1. What is the projected Compound Annual Growth Rate (CAGR) of the Low-floor Tram?

The projected CAGR is approximately XX%.

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.

Low-floor Tram

Low-floor TramLow-floor Tram by Type (100% Low-floor Tram, 70% Low-floor Tram, World Low-floor Tram Production ), by Application (Scenic Spot, Urban Traffic, World Low-floor Tram Production ), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2025-2033

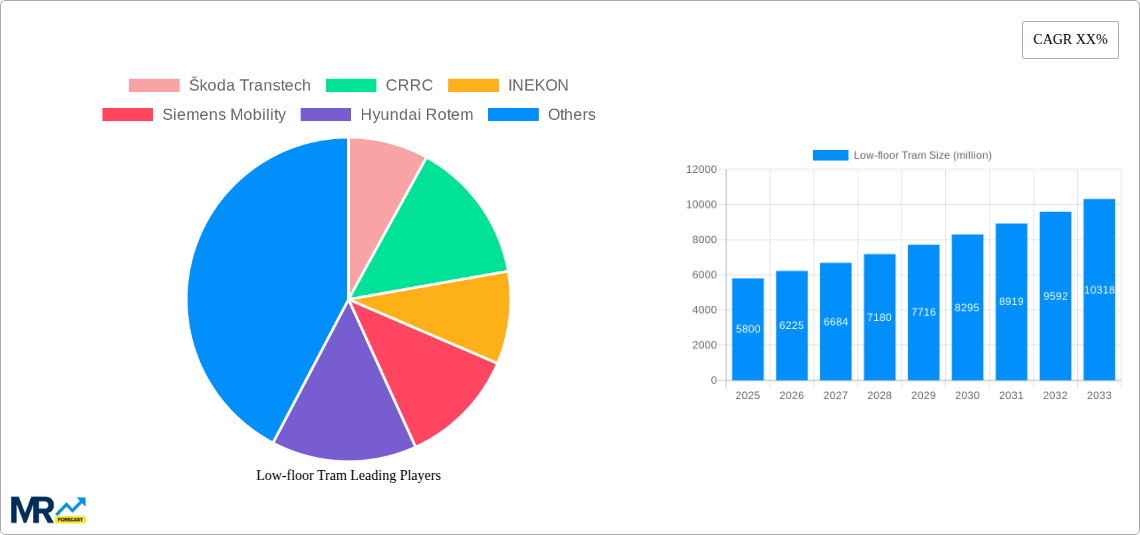

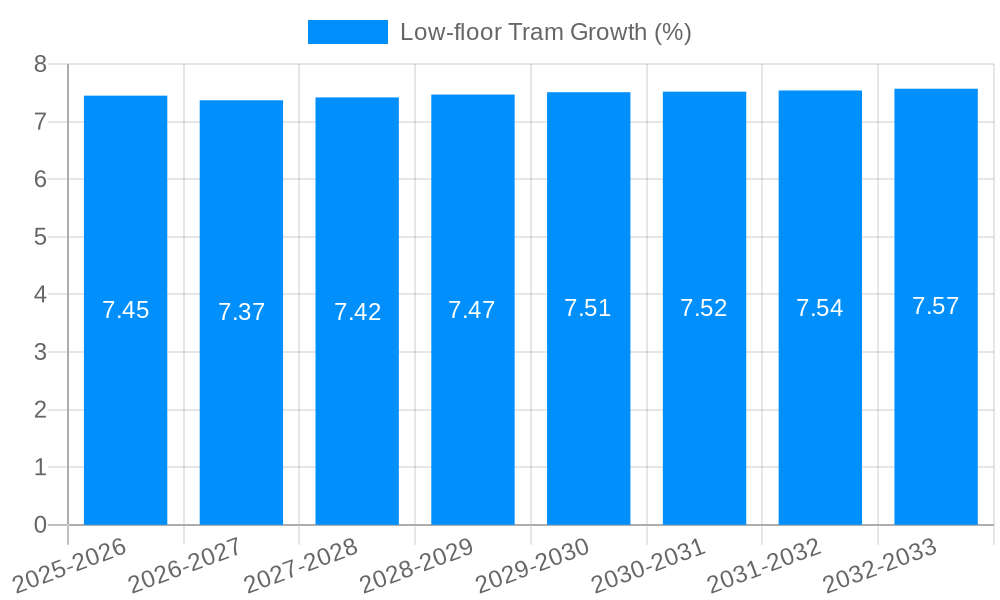

The global low-floor tram market is poised for significant expansion, driven by increasing urbanization, a growing demand for sustainable public transportation, and government initiatives promoting eco-friendly mobility solutions. With an estimated market size of $5,800 million in 2025, the sector is projected to witness a robust Compound Annual Growth Rate (CAGR) of 7.2% through 2033. This growth is underpinned by the inherent advantages of low-floor trams, including enhanced accessibility for all passengers, improved boarding and alighting efficiency, and a reduced environmental footprint compared to traditional public transport. The market is broadly segmented by type into 100% low-floor trams and 70% low-floor trams, with 100% low-floor variants gaining traction due to their superior accessibility features. Applications are primarily concentrated in urban traffic and scenic spots, reflecting the tram's role in both daily commuting and tourism. Key players like CRRC, Siemens Mobility, and Alstom are at the forefront of innovation, developing advanced, energy-efficient models to meet evolving market needs.

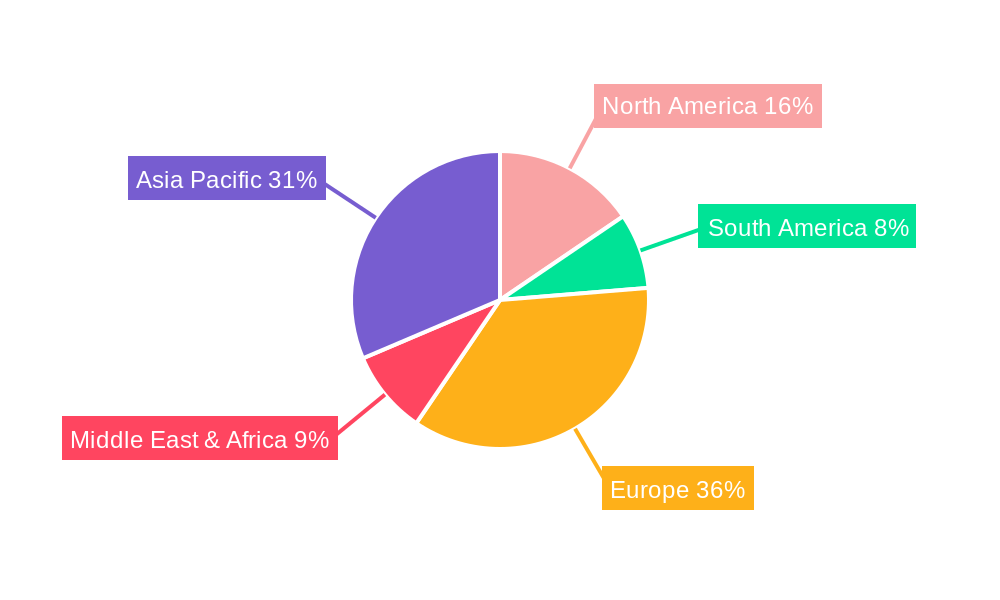

The market's upward trajectory is further fueled by ongoing infrastructure development in emerging economies and a renewed focus on revitalizing urban public transit systems in established regions. Challenges, such as high initial investment costs and the need for dedicated track infrastructure, are being addressed through technological advancements and strategic partnerships between manufacturers and urban planners. The Asia Pacific region, particularly China and India, is expected to be a major growth engine, owing to rapid urbanization and substantial investments in public transportation networks. Europe, a mature market with extensive tram networks, will continue to be a significant contributor, driven by modernization projects and sustainability goals. North America is also showing promising growth as cities explore innovative transit solutions. The emphasis on rider comfort, safety, and operational efficiency will continue to shape product development and market strategies in the coming years.

This comprehensive report delves into the global low-floor tram market, offering an in-depth analysis of market dynamics, key trends, driving forces, and future projections. Spanning a study period from 2019 to 2033, with a base year of 2025 and a forecast period of 2025-2033, this report provides invaluable insights for stakeholders. The report examines historical data from 2019-2024 to establish a robust foundation for future estimations. It quantifies the market size in the millions of units and focuses on critical aspects shaping the industry's trajectory.

XXX The global low-floor tram market is witnessing a significant surge in demand, driven by increasing urbanization and a growing emphasis on sustainable transportation solutions. The shift from traditional high-floor trams to low-floor models is a defining trend, offering enhanced accessibility for passengers with reduced mobility, including the elderly and individuals using wheelchairs. This focus on inclusivity is a cornerstone of modern urban planning, making low-floor trams a preferred choice for public transit authorities. The market is also experiencing a notable evolution in tram technology, with manufacturers investing heavily in research and development to incorporate advanced features such as improved energy efficiency, enhanced passenger comfort, and smart connectivity solutions. The increasing adoption of 100% low-floor trams signifies a commitment to complete accessibility, while the continued presence of 70% low-floor variants caters to evolving infrastructure and budget considerations. The World Low-floor Tram Production segment is expected to see substantial growth, reflecting the global expansion of tram networks and the retirement of older fleets. Scenic spot applications, leveraging the aesthetic appeal and eco-friendliness of trams, are emerging as a niche but growing segment. Urban traffic remains the dominant application, as cities worldwide grapple with congestion and pollution, seeking efficient and environmentally sound public transport alternatives. The demand for larger capacity trams to cater to burgeoning urban populations is also a key trend, pushing manufacturers to innovate in terms of vehicle design and operational efficiency. Furthermore, the integration of trams with other public transport modes, creating seamless multimodal networks, is a significant trend that will shape the future of urban mobility. This interconnectedness is crucial for optimizing passenger flow and reducing reliance on private vehicles. The market's growth is also underpinned by supportive government policies and investments in public transportation infrastructure across various countries, aiming to create smarter and greener cities.

The low-floor tram market's expansion is primarily fueled by a confluence of global megatrends and strategic initiatives. Paramount among these is the relentless pace of urbanization. As cities across the globe swell, so does the demand for efficient, high-capacity, and environmentally friendly public transportation systems. Low-floor trams, with their inherent accessibility and operational flexibility, are perfectly positioned to address these evolving urban mobility needs. They offer a superior alternative to traditional buses, which often contribute to traffic congestion and air pollution. Government initiatives and policies play a pivotal role. Many nations are actively promoting public transport investment as a cornerstone of their sustainability agendas, offering subsidies, tax incentives, and favorable regulations that encourage the adoption of low-floor tram systems. The increasing global awareness and concern regarding climate change and environmental degradation are also significant drivers. Low-floor trams, powered by electricity, represent a clean and green mode of transport, drastically reducing carbon footprints compared to fossil fuel-dependent vehicles. Furthermore, the aging global population and a growing emphasis on inclusive societies are pushing for greater accessibility in public infrastructure. Low-floor trams significantly enhance mobility for the elderly, individuals with disabilities, and parents with strollers, making them a socially responsible and increasingly mandated choice for urban transit. The pursuit of economic development, often linked to improved infrastructure, also contributes, as efficient public transport networks are vital for facilitating commerce and connecting communities.

Despite the robust growth trajectory, the low-floor tram market encounters several significant challenges and restraints that could potentially impede its full potential. A primary hurdle is the substantial initial capital investment required for the procurement of low-floor trams and the subsequent infrastructure development, including dedicated tracks, signaling systems, and depot facilities. This can be a considerable barrier for municipalities with constrained budgets. The integration of new tram lines into existing urban landscapes can also be complex and disruptive, often involving extensive civil engineering work, land acquisition, and the displacement of existing infrastructure, leading to delays and increased costs. Regulatory complexities and the lengthy approval processes associated with public transport projects can also prolong deployment timelines. Furthermore, the maintenance and operational costs of low-floor tram systems, while often competitive in the long run, can be perceived as high in the short to medium term, especially when compared to less capital-intensive alternatives. The need for specialized skilled labor for both manufacturing and maintenance also presents a challenge in certain regions. Moreover, the market is susceptible to technological obsolescence, requiring continuous investment in upgrades and modernizations to remain competitive and meet evolving passenger expectations. Competition from other modes of public transport, such as advanced bus rapid transit (BRT) systems and light rail vehicles, can also pose a restraint, particularly in areas where the established infrastructure favors these alternatives. Finally, public acceptance and community engagement are crucial; any perceived disruption during construction or operational issues can lead to public opposition, slowing down project implementation.

The 100% Low-floor Tram segment is poised to exhibit the most significant dominance in the global market, driven by an unwavering commitment to universal accessibility and modern urban transit standards. This segment caters to the growing imperative for public transportation systems that are inherently inclusive, removing barriers for elderly passengers, individuals with disabilities, parents with prams, and those with luggage. As urban planners and transport authorities worldwide prioritize equity and ease of use, the demand for trams that offer a completely level boarding experience is escalating. This trend is particularly pronounced in developed economies and rapidly developing cities that are investing in state-of-the-art public transport infrastructure.

Key Regions and Countries Driving Dominance:

Europe: This region has historically been a frontrunner in adopting advanced public transportation solutions, and the push for 100% low-floor trams is exceptionally strong. Countries like Germany, France, Switzerland, and the Netherlands are leading the charge with extensive tram networks and continuous fleet modernization programs. The established infrastructure and the proactive stance of European cities in embracing sustainable mobility solutions make them a dominant force. The market value in this region alone is projected to reach several thousand million Euros in the forecast period, with significant investments in new tram lines and fleet renewals.

North America: While traditionally more focused on road-based transport, North America is witnessing a resurgence in light rail and tram systems, particularly in major metropolitan areas. Cities such as Portland, Denver, and Toronto are expanding their tram networks and increasingly opting for 100% low-floor designs to enhance passenger experience and accessibility. The market size in this region is expected to grow by hundreds of millions of dollars annually, driven by urban regeneration projects and environmental mandates.

Asia-Pacific: This region presents a dynamic growth landscape. China, with its rapid urbanization and massive investments in public transport, is a significant player, though a substantial portion of its existing fleet may still include 70% low-floor variants. However, new projects and fleet upgrades are heavily leaning towards 100% low-floor solutions. Cities in Australia (e.g., Melbourne, Sydney) and increasingly in Southeast Asia are also adopting these accessible trams. The market value in this region is projected to experience double-digit growth, reaching billions of dollars by the end of the forecast period.

Other Emerging Markets: Countries in Latin America and the Middle East are also gradually incorporating low-floor tram technology, with 100% low-floor designs becoming the preferred choice for new projects aiming for international standards of accessibility and sustainability. While the market share might be smaller currently, the growth potential is substantial.

Segment Dominance Rationale: The preference for 100% low-floor trams is not merely a matter of convenience; it is increasingly becoming a regulatory requirement and a benchmark for modern urban transit. The associated benefits, such as reduced dwell times at stops due to faster boarding and alighting, and improved passenger flow, contribute to the overall efficiency of the public transport system. The integration of advanced technologies, such as digital information displays, climate control, and enhanced safety features, further bolsters the appeal of this segment. The World Low-floor Tram Production output will naturally be dominated by the production of these 100% low-floor models to meet the global demand. This segment's dominance is therefore intrinsically linked to the overall growth and modernization of urban rail transit systems worldwide.

Several factors are acting as significant catalysts for growth within the low-floor tram industry. The persistent global trend of urbanization and the subsequent increasing demand for efficient, high-capacity public transportation systems are paramount. Governments worldwide are actively investing in public transit infrastructure to combat traffic congestion and reduce carbon emissions, often prioritizing eco-friendly solutions like trams. Furthermore, a growing emphasis on accessibility and inclusivity in urban mobility is a major driver, with low-floor designs being essential for catering to passengers with reduced mobility. Technological advancements in areas such as energy efficiency, passenger comfort, and smart connectivity are making low-floor trams more attractive and cost-effective.

This report provides a holistic and comprehensive analysis of the global low-floor tram market, offering in-depth insights across its entire value chain. It meticulously examines market size and growth projections in the millions of units, from the historical period of 2019-2024 through to the forecast period of 2025-2033, with a specific focus on the estimated year 2025. The report dissects key trends such as the increasing prevalence of 100% low-floor trams and the specific applications in urban traffic and scenic spots. It identifies the pivotal driving forces, including urbanization and sustainability mandates, while also addressing the critical challenges and restraints such as high initial investment and infrastructure integration. Crucially, the report highlights the dominant regions and segments, providing strategic context for market players. It further elaborates on the catalysts propelling industry growth and profiles the leading companies and their significant recent developments, offering a complete panorama for strategic decision-making.

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of XX% from 2019-2033 |

| Segmentation |

|

Note*: In applicable scenarios

Primary Research

Secondary Research

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

The projected CAGR is approximately XX%.

Key companies in the market include Škoda Transtech, CRRC, INEKON, Siemens Mobility, Hyundai Rotem, Alstom, Bombardier, Trade House BKM, Kawasaki.

The market segments include Type, Application.

The market size is estimated to be USD XXX million as of 2022.

N/A

N/A

N/A

N/A

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4480.00, USD 6720.00, and USD 8960.00 respectively.

The market size is provided in terms of value, measured in million and volume, measured in K.

Yes, the market keyword associated with the report is "Low-floor Tram," which aids in identifying and referencing the specific market segment covered.

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

To stay informed about further developments, trends, and reports in the Low-floor Tram, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.