1. What is the projected Compound Annual Growth Rate (CAGR) of the Light and Heavy-duty Natural Gas Vehicle?

The projected CAGR is approximately XX%.

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.

Light and Heavy-duty Natural Gas Vehicle

Light and Heavy-duty Natural Gas VehicleLight and Heavy-duty Natural Gas Vehicle by Type (Light-duty NGV, Heavy-duty NGV), by Application (Public Transportation, Logistics), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2025-2033

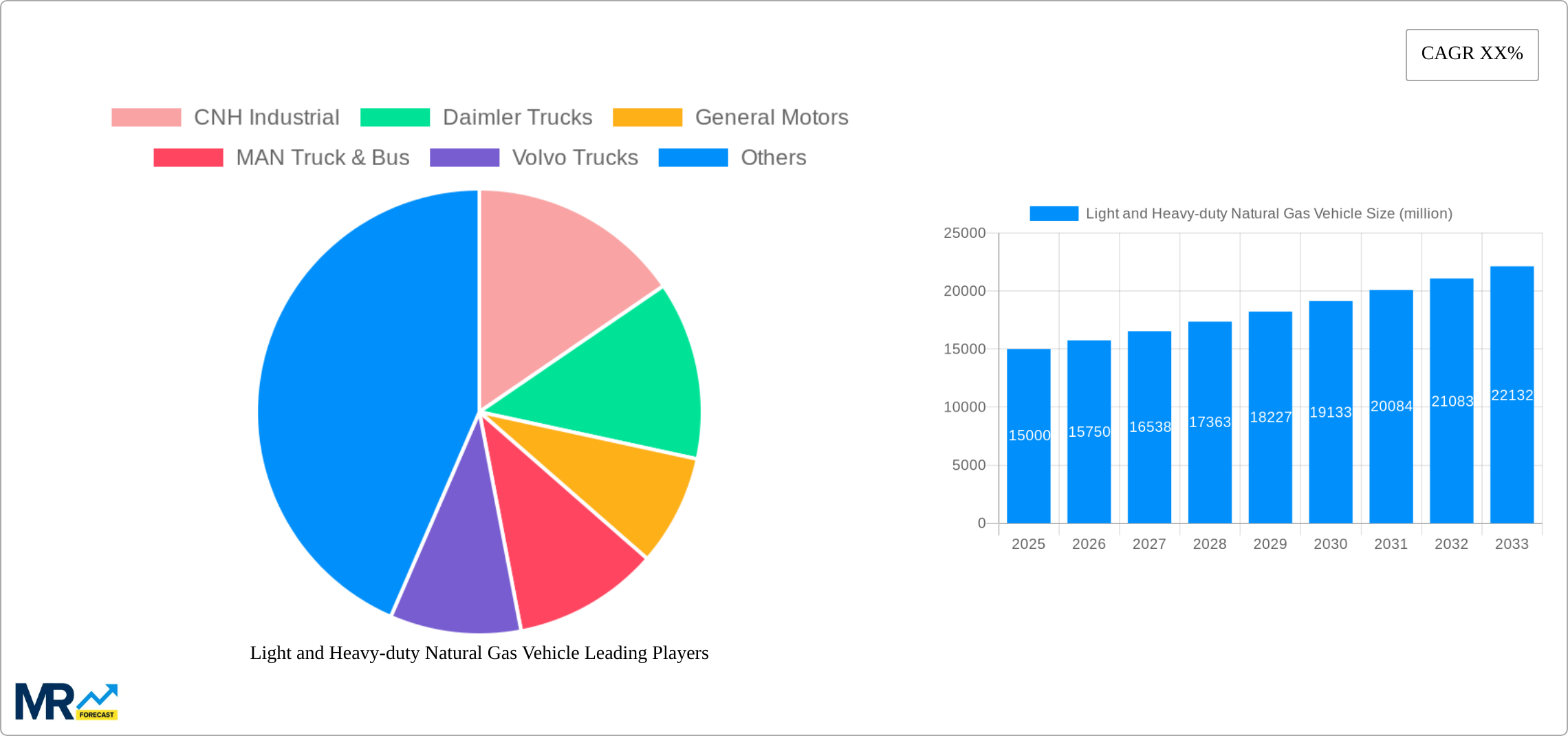

The light and heavy-duty natural gas vehicle (NGV) market is experiencing significant growth, driven by increasing environmental concerns and stringent emission regulations globally. While precise market sizing data is absent, we can infer substantial potential based on the presence of major players like CNH Industrial, Daimler Trucks, and Volvo Trucks, indicating a considerable market investment. The Compound Annual Growth Rate (CAGR) – though unspecified – is likely to be in the range of 5-8% for the forecast period (2025-2033), reflecting the steady adoption of NGVs across various sectors, particularly in transportation and logistics. Key market drivers include the decreasing cost of natural gas relative to other fuels, supportive government policies promoting cleaner transportation solutions through subsidies and tax incentives, and growing awareness among businesses about their environmental responsibility. However, challenges remain, including the limited refueling infrastructure compared to gasoline and diesel, concerns regarding the range limitations of NGVs, and the fluctuating price of natural gas which can affect cost competitiveness. Market segmentation likely includes vehicle types (light-duty trucks, heavy-duty trucks, buses), applications (urban transit, long-haul transportation), and geographical regions with variation in adoption rates based on regulatory landscapes and infrastructure development. The period from 2019 to 2024 represents a crucial foundation for the market's current trajectory, with advancements in technology and infrastructure paving the way for substantial growth in the coming years.

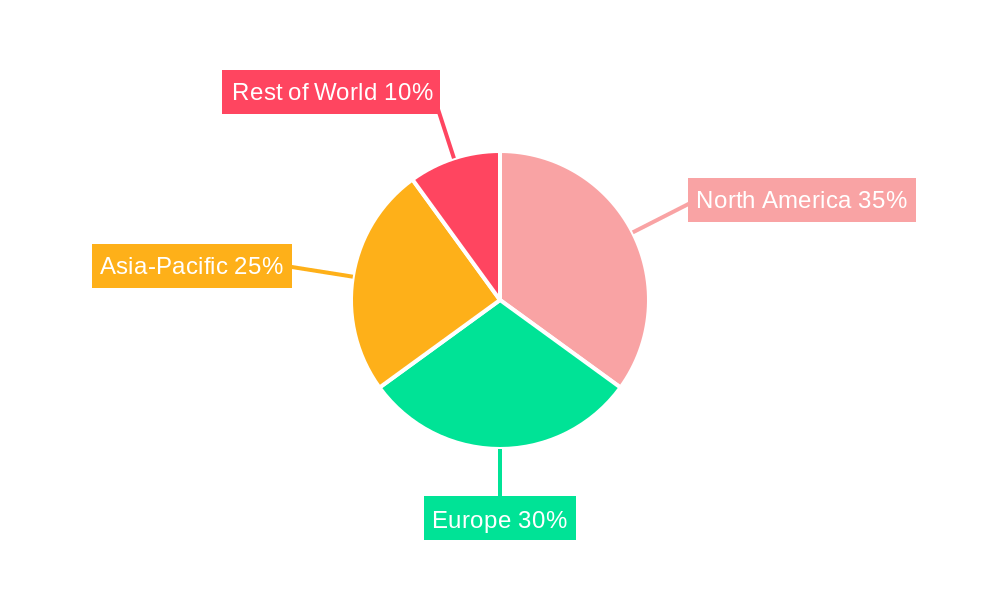

The competitive landscape is characterized by a mix of established automotive manufacturers and specialized NGV technology providers. This diverse group fosters innovation and ensures the market benefits from both technological advancements in vehicle design and the development of a comprehensive refueling network. Regional disparities in market penetration are expected, with developed nations in North America and Europe leading the adoption, while emerging economies in Asia and other regions gradually increase their uptake driven by government initiatives and expanding industrial activity. Future market growth will depend heavily on technological innovations improving vehicle performance and range, coupled with sustained government support and expanding infrastructure to facilitate seamless NGV operations. This symbiotic relationship between technological development and infrastructure improvements will determine the extent to which NGVs can displace conventional vehicles in the coming years.

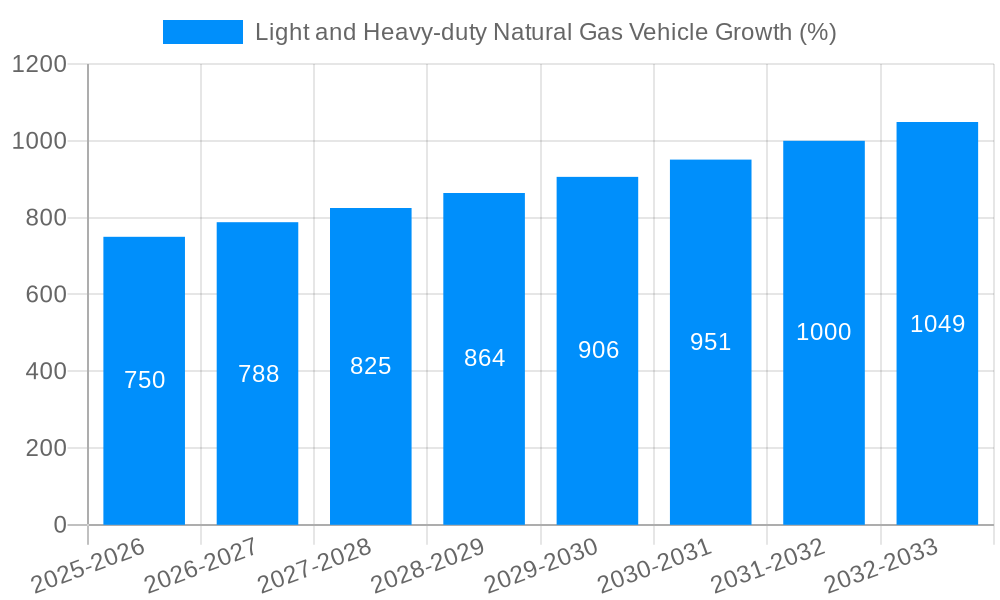

The global light and heavy-duty natural gas vehicle (NGV) market is poised for significant growth over the forecast period (2025-2033), driven by increasing environmental concerns and supportive government regulations. The historical period (2019-2024) witnessed a steady, albeit moderate, adoption of NGVs, primarily in regions with readily available natural gas infrastructure and supportive policies. However, the estimated year 2025 marks a turning point, with several factors converging to accelerate market expansion. This includes technological advancements leading to improved engine efficiency and reduced emissions, coupled with a growing awareness among consumers and businesses about the environmental benefits of natural gas compared to traditional fuels. The market is witnessing a shift towards heavier-duty NGVs, particularly in the transportation and logistics sectors, fueled by the need for cost-effective and cleaner transportation solutions for long-haul trucking and public transportation. While challenges remain, including infrastructure limitations and the fluctuating price of natural gas, the overall trend indicates a substantial rise in NGV adoption across both light and heavy-duty segments, potentially exceeding 10 million units by 2033. The market is segmented by vehicle type (light-duty, heavy-duty), fuel type (CNG, LNG), and application (passenger vehicles, commercial vehicles), providing granular insights into specific market dynamics. By 2033, the market is projected to show a Compound Annual Growth Rate (CAGR) exceeding 15%, driven by various factors elaborated in subsequent sections. The study period, encompassing 2019-2033, offers a comprehensive overview of the market’s evolution.

Several key factors are accelerating the adoption of light and heavy-duty natural gas vehicles. Firstly, stringent emission regulations worldwide are pushing manufacturers and fleet operators towards cleaner alternatives to conventional diesel and gasoline vehicles. Natural gas, being a relatively cleaner-burning fuel, offers a significant advantage in meeting these regulations, particularly in urban areas with poor air quality. Secondly, the cost competitiveness of natural gas, compared to other alternative fuels like electricity or hydrogen, makes it an attractive option, especially for heavy-duty applications where fuel costs represent a substantial portion of the operating budget. This is further enhanced by government incentives and subsidies aimed at promoting NGV adoption, including tax breaks, grants, and infrastructure development funding. Thirdly, technological advancements in NGV technology have led to improvements in engine efficiency, performance, and range, addressing some of the earlier limitations associated with natural gas vehicles. The development of more robust and efficient fuel storage systems, as well as advancements in engine design, have made NGVs more comparable to their conventional counterparts. Finally, growing public awareness of environmental concerns and a greater demand for sustainable transportation options are driving consumer and commercial preferences towards NGVs, thus creating a positive feedback loop that strengthens market growth.

Despite the positive trends, the NGV market faces several challenges. The limited availability of natural gas refueling infrastructure remains a significant obstacle, especially in regions with underdeveloped networks. This lack of accessibility restricts the operational range of NGVs and can deter potential buyers. The fluctuating price of natural gas, subject to market volatility and geopolitical factors, also presents a risk, impacting the cost-effectiveness of NGVs and making it difficult to project long-term fuel costs accurately. Furthermore, the initial cost of NGVs, including the higher price of vehicles and the need for specialized refueling equipment, can be a barrier for some consumers and businesses, particularly small and medium-sized enterprises (SMEs). Moreover, technological limitations in certain aspects, such as range anxiety comparable to battery electric vehicles (BEVs) and the potential for methane leaks contributing to greenhouse gas emissions, require further development and innovation. Addressing these challenges through government support, private investment in infrastructure, and ongoing technological advancements will be crucial for the sustained growth of the NGV market.

China: China’s substantial investments in natural gas infrastructure and its strong government support for NGV adoption make it a key market driver. The country's vast commercial vehicle fleet presents a significant opportunity for heavy-duty NGV penetration. Domestic manufacturers like Beiqi Foton Motor and Dongfeng Motor are actively contributing to the market’s growth. The sheer size of China's market makes it a dominant player in global NGV sales.

North America (United States & Canada): While the US market is less centralized than China's, significant activity in the heavy-duty trucking segment is driven by companies like Navistar and the adoption of CNG (Compressed Natural Gas) and LNG (Liquefied Natural Gas) trucks. Government incentives and a relatively developed natural gas infrastructure support the market's growth.

Europe: The European Union's stringent emission standards are driving the adoption of cleaner vehicles, with many countries providing incentives for NGV adoption. Companies such as Daimler Trucks, Volvo Trucks, and MAN Truck & Bus are actively participating in the market. The focus here is more on heavy-duty vehicles for long-haul trucking and public transport.

Heavy-Duty Segment: The heavy-duty segment demonstrates faster growth compared to the light-duty segment, driven by significant cost savings from using natural gas in long-haul transportation and the environmental benefits that outweigh the initial cost. The demand for cleaner solutions in the trucking and logistics sectors will further propel this segment's expansion. The higher volume of fuel consumed by heavy-duty vehicles also makes the fuel cost advantage more significant.

CNG (Compressed Natural Gas): The lower initial investment cost compared to LNG infrastructure, coupled with its suitability for urban applications, drives the prevalence of CNG. The widespread availability of CNG filling stations in many regions further promotes its adoption.

In summary, the combination of supportive government policies, technological advancements, and economic factors makes China a frontrunner in the global market, with significant potential in North America and Europe, especially within the heavy-duty vehicle segment using CNG.

The growth of the light and heavy-duty natural gas vehicle industry is being propelled by a convergence of factors. Stringent emission regulations globally are mandating cleaner transportation solutions, making natural gas a compelling alternative. Simultaneously, the decreasing cost of natural gas, coupled with government incentives and subsidies targeted at promoting NGV adoption, significantly enhances the market's attractiveness. Moreover, technological advancements leading to improved engine efficiency and extended vehicle ranges are overcoming past limitations and fostering wider acceptance of NGVs. This confluence of factors, along with rising consumer awareness of environmental issues and a growing preference for sustainable transportation, is expected to significantly boost the market's expansion in the coming years.

This report provides a comprehensive analysis of the light and heavy-duty natural gas vehicle market, covering market trends, driving forces, challenges, key regions and segments, growth catalysts, leading players, and significant developments. The report utilizes detailed data and projections to present a clear picture of the market's current state and its future trajectory. The information presented helps stakeholders understand the market's dynamics, identify opportunities, and make informed decisions. The report's meticulous approach offers valuable insights for various industry participants, including manufacturers, suppliers, investors, and policymakers, contributing to a comprehensive understanding of the NGV landscape.

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of XX% from 2019-2033 |

| Segmentation |

|

Note*: In applicable scenarios

Primary Research

Secondary Research

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

The projected CAGR is approximately XX%.

Key companies in the market include CNH Industrial, Daimler Trucks, General Motors, MAN Truck & Bus, Volvo Trucks, Beiqi Foton Motor, BRC Gas Equipment, Cummins Westport, Dongfeng Motor, Fiat Chrysler Automobiles, Ford Motor, Gaz, Honda, Impco Technologies, Isuzu Motors, Kamaz, Landi Renzo, Navistar, Renault, Volkswagen, .

The market segments include Type, Application.

The market size is estimated to be USD XXX million as of 2022.

N/A

N/A

N/A

N/A

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3480.00, USD 5220.00, and USD 6960.00 respectively.

The market size is provided in terms of value, measured in million and volume, measured in K.

Yes, the market keyword associated with the report is "Light and Heavy-duty Natural Gas Vehicle," which aids in identifying and referencing the specific market segment covered.

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

To stay informed about further developments, trends, and reports in the Light and Heavy-duty Natural Gas Vehicle, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.