1. What is the projected Compound Annual Growth Rate (CAGR) of the Last Mile Delivery Transportation?

The projected CAGR is approximately XX%.

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.

Last Mile Delivery Transportation

Last Mile Delivery TransportationLast Mile Delivery Transportation by Type (Business-to-Business (B2B), Business-to-Consumer (B2C), Customer-to-Customer (C2C)), by Application (Motorcycle, Commercial Vehicles, Drones), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2025-2033

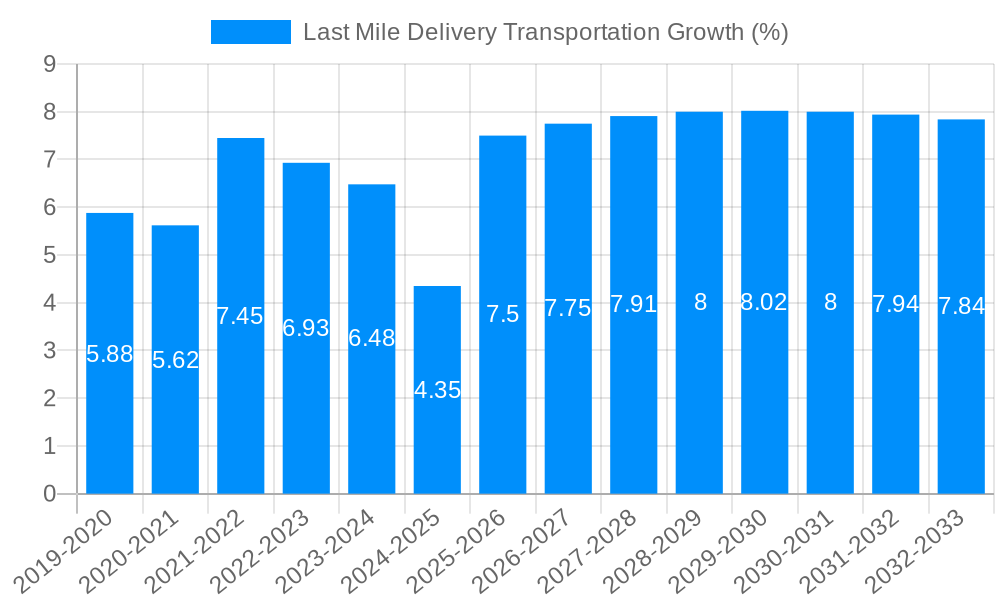

The Last Mile Delivery Transportation market is poised for substantial expansion, driven by an estimated market size of $120 billion in 2025 and projected to grow at a Compound Annual Growth Rate (CAGR) of 8.5% through 2033. This robust growth is fueled by escalating e-commerce penetration, increasing consumer demand for faster delivery options, and the burgeoning adoption of specialized vehicles like drones for last-mile logistics. The business-to-business (B2B) segment is expected to dominate, catering to the complex supply chain needs of enterprises, while the business-to-consumer (B2C) segment will witness significant gains as online retail continues its upward trajectory. The increasing reliance on technology for route optimization, real-time tracking, and efficient fleet management are key enablers of this market's expansion.

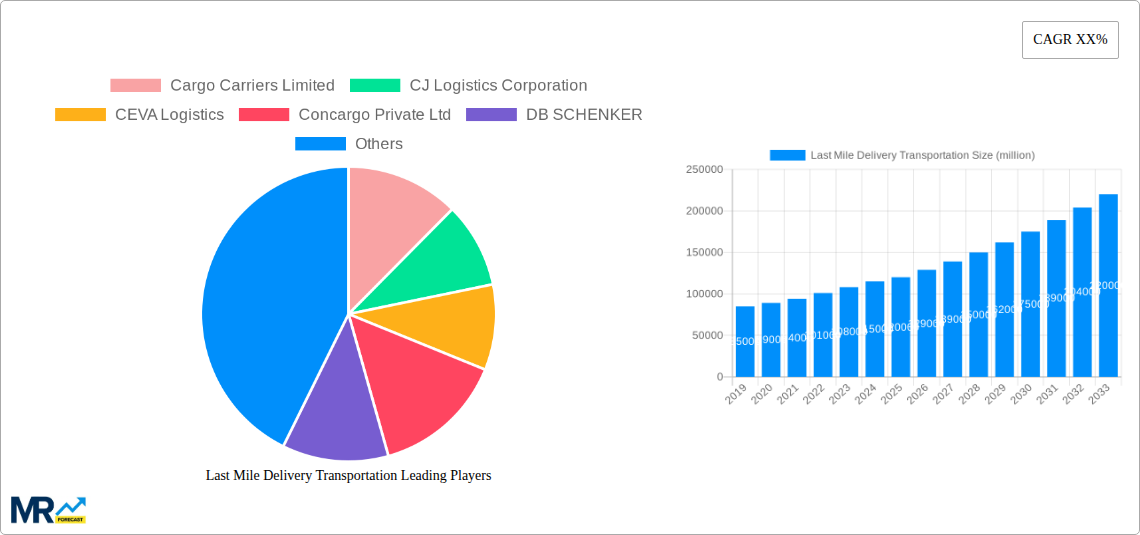

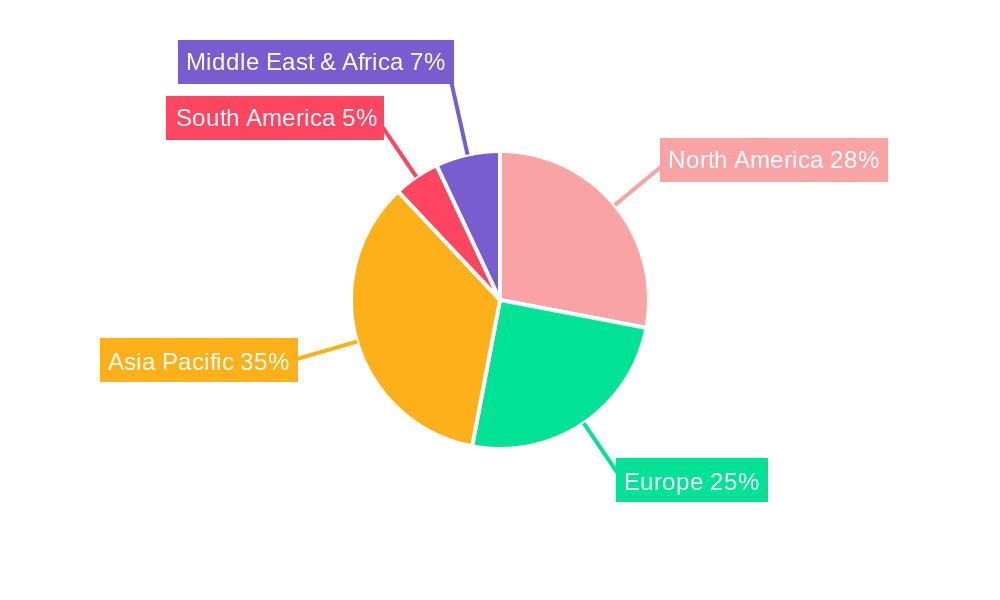

Geographically, Asia Pacific is anticipated to lead market growth, propelled by the sheer volume of e-commerce activities in countries like China and India, alongside the rapid adoption of innovative delivery solutions. North America and Europe are also expected to maintain strong growth, supported by established logistics infrastructure and ongoing investments in smart city initiatives and sustainable delivery practices. However, the market faces challenges such as rising operational costs, including fuel and labor, and the need for significant investment in new technologies to meet ever-increasing delivery speed expectations. Regulations and urban congestion can also pose constraints, necessitating the development of more efficient and environmentally friendly delivery models. Key players like FedEx, DHL, and UPS are actively investing in expanding their networks and integrating advanced technologies to capture a larger share of this dynamic market.

This comprehensive report delves into the dynamic and rapidly evolving landscape of Last Mile Delivery Transportation, offering a granular analysis of market trends, driving forces, challenges, and future projections. Spanning a detailed study period from 2019 to 2033, with a focused base and estimated year of 2025, and a forecast period from 2025 to 2033, this research leverages historical data from 2019-2024 to provide an authoritative outlook. The report explores the intricate interplay between various market segments, including Business-to-Business (B2B), Business-to-Consumer (B2C), and Customer-to-Customer (C2C) deliveries, alongside a thorough examination of key applications such as motorcycles, commercial vehicles, and the burgeoning drone delivery sector. Understanding the nuances of last mile delivery is paramount as it represents the most cost-intensive and complex stage in the supply chain, directly impacting customer satisfaction and operational efficiency. The market, valued in the millions, is characterized by continuous innovation and strategic investments aimed at optimizing speed, cost-effectiveness, and sustainability. This report aims to equip stakeholders with the critical insights needed to navigate this crucial segment of the logistics industry and capitalize on emerging opportunities.

XXX The last mile delivery transportation market is experiencing a profound transformation, driven by an insatiable demand for faster, more efficient, and customer-centric delivery solutions. A significant trend observed throughout the historical period (2019-2024) and projected to intensify during the forecast period (2025-2033) is the escalating dominance of Business-to-Consumer (B2C) deliveries. This surge is directly attributable to the meteoric rise of e-commerce, compelling consumers to expect near-instantaneous gratification for their online purchases. The base year of 2025 firmly positions B2C as the primary revenue generator, with its market share projected to expand further. Consequently, this has led to an increased reliance on agile and adaptable transportation methods. Motorcycles, for instance, have proven to be invaluable assets in densely populated urban environments, enabling swift navigation through congested streets and reducing delivery times. The integration of advanced route optimization software and real-time tracking technologies has further enhanced the efficiency of motorcycle-based deliveries, minimizing delays and improving overall customer experience. Conversely, while commercial vehicles remain the backbone for larger shipments and bulk deliveries, their role is evolving. There's a growing emphasis on electrifying these fleets, aligning with sustainability goals and addressing increasing environmental regulations. This transition aims to reduce operational costs associated with fuel and maintenance, while also contributing to a greener supply chain. The year 2025 marks a pivotal point where the adoption of electric commercial vehicles is expected to accelerate significantly, driven by government incentives and advancements in battery technology. The exploration and early adoption of drones for delivery, particularly for lightweight, high-value items and in specific geographical areas, also represent a forward-looking trend. While still in its nascent stages for widespread commercial application, pilot programs and regulatory frameworks are being actively developed, suggesting a future where drone deliveries play a more integrated role by the end of the study period in 2033. The market is also witnessing a proliferation of micro-fulfillment centers strategically located within urban areas, shortening the distance for the final leg of delivery and thereby enhancing speed and reducing costs associated with longer transit times. This shift towards localized distribution hubs is a direct response to the demand for immediate deliveries. Furthermore, the integration of artificial intelligence (AI) in demand forecasting and predictive analytics is enabling companies to anticipate delivery volumes more accurately, optimize resource allocation, and proactively address potential bottlenecks in the last mile. The emphasis on customer experience extends beyond speed to include flexible delivery options, such as scheduled deliveries, pick-up points, and contactless delivery, all of which are reshaping how last mile logistics are executed.

The last mile delivery transportation sector is being propelled by a confluence of powerful forces, with the unyielding growth of e-commerce standing as the paramount driver. As online retail continues its upward trajectory, the demand for efficient and timely delivery of goods directly to consumers' doorsteps has surged exponentially. This burgeoning e-commerce ecosystem necessitates robust and agile last mile solutions, thereby fueling investment and innovation in the sector. The base year of 2025 underscores the established dominance of e-commerce-driven B2C deliveries, which account for a substantial portion of last mile operations. Furthermore, increasing consumer expectations for speed and convenience play a pivotal role. Modern consumers, accustomed to same-day or next-day delivery for many online purchases, are driving the demand for faster transit times, pushing logistics providers to re-evaluate and optimize their delivery networks. This demand for expedited service is particularly evident in urban areas where traffic congestion can significantly impact delivery schedules. Moreover, technological advancements are acting as significant catalysts. The widespread adoption of GPS, real-time tracking software, and advanced route optimization algorithms are empowering delivery companies to enhance efficiency, reduce delivery times, and provide greater transparency to customers. These technologies enable better management of fleets and drivers, allowing for dynamic adjustments to routes in response to traffic conditions or unexpected delays. Industry developments, such as the increasing focus on sustainability and environmental responsibility, are also shaping the market. Growing awareness of carbon emissions and the desire to reduce the environmental impact of logistics operations are leading to a greater adoption of electric vehicles (EVs) and alternative delivery methods. This shift towards greener logistics solutions is not only driven by regulatory pressures but also by a growing consumer preference for environmentally conscious brands. Finally, the evolving nature of the retail landscape, with the rise of omnichannel strategies and the integration of online and offline sales channels, further complicates and necessitates optimized last mile solutions to ensure a seamless customer experience across all touchpoints.

Despite the robust growth and innovation within the last mile delivery transportation sector, several significant challenges and restraints continue to impede its seamless operation. The most pervasive issue remains urban congestion. Densely populated cities, with their intricate road networks and frequent traffic jams, present a formidable obstacle to timely and efficient deliveries. This congestion not only increases delivery times and fuel consumption but also leads to higher operational costs and greater driver fatigue. By the estimated year of 2025, this challenge is projected to remain a critical concern for logistics providers operating in major metropolitan areas. Another substantial restraint is the increasing cost of operations. This includes rising fuel prices, the escalating cost of labor, and the investment required for fleet upgrades and technological integration. The inherent inefficiency of many last mile routes, characterized by multiple stops and fragmented delivery networks, further contributes to these elevated costs. The demand for faster deliveries, while a driving force, also becomes a restraint when it necessitates the deployment of more resources and potentially less optimized routes to meet stringent delivery windows. Labor shortages and the availability of skilled drivers pose another significant challenge. The demanding nature of last mile delivery, often involving long hours and physical exertion, coupled with a competitive job market, makes it difficult for companies to attract and retain qualified personnel. This shortage can lead to delivery delays and increased reliance on gig economy workers, which can sometimes compromise service quality and consistency. The lack of adequate infrastructure, particularly in emerging markets and even in certain parts of established urban centers, can also be a considerable restraint. This includes the absence of designated loading zones, secure parking for delivery vehicles, and efficient parcel locker networks, all of which contribute to operational inefficiencies. Furthermore, the complexity of managing a diverse fleet, encompassing everything from motorcycles to commercial vehicles and nascent drone operations, requires sophisticated fleet management systems and specialized training for drivers and technicians. Finally, regulatory hurdles and evolving compliance requirements, particularly concerning emissions standards, vehicle usage in urban areas, and the burgeoning drone delivery sector, necessitate continuous adaptation and investment from companies operating in this space.

The Business-to-Consumer (B2C) segment is unequivocally poised to dominate the last mile delivery transportation market, a trend firmly established in the historical period (2019-2024) and projected to continue its ascendance through the forecast period (2025-2033). This dominance is intrinsically linked to the explosive growth of e-commerce, a global phenomenon that has fundamentally reshaped consumer purchasing habits. As more individuals gravitate towards online shopping for a vast array of goods, the demand for direct-to-consumer delivery has skyrocketed. The base year of 2025 solidifies B2C’s position as the primary revenue driver, with its market share expected to expand as online retail penetration deepens across various demographics and geographical locations.

Within this dominant B2C landscape, specific applications and regions are emerging as key enablers and growth engines.

North America and Europe are anticipated to remain the dominant regions in the last mile delivery transportation market. These regions boast highly developed e-commerce ecosystems, a strong consumer propensity for online purchasing, and significant investments in logistics infrastructure and technology. The high disposable income and advanced technological adoption in countries like the United States, Canada, Germany, and the United Kingdom fuel a consistent demand for fast and reliable last mile deliveries. The presence of major e-commerce players and well-established logistics companies within these regions further amplifies their market leadership.

Asia Pacific, however, presents the most significant growth potential. Countries such as China, India, and Southeast Asian nations are witnessing an unprecedented surge in e-commerce adoption, driven by a burgeoning middle class, increasing internet penetration, and the widespread availability of smartphones. While the infrastructure in some of these areas may still be developing, the sheer volume of consumers and the rapid pace of digital transformation make this region a critical focus for last mile delivery strategies.

The Motorcycle application will continue to be a vital component of last mile delivery, particularly in densely populated urban centers across all regions, but especially in Asia Pacific and parts of Europe. Their agility in navigating congested city streets, lower operational costs compared to larger vehicles, and ability to make frequent, quick stops make them indispensable for same-day and rapid deliveries of smaller parcels, food, and documents.

Commercial Vehicles, especially light-duty vans and trucks, will remain the workhorses for a substantial portion of last mile deliveries, particularly for larger items and in less congested areas. The ongoing trend towards electrification of these vehicles, driven by sustainability initiatives and government regulations, will be a key development within this segment throughout the forecast period. Companies are increasingly investing in electric vans to reduce their carbon footprint and operational costs.

The Drone application, while still in its nascent stages for widespread commercial use, holds immense future potential. Pilot programs and limited deployments are already underway in North America and Europe for specific use cases, such as medical supply deliveries or urgent package transport in remote or difficult-to-access areas. As regulatory frameworks evolve and technological capabilities improve, drones are expected to carve out a significant niche in the last mile, particularly for ultra-fast deliveries of high-value, lightweight items. The study period ending in 2033 anticipates a more mature drone delivery landscape.

The synergistic interplay of these segments and regions, driven by evolving consumer demands and technological advancements, will define the trajectory of the last mile delivery transportation market, with B2C deliveries at its core.

Several key growth catalysts are actively shaping the trajectory of the last mile delivery transportation industry. The relentless expansion of e-commerce is the primary engine, creating an ever-increasing demand for efficient delivery solutions. Alongside this, rising consumer expectations for speed, convenience, and personalized delivery options are compelling logistics providers to innovate and invest in faster, more flexible services. Technological advancements, including AI-powered route optimization, real-time tracking, and the development of autonomous delivery solutions, are crucial enablers, enhancing operational efficiency and reducing costs. Furthermore, the growing focus on sustainability is driving the adoption of electric vehicles and alternative delivery methods, opening new avenues for growth and differentiation.

This report provides an all-encompassing view of the last mile delivery transportation market, delving into its intricate workings and future potential. It offers a detailed breakdown of market segmentation by delivery type (B2B, B2C, C2C) and application (Motorcycle, Commercial Vehicles, Drones), providing granular insights into the performance and growth prospects of each. The analysis is grounded in robust historical data from 2019-2024 and extends to detailed projections up to 2033, with a particular focus on the pivotal year of 2025. Key trends, driving forces, and challenges are meticulously examined, shedding light on the factors shaping the industry. Furthermore, the report identifies the leading players and significant developments, offering a strategic perspective for stakeholders to understand the competitive landscape and anticipate future shifts. This comprehensive coverage ensures that businesses, investors, and policymakers are equipped with the knowledge necessary to navigate and capitalize on the opportunities within this critical sector of the global supply chain.

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of XX% from 2019-2033 |

| Segmentation |

|

Note*: In applicable scenarios

Primary Research

Secondary Research

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

The projected CAGR is approximately XX%.

Key companies in the market include Cargo Carriers Limited, CJ Logistics Corporation, CEVA Logistics, Concargo Private Ltd, DB SCHENKER, Interlogix Pty Ltd., DHL Paket GmbH, Estes Express Lines, FedEx Corporation, Kuehne + Nagel, Nippon Express Co., Ltd., KART, SNCF Geodis, Swift Transportation, TNT Holding B.V., Procet Freight, Tuma Transport, Yamato Holdings Co., Ltd., United Parcel Service Inc., .

The market segments include Type, Application.

The market size is estimated to be USD XXX million as of 2022.

N/A

N/A

N/A

N/A

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3480.00, USD 5220.00, and USD 6960.00 respectively.

The market size is provided in terms of value, measured in million.

Yes, the market keyword associated with the report is "Last Mile Delivery Transportation," which aids in identifying and referencing the specific market segment covered.

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

To stay informed about further developments, trends, and reports in the Last Mile Delivery Transportation, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.