1. What is the projected Compound Annual Growth Rate (CAGR) of the Laboratory Glassware?

The projected CAGR is approximately XX%.

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.

Laboratory Glassware

Laboratory GlasswareLaboratory Glassware by Type (Container, Measurer, Filter, Others, World Laboratory Glassware Production ), by Application (Chemical Laboratory, Bio-Pharmaceutical Laboratory, Food Testing Laboratory, Others, World Laboratory Glassware Production ), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2025-2033

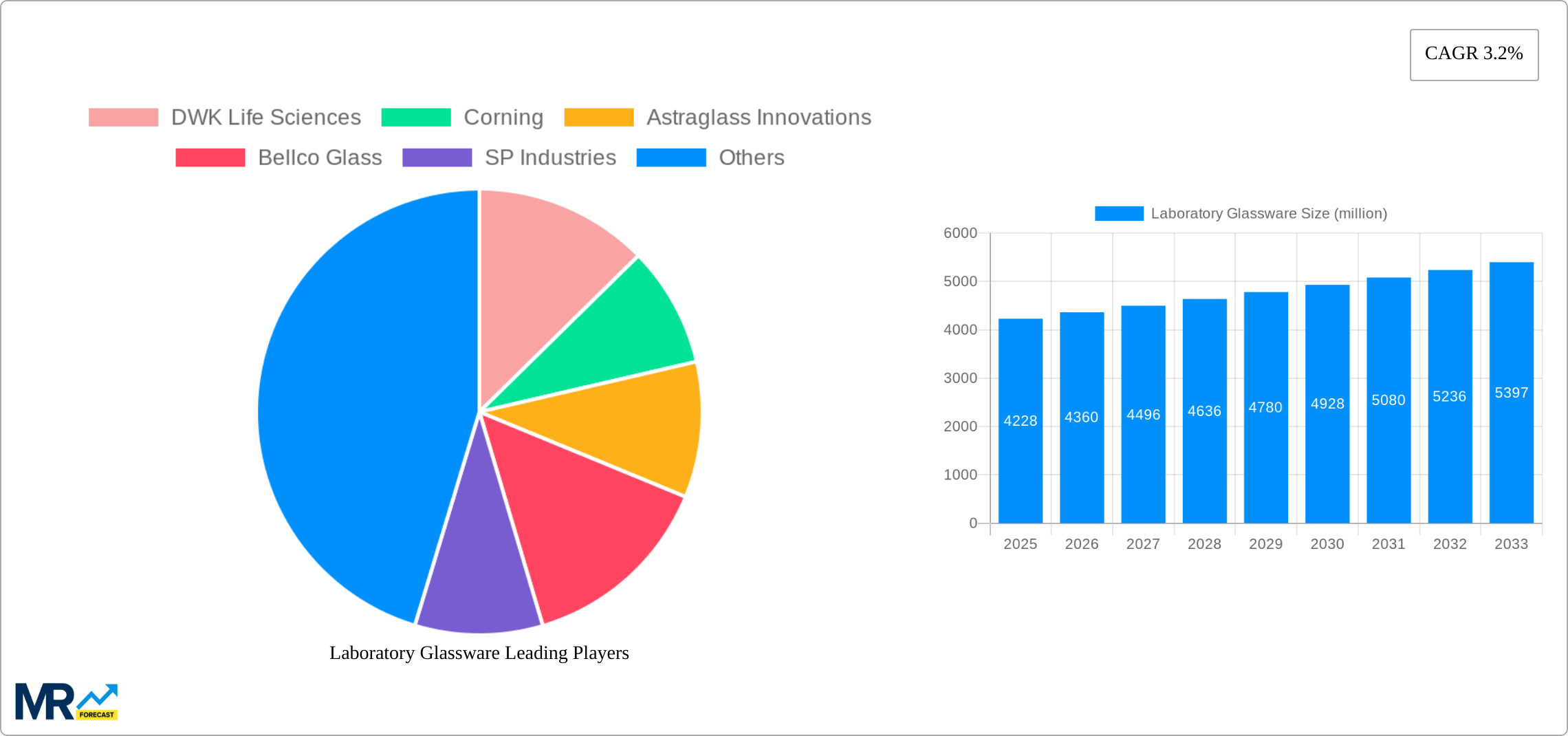

The global laboratory glassware market is poised for significant expansion, projected to reach a substantial USD 4228 million by 2025. This growth is fueled by an increasing demand for precise and reliable scientific equipment across a multitude of research and analytical sectors. The bio-pharmaceutical industry, in particular, is a major contributor, driven by accelerated drug discovery, development, and manufacturing processes. Advancements in analytical techniques and the growing need for high-purity materials in sensitive experiments further bolster market expansion. The chemical laboratory sector also remains a cornerstone, with ongoing research and development activities requiring a constant supply of essential glassware. Emerging economies, with their burgeoning research infrastructure and increased investment in scientific education, are presenting new avenues for market penetration and growth. Innovations in material science, leading to more durable, chemically resistant, and temperature-stable glassware, are also contributing to market dynamism.

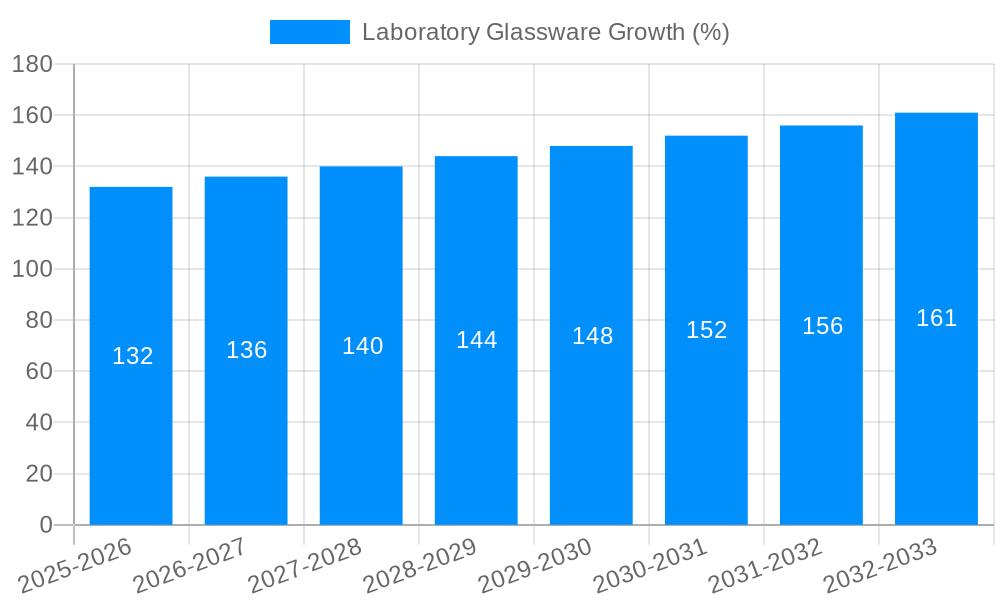

The laboratory glassware market is characterized by a moderate Compound Annual Growth Rate (CAGR) of approximately 6.5% for the forecast period of 2025-2033. This steady expansion is underpinned by several key trends, including the rise of advanced laboratory automation, the increasing focus on sustainability and the development of eco-friendly manufacturing processes for glassware, and the growing adoption of specialized glassware for niche applications like microfluidics and high-throughput screening. However, the market also faces certain restraints, such as the initial high cost of certain specialized glassware, the potential for breakage and contamination impacting cost-effectiveness, and stringent regulatory requirements that necessitate adherence to quality standards. The competitive landscape is dynamic, with established global players like DWK Life Sciences and Corning alongside emerging regional manufacturers, particularly in the Asia Pacific region, vying for market share. The market segmentation by type includes crucial components like containers, measurers, and filters, with "Others" encompassing specialized items. Application segments highlight the dominance of chemical and bio-pharmaceutical laboratories, with food testing laboratories also contributing significantly.

The global laboratory glassware market, projected to reach a colossal value of over USD 3,500 million by 2033, is on an upward trajectory fueled by an insatiable demand for precision and reliability across scientific disciplines. During the study period of 2019-2033, with a base year of 2025, this market has witnessed consistent growth, moving from a historical period of 2019-2024 into a robust forecast period of 2025-2033. The year 2025, designated as the estimated year, stands as a pivotal point for market analysis, reflecting current trends and setting the stage for future expansion. The sheer volume of World Laboratory Glassware Production indicates a strong underlying need for these essential scientific tools. The dominance of the "Container" type segment, accounting for a significant portion of the market value, underscores its fundamental role in countless experimental setups. From basic beakers and flasks to specialized volumetric flasks and test tubes, containers form the bedrock of laboratory operations. Their widespread application in Chemical Laboratories, Bio-Pharmaceutical Laboratories, and Food Testing Laboratories, among others, ensures their perpetual relevance. The increasing complexity of research and development activities, particularly in the life sciences, necessitates higher quality, more durable, and precisely calibrated glassware. Advancements in materials science and manufacturing techniques are also contributing to the evolution of laboratory glassware, with innovations focusing on enhanced chemical resistance, thermal shock resistance, and improved accuracy. The market's growth is further bolstered by increasing government investments in scientific research and education globally, creating a sustained demand for laboratory equipment, including glassware. The projected expansion signals a healthy and dynamic market, poised for continued innovation and market penetration in the coming years, driven by both established players and emerging manufacturers.

The global laboratory glassware market is experiencing a significant upswing, propelled by several formidable driving forces. Foremost among these is the relentless expansion of the bio-pharmaceutical sector. With an ever-increasing investment in drug discovery, development, and manufacturing, the demand for high-precision, chemically inert, and sterile laboratory glassware for applications ranging from cell culture to drug formulation is soaring. This surge is directly reflected in the substantial World Laboratory Glassware Production figures observed. Furthermore, the growing emphasis on stringent quality control and assurance measures across various industries, including food and beverage, environmental testing, and manufacturing, necessitates the use of reliable and accurate measuring and containment tools, thereby boosting the demand for specialized laboratory glassware. Government initiatives promoting scientific research and development, coupled with increased funding for academic institutions and research centers, are also key contributors. These investments translate directly into greater procurement of laboratory equipment, including a wide array of glassware. The increasing trend towards automation in laboratories, while seemingly a move away from manual tasks, actually spurs the need for specialized, robot-compatible glassware designed for seamless integration into automated systems. This evolution ensures that even as workflows change, the fundamental need for high-quality glassware persists.

Despite the optimistic outlook, the laboratory glassware market is not without its hurdles. One of the primary challenges is the volatile pricing of raw materials, particularly silica sand and borosilicate glass components. Fluctuations in the cost of these essential inputs can significantly impact manufacturing costs and subsequently influence the final pricing of laboratory glassware, potentially dampening demand. Another significant restraint is the growing competition from alternative materials. While glass remains the gold standard for many applications due to its inertness and transparency, advancements in plastics and polymers have led to the development of disposable or reusable labware that offers advantages such as reduced breakage and lower costs in certain scenarios, particularly for high-throughput screening or single-use applications. This competition necessitates continuous innovation from glass manufacturers to highlight the inherent benefits of their products. Furthermore, the stringent regulatory landscape governing the production and quality of laboratory glassware, especially for use in pharmaceutical and medical applications, imposes high compliance costs. Ensuring adherence to standards set by bodies like ISO and ASTM can be a complex and resource-intensive process. The logistical challenges associated with shipping fragile glass products, particularly across international borders, also add to operational costs and can sometimes lead to delays, impacting the supply chain. Lastly, the inherent fragility of glass, even borosilicate, remains a concern, necessitating careful handling and increasing replacement rates in some laboratory environments.

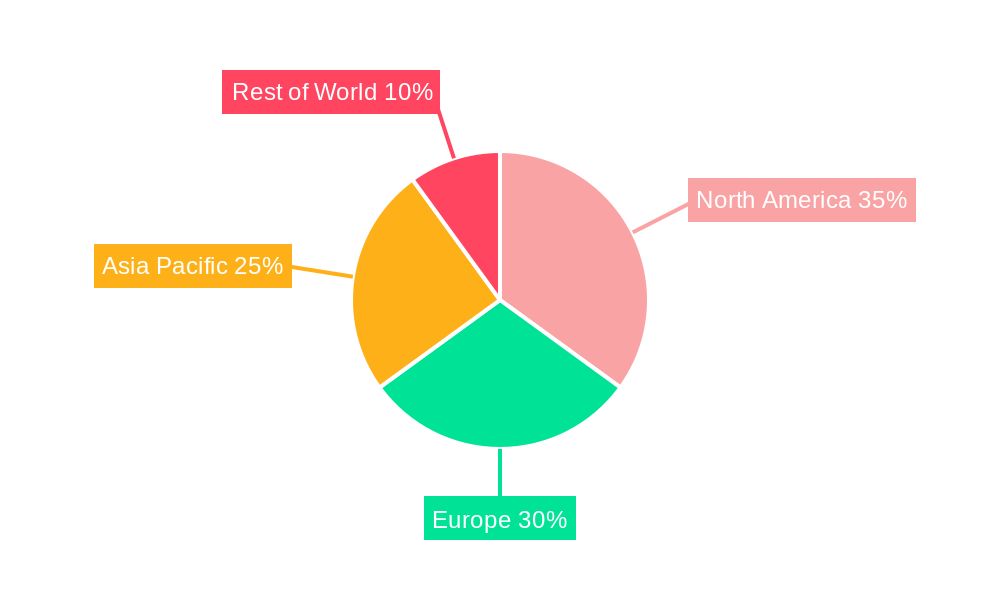

The global laboratory glassware market is characterized by distinct regional dynamics and segment dominance. In terms of regional dominance, North America and Europe are anticipated to continue their stronghold throughout the forecast period of 2025-2033, primarily driven by their advanced research infrastructure, substantial investments in biotechnology and pharmaceuticals, and stringent quality control mandates. These regions boast a high concentration of research institutions, universities, and multinational biopharmaceutical companies, all of which are major consumers of laboratory glassware. The established regulatory frameworks and a strong emphasis on scientific accuracy further solidify their leading position. Asia Pacific, however, is projected to witness the most rapid growth, fueled by increasing government support for scientific research, a burgeoning bio-pharmaceutical industry, and a growing number of contract research organizations (CROs) and contract manufacturing organizations (CMOs). Countries like China and India are emerging as significant production hubs and rapidly expanding consumer markets for laboratory glassware.

Focusing on the segment dominance, the "Container" type segment is overwhelmingly set to dominate the World Laboratory Glassware Production value, contributing significantly to the overall market size. This dominance stems from the indispensable nature of containers across virtually all laboratory applications.

While other segments like "Measurer" (e.g., burettes, pipettes, cylinders) are crucial for precision, and "Filter" (e.g., Büchner flasks, filter funnels) plays a vital role in separation processes, the sheer breadth of application and consistent demand for basic containment solutions firmly place the "Container" segment at the forefront of market value and volume. The World Laboratory Glassware Production figures are heavily influenced by the consistent and high-volume manufacturing of these indispensable laboratory vessels.

The laboratory glassware industry is poised for robust growth, driven by several key catalysts. The escalating global expenditure on research and development, particularly in the life sciences and biotechnology sectors, is a primary growth engine. Increased funding for academic institutions and government research initiatives translates directly into a higher demand for essential laboratory equipment, including glassware. Furthermore, the growing stringency of regulatory requirements across various industries, such as pharmaceuticals and food safety, mandates the use of highly accurate and reliable laboratory glassware for quality control and compliance. The expanding healthcare sector and the continuous pursuit of new drug discoveries also contribute significantly to market expansion, creating sustained demand for specialized laboratory glassware.

This report provides a comprehensive analysis of the global laboratory glassware market, encompassing the historical period (2019-2024) and a detailed forecast for the period 2025-2033, with 2025 serving as the base and estimated year. It delves into the market's projected valuation exceeding USD 3,500 million by 2033, highlighting key trends and the significant World Laboratory Glassware Production volumes. The report meticulously examines the driving forces, including the expansion of the bio-pharmaceutical sector and increasing R&D investments, as well as the challenges faced, such as raw material price volatility and competition from alternative materials. It offers in-depth insights into regional market dynamics and segment dominance, particularly emphasizing the "Container" segment's substantial contribution to market value. Furthermore, the report identifies key growth catalysts and profiles leading industry players, alongside a timeline of significant developments. This exhaustive coverage ensures stakeholders gain a complete understanding of the laboratory glassware landscape and its future trajectory.

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of XX% from 2019-2033 |

| Segmentation |

|

Note*: In applicable scenarios

Primary Research

Secondary Research

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

The projected CAGR is approximately XX%.

Key companies in the market include DWK Life Sciences, Corning, Astraglass Innovations, Bellco Glass, SP Industries, Hamilton Laboratory Glass, Kavalierglass, Borosil, Hilgenberg, Glacier Glass Works, Eagle Laboratory Glass Company, Jencons Glass Industries, Sibata Scientific Technology, Glassco Group, Coslab India, HARIO, SCAM Lab Glass, Sichuan Shubo, Huaou Industry, North Glass, Tianbao Glass Instrument, Jianghai Instrument Fitting, Jiangsu Kahotest Citotest Medical Instruments, Haimen Shengbang Laboratory Equipment.

The market segments include Type, Application.

The market size is estimated to be USD 4228 million as of 2022.

N/A

N/A

N/A

N/A

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4480.00, USD 6720.00, and USD 8960.00 respectively.

The market size is provided in terms of value, measured in million and volume, measured in K.

Yes, the market keyword associated with the report is "Laboratory Glassware," which aids in identifying and referencing the specific market segment covered.

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

To stay informed about further developments, trends, and reports in the Laboratory Glassware, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.