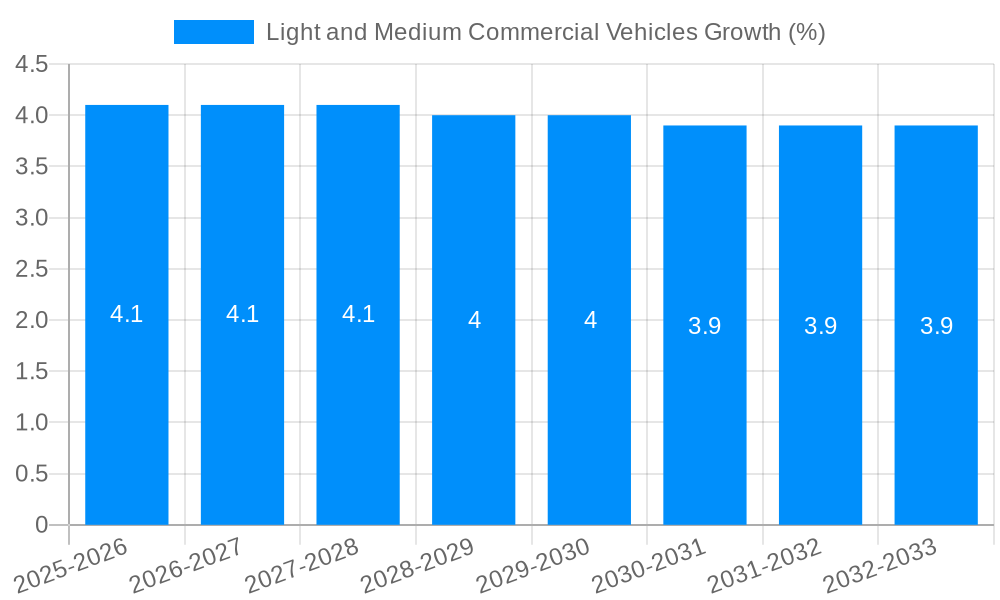

1. What is the projected Compound Annual Growth Rate (CAGR) of the Light and Medium Commercial Vehicles?

The projected CAGR is approximately XX%.

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.

Light and Medium Commercial Vehicles

Light and Medium Commercial VehiclesLight and Medium Commercial Vehicles by Type (LCVs, MCVs, World Light and Medium Commercial Vehicles Production ), by Application (Personal Use, Agricultural Use, Commercial Use, Industrial Use, Others, World Light and Medium Commercial Vehicles Production ), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2025-2033

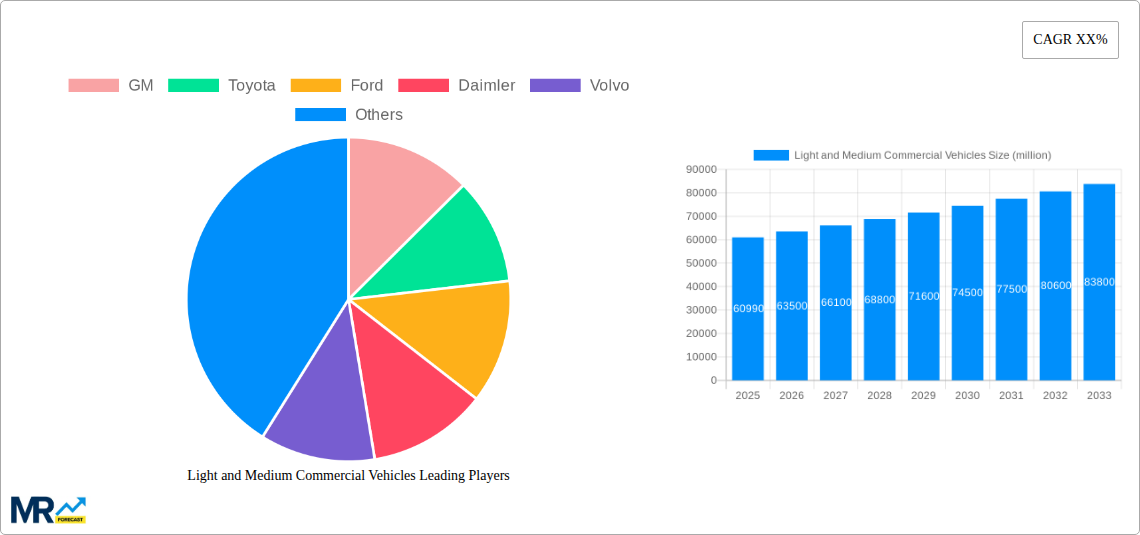

The global Light and Medium Commercial Vehicles (LMCVs) market is poised for significant expansion, projected to reach an estimated USD 60,990 million by 2025. This growth is fueled by a confluence of robust economic activity, increasing e-commerce penetration, and the rising demand for efficient logistics solutions across diverse sectors. The inherent versatility of LMCVs, catering to personal use, agricultural needs, commercial distribution, and industrial applications, underpins their widespread adoption. Major manufacturers like GM, Toyota, Ford, and Daimler are actively innovating, introducing lighter, more fuel-efficient, and technologically advanced models to meet evolving consumer and business demands. The surge in online retail, in particular, necessitates faster and more flexible last-mile delivery, directly benefiting the LMCV segment. Furthermore, ongoing infrastructure development in emerging economies and a gradual shift towards sustainable transportation solutions, including electric and hybrid LMCVs, are expected to drive substantial market value in the coming years.

The market's trajectory is further shaped by several key trends. The increasing adoption of connected vehicle technologies, offering enhanced fleet management and operational efficiency, is a notable development. Moreover, a growing emphasis on reducing carbon footprints is pushing manufacturers to invest heavily in research and development for electric LMCVs, which are anticipated to capture a significant market share in the forecast period. However, the market is not without its challenges. Fluctuations in raw material prices, stringent emission regulations, and intense competition among established players and emerging entities like BYD and Yutong present potential restraints. Despite these hurdles, the fundamental demand for agile and cost-effective transportation solutions, coupled with favorable government policies promoting commercial vehicle upgrades and electrification, ensures a positive outlook for the global LMCV production landscape. The diverse regional landscape, with Asia Pacific and North America leading in production volumes, highlights the global appeal and economic importance of these vehicles.

Here's a unique report description on Light and Medium Commercial Vehicles, incorporating your specified elements:

XXX, the global Light and Medium Commercial Vehicles (LCV and MCV) market is undergoing a profound transformation, driven by evolving consumer needs, technological advancements, and shifting economic landscapes. The study period, spanning from 2019 to 2033, with a base and estimated year of 2025 and a forecast period from 2025-2033, reveals a dynamic trajectory. Historical data from 2019-2024 indicates a consistent demand, but the coming decade promises accelerated growth and innovation. Production of LCVs and MCVs, projected to reach substantial figures in the millions of units, is being reshaped by the burgeoning e-commerce sector, necessitating a greater volume of last-mile delivery vehicles. Furthermore, the increasing preference for personal mobility solutions, coupled with the vital role these vehicles play in agricultural and industrial applications, underpins their sustained relevance. The report will delve into the intricate interplay of these factors, highlighting emerging trends such as the electrification of commercial fleets, the integration of advanced telematics for improved efficiency and safety, and the rise of subscription-based models for vehicle utilization. Consumer-driven demand for versatility and adaptability in vehicles designed for diverse applications, from personal use to heavy-duty industrial hauling, will be a significant focus. The report will also scrutinize the impact of geopolitical events and regulatory frameworks on production volumes and market accessibility. Understanding these multifaceted trends is crucial for stakeholders aiming to navigate the complexities and capitalize on the opportunities within this vital segment of the automotive industry. The estimated production figures for 2025 and subsequent years will be presented in millions of units, offering a clear quantitative perspective on market scale.

The remarkable surge in the Light and Medium Commercial Vehicles (LCVs and MCVs) market is propelled by a confluence of potent economic and societal drivers. The unyielding expansion of e-commerce stands as a paramount force, escalating the demand for agile and efficient vehicles for last-mile deliveries. This logistical imperative is further amplified by the growing trend of urbanization, which concentrates consumer bases and necessitates a robust network of localized distribution. Beyond commerce, the agricultural sector continues to rely heavily on the practicality and affordability of LCVs and MCVs for a wide array of tasks, from crop transportation to equipment hauling, especially in developing economies. Moreover, the increasing emphasis on flexible workforce solutions and the gig economy has spurred demand for versatile vehicles adaptable to a multitude of commercial applications. The underlying economic health and growth in various regions directly translate into increased capital expenditure on fleet upgrades and expansions, further bolstering LCV and MCV production and sales. These interconnected forces are collectively sculpting a market poised for significant and sustained expansion.

Despite the robust growth prospects, the Light and Medium Commercial Vehicles (LCVs and MCVs) market is not without its hurdles. The transition towards electrification, while a significant opportunity, presents substantial challenges in terms of high upfront costs for electric LCVs and MCVs, coupled with the need for widespread charging infrastructure development. Supply chain disruptions, a recurring theme in recent years, continue to impact production volumes and component availability, leading to longer lead times and potential price volatility. Stringent emission regulations and evolving safety standards across different regions necessitate continuous investment in research and development, adding to manufacturing costs. Furthermore, the economic sensitivity of the commercial vehicle sector means that fluctuations in global economic growth, interest rates, and trade policies can significantly dampen demand. The increasing competition from both established OEMs and new entrants, particularly in the electric vehicle space, also exerts pressure on profit margins and market share. Navigating these complexities will be critical for sustained success in this dynamic industry.

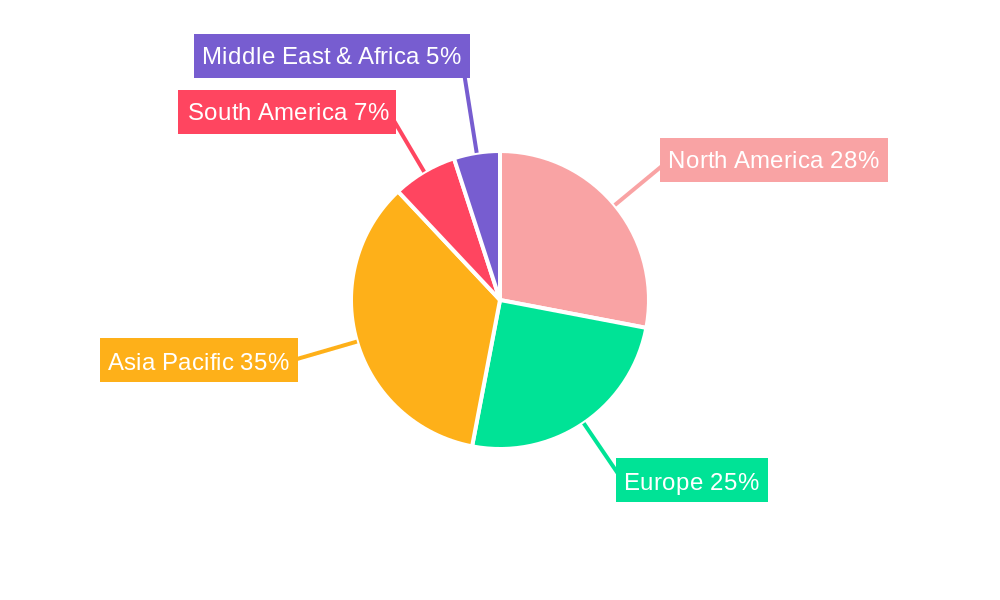

The global Light and Medium Commercial Vehicles (LCVs and MCVs) market is characterized by regional dominance and segment specialization, with distinct areas poised to shape the industry's trajectory.

Key Regions/Countries Poised for Dominance:

Asia-Pacific (APAC): This region is undeniably the powerhouse of LCV and MCV production and consumption.

North America: The United States and Canada constitute a major market, driven by a strong economy and high purchasing power.

Europe: While facing stricter environmental regulations, Europe, with manufacturers like Daimler, Volvo, and Stellantis, remains a crucial market.

Dominating Segments:

LCVs (Light Commercial Vehicles): This segment is expected to witness substantial growth.

MCVs (Medium Commercial Vehicles): While smaller in volume compared to LCVs, MCVs play a critical role in regional distribution and specific industrial applications.

The interplay of these regional strengths and segment preferences will dictate the market's dynamics, with Asia-Pacific leading in overall volume and North America and Europe setting trends in technological adoption and electrification. The estimated production for these dominant segments in millions of units will be a key takeaway of the report.

Several key catalysts are igniting growth within the Light and Medium Commercial Vehicles (LCVs and MCVs) industry. The relentless expansion of e-commerce is a primary driver, demanding an increased fleet of LCVs for efficient last-mile delivery. Furthermore, the increasing adoption of electric vehicles (EVs) by fleet operators, driven by sustainability goals and potential operational cost savings, presents a significant growth avenue, supported by government incentives and advancements in battery technology. The burgeoning gig economy and the rise of small businesses also necessitate flexible and affordable commercial vehicle solutions. Finally, technological integrations like advanced telematics and driver-assistance systems are enhancing efficiency and safety, making these vehicles more attractive for a wider range of applications.

This comprehensive report on the Light and Medium Commercial Vehicles (LCVs and MCVs) market offers an in-depth analysis from 2019 to 2033. It meticulously examines historical trends, current market dynamics, and future projections, providing estimated production figures in the millions of units for the base and estimated year of 2025 and the forecast period. The report delves into the driving forces, such as the e-commerce boom and urbanization, alongside critical challenges like supply chain volatility and the high cost of electrification. It identifies key regions and segments poised for dominance, with a particular focus on the Asia-Pacific market and the Commercial Use application segment. Growth catalysts, including technological advancements and sustainability initiatives, are thoroughly explored. Furthermore, the report profiles leading global players and highlights significant industry developments, offering a holistic view of this vital sector.

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of XX% from 2019-2033 |

| Segmentation |

|

Note*: In applicable scenarios

Primary Research

Secondary Research

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

The projected CAGR is approximately XX%.

Key companies in the market include GM, Toyota, Ford, Daimler, Volvo, Stellantis, PACCAR, Faw Jiefang Group, Scania, Iveco, Sinotruck, Shaanxi Heavy Duty Automobile, Isuzu Motors, Navistar, Tata Motors, Yutong, BYD, .

The market segments include Type, Application.

The market size is estimated to be USD 60990 million as of 2022.

N/A

N/A

N/A

N/A

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4480.00, USD 6720.00, and USD 8960.00 respectively.

The market size is provided in terms of value, measured in million and volume, measured in K.

Yes, the market keyword associated with the report is "Light and Medium Commercial Vehicles," which aids in identifying and referencing the specific market segment covered.

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

To stay informed about further developments, trends, and reports in the Light and Medium Commercial Vehicles, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.