1. What is the projected Compound Annual Growth Rate (CAGR) of the Liquid Aseptic Packaging Products?

The projected CAGR is approximately XX%.

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.

Liquid Aseptic Packaging Products

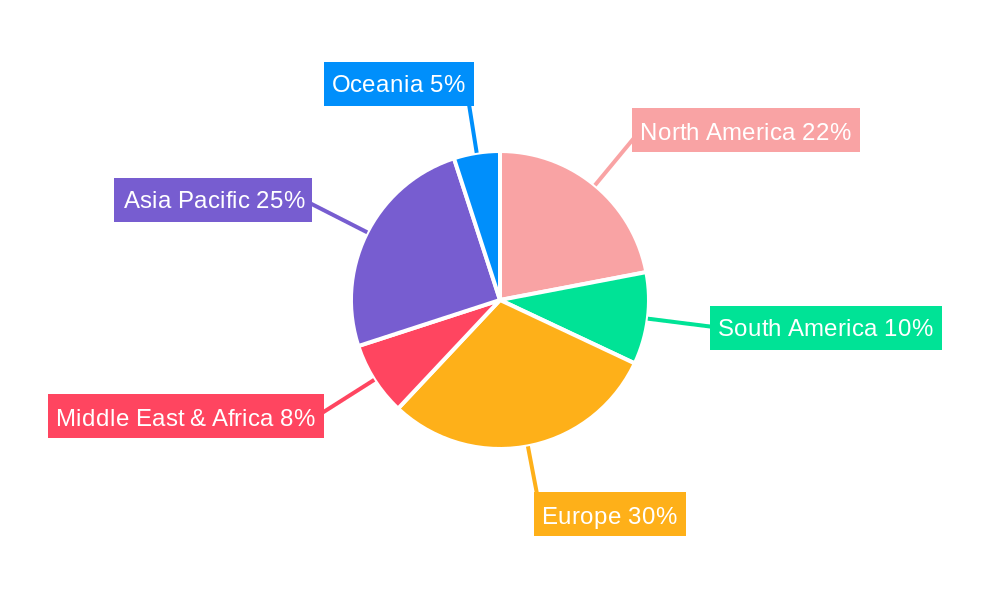

Liquid Aseptic Packaging ProductsLiquid Aseptic Packaging Products by Type (Refrigerated Packaging Products, Room Temperature Packaging Products, World Liquid Aseptic Packaging Products Production ), by Application (Dairy Products, Non-carbonated Beverages, Others, World Liquid Aseptic Packaging Products Production ), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2025-2033

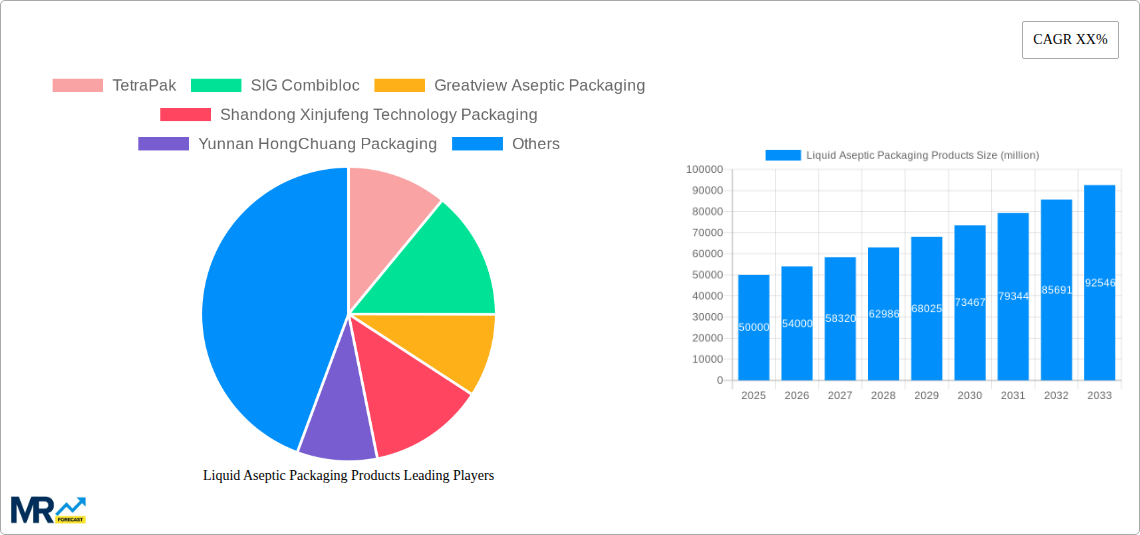

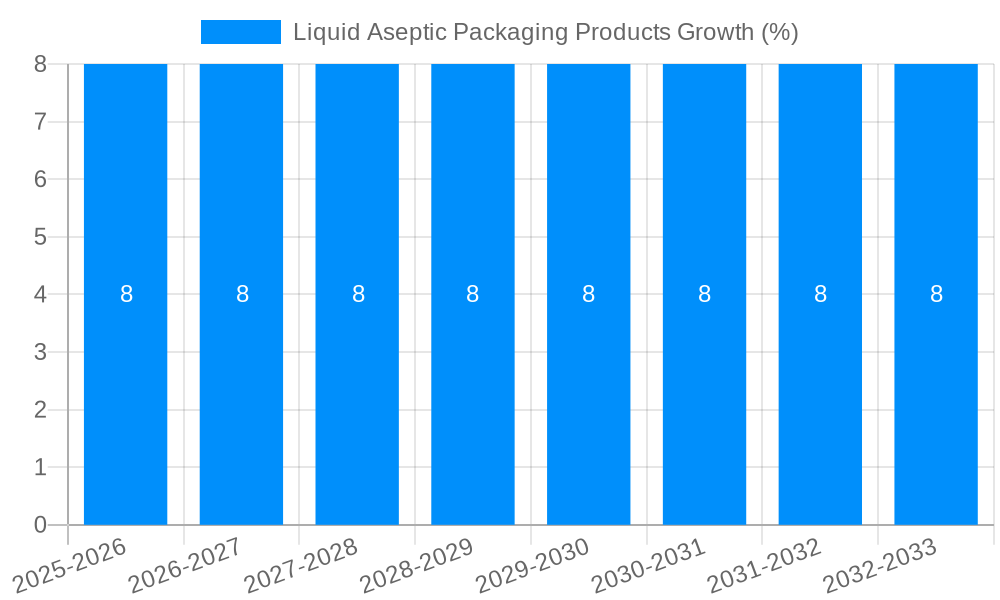

The global liquid aseptic packaging market is poised for significant expansion, projected to reach approximately $50,000 million by 2025 with a robust Compound Annual Growth Rate (CAGR) of 8%. This dynamic growth is primarily fueled by escalating consumer demand for convenient, shelf-stable, and safe liquid food and beverage options, alongside increasing investments in advanced packaging technologies that minimize environmental impact. Key market drivers include the rising disposable incomes in emerging economies, leading to greater consumption of packaged goods, and a growing preference for single-serving, portable packaging formats. The emphasis on food safety and reducing spoilage further propels the adoption of aseptic packaging, which extends product shelf life without the need for refrigeration or preservatives. Innovations in material science, leading to more sustainable and recyclable aseptic packaging solutions, are also playing a crucial role in shaping market trends. The market segmentation highlights the dominance of Room Temperature Packaging Products, followed by Refrigerated Packaging Products and World Liquid Aseptic Packaging Products.

The market is currently experiencing a pronounced trend towards eco-friendly and sustainable packaging materials, driven by both regulatory pressures and heightened consumer awareness regarding environmental concerns. This has spurred research and development into biodegradable and recyclable alternatives to traditional multi-layer aseptic cartons. Furthermore, the increasing adoption of aseptic packaging for a wider array of liquid products beyond traditional dairy and non-carbonated beverages, including plant-based alternatives, soups, and ready-to-drink meals, signifies a broadening application base. However, the market faces certain restraints, such as the initial high capital investment required for aseptic processing and packaging lines, and the complexities associated with the supply chain for specialized aseptic materials. The competitive landscape is characterized by the presence of major global players like TetraPak and SIG Combibloc, alongside emerging regional manufacturers, particularly in Asia Pacific, indicating a consolidated yet evolving market structure with ongoing innovation and strategic collaborations.

This comprehensive report delves into the dynamic global market for Liquid Aseptic Packaging Products, offering in-depth analysis and future projections from 2019 to 2033. With a base year of 2025, the report provides crucial insights into market trends, driving forces, challenges, regional dominance, and key industry developments. Utilizing a granular approach, the analysis includes production volumes in the million unit, segmented by product type, application, and encompassing global production figures for accurate market understanding. The study period covers historical performance (2019-2024), the estimated current state (2025), and an extensive forecast period (2025-2033).

The global Liquid Aseptic Packaging Products market is witnessing a paradigm shift, driven by an escalating demand for extended shelf-life, reduced food waste, and enhanced consumer convenience. XXX highlights a significant market evolution, moving beyond traditional preservation methods to embrace innovative aseptic technologies. We project a robust Compound Annual Growth Rate (CAGR) throughout the forecast period, fueled by increasing urbanization, a burgeoning middle class with disposable income, and a heightened awareness of food safety and hygiene. The trend towards single-serve and smaller packaging formats is also gaining traction, catering to the on-the-go lifestyles and individual consumption patterns. Furthermore, the increasing adoption of advanced materials with superior barrier properties is contributing to longer product viability without refrigeration, thereby reducing reliance on cold chains and their associated energy costs. The push for sustainable packaging solutions is also a dominant trend, with manufacturers actively investing in recyclable and biodegradable materials for aseptic packaging. This focus on environmental responsibility is not only meeting regulatory demands but also resonating with a growing segment of eco-conscious consumers. The market is characterized by continuous innovation in barrier layers and sealing technologies, enabling the packaging of a wider array of liquid products, from sensitive dairy and juice formulations to plant-based alternatives. The integration of smart packaging features, such as traceability and freshness indicators, is another emerging trend that promises to enhance consumer trust and product integrity. The World Liquid Aseptic Packaging Products Production is expected to reach a significant volume in million units by the end of the forecast period, reflecting the growing global appetite for these advanced packaging solutions. The interplay between technological advancements, evolving consumer preferences, and a growing emphasis on sustainability is shaping a highly dynamic and promising future for the liquid aseptic packaging sector.

Several potent forces are propelling the growth of the Liquid Aseptic Packaging Products market forward. Foremost among these is the increasing consumer demand for convenient and safe food and beverage options with extended shelf life. The inherent ability of aseptic packaging to preserve products without the need for refrigeration significantly reduces spoilage, thereby curbing food waste and lowering distribution costs associated with cold chains. This aligns perfectly with global efforts to enhance food security and sustainability. Furthermore, the rapidly growing population, coupled with increasing urbanization and a rising disposable income in developing economies, is directly translating into a higher demand for packaged liquid products, especially dairy and non-carbonated beverages. Manufacturers are increasingly recognizing the economic and logistical advantages offered by aseptic packaging, which allows for efficient storage, transportation, and wider market reach. The continuous innovation in materials science and packaging technology, leading to improved barrier properties and enhanced product integrity, is also a crucial driver. This technological evolution enables the packaging of a broader spectrum of liquid products, including those that were previously challenging to preserve. The growing health consciousness among consumers, leading to a preference for minimally processed foods and beverages, further bolsters the adoption of aseptic packaging, which often preserves nutritional value and taste without preservatives.

Despite the robust growth trajectory, the Liquid Aseptic Packaging Products market is not without its challenges and restraints. A significant hurdle remains the high initial investment required for aseptic packaging machinery and technology. This capital-intensive setup can be a deterrent for smaller manufacturers or those in emerging economies looking to adopt these advanced solutions. The perceived complexity of aseptic packaging processes and the need for specialized knowledge and training can also pose a barrier to entry. Environmental concerns surrounding the disposal of multi-layer composite packaging materials, often used in aseptic cartons, are another area of contention. While efforts are underway to improve recyclability, the current infrastructure and consumer awareness regarding proper disposal can hinder widespread adoption and create negative perceptions. Fluctuations in the cost of raw materials, particularly paperboard and the various barrier layers like polyethylene and aluminum foil, can impact the overall cost-effectiveness of aseptic packaging and influence profit margins for manufacturers. Furthermore, the stringent regulatory requirements for food contact materials and packaging processes, while essential for consumer safety, can add to compliance costs and slow down the introduction of new packaging formats or materials. The presence of established, lower-cost conventional packaging alternatives for certain product categories also presents a competitive restraint. Finally, consumer perception and education regarding the safety and benefits of aseptic packaging are crucial; any misinformation or lack of understanding could impact market penetration.

The Asia Pacific region is poised to be a dominant force in the global Liquid Aseptic Packaging Products market, driven by a confluence of economic, demographic, and technological factors. Within this region, China stands out as a key country, demonstrating exceptional growth in both production and consumption. The sheer size of its population, coupled with a rapidly expanding middle class and increasing disposable incomes, has fueled a surge in demand for packaged food and beverages. The country's robust manufacturing capabilities and a proactive government focus on industrial upgrading have also positioned it as a leader in the production of aseptic packaging materials and technologies.

The Room Temperature Packaging Products segment is expected to exhibit particularly strong dominance within the Asia Pacific region and globally. This is primarily due to the significant advantages it offers in terms of reduced reliance on cold chain infrastructure, which is often underdeveloped or costly to maintain in many parts of the world. Products packaged for room temperature stability can be distributed more efficiently and cost-effectively, reaching a wider consumer base.

Within the Application segments, Dairy Products and Non-carbonated Beverages are anticipated to be the primary drivers of market growth and dominance.

The World Liquid Aseptic Packaging Products Production figures for these segments and regions are expected to reflect this dominance. For instance, we project production volumes for Room Temperature Packaging Products in the Asia Pacific to reach several hundred million units by the end of the forecast period, with Dairy Products and Non-carbonated Beverages applications contributing a substantial portion of this volume. This dominance is underpinned by:

The synergy between these factors solidifies the Asia Pacific region, particularly China, and the Room Temperature Packaging Products segment, with Dairy Products and Non-carbonated Beverages as key applications, as the primary dominators of the global Liquid Aseptic Packaging Products market throughout the study period.

The Liquid Aseptic Packaging Products industry is experiencing robust growth, propelled by several key catalysts. A primary driver is the escalating global demand for extended shelf-life food and beverages, which directly combats food waste and enhances product accessibility. The increasing disposable incomes in emerging economies, coupled with a growing preference for convenient and healthy options, further fuels this demand. Continuous innovation in materials science, leading to improved barrier properties and enhanced recyclability of packaging, acts as another significant catalyst. Furthermore, the rising focus on sustainability and the desire to reduce reliance on energy-intensive cold chains are pushing manufacturers towards aseptic solutions. The expansion of e-commerce and direct-to-consumer models also benefits aseptic packaging due to its durability and extended shelf life, facilitating wider distribution networks.

This report provides a truly comprehensive overview of the Liquid Aseptic Packaging Products market, extending beyond simple market size figures. It offers a deep dive into the intricate web of factors influencing market dynamics, from macro-economic trends and consumer behavior shifts to technological innovations and regulatory landscapes. The report meticulously analyzes the interplay between product types like Refrigerated and Room Temperature Packaging Products, alongside the vast World Liquid Aseptic Packaging Products Production volumes, providing a clear picture of the market's structure. Furthermore, it dissects the dominant application segments, including Dairy Products, Non-carbonated Beverages, and Others, to understand where consumption is most concentrated. The robust forecast period from 2025-2033, built upon a solid foundation of historical data from 2019-2024 and a precise base year of 2025, ensures that stakeholders receive actionable intelligence for strategic decision-making. The inclusion of detailed company profiles and significant industry developments further empowers readers with a holistic understanding of the competitive environment and the trajectory of this vital sector.

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of XX% from 2019-2033 |

| Segmentation |

|

Note*: In applicable scenarios

Primary Research

Secondary Research

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

The projected CAGR is approximately XX%.

Key companies in the market include TetraPak, SIG Combibloc, Greatview Aseptic Packaging, Shandong Xinjufeng Technology Packaging, Yunnan HongChuang Packaging, Shandong Bihai Packaging Materials, Uflex (ASEPTO).

The market segments include Type, Application.

The market size is estimated to be USD XXX million as of 2022.

N/A

N/A

N/A

N/A

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4480.00, USD 6720.00, and USD 8960.00 respectively.

The market size is provided in terms of value, measured in million and volume, measured in K.

Yes, the market keyword associated with the report is "Liquid Aseptic Packaging Products," which aids in identifying and referencing the specific market segment covered.

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

To stay informed about further developments, trends, and reports in the Liquid Aseptic Packaging Products, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.