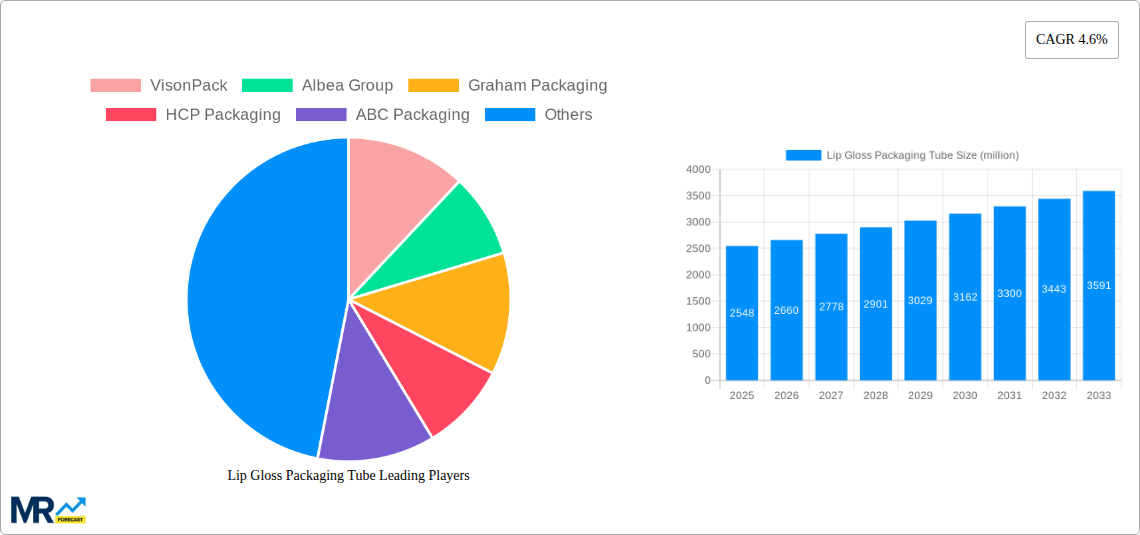

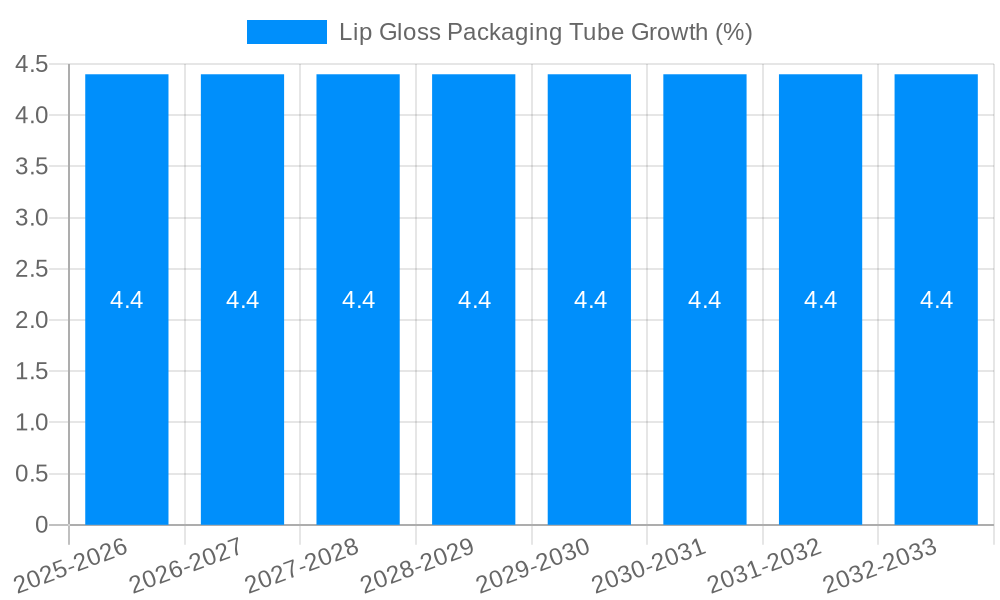

1. What is the projected Compound Annual Growth Rate (CAGR) of the Lip Gloss Packaging Tube?

The projected CAGR is approximately 4.6%.

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.

Lip Gloss Packaging Tube

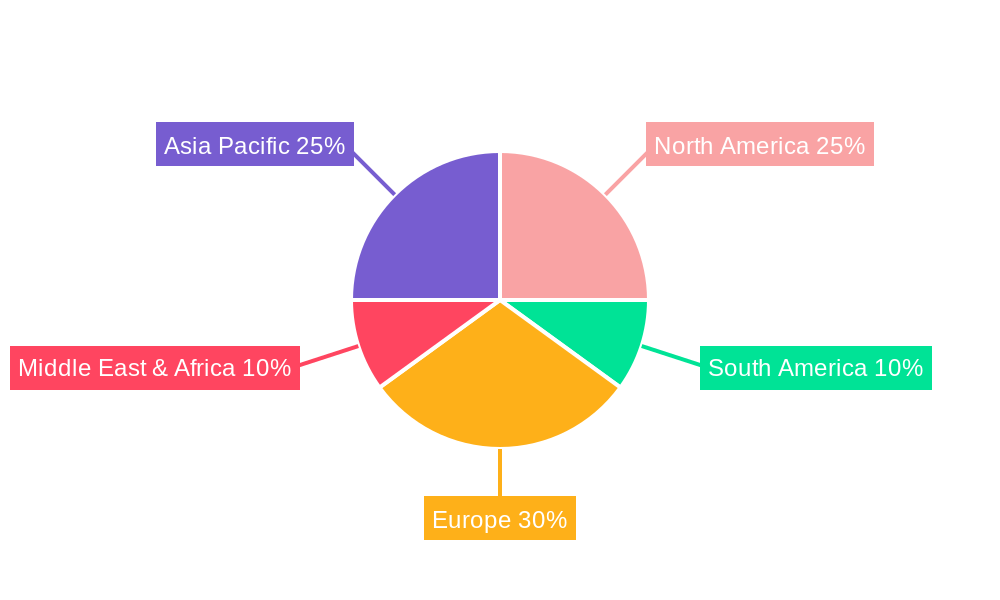

Lip Gloss Packaging TubeLip Gloss Packaging Tube by Type (Polypropylene, High-Density Polyethylene, Metal), by Application (Makeup Shop, Personal, Others), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2025-2033

The global lip gloss packaging tube market is poised for robust expansion, projected to reach a valuation of approximately USD 2,548 million by 2025. This growth trajectory is underpinned by a steady Compound Annual Growth Rate (CAGR) of 4.6% from 2019 to 2033, indicating sustained demand and evolving market dynamics. Key drivers fueling this expansion include the burgeoning global cosmetics industry, with a particular emphasis on lip care products and the increasing popularity of lip glosses among a diverse consumer base. The rising disposable incomes in emerging economies, coupled with a growing influence of social media and beauty trends, are significantly contributing to the demand for visually appealing and functional lip gloss packaging. Furthermore, advancements in material science and packaging technology are enabling manufacturers to offer innovative designs, enhanced product protection, and improved user experience, further stimulating market growth.

The market segmentation reveals a strong preference for Polypropylene and High-Density Polyethylene (HDPE) as primary materials, driven by their cost-effectiveness, durability, and design flexibility. In terms of applications, makeup shops and personal use represent the dominant segments, reflecting the direct consumer purchase patterns. The competitive landscape is dynamic, featuring a mix of established global players like VisonPack, Albea Group, and Graham Packaging, alongside emerging regional manufacturers such as KING SAN YOU and Shantou Yifan Cosmetic Packaging. The Asia Pacific region, led by China and India, is expected to be a significant growth engine, owing to its large consumer base and rapid industrialization. However, the market also faces certain restraints, including the increasing environmental consciousness and the demand for sustainable packaging solutions, which necessitate continuous innovation in recyclable and biodegradable materials.

Here is a unique report description for Lip Gloss Packaging Tubes, incorporating your specified details:

The global lip gloss packaging tube market is poised for significant expansion, with an estimated market size projected to reach over 150 million units by 2025. This upward trajectory is underpinned by evolving consumer preferences and industry innovations, painting a vibrant picture for the sector. Throughout the study period of 2019-2033, with a base year of 2025, the market has witnessed a steady increase in demand for sophisticated and functional lip gloss packaging. The forecast period of 2025-2033 anticipates this growth to accelerate, driven by emerging trends that cater to both aesthetic appeal and practical usability. Consumers are increasingly seeking packaging that not only protects the product but also enhances the overall user experience, leading to a greater demand for premium finishes, unique applicator designs, and eco-conscious materials. The shift towards smaller, more portable packaging sizes, suitable for on-the-go touch-ups, is also a prominent trend. Furthermore, the influence of social media beauty influencers and the constant introduction of new lip gloss formulations are fueling the need for diverse and eye-catching packaging solutions. Manufacturers are responding by investing in advanced design capabilities and exploring novel materials that offer superior performance and visual appeal. The historical period of 2019-2024 laid the groundwork for this anticipated growth, characterized by a gradual but consistent rise in production and consumption. The emphasis is shifting from purely functional containers to integral components of the product's brand identity and marketing strategy. This includes a growing interest in transparent tubes that showcase the color and texture of the lip gloss, as well as options with integrated mirrors or innovative dispensing mechanisms. The market is becoming more dynamic, with a strong emphasis on customization and personalization to meet the diverse needs of brands and consumers alike.

Several key factors are actively propelling the growth of the lip gloss packaging tube market. Foremost among these is the sustained and robust demand for lip gloss itself, a staple in makeup routines worldwide. As consumer spending on beauty and personal care products continues its upward trajectory, the demand for associated packaging, like tubes, naturally escalates. The burgeoning influence of the digital age, particularly social media platforms like Instagram and TikTok, plays a crucial role. These platforms have democratized beauty trends, showcasing new products and application techniques, thereby stimulating consumer interest and driving sales. This has, in turn, created a need for visually appealing and instagrammable packaging that stands out in a crowded digital landscape. Furthermore, the continuous innovation in lip gloss formulations, ranging from long-lasting matte finishes to hydrating glosses with unique textures and glitter effects, necessitates specialized packaging that can effectively contain and dispense these varied products. The increasing focus on sustainable and eco-friendly packaging solutions is also a significant driver. Consumers and brands alike are actively seeking recyclable, biodegradable, or post-consumer recycled (PCR) content in their packaging, pushing manufacturers to develop innovative material solutions. This environmental consciousness aligns with global sustainability initiatives and is becoming a key differentiator in the market.

Despite the promising growth, the lip gloss packaging tube market encounters several challenges and restraints. A primary concern is the inherent volatility in raw material prices, particularly for plastics like Polypropylene and High-Density Polyethylene, which are heavily reliant on petrochemicals. Fluctuations in crude oil prices can directly impact production costs, leading to price instability and potentially affecting profit margins for manufacturers. The stringent regulatory landscape surrounding cosmetic packaging, especially concerning material safety, environmental impact, and labeling requirements, can also pose a hurdle. Navigating these complex regulations across different regions requires significant investment in research, development, and compliance, which can be particularly challenging for smaller manufacturers. Furthermore, intense market competition, characterized by a large number of players vying for market share, can lead to price wars and reduced profitability. The constant need for innovation and differentiation also demands substantial R&D expenditure, putting pressure on companies to stay ahead of trends and consumer demands. Supply chain disruptions, as witnessed in recent years, can further exacerbate these challenges by impacting the availability and timely delivery of raw materials and finished goods. The increasing consumer preference for sustainable packaging, while a growth driver, also presents a challenge for manufacturers who need to invest in new technologies and materials to meet these evolving demands, often at a higher initial cost.

The Polypropylene (PP) segment, particularly within the Makeup Shop application, is projected to exert significant dominance over the lip gloss packaging tube market. This dominance is observed across various key regions, with Asia Pacific emerging as a powerhouse in both production and consumption.

Asia Pacific's Ascendancy: This region is expected to lead the market due to several interconnected factors.

Polypropylene's Reign: The Polypropylene segment is expected to outpace other material types due to its inherent advantages:

Makeup Shop Dominance: The "Makeup Shop" application segment is set to lead due to the direct correlation with retail sales of lip gloss.

While High-Density Polyethylene (HDPE) and Metal also hold significant market share, PP's optimal blend of cost, performance, and design flexibility, coupled with the expansive market in Asia Pacific and the crucial role of makeup shops, positions these segments for continued and substantial dominance in the lip gloss packaging tube market.

The lip gloss packaging tube industry is experiencing several key growth catalysts. The relentless pursuit of innovation by cosmetic brands in product development, leading to new textures, finishes, and application experiences, directly fuels demand for specialized and aesthetically pleasing packaging. The pervasive influence of social media and beauty influencers continues to drive trends and consumer desire for visually appealing and shareable products, making packaging a critical marketing tool. Furthermore, a growing consumer consciousness regarding sustainability is pushing the industry towards eco-friendly materials and packaging solutions, creating opportunities for companies offering recyclable, biodegradable, and PCR-content tubes.

This comprehensive report delves into the intricate details of the lip gloss packaging tube market, providing an in-depth analysis of trends, drivers, challenges, and future outlook. The study meticulously examines the market dynamics from 2019 to 2033, with a sharp focus on the base year of 2025 and an extended forecast period. It offers granular insights into the dominant segments, such as the material types like Polypropylene and High-Density Polyethylene, and application segments like Makeup Shop and Personal use. The report also highlights significant industry developments and strategic initiatives undertaken by key players, offering a holistic view of the market landscape.

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 4.6% from 2019-2033 |

| Segmentation |

|

Note*: In applicable scenarios

Primary Research

Secondary Research

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

The projected CAGR is approximately 4.6%.

Key companies in the market include VisonPack, Albea Group, Graham Packaging, HCP Packaging, ABC Packaging, Aptargroup, Libo Cosmetics, KING SAN YOU, Shantou Yifan Cosmetic Packaging, East Hill Industries, Berlin Packaging, The Packaging Company, Raepak Ltd, Taizhou Kechuang Plastic, Jiangyin Meishun Packing, Shangyu Wanrong(WR)Plastic, Shantou City of Guangdong Province Fine Arts Plastic, Zhan Yu Enterprise, Zhejiang Axilone Shunhua Aluminium & Plastic, Zhejiang Sanrong Plastic & Rubber, Shaoxing Hongyu Aluminium Plastic, Shantou Feiyi Cosmetic Packaging, .

The market segments include Type, Application.

The market size is estimated to be USD 2548 million as of 2022.

N/A

N/A

N/A

N/A

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3480.00, USD 5220.00, and USD 6960.00 respectively.

The market size is provided in terms of value, measured in million and volume, measured in K.

Yes, the market keyword associated with the report is "Lip Gloss Packaging Tube," which aids in identifying and referencing the specific market segment covered.

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

To stay informed about further developments, trends, and reports in the Lip Gloss Packaging Tube, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.