1. What is the projected Compound Annual Growth Rate (CAGR) of the Laboratory Dog?

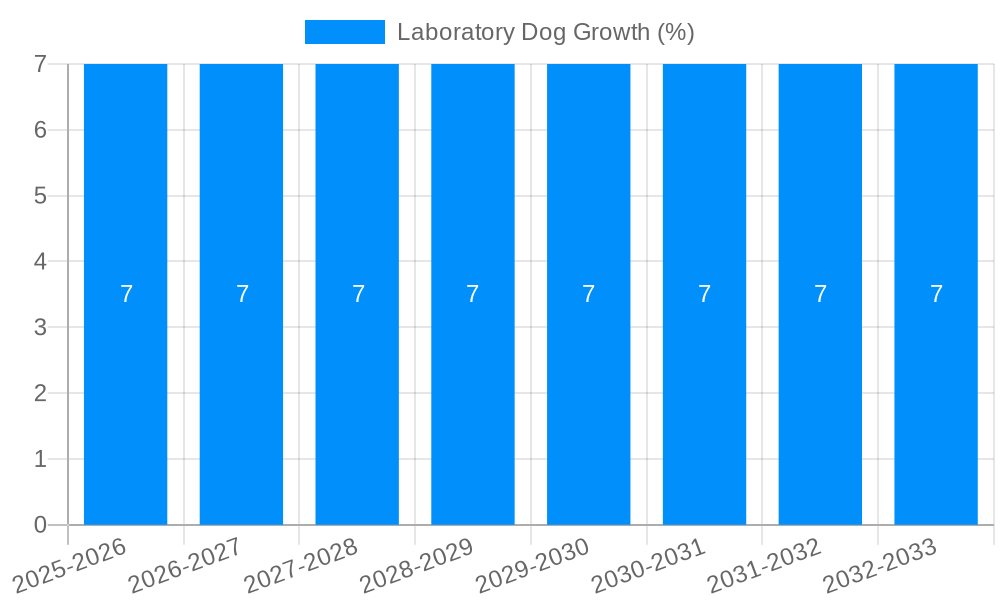

The projected CAGR is approximately XX%.

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.

Laboratory Dog

Laboratory DogLaboratory Dog by Type (Beagle, Four-Line Hybrid Dog, Black and White Spotted Short Haired Dog, Mexican Hairless Dog, Others), by Application (Research Institutions, Medical Center, School, Others), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2025-2033

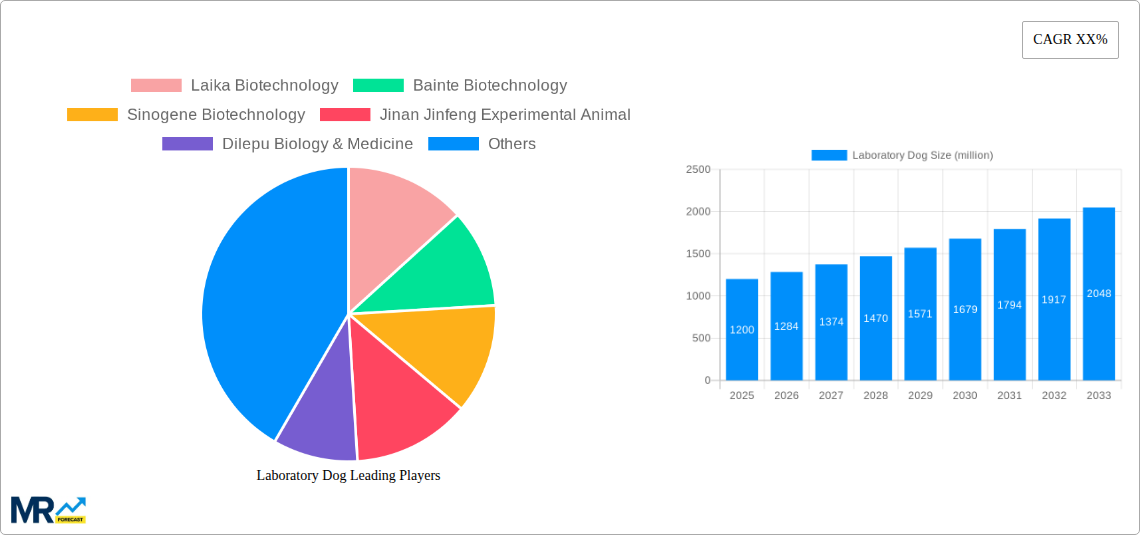

The global laboratory dog market is experiencing robust growth, driven by the increasing demand for animal models in biomedical research and drug development. The market, segmented by dog breed (Beagle, Four-Line Hybrid Dog, Black and White Spotted Short Haired Dog, Mexican Hairless Dog, and Others) and application (Research Institutions, Medical Centers, Schools, and Others), is witnessing a significant expansion fueled by advancements in genetic engineering and a rising number of clinical trials. The preference for specific breeds, like Beagles, due to their docile nature and established genetic profiles, contributes to market segmentation. However, ethical concerns surrounding animal testing and the rising costs associated with maintaining laboratory animals are key restraints to growth. While precise market sizing requires further data, a logical estimation based on industry reports and trends suggests a 2025 market value of approximately $500 million, with a Compound Annual Growth Rate (CAGR) of 5-7% projected through 2033. This growth will likely be driven by the continued expansion of the pharmaceutical and biotechnology industries, particularly in North America and Asia-Pacific regions, where research infrastructure is substantial.

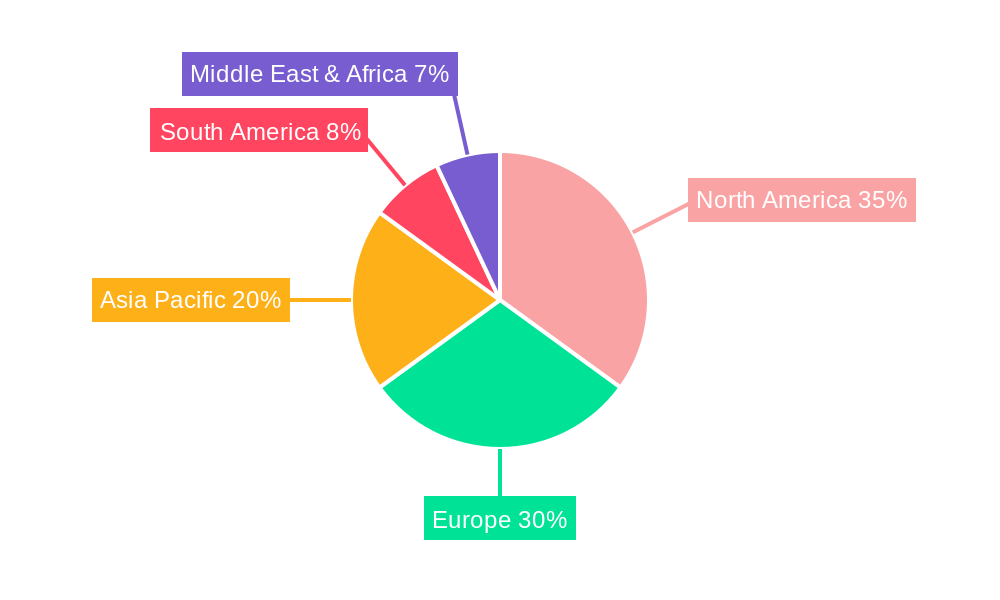

The geographical distribution of the laboratory dog market is largely influenced by the concentration of research institutions and pharmaceutical companies. North America currently holds a dominant market share due to substantial investments in research and development, followed by Europe and Asia-Pacific. Emerging economies in Asia-Pacific, particularly China and India, are expected to demonstrate significant growth in the coming years, driven by increasing government funding for research and development initiatives and a growing pool of scientific talent. However, regulatory hurdles and ethical considerations, varying significantly across different regions, present a complex landscape for market players. The competitive landscape is characterized by a mix of large multinational companies and specialized regional players. These companies are constantly seeking to improve breeding techniques, genetic modification capabilities, and the overall welfare of laboratory dogs to align with evolving ethical guidelines and strengthen their market positions. Strategic partnerships and collaborations are expected to play a crucial role in the overall growth and development of the laboratory dog market.

The global laboratory dog market is experiencing robust growth, projected to reach multi-million unit sales by 2033. Driven by escalating demand from research institutions, medical centers, and educational facilities, the market demonstrates a significant upward trajectory. Analysis of the historical period (2019-2024) reveals a steady increase in laboratory dog usage, mirroring advancements in biomedical research and the growing need for animal models in pre-clinical studies. The estimated market value for 2025 stands at a substantial figure, reflecting the continued reliance on canine models for their physiological similarities to humans. The forecast period (2025-2033) anticipates continued expansion, fueled by technological advancements in breeding and genetic modification, resulting in more specialized and genetically homogenous laboratory dogs. However, ethical considerations and increasing regulatory scrutiny pose ongoing challenges, potentially influencing the market's growth trajectory. The key market insight lies in the evolving demand for specific breeds possessing unique genetic characteristics suitable for targeted research applications. This trend encourages investment in advanced breeding programs to produce dogs with pre-determined traits, leading to increased efficiency and accuracy in research outcomes. This specialized breeding is simultaneously driving up the cost of certain laboratory dog types, leading to price differentiation across the market. The increasing adoption of 3Rs (Replacement, Reduction, Refinement) principles in animal research may also influence market growth in the coming years, demanding a focus on refined methodologies and ethical sourcing of animals.

Several factors contribute to the burgeoning laboratory dog market. The increasing prevalence of complex diseases requiring sophisticated animal models for pre-clinical testing is a primary driver. Canine models often exhibit physiological similarities to humans, making them valuable in studying conditions like cancer, cardiovascular diseases, and neurological disorders. Moreover, advancements in genetic engineering and breeding techniques enable the creation of genetically modified dogs with specific traits, significantly enhancing the reliability and relevance of research findings. The expansion of the pharmaceutical and biotechnology industries further fuels demand, as companies increasingly rely on pre-clinical testing using animal models to ensure drug safety and efficacy before human trials. The growing number of research institutions and medical centers globally, coupled with increased funding for biomedical research, also contributes significantly to the market's expansion. Finally, the development of new diagnostic tools and technologies for canine health improves the efficiency and precision of research studies involving laboratory dogs.

Despite the market's promising growth, several challenges and restraints exist. Ethical considerations surrounding the use of animals in research remain a significant concern, leading to increased regulatory scrutiny and public pressure. Stringent regulations on animal welfare and research protocols often necessitate substantial investments in infrastructure and compliance measures, increasing operating costs for researchers and breeders. The high cost associated with acquiring, housing, and maintaining laboratory dogs, particularly specialized breeds, represents a barrier to entry for smaller research institutions and laboratories. Furthermore, the availability of alternative research methods, such as in vitro studies and computer modeling, presents competition and potentially reduces the reliance on animal models in certain research areas. The potential for zoonotic diseases and the need for stringent biosecurity measures also pose challenges in managing laboratory dog facilities and ensuring the safety of researchers and the wider community.

The Beagle breed significantly dominates the laboratory dog market due to its docile temperament, readily available supply, and well-established history in biomedical research. Its characteristics make it an ideal model for a wide range of studies.

Beagle: This breed accounts for a substantial portion of the total market share due to its suitability for various research purposes, established breeding programs, and readily available supply. Its temperament and size are also advantageous in research settings.

Research Institutions: This segment contributes the highest share to market revenue owing to the substantial research activities carried out within these institutions and their reliance on animal models for pre-clinical studies. The funding allocated to research within these organizations fuels this segment's dominance.

While other breeds, such as Four-Line Hybrid Dogs, are increasingly utilized for specific research needs, the Beagle remains the dominant breed owing to its broad applicability and established history. The Research Institutions segment shows the highest market share due to the sheer volume of research and development activities ongoing within these facilities. Many large pharmaceutical and biotechnology companies heavily utilize these institutions to conduct pre-clinical testing, driving up the demand for laboratory dogs within this segment. This also suggests a considerable concentration of the market geographically within regions that have a high concentration of research institutions and pharmaceutical and biotechnology industries.

In paragraph form: The Beagle's dominance stems from its long history in research, its readily available supply, manageable size, and docile temperament, making it suitable for a broad range of studies. Research institutions are the leading consumers of laboratory dogs, driven by their significant research activities and investments in pre-clinical studies, further solidifying the Beagle's position as the market leader in terms of breed. While other breeds and applications exist, the combination of these factors makes the Beagle in the Research Institution setting the most prominent segment in the current market landscape. The projected growth forecast points to a continuation of this dominance, but future trends will be affected by the increasing use of specific breeds for targeted research and the impact of regulatory changes in animal research ethics.

The industry's growth is propelled by the increasing complexity of diseases demanding advanced animal models, advancements in genetic engineering facilitating the creation of specialized dogs, and the expanding pharmaceutical and biotechnology sectors heavily reliant on pre-clinical testing.

This report provides a comprehensive analysis of the laboratory dog market, encompassing historical data, current market trends, and future growth projections. It examines key driving forces, challenges, and opportunities within the sector, detailing market segmentation based on dog breed and application. This detailed analysis offers valuable insights for industry stakeholders, researchers, and investors seeking to understand and navigate this dynamic market.

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of XX% from 2019-2033 |

| Segmentation |

|

Note*: In applicable scenarios

Primary Research

Secondary Research

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

The projected CAGR is approximately XX%.

Key companies in the market include Laika Biotechnology, Bainte Biotechnology, Sinogene Biotechnology, Jinan Jinfeng Experimental Animal, Dilepu Biology & Medicine, Dashuo Experimental Animal, Guangzhou General Pharmaceutical Research Institute, .

The market segments include Type, Application.

The market size is estimated to be USD XXX million as of 2022.

N/A

N/A

N/A

N/A

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3480.00, USD 5220.00, and USD 6960.00 respectively.

The market size is provided in terms of value, measured in million and volume, measured in K.

Yes, the market keyword associated with the report is "Laboratory Dog," which aids in identifying and referencing the specific market segment covered.

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

To stay informed about further developments, trends, and reports in the Laboratory Dog, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.