1. What is the projected Compound Annual Growth Rate (CAGR) of the Liquid Chromatography Based Cannabis Analysis?

The projected CAGR is approximately XX%.

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.

Liquid Chromatography Based Cannabis Analysis

Liquid Chromatography Based Cannabis AnalysisLiquid Chromatography Based Cannabis Analysis by Type (/> Terpenoids Test, Microbiological Test, Cannabinoids Test), by Application (/> Pain Management, Seizures, Sclerosis, Others), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2025-2033

The liquid chromatography-based cannabis analysis market is experiencing robust growth, driven by the increasing legalization and commercialization of cannabis products globally. Stringent regulatory requirements for quality control and safety testing are fueling demand for accurate and reliable analytical methods, with liquid chromatography (LC) playing a crucial role. The market is segmented by various techniques within LC, including HPLC and UHPLC, each catering to specific analytical needs and throughput requirements. Key players are continuously innovating, developing advanced LC-MS and LC-UV methods optimized for the complex chemical composition of cannabis, improving sensitivity and speed of analysis. This demand is further amplified by the burgeoning research into the therapeutic benefits of cannabinoids, requiring sophisticated analytical tools to understand their pharmacokinetic and pharmacodynamic properties. The market is expected to witness a significant rise in adoption across various sectors, including pharmaceutical companies developing cannabinoid-based drugs, testing laboratories ensuring product compliance, and research institutions exploring cannabis's medicinal potential.

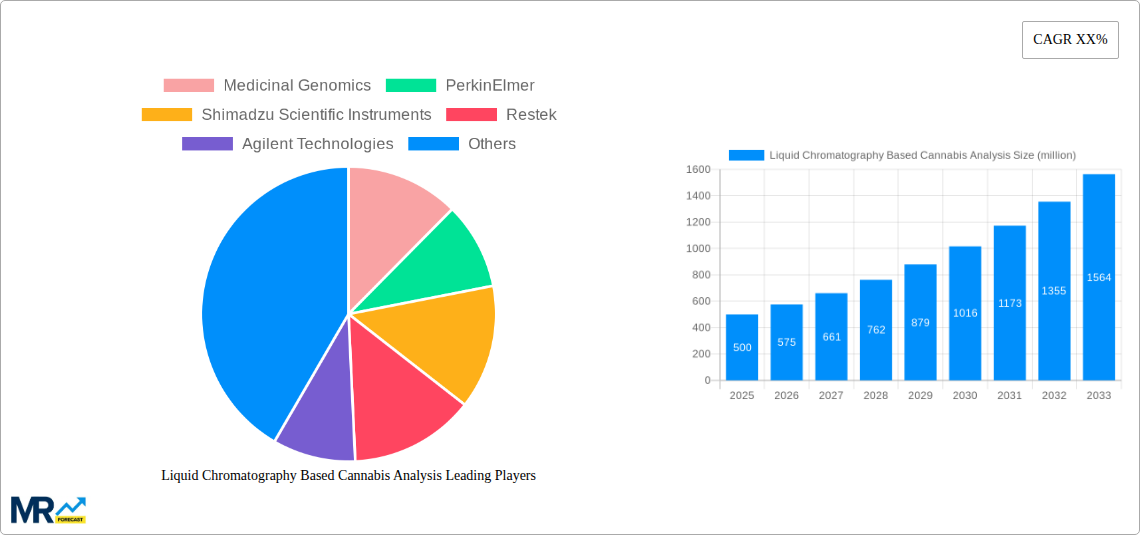

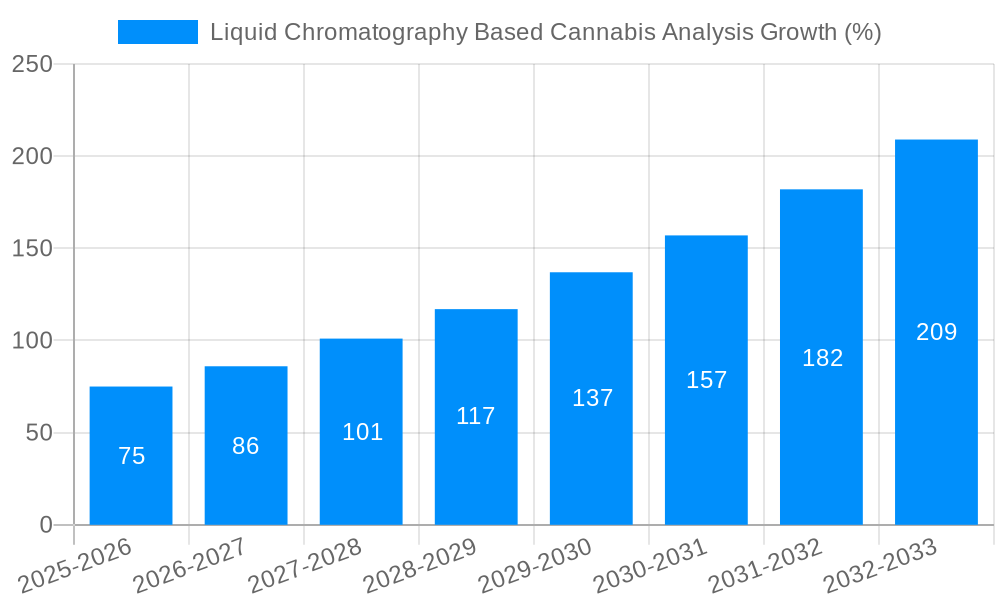

This market expansion is projected to continue over the forecast period (2025-2033), propelled by several factors. The expanding global cannabis market, coupled with increasing consumer awareness and demand for quality-assured products, creates a continuous need for sophisticated analytical testing. Furthermore, technological advancements in LC instrumentation, software, and data analysis capabilities continue to improve efficiency and accuracy, further driving market growth. However, challenges remain, including the high cost of advanced LC systems and the need for skilled personnel to operate and interpret the results. Despite these restraints, the substantial growth potential, particularly in North America and Europe, is expected to attract significant investment and innovation in the liquid chromatography based cannabis analysis market, paving the way for future expansion and market diversification. A conservative estimate places the 2025 market size at $500 million, with a compound annual growth rate (CAGR) of 15% projected through 2033.

The global liquid chromatography (LC) based cannabis analysis market is experiencing explosive growth, projected to reach multi-million dollar valuations within the forecast period (2025-2033). Driven by the burgeoning legal cannabis industry, increasing regulatory scrutiny demanding precise cannabinoid profiling, and advancements in LC technology, this market shows no signs of slowing down. The historical period (2019-2024) witnessed significant adoption of LC techniques for potency testing, terpene profiling, and pesticide residue analysis. This trend is expected to accelerate, with the estimated market value in 2025 exceeding several hundred million dollars. The market's expansion is fueled by the growing demand for consistent, reliable, and high-throughput analytical methods within cannabis production, processing, and quality control. This necessitates advanced technologies like high-performance liquid chromatography (HPLC) and ultra-high-performance liquid chromatography (UHPLC), which offer superior resolution, sensitivity, and speed compared to traditional methods. Consequently, the market is witnessing increased investment in research and development, leading to the introduction of innovative LC columns, detectors, and software solutions specifically tailored for cannabis analysis. Furthermore, the increasing awareness among consumers about the quality and safety of cannabis products further propels the demand for sophisticated analytical techniques such as LC-based methods, ensuring accurate labeling and preventing health risks. The market is also witnessing the integration of LC with other analytical techniques, such as mass spectrometry (MS), creating powerful hyphenated methods like LC-MS and LC-MS/MS for comprehensive cannabis characterization. This comprehensive approach to analysis ensures better quality control and facilitates the development of improved cannabis-based products. This continuous innovation and growing demand collectively contribute to the market’s impressive trajectory throughout the study period (2019-2033).

The rapid expansion of the legal cannabis industry is the primary driver behind the growth of the liquid chromatography-based cannabis analysis market. Governments across the globe are increasingly legalizing medical and recreational cannabis, leading to a surge in cannabis production and a parallel increase in the need for rigorous quality control. Regulations mandating accurate potency testing, pesticide screening, and terpene profiling are driving the adoption of advanced analytical techniques, including LC-based methods, within cannabis testing laboratories. LC offers unmatched accuracy and precision in quantifying cannabinoids such as THC and CBD, which are crucial for ensuring product safety and compliance. Furthermore, the complexity of the cannabis plant's chemical composition necessitates sophisticated analytical tools to identify and quantify hundreds of compounds. LC-MS/MS, for instance, proves invaluable in detecting even trace amounts of pesticides, heavy metals, and other contaminants, ensuring compliance with increasingly stringent regulatory standards. The demand for high-throughput analysis within the cannabis industry is another key factor driving the growth. LC systems, particularly UHPLC, offer high-speed analysis, enabling labs to process a larger number of samples efficiently, reducing turnaround times and meeting the ever-increasing demand for testing. This increased efficiency is crucial for companies involved in cannabis production and distribution, optimizing their operations and facilitating swift product release to the market.

Despite the significant growth potential, the liquid chromatography-based cannabis analysis market faces some challenges. The high cost of advanced LC equipment and specialized columns represents a significant barrier to entry for smaller cannabis testing laboratories. The sophisticated nature of the instruments requires highly trained personnel for operation and maintenance, which can be a considerable cost burden. This can especially hinder the growth of the market in smaller laboratories or companies with limited financial resources. The constantly evolving regulatory landscape presents another hurdle. The regulations regarding cannabis testing vary considerably across different jurisdictions, leading to complexity in standardization and method validation across different laboratories and regions. This necessitates continuous adaptations of analysis techniques and potentially inhibits the widespread use of standardized methods. Furthermore, the complexity of the cannabis matrix itself poses analytical challenges. The presence of numerous compounds with varying polarities and concentrations can interfere with the separation and quantification of target analytes, requiring meticulous sample preparation and optimization of LC methods. Ensuring the accuracy and reliability of the results across various testing labs is also paramount; lack of standardization might create inconsistency in testing results and complicate market harmonization. These challenges need to be addressed through technological advancements, improved standardization efforts, and collaboration between industry stakeholders to facilitate the continued growth of the market.

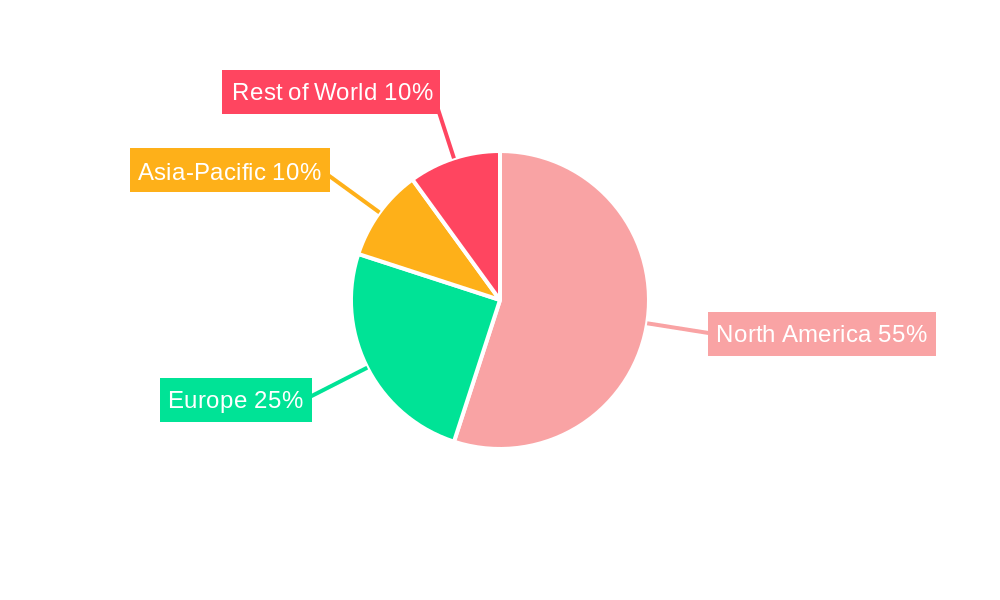

North America (United States and Canada): These countries have been at the forefront of cannabis legalization, leading to a significantly large and rapidly growing market for cannabis testing services. This high demand directly translates into increased adoption of LC-based analysis techniques. The well-established scientific infrastructure and presence of numerous cannabis testing labs in these regions further strengthens their dominance. The regulatory framework, despite its complexities, provides a defined pathway for market players, further driving growth.

Europe: While legalization efforts vary across different European countries, a growing number are embracing medical cannabis programs, creating an increasing demand for accurate and reliable cannabis analysis. This is fueling market expansion for LC-based analytical solutions in the region, especially with the emergence of sophisticated laboratories and testing centers.

Potency Testing Segment: This segment is expected to be the largest within the market. Accurate quantification of cannabinoids, such as THC and CBD, is crucial for product labeling and compliance with regulatory requirements. LC-based methods provide the necessary precision and accuracy for this critical aspect of cannabis analysis, leading to this segment's significant market share.

Pesticide Residue Analysis Segment: The growing concern over the presence of pesticides and other contaminants in cannabis products is driving the demand for robust analytical methods to ensure product safety. LC-MS/MS techniques are particularly well-suited for this purpose, allowing for the sensitive detection and quantification of various pesticide residues. This segment’s market share is driven by the stringent regulations imposed on cannabis products and the need to guarantee consumer safety.

The combined impact of these regional and segmental factors positions North America as the leading region, with the potency testing segment as the most dominant market segment, currently representing several hundred million dollars annually and forecast to reach billions within the forecast period.

The ongoing development of more sensitive and selective LC columns, coupled with advancements in mass spectrometry detectors, is accelerating the adoption of these technologies. Increased automation and software improvements are streamlining workflows, leading to higher throughput and reduced analysis times. Furthermore, the continuous improvement in regulatory guidelines promoting standardization in cannabis testing procedures ensures greater market clarity and promotes wider adoption of LC-based analysis methods. The combination of these technological and regulatory advancements is creating a positive feedback loop, further fueling the expansion of this dynamic market.

This report provides a comprehensive overview of the liquid chromatography-based cannabis analysis market, encompassing historical data, current market trends, and future projections. It offers detailed analysis of market segments, key players, driving factors, challenges, and regional insights. The report is designed to provide a clear and concise understanding of the market dynamics, enabling businesses and stakeholders to make informed decisions related to investment, product development, and market strategy within this rapidly growing sector.

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of XX% from 2019-2033 |

| Segmentation |

|

Note*: In applicable scenarios

Primary Research

Secondary Research

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

The projected CAGR is approximately XX%.

Key companies in the market include Medicinal Genomics, PerkinElmer, Shimadzu Scientific Instruments, Restek, Agilent Technologies, LabLynx, PharmLabs, Digipath Labs.

The market segments include Type, Application.

The market size is estimated to be USD XXX million as of 2022.

N/A

N/A

N/A

N/A

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4480.00, USD 6720.00, and USD 8960.00 respectively.

The market size is provided in terms of value, measured in million.

Yes, the market keyword associated with the report is "Liquid Chromatography Based Cannabis Analysis," which aids in identifying and referencing the specific market segment covered.

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

To stay informed about further developments, trends, and reports in the Liquid Chromatography Based Cannabis Analysis, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.