1. What is the projected Compound Annual Growth Rate (CAGR) of the Light Diesel Vehicle?

The projected CAGR is approximately XX%.

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.

Light Diesel Vehicle

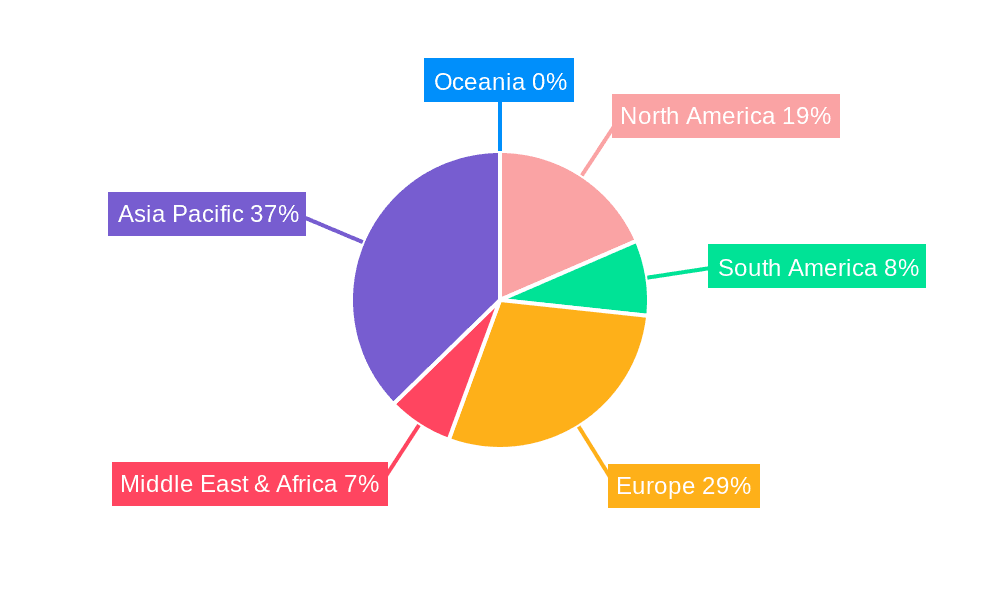

Light Diesel VehicleLight Diesel Vehicle by Type (Passenger Cars, Sports Utility Vehicles (SUVs), Light Weight Trucks, Pick-Up Trucks, Minivans), by Application (Personal Use, Commercial, Industrial, Others), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2026-2034

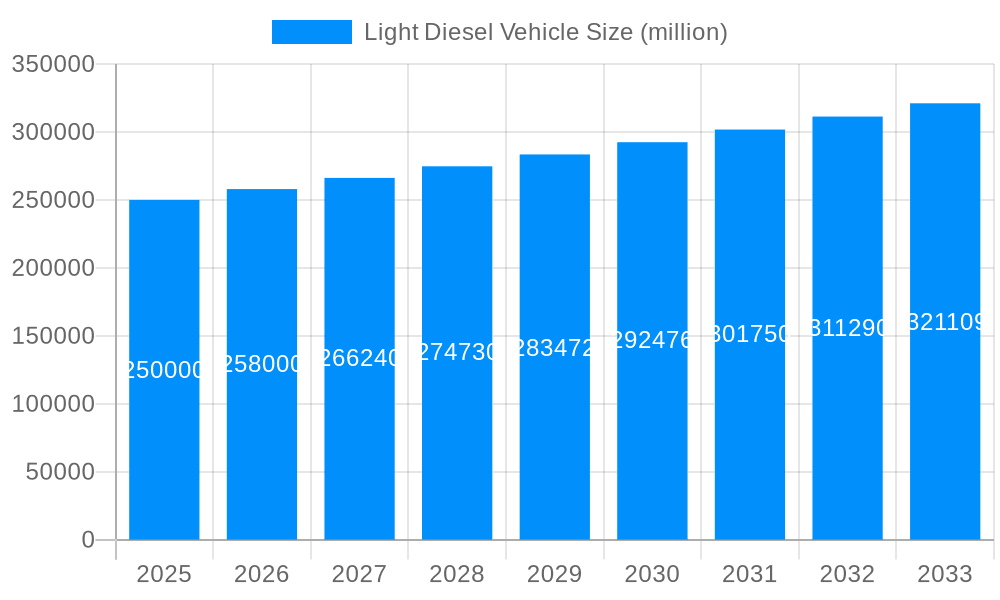

The light diesel vehicle (LDV) market, encompassing passenger cars, SUVs, light trucks, and pick-up trucks used for personal, commercial, and industrial applications, is experiencing a period of moderate growth. While the overall automotive market shifts towards electrification, the LDV segment continues to hold relevance, particularly in certain regions and applications where diesel's fuel efficiency and torque remain advantageous. The market's size in 2025 is estimated at $150 billion, based on a reasonable extrapolation from global automotive market trends and acknowledging the declining share of diesel vehicles. A compound annual growth rate (CAGR) of 3% is projected for the forecast period 2025-2033, driven primarily by persistent demand in developing economies, where diesel remains a cost-effective fuel option for commercial fleets and heavy-duty applications like construction and agriculture. However, stringent emission regulations in developed markets like Europe and North America are acting as a significant restraint, pushing manufacturers towards cleaner diesel technologies or alternative fuels. This leads to market segmentation where growth is localized, with stronger performance in regions with less stringent environmental standards or where diesel maintains a cost advantage.

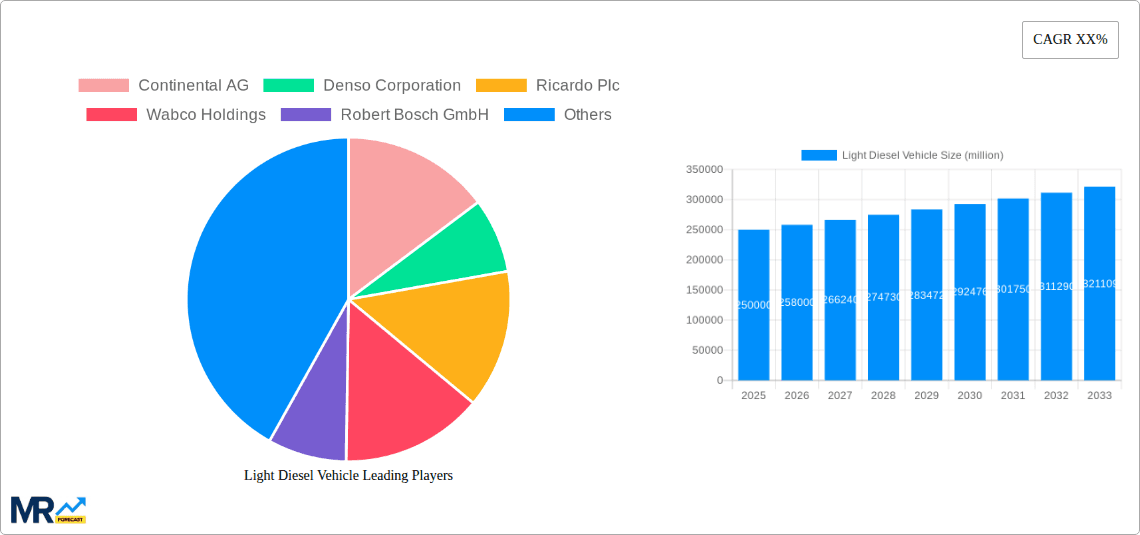

The competitive landscape is dominated by established automotive manufacturers like Volkswagen AG, Daimler AG, and Toyota Motor Corporation, as well as major automotive parts suppliers like Bosch and Continental AG. These players are investing in advanced diesel technologies to meet evolving emission regulations and maintain market share. However, the increasing adoption of electric and hybrid vehicles poses a significant long-term challenge to the LDV market. Success for LDV manufacturers in the coming years will depend on strategies that balance affordability, fuel efficiency, and compliance with increasingly stricter environmental regulations. Specific regional growth will be shaped by factors such as government incentives, fuel prices, and infrastructure development. The market presents opportunities for companies focusing on innovative solutions for reducing diesel emissions and enhancing fuel economy.

The global light diesel vehicle (LDV) market, encompassing passenger cars, SUVs, light-weight trucks, pick-up trucks, and minivans, experienced a period of significant fluctuation between 2019 and 2024. Stringent emission regulations, particularly in Europe and North America, coupled with the rising popularity of gasoline and electric vehicles, led to a decline in diesel vehicle sales during this historical period. However, the market displayed resilience, particularly in certain regions where diesel engines retain advantages in terms of fuel efficiency and towing capacity. The estimated market size in 2025 reflects a stabilization, with certain segments showing growth. The forecast period (2025-2033) suggests a complex trajectory, influenced by the continued evolution of emission standards, advancements in diesel engine technology, and fluctuating fuel prices. While a complete resurgence is unlikely, niche markets and regions where diesel remains a competitive option will likely continue to contribute to overall sales volume, potentially reaching several million units annually. The market’s future hinges on the balance between advancements in clean diesel technology and the accelerating adoption of alternative fuel vehicles. The specific mix of vehicle types – passenger cars versus SUVs and trucks – will be a key factor, reflecting changing consumer preferences and the availability of suitable diesel models. Market intelligence suggests that SUVs and light-weight trucks remain significant segments within the LDV market, demonstrating continued demand for diesel power in specific applications, even in the face of stricter regulations. The report provides a detailed analysis of these trends across various geographical markets and vehicle segments, utilizing data encompassing millions of units sold and projected for the coming years.

Several factors continue to contribute to the ongoing demand for light diesel vehicles, despite the challenges posed by stricter emission regulations and the rise of electric vehicles. In certain regions, particularly developing economies, diesel fuel remains significantly cheaper than gasoline, making diesel vehicles economically attractive to a broad consumer base. This cost advantage is particularly impactful for commercial applications where fuel efficiency directly translates to reduced operational costs, driving demand for diesel-powered light trucks and vans. Furthermore, diesel engines often provide superior torque and power, particularly crucial for heavier vehicles such as SUVs and pick-up trucks, which are popular in many markets. This advantage translates to better towing capacity and improved performance in challenging terrains or carrying heavy loads. Finally, technological advancements in diesel engine design and emission control systems are helping to mitigate the environmental concerns associated with diesel emissions. These advancements, including selective catalytic reduction (SCR) and diesel particulate filters (DPF), are leading to cleaner and more efficient diesel engines that meet or surpass increasingly stringent emission standards.

The light diesel vehicle market faces significant headwinds, primarily driven by stricter emission regulations worldwide. Meeting these increasingly stringent standards requires substantial investment in advanced emission control technologies, leading to increased vehicle costs and potentially impacting competitiveness against gasoline and electric vehicles. This increased cost can affect both manufacturers and consumers, making diesel vehicles less appealing compared to alternatives. In addition, growing environmental concerns and the push towards cleaner transportation solutions contribute to negative public perception of diesel engines, further impacting consumer demand, particularly in developed countries. The rising popularity of electric vehicles (EVs) and hybrid vehicles presents another significant challenge. Governments are increasingly incentivizing the adoption of EVs, providing financial subsidies and implementing policies that favor electric mobility. This shift in policy and consumer preference toward cleaner alternatives further restricts the growth of the light diesel vehicle market, especially in urban areas and regions with progressive environmental policies.

The Asia-Pacific region's dominance is primarily driven by the large and growing economies of India and China, where affordability and fuel efficiency remain significant purchasing factors. The demand for light-weight trucks and SUVs, particularly in rural areas and for commercial transport, contributes significantly to the overall sales figures. While passenger cars are also part of the mix, the commercial and utility segments are predicted to demonstrate greater growth in this region, pushing the overall market size into the multi-million-unit range. In contrast, mature markets in North America and Europe are undergoing a faster transition towards alternative fuel vehicles. While there will still be a market for diesel-powered LDVs in these regions, the growth rate is expected to be more moderate compared to the Asia-Pacific region's anticipated expansion. The shift toward commercial applications and utility vehicle preferences plays a vital role in sustaining diesel vehicle market size in the coming years.

Technological advancements in diesel engine technology, focusing on improved fuel efficiency and reduced emissions, are crucial catalysts. These innovations, coupled with continued cost advantages in certain regions and ongoing demand for robust vehicles for commercial use, will stimulate market expansion. The ongoing development of cleaner diesel fuels and effective emission control systems will be critical to ensuring the long-term viability and growth of this segment.

This report provides a comprehensive analysis of the light diesel vehicle market, including historical data, current market estimates, and future forecasts. The report covers key market trends, driving forces, challenges, and opportunities. It also provides detailed regional and segment analyses, identifying key players and significant industry developments to assist in understanding the complexities and future projections of the LDV market. The comprehensive data, presented in various formats (charts, tables, and detailed narratives), provides a holistic view of this evolving sector, considering the millions of units impacted by market shifts and regulatory changes.

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of XX% from 2020-2034 |

| Segmentation |

|

Note*: In applicable scenarios

Primary Research

Secondary Research

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

The projected CAGR is approximately XX%.

Key companies in the market include Continental AG, Denso Corporation, Ricardo Plc, Wabco Holdings, Robert Bosch GmbH, Tenneco(Federal-Mogul), BMW AG, Daimler AG, General Motors (GM) Company, Hyundai Motor Company, Mitsubishi Motors Corporation, Renault S.A, Suzuki Motor Corporation, Volkswagen AG, Chrysler Group, Honda Motor Company, Porsche AG, Subaru of America, Toyota Motor Corporation, .

The market segments include Type, Application.

The market size is estimated to be USD XXX million as of 2022.

N/A

N/A

N/A

N/A

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3480.00, USD 5220.00, and USD 6960.00 respectively.

The market size is provided in terms of value, measured in million and volume, measured in K.

Yes, the market keyword associated with the report is "Light Diesel Vehicle," which aids in identifying and referencing the specific market segment covered.

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

To stay informed about further developments, trends, and reports in the Light Diesel Vehicle, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.