer entrants, such as those from Pagani and Koenigsegg, are also exploring electrification to enhance their already formidable offerings. Furthermore, the concept of exclusivity is being redefined. Limited production runs, bespoke customization options, and unique ownership experiences are paramount. The value proposition extends beyond the sheer power of the engine; it encompasses craftsmanship, heritage, and the emotional connection a buyer forms with their meticulously engineered machine. The integration of advanced AI and connectivity features is also becoming standard, enhancing the driving experience and offering a glimpse into the future of automotive personalization. This intricate interplay of raw power, sustainable innovation, and unparalleled exclusivity will continue to shape the luxury sports car landscape throughout our study period, with projections for 2025-2033 indicating sustained growth, albeit with a progressively greener footprint. The study encompasses a diverse range of manufacturers, including iconic names like BMW, Mercedes-Benz, Bentley, Rolls-Royce, Lamborghini, Ferrari, Bugatti, Porsche, McLaren, Aston Martin, Pagani, and Koenigsegg, alongside their luxury counterparts from Lexus, and emerging players such as FAW GROUP (Hongqi). We also analyze the impact on traditional automotive giants like Toyota, Honda, Ford, Volkswagen, and Audi, who are either directly involved or indirectly influenced by the trends in this segment.

The enduring allure and sustained growth of the luxury sports car market are underpinned by a potent combination of aspirational desires and technological advancements. At its core, the demand for these vehicles is driven by the innate human fascination with speed, power, and cutting-edge engineering. For affluent consumers, a luxury sports car represents not just a mode of transportation, but a tangible symbol of success, status, and personal achievement. The inherent exclusivity associated with these high-priced machines, often with production numbers in the hundreds rather than millions, further amplifies their desirability. Beyond emotional appeal, technological innovation plays a crucial role. Manufacturers are continuously pushing the boundaries of performance, not only through more powerful and efficient internal combustion engines but also through the rapid integration of hybrid and fully electric powertrains. The pursuit of groundbreaking acceleration figures, superior handling dynamics, and advanced driver-assistance systems creates a compelling case for technological leadership, drawing in discerning buyers who seek the absolute pinnacle of automotive engineering. Furthermore, the evolving definition of luxury, which increasingly incorporates sustainability and responsible consumption, is also subtly influencing the market. The development of high-performance electric and hybrid sports cars allows consumers to indulge their passion for speed without compromising their environmental consciousness, opening up new avenues for growth and appealing to a younger generation of affluent buyers. The continuous investment in research and development by these elite manufacturers ensures a steady stream of groundbreaking models that keep the market vibrant and the demand consistently high.

Despite its inherent desirability and robust demand, the luxury sports car market is not without its significant hurdles. The most prominent challenge lies in the ever-increasing regulatory scrutiny and evolving environmental legislation across global markets. Stringent emissions standards and the push towards decarbonization necessitate substantial investments in developing cleaner powertrains, such as electric and hybrid technologies. While these advancements can be a growth catalyst, the transition requires significant capital expenditure and can impact profit margins, especially for manufacturers heavily reliant on traditional ICE technology. The high cost of research and development for these sophisticated powertrains, coupled with the expensive materials and artisanal craftsmanship involved in building these exclusive vehicles, contributes to their already astronomical price tags, potentially limiting the addressable market. Furthermore, the global economic climate and geopolitical uncertainties can have a pronounced impact on the discretionary spending of the ultra-wealthy. A downturn in global economic stability or significant geopolitical tensions can lead to a cautious approach in purchasing such high-value assets. Supply chain disruptions, as witnessed in recent years, can also pose a challenge in manufacturing these intricate vehicles, potentially leading to production delays and increased costs. The sheer complexity of sourcing specialized components and the reliance on a global network for their assembly can make them vulnerable to external shocks. Lastly, the growing environmental awareness among consumers, even in the luxury segment, puts pressure on manufacturers to demonstrate their commitment to sustainability, requiring a careful balancing act between performance and ecological responsibility.

The global luxury sports car market is a fascinating tapestry woven from regional preferences, segment dominance, and specific applications, all contributing to its multi-million-dollar valuation.

Dominant Segments:

Type: Electric Car: While historically dominated by roaring internal combustion engines, the Electric Car segment is rapidly emerging as a key contender for market dominance within the luxury sports car landscape, especially as we project towards 2033. The sheer exhilaration offered by instantaneous torque, coupled with silent, yet potent, acceleration, is redefining performance benchmarks. Manufacturers like Porsche with its Taycan Turbo S, Tesla with its Roadster (forthcoming), and even niche players are showcasing the potential of electric powertrains to deliver unparalleled driving experiences. The market value of these electric luxury sports cars is projected to climb significantly, with individual units often fetching prices in the high six to seven figures. This segment's growth is fueled by technological advancements in battery technology, charging infrastructure, and government incentives aimed at promoting EV adoption.

Application: Private: The overwhelming majority of luxury sports cars produced are destined for Private use. These vehicles are the ultimate expression of personal aspiration and automotive passion for high-net-worth individuals. The discerning buyer seeks not only raw performance but also unparalleled craftsmanship, bespoke customization options, and the emotional connection that comes with owning a rare and exquisite machine. The average transaction value in this segment remains exceptionally high, with many limited-edition models exceeding the $1 million mark. The demand for private ownership is consistently driven by the desire for exclusivity, status, and the pure joy of driving a supercar.

Dominant Regions/Countries:

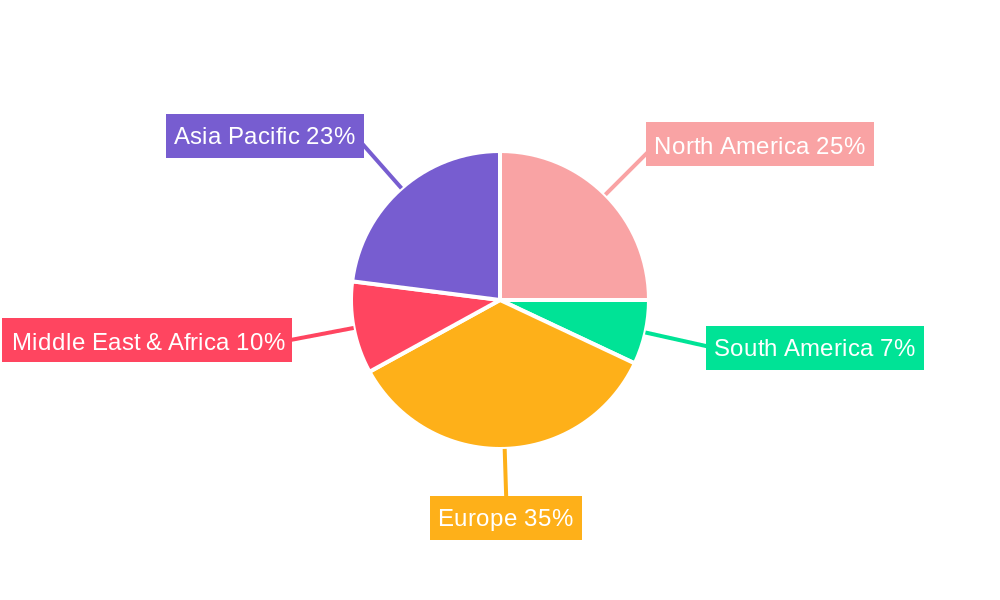

North America (particularly the USA): This region consistently represents a powerhouse for luxury sports cars, driven by a strong economy and a significant concentration of ultra-high-net-worth individuals. The USA, in particular, exhibits a deep appreciation for high-performance vehicles, with a well-established culture of supercar ownership. The market here is characterized by a demand for both established European marques and increasingly, domestic innovations in the hypercar space. The presence of numerous private collectors and a robust enthusiast community further solidifies North America's leading position. The sales figures in millions of dollars for this region are substantial, reflecting the sheer volume and value of transactions.

Europe: As the birthplace of many iconic luxury sports car brands such as Ferrari, Lamborghini, Bugatti, Porsche, McLaren, and Aston Martin, Europe remains a pivotal region. The European market is driven by a blend of heritage, engineering prowess, and a sophisticated consumer base that appreciates the legacy and craftsmanship embedded in these vehicles. The demand is robust across various segments, from high-performance grand tourers to track-focused hypercars. The affluent demographics in countries like Germany, the UK, Switzerland, and France contribute significantly to the multi-million-dollar market value, with a growing interest in the hybrid and electric variants as well.

Asia-Pacific (especially China and the Middle East): The Asia-Pacific region, particularly China and the affluent nations of the Middle East (e.g., UAE, Saudi Arabia), has emerged as a critical growth engine for luxury sports cars. Rapid wealth creation has fostered a burgeoning class of buyers who are eager to acquire the world's most exclusive and high-performance automobiles. China's expanding luxury market, coupled with the oil-rich economies of the Middle East, creates a significant demand for vehicles often valued in the millions. This region is increasingly influential in shaping design trends and driving demand for limited-edition models, contributing substantially to the global market value in the millions of dollars.

The interplay between these dominant segments and regions creates a dynamic market where innovation in electric powertrains and the continued allure of private ownership drive significant economic activity, measured in billions and trillions of dollars annually.

Several key factors are propelling the growth of the luxury sports car industry. The relentless pursuit of technological innovation, particularly in electrification and performance enhancement, is a significant catalyst. The increasing affluence of a global ultra-high-net-worth demographic, especially in emerging markets, fuels demand for exclusive and high-performance vehicles. Furthermore, the growing trend of experiential luxury, where ownership transcends mere transportation and becomes a lifestyle statement, encourages investment in these coveted machines. The introduction of bespoke customization options and limited-edition models further heightens desirability and exclusivity.

This comprehensive report provides an exhaustive analysis of the global luxury sports car market from 2019 to 2033, with a base year of 2025. It meticulously examines market dynamics, key trends, and growth catalysts, offering deep insights into the factors shaping this high-value sector. The report covers a wide array of segments, including Fuel Cars, Electric Cars, and Hybrid Cars, analyzing their respective market shares and projected growth. It also scrutinizes the dominant application segments: Private and Commercial Lease, alongside World Luxury Sports Car Production volumes and industry developments. By incorporating data on leading manufacturers like BMW, Mercedes-Benz, Bentley, Rolls-Royce, Lamborghini, Ferrari, Bugatti, Porsche, McLaren, Aston Martin, Pagani, Koenigsegg, Maserati, Lexus, and FAW GROUP (Hongqi), this report delivers a holistic understanding of the market's trajectory, its challenges, and its immense future potential.

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of XX% from 2019-2033 |

| Segmentation |

|

Note*: In applicable scenarios

Primary Research

Secondary Research

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

The projected CAGR is approximately XX%.

Key companies in the market include BMW, Benz, Bentley, Rolls-Royce, Lamborghini, Ferrari, Bugatti, TOYOTA, Honda, Ford, Porsche, Volkswagen, Audi, McLaren, Aston Martin, Pagani, Koenigsegg, Maserati, Lexus, FAW GROUP (Hongqi), .

The market segments include Type, Application.

The market size is estimated to be USD XXX million as of 2022.

N/A

N/A

N/A

N/A

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4480.00, USD 6720.00, and USD 8960.00 respectively.

The market size is provided in terms of value, measured in million and volume, measured in K.

Yes, the market keyword associated with the report is "Luxury Sports Car," which aids in identifying and referencing the specific market segment covered.

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

To stay informed about further developments, trends, and reports in the Luxury Sports Car, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.