1. What is the projected Compound Annual Growth Rate (CAGR) of the Non - Laboratory - based Cannabis Testing?

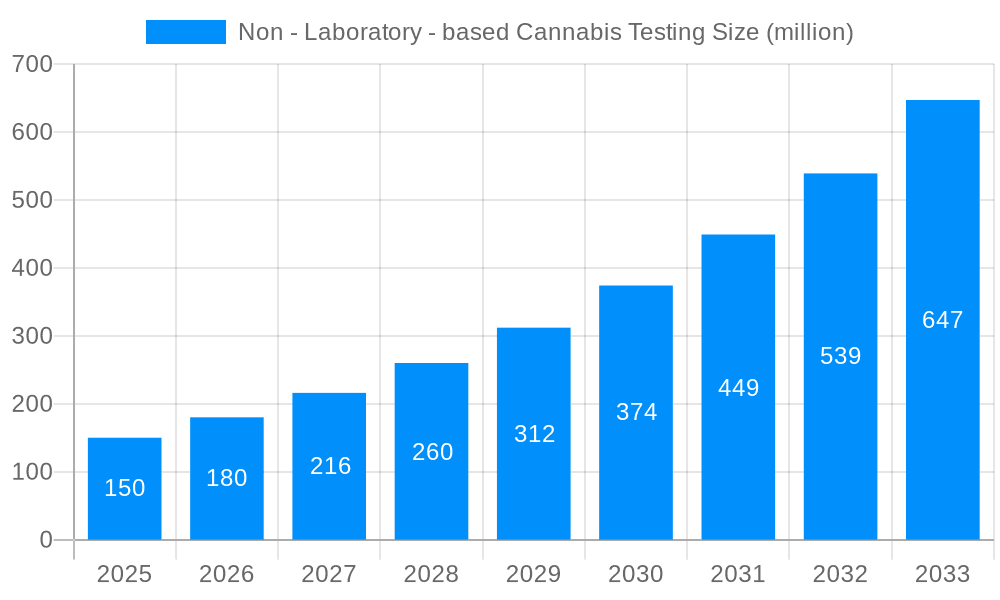

The projected CAGR is approximately 18%.

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.

Non - Laboratory - based Cannabis Testing

Non - Laboratory - based Cannabis TestingNon - Laboratory - based Cannabis Testing by Type (/> Chromatography, Spectroscopy, Others), by Application (/> Recreation, Agriculture, Others), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2026-2034

The non-laboratory-based cannabis testing market is projected for significant expansion, driven by global cannabis industry growth and increasing legalization. Demand for rapid, on-site testing solutions is accelerating, meeting the needs of producers, dispensaries, and consumers for convenient and cost-effective verification of cannabis product potency, purity, and safety. Technological advancements in handheld devices and rapid testing kits enable swift analysis of cannabinoid profiles, terpenes, pesticides, and contaminants, overcoming traditional laboratory limitations in turnaround time and accessibility, particularly in regions with developing infrastructure. The market is segmented by testing type (cannabinoid content, pesticide residue, terpene profile), device type (handheld devices, test kits), and end-user (producers, dispensaries, consumers). Key industry players are focused on innovation to enhance accuracy, usability, and affordability, supporting robust market growth.

Despite strong growth potential, regulatory hurdles concerning the acceptance and standardization of non-laboratory testing methods present a significant challenge. Ensuring the accuracy and reliability of these methods against laboratory-based analyses is critical for consumer trust and industry credibility. Intensifying competition necessitates continuous product innovation and may lead to price pressures. Future market success depends on navigating regulatory landscapes, consistent technological advancements, and broader adoption across the cannabis supply chain. The market is expected to experience sustained growth, with potential for consolidation as established companies acquire innovative firms.

The non-laboratory-based cannabis testing market is experiencing explosive growth, projected to reach several billion dollars by 2033. This surge is driven by the increasing legalization and commercialization of cannabis across North America and Europe, coupled with a rising consumer demand for safe and high-quality products. This trend necessitates rapid, convenient, and cost-effective testing solutions beyond traditional laboratory settings. The market is witnessing a shift from time-consuming and expensive lab-based testing to rapid, on-site analysis methods. This is fueled by the need for faster turnaround times in production and quality control, particularly in the burgeoning cannabis retail sector. The demand for point-of-sale testing devices is particularly strong, allowing for immediate verification of product potency and purity, thus enhancing consumer trust and reducing the risk of purchasing counterfeit or adulterated goods. Furthermore, the development of sophisticated yet user-friendly handheld devices is significantly reducing the technical expertise required for accurate testing, enabling smaller businesses and cultivators to conduct their own quality control checks. This democratization of cannabis testing is a key driver of market expansion. The historical period (2019-2024) showed a steady rise, with the estimated market value in 2025 already exceeding several hundred million dollars. The forecast period (2025-2033) is poised for exponential growth, fueled by technological advancements and increasing regulatory scrutiny. Key market insights reveal a strong preference for portable, easy-to-use devices capable of delivering reliable results quickly. The market is also highly competitive, with companies constantly innovating to improve accuracy, speed, and affordability. This constant drive for innovation ensures the non-laboratory-based cannabis testing market remains a dynamic and rapidly expanding sector.

Several factors are accelerating the adoption of non-laboratory-based cannabis testing. Firstly, the increasing legalization of cannabis worldwide creates a larger market demanding efficient quality control. Secondly, the rising consumer awareness of product quality and safety necessitates quick and readily available testing solutions. Consumers are becoming more discerning, demanding transparent information about the cannabis products they purchase, which drives the demand for on-site testing capabilities. Thirdly, the cost-effectiveness of non-laboratory methods compared to traditional lab testing makes them particularly attractive to smaller cannabis businesses and cultivators. Reduced testing costs lead to increased profitability, encouraging wider adoption. The speed and convenience offered by portable testing devices are also significant drivers. These devices allow for immediate results, significantly streamlining the production process and reducing delays compared to traditional lab testing which can often take several days. Finally, technological advancements leading to more accurate, reliable, and user-friendly devices further propel market growth. The development of sophisticated sensors and improved analytical techniques contributes to the overall appeal and adoption of these testing methods. The convergence of these factors paints a compelling picture of continued and rapid growth within the non-laboratory-based cannabis testing sector.

Despite the significant growth potential, the non-laboratory-based cannabis testing market faces certain challenges. One major hurdle is ensuring the accuracy and reliability of these rapid tests. Concerns persist about the potential for false positive or false negative results, impacting product quality assurance. Regulatory hurdles represent another challenge, as varying regulations across different jurisdictions can create complexities for manufacturers and distributors seeking market access. The need for standardized testing protocols and certifications is crucial for building trust and ensuring the widespread acceptance of these methods. Moreover, the market is still relatively nascent, with ongoing technological advancements and refinements needed to improve the accuracy, sensitivity, and range of analytes detectable by these devices. Competition is fierce, with numerous players vying for market share. This forces companies to constantly innovate and invest in research and development to maintain their competitiveness. Ensuring appropriate training and education for users of these devices is also vital to prevent misinterpretations and erroneous results. Ultimately, the successful growth of this sector hinges on addressing these challenges through improved technology, stricter regulatory frameworks, and robust quality control measures.

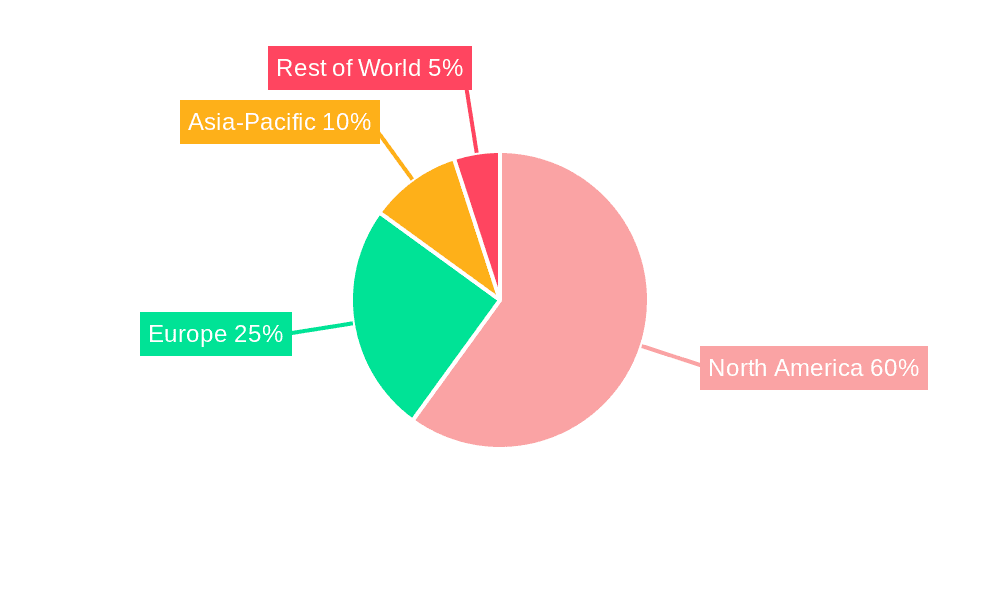

The North American market, particularly the United States and Canada, is expected to dominate the non-laboratory-based cannabis testing market during the forecast period (2025-2033). This dominance stems from the advanced stage of cannabis legalization and the substantial size of the cannabis industry in these regions. Within North America, states like California, Colorado, and Oregon are projected to lead due to their established cannabis markets and stringent regulatory frameworks driving the need for rapid testing solutions.

The point-of-sale testing segment is anticipated to witness significant growth due to its ability to immediately verify product potency and purity, boosting consumer confidence and reducing the risk of purchasing counterfeit or substandard products.

The market is expected to experience a Compound Annual Growth Rate (CAGR) in the millions of dollars during the forecast period, showing significant potential. The continued expansion of legal cannabis markets, coupled with advancements in non-laboratory testing technologies, will further drive this growth.

The burgeoning legal cannabis industry, coupled with increasing consumer demand for safe and high-quality products, is significantly accelerating the growth of the non-laboratory-based cannabis testing market. The development of sophisticated, user-friendly, and cost-effective handheld testing devices is democratizing access to quality control, allowing smaller cultivators and businesses to perform their own testing. These factors, along with the increasing regulatory scrutiny emphasizing product safety and compliance, are creating a robust market for convenient and rapid testing solutions.

This report provides a comprehensive analysis of the non-laboratory-based cannabis testing market, encompassing market size estimations, growth drivers, challenges, key players, and future trends. It offers valuable insights into the evolving landscape of cannabis testing, assisting stakeholders in making informed decisions related to product development, market entry, and investment strategies. The forecast period, extending to 2033, offers a long-term perspective on the potential of this rapidly expanding market segment.

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 18% from 2020-2034 |

| Segmentation |

|

Note*: In applicable scenarios

Primary Research

Secondary Research

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

The projected CAGR is approximately 18%.

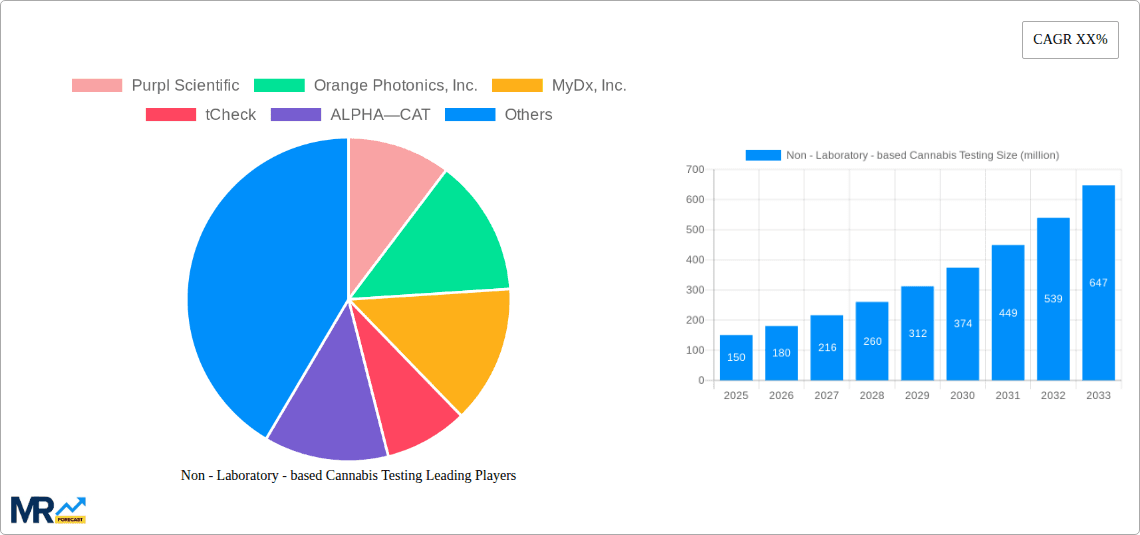

Key companies in the market include Purpl Scientific, Orange Photonics, Inc., MyDx, Inc., tCheck, ALPHA—CAT, Sage Analytics, Inc..

The market segments include Type, Application.

The market size is estimated to be USD 2129 million as of 2022.

N/A

N/A

N/A

N/A

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4480.00, USD 6720.00, and USD 8960.00 respectively.

The market size is provided in terms of value, measured in million.

Yes, the market keyword associated with the report is "Non - Laboratory - based Cannabis Testing," which aids in identifying and referencing the specific market segment covered.

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

To stay informed about further developments, trends, and reports in the Non - Laboratory - based Cannabis Testing, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.