1. What is the projected Compound Annual Growth Rate (CAGR) of the Luxury Spirit Packaging?

The projected CAGR is approximately XX%.

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.

Luxury Spirit Packaging

Luxury Spirit PackagingLuxury Spirit Packaging by Type (Bag-in-box, Pouch, Glass Bottles), by Application (Whiskey, Vodka, Tequila, Rum, Gin, Brandy), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2025-2033

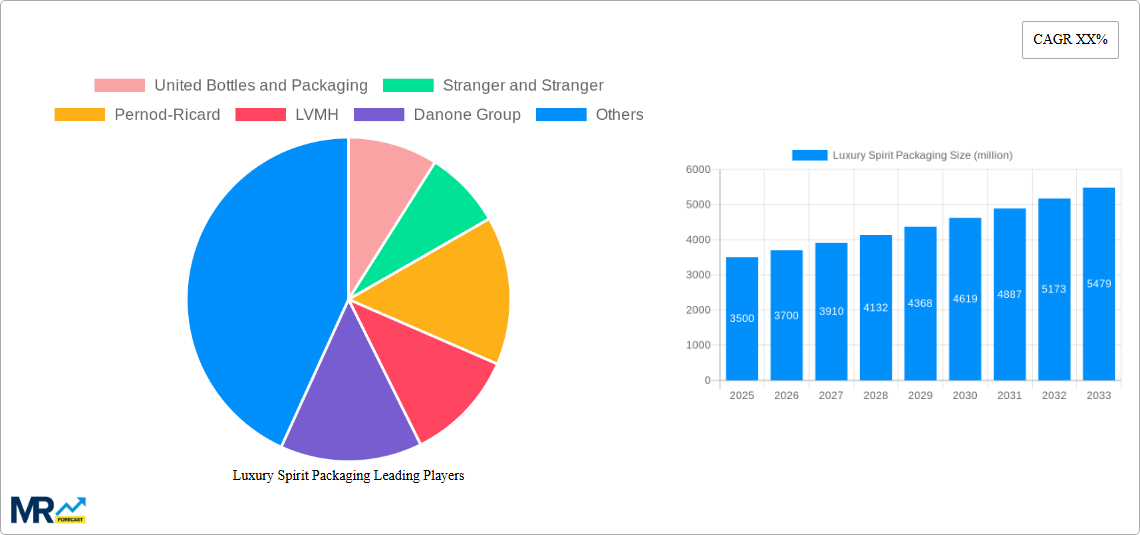

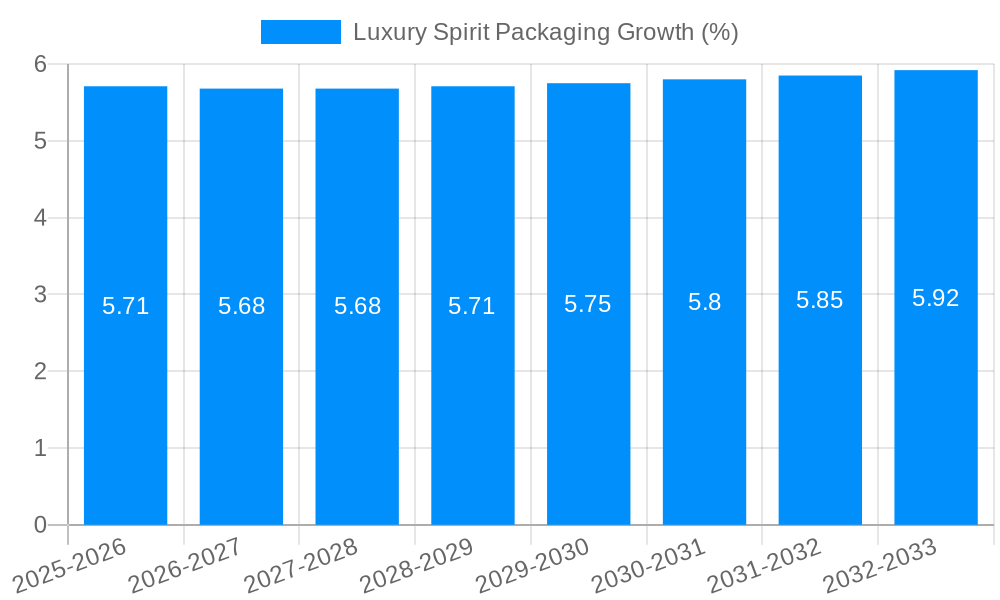

The luxury spirit packaging market is experiencing robust growth, driven by the increasing demand for premium spirits and a heightened consumer focus on brand experience and aesthetics. The market, estimated at $15 billion in 2025, is projected to exhibit a compound annual growth rate (CAGR) of 7% from 2025 to 2033, reaching approximately $28 billion by 2033. This growth is fueled by several key factors. Consumers are willing to pay a premium for unique and high-quality packaging that enhances the overall brand image and elevates the gifting experience. Furthermore, the rise of e-commerce and the growing popularity of luxury spirits in emerging markets are contributing to market expansion. Sustainable and eco-friendly packaging solutions are gaining traction, reflecting a broader consumer shift towards environmentally responsible practices. Leading players like United Bottles and Packaging, Stranger and Stranger, and Pernod Ricard are investing heavily in innovation and design to meet evolving consumer preferences and maintain a competitive edge. The market segmentation includes various packaging types like glass bottles, wooden boxes, and bespoke containers, each catering to specific price points and brand identities.

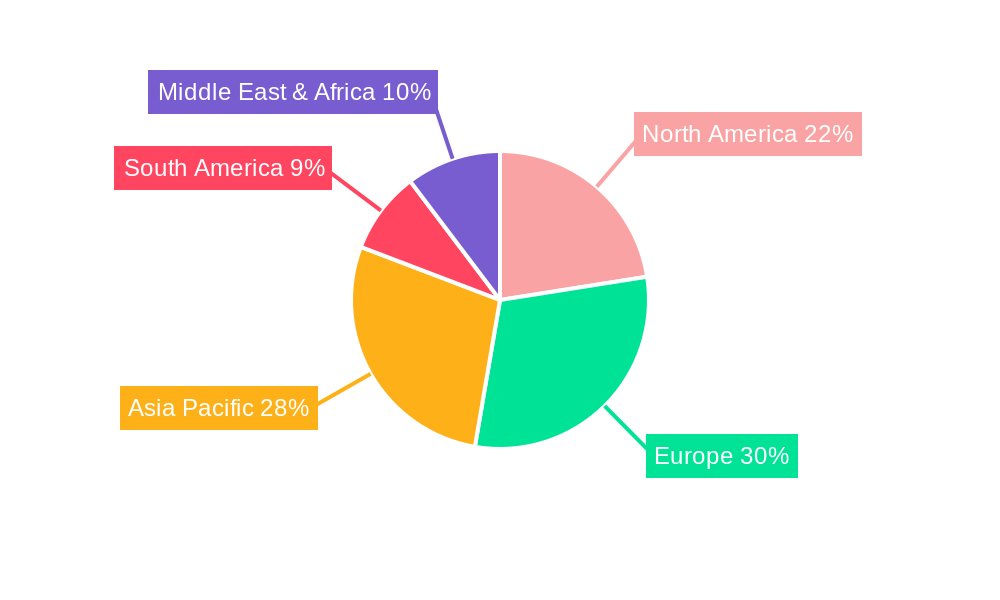

The competitive landscape is characterized by a mix of established players and innovative startups. Established brands leverage their strong brand recognition and distribution networks to maintain market share, while smaller companies focus on niche markets and customized solutions. Geographic variations exist, with North America and Europe currently holding the largest market shares. However, the Asia-Pacific region is showing significant growth potential, driven by rising disposable incomes and increasing demand for luxury goods. Challenges for market players include managing fluctuating raw material costs, ensuring sustainable sourcing practices, and adapting to changing consumer trends. Maintaining brand authenticity and combating counterfeiting remain ongoing concerns for luxury spirit brands. Overall, the future outlook for the luxury spirit packaging market is positive, with continued growth expected over the forecast period.

The luxury spirit packaging market, valued at several billion units in 2025, is experiencing a significant transformation driven by evolving consumer preferences and technological advancements. Over the historical period (2019-2024), we observed a steady growth trajectory, with the forecast period (2025-2033) promising even more substantial expansion. This growth is fueled by a confluence of factors, including the increasing demand for premium and artisanal spirits, a growing appreciation for sustainable and eco-friendly packaging solutions, and the rise of e-commerce, which necessitates packaging that can withstand shipping and handling while maintaining its aesthetic appeal. Consumers are increasingly willing to pay a premium for visually stunning and uniquely designed packaging, elevating the bottle from mere containment to a significant part of the brand experience. This trend is prompting a shift towards more innovative materials, such as sustainable wood, recycled glass, and intricate metal embellishments, replacing traditional, less visually striking options. The personalization trend is also making inroads, with brands offering bespoke packaging options tailored to individual consumer preferences, strengthening brand loyalty and driving sales. The market is seeing a move away from mass-produced, generic designs towards more exclusive, limited-edition packaging and collectible bottles, capitalizing on the desire for unique and luxurious possessions. The integration of technology, such as augmented reality features, QR codes linking to brand stories, and interactive elements, further enhances the consumer experience and creates a stronger brand connection. This holistic approach to luxury spirit packaging is driving market expansion and shaping future trends.

Several key factors are propelling the growth of the luxury spirit packaging market. The increasing disposable incomes in emerging economies, coupled with the rising popularity of premium spirits among affluent consumers worldwide, are driving demand for high-end packaging solutions. Consumers are increasingly discerning, seeking out unique and visually appealing packaging that reflects the quality and craftsmanship of the spirit itself. Brand differentiation is crucial in a crowded market, and luxury packaging offers a powerful way for brands to stand out and attract attention. The growing trend of gifting premium spirits further fuels the demand for attractive and sophisticated packaging, as presentation becomes a significant part of the gift-giving experience. Furthermore, the rising demand for sustainable and eco-friendly packaging options is creating new opportunities for manufacturers, with a focus on materials such as recycled glass, sustainably sourced wood, and biodegradable alternatives. The luxury segment is particularly receptive to these initiatives, as environmentally conscious consumers are increasingly seeking out brands that align with their values. Finally, technological advancements in packaging design and printing techniques are creating innovative and aesthetically pleasing options, further enhancing the desirability of premium spirit packaging and driving market growth.

Despite the significant growth potential, the luxury spirit packaging market faces several challenges. The high cost of premium materials and sophisticated production techniques can create a significant barrier to entry for smaller brands and limit market accessibility. Maintaining a balance between luxury and sustainability can also prove difficult, as environmentally conscious consumers seek sustainable options but are still seeking the premium look and feel of luxury packaging. The fluctuating prices of raw materials, particularly precious metals and exotic woods, pose a risk to profitability and pricing stability. Stringent regulatory requirements and compliance standards related to safety, labeling, and environmental impact also add complexity and increase production costs. Intense competition among established players and the emergence of new entrants necessitate continuous innovation and adaptation to maintain a competitive edge. Finally, counterfeiting and brand piracy pose a significant threat, as the high value and desirability of luxury spirit packaging make it a target for illicit activities. Addressing these challenges effectively is crucial for sustained growth in this competitive market.

North America: The high disposable incomes and strong consumer preference for premium spirits make North America a dominant market for luxury spirit packaging. The region displays a high rate of adoption of new technologies and sustainable materials.

Europe: Traditional spirit-producing regions in Europe, such as France, Italy, and Scotland, maintain a significant market share. The strong presence of established luxury brands and a sophisticated consumer base contribute to high demand.

Asia-Pacific: Rapid economic growth and a rising middle class are driving increasing demand for premium spirits and luxury packaging in countries like China, Japan, and South Korea.

Segments: The high-end glass bottles segment is likely to dominate due to its long-standing association with luxury and prestige. Custom-designed wooden boxes and other unique packaging forms targeting the premium niche also show strong growth potential. The growing interest in sustainable and eco-friendly packaging presents significant opportunities for innovative materials and design solutions. The limited-edition and collector's items segment will experience growth driven by strong consumer interest in unique, highly desirable packaging.

In summary, the confluence of affluence, consumer preference, and brand differentiation strategies positions the North American and European markets as dominant, while rapid growth is expected from the Asia-Pacific region. Within segments, high-end glass coupled with customized luxury cases will remain the leading area of the market.

The luxury spirit packaging market is experiencing robust growth propelled by several factors: rising disposable incomes, the growing popularity of premium spirits, a focus on brand differentiation through unique packaging, the increasing demand for sustainable packaging options, and technological advancements enabling innovative designs. These factors create a positive feedback loop accelerating further market expansion.

This report offers a comprehensive analysis of the luxury spirit packaging market, covering historical data, current market trends, and future growth projections. It provides valuable insights into key market drivers and restraints, along with an in-depth examination of the competitive landscape and leading players. The report also identifies key regional and segmental growth opportunities, offering detailed analysis of market dynamics and valuable strategic recommendations for stakeholders. The extensive data and forecasts provide a holistic perspective on the market, equipping businesses with the information needed to make informed decisions and capitalize on emerging opportunities.

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of XX% from 2019-2033 |

| Segmentation |

|

Note*: In applicable scenarios

Primary Research

Secondary Research

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

The projected CAGR is approximately XX%.

Key companies in the market include United Bottles and Packaging, Stranger and Stranger, Pernod-Ricard, LVMH, Danone Group, Suntory, Kirin Holdings, ITO EN Group, Heineken, Jacobs Douwe Egberts, Scholle IPN, Saxon Packaging, BIG SKY PACKAGING, LiDestri Spirits, AstraPouch, .

The market segments include Type, Application.

The market size is estimated to be USD XXX million as of 2022.

N/A

N/A

N/A

N/A

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3480.00, USD 5220.00, and USD 6960.00 respectively.

The market size is provided in terms of value, measured in million and volume, measured in K.

Yes, the market keyword associated with the report is "Luxury Spirit Packaging," which aids in identifying and referencing the specific market segment covered.

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

To stay informed about further developments, trends, and reports in the Luxury Spirit Packaging, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.