1. What is the projected Compound Annual Growth Rate (CAGR) of the IVD Infectious Diseases?

The projected CAGR is approximately XX%.

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.

IVD Infectious Diseases

IVD Infectious DiseasesIVD Infectious Diseases by Type (/> Immunochemistry, Molecular Diagnostics), by Application (/> Clinical Laboratories, Diagnostic Centers), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2025-2033

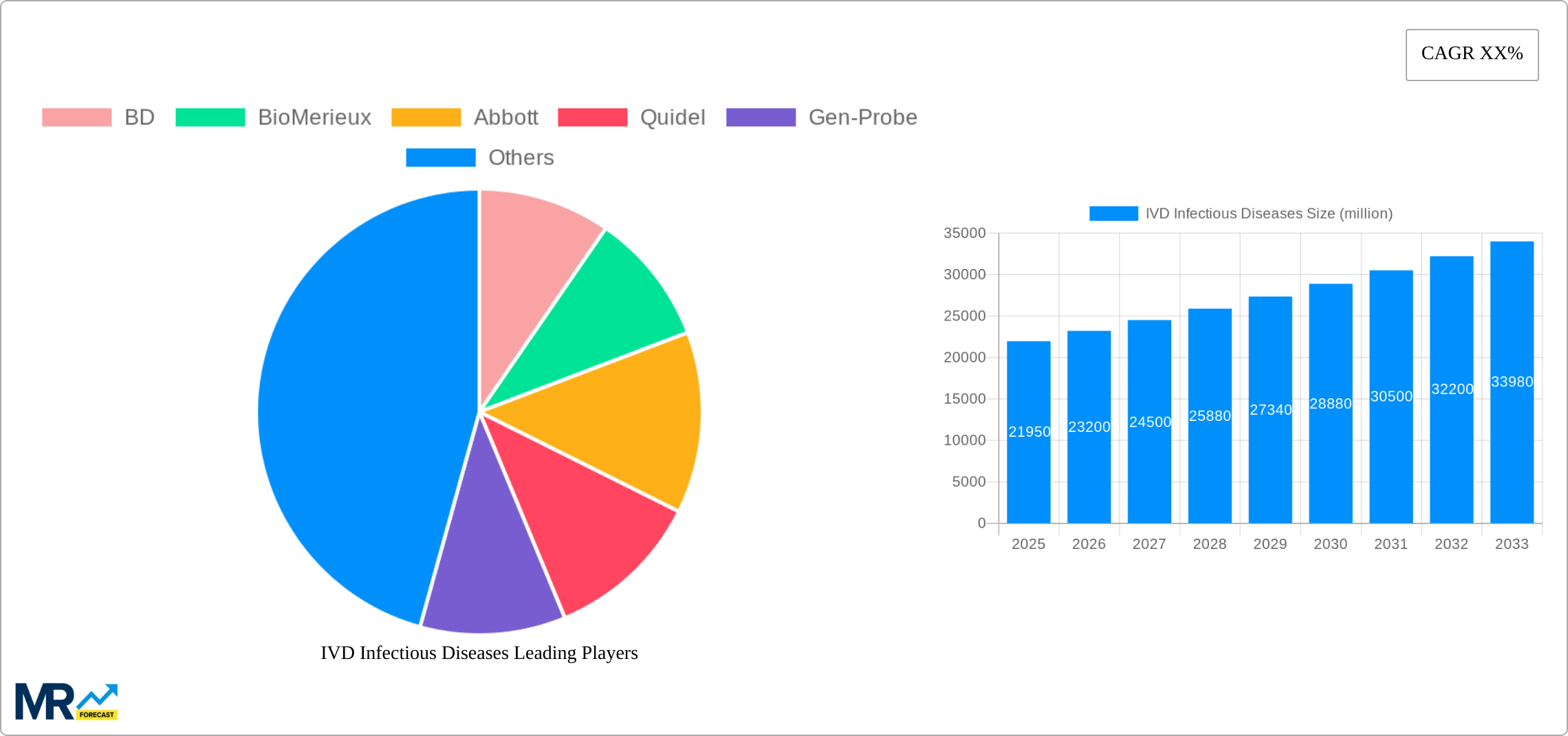

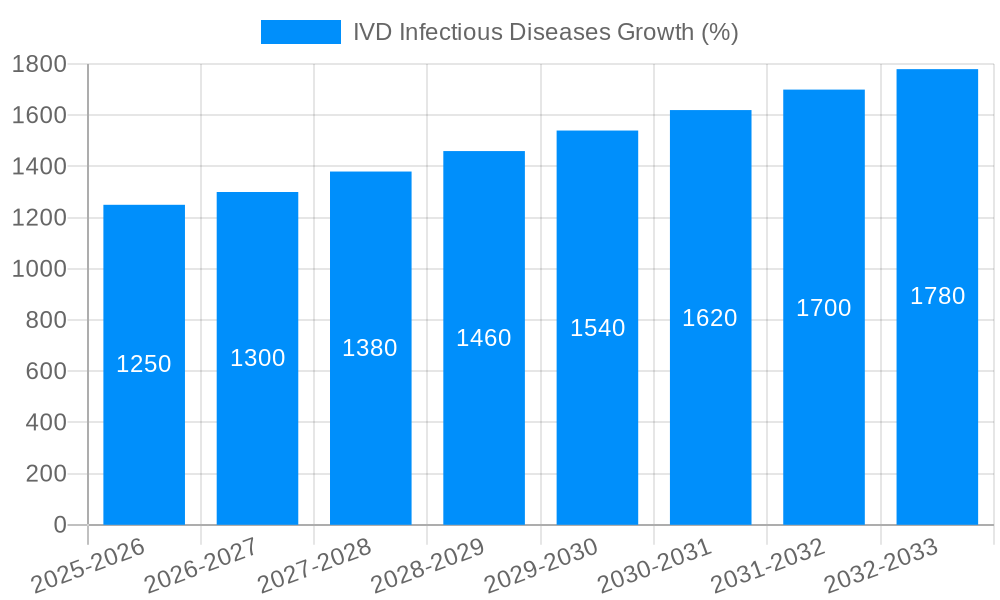

The In Vitro Diagnostics (IVD) Infectious Diseases market, valued at approximately $21.95 billion in 2025, is poised for substantial growth over the forecast period (2025-2033). While a precise CAGR isn't provided, considering the robust drivers within the sector—rising prevalence of infectious diseases globally, increasing demand for rapid and accurate diagnostics, technological advancements in molecular diagnostics and immunochemistry, and growing investments in healthcare infrastructure, particularly in emerging economies—a conservative estimate of a 5-7% CAGR is plausible. This growth is fueled by the increasing need for early and effective diagnosis and treatment of infectious diseases, leading to improved patient outcomes and reduced healthcare costs. The market segmentation reveals significant opportunities across various testing methodologies, with immunochemistry and molecular diagnostics leading the way. Application-wise, clinical laboratories and diagnostic centers represent the largest market segments, driven by high testing volumes and established infrastructure. Key players like BD, BioMerieux, Abbott, and Roche Diagnostics are driving innovation and competition, further shaping market dynamics. However, challenges remain, including regulatory hurdles for new diagnostic technologies, pricing pressures, and the need for consistent quality control across different diagnostic settings.

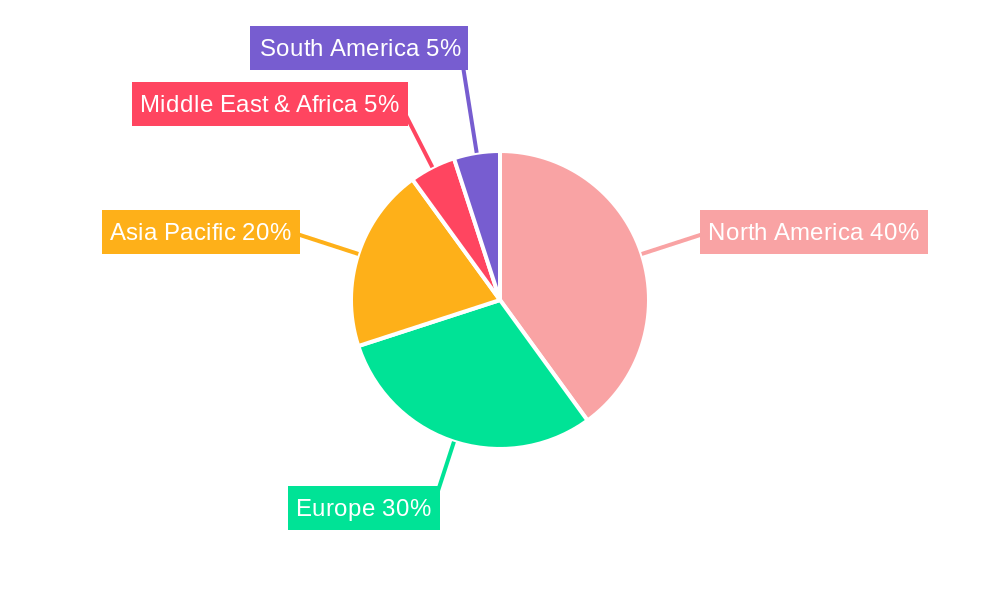

The geographic distribution of the market indicates substantial growth potential in emerging markets like Asia-Pacific and the Middle East & Africa. These regions are witnessing rapid population growth, rising healthcare spending, and increasing disease burden, contributing to increased demand for IVD solutions. North America and Europe, while already established markets, will continue to witness growth driven by the adoption of advanced diagnostic technologies and the management of chronic infectious diseases within their aging populations. Overall, the IVD Infectious Diseases market demonstrates compelling growth potential, driven by a combination of technological advancements, epidemiological shifts, and increasing healthcare investments, but stakeholders must also consider and address challenges relating to regulatory compliance, cost-effectiveness, and global disparities in healthcare access.

The global in-vitro diagnostics (IVD) infectious diseases market is experiencing robust growth, driven by the increasing prevalence of infectious diseases, advancements in diagnostic technologies, and rising healthcare expenditure. The market, valued at $XX billion in 2025, is projected to reach $YY billion by 2033, exhibiting a Compound Annual Growth Rate (CAGR) of Z%. This expansive market encompasses a diverse range of diagnostic techniques, including immunochemistry, molecular diagnostics, and microbiology, catering to various applications across clinical laboratories, diagnostic centers, and point-of-care settings. The historical period (2019-2024) witnessed significant market expansion fueled by the COVID-19 pandemic, which highlighted the critical need for rapid and accurate infectious disease diagnostics. The forecast period (2025-2033) anticipates continued growth, driven by factors such as the emergence of antimicrobial resistance, increasing demand for rapid diagnostic tests (RDTs), and the growing adoption of advanced technologies like next-generation sequencing (NGS) and mass spectrometry. This report analyzes the market dynamics, key players, and future trends influencing this vital sector of the healthcare industry. Technological advancements are continually shaping the market, with a shift towards automation, miniaturization, and the integration of artificial intelligence (AI) for improved diagnostic accuracy and efficiency. The increasing focus on personalized medicine is also driving the development of more targeted and specific diagnostic tests for various infectious diseases. The market is witnessing a rise in the adoption of molecular diagnostics, owing to their superior sensitivity and specificity compared to traditional methods.

Several factors are contributing to the rapid growth of the IVD infectious diseases market. The escalating global burden of infectious diseases, including both newly emerging and re-emerging pathogens, necessitates advanced diagnostic tools for effective disease management and control. The rising prevalence of antimicrobial resistance (AMR) poses a significant threat, demanding faster and more accurate diagnostics to guide appropriate antibiotic stewardship and limit the spread of resistant strains. Technological advancements in diagnostic platforms, such as the development of highly sensitive and specific molecular assays, rapid diagnostic tests, and automated systems, are driving market expansion. Increased healthcare spending, particularly in developing economies, is also boosting demand for these diagnostic tools. Furthermore, the growing awareness among healthcare professionals and the general public regarding the importance of early and accurate diagnosis of infectious diseases is fueling the market's growth. Governments' initiatives to improve healthcare infrastructure and strengthen disease surveillance programs are further contributing to this upward trend. The increasing demand for point-of-care diagnostics, particularly in resource-limited settings, is another significant driver, facilitating rapid diagnosis and treatment in remote areas.

Despite the promising growth trajectory, the IVD infectious diseases market faces several challenges. High costs associated with advanced diagnostic technologies, particularly molecular assays and NGS, can limit their accessibility, especially in low- and middle-income countries. The regulatory complexities and stringent approval processes for new diagnostic devices can pose significant hurdles for manufacturers. The emergence of new and unknown pathogens necessitates continuous development and adaptation of diagnostic techniques, presenting a constant challenge to manufacturers and regulatory bodies. The lack of standardized diagnostic protocols and the variability in laboratory practices can affect the reliability and comparability of diagnostic results across different settings. Furthermore, ensuring the quality and accuracy of diagnostic tests, particularly in resource-constrained settings, remains a challenge. Competition among established players and the entry of new entrants can also intensify price pressures and affect profit margins. Addressing these challenges requires collaborative efforts from stakeholders across the healthcare ecosystem.

The North American and European regions are expected to dominate the IVD infectious diseases market during the forecast period, owing to the high prevalence of infectious diseases, advanced healthcare infrastructure, and robust regulatory frameworks. However, the Asia-Pacific region is projected to witness the fastest growth rate due to increasing healthcare expenditure, rising awareness of infectious diseases, and expanding diagnostic testing infrastructure.

Molecular Diagnostics Segment: This segment is expected to experience significant growth due to its high sensitivity and specificity in detecting a wide range of infectious agents. Molecular diagnostic tests, including PCR and other nucleic acid amplification technologies, are increasingly preferred over traditional methods.

Clinical Laboratories: Clinical laboratories are the primary users of IVD infectious disease tests, due to their advanced equipment, trained personnel, and capacity to handle large volumes of tests. Their contribution to the overall market is significant, particularly in developed countries.

United States: The United States is a major player in the global IVD market, with significant demand for advanced diagnostic technologies and a high prevalence of infectious diseases.

Germany: Germany possesses a well-established healthcare infrastructure and a large number of clinical laboratories, contributing substantially to European market dominance.

Japan: Japan is a key player in the Asia-Pacific region, characterized by a focus on high-quality healthcare and significant investments in advanced diagnostic technologies.

In summary, while North America and Europe hold a larger market share currently due to established infrastructure and higher per capita healthcare expenditure, the Asia-Pacific region's substantial population and rapidly developing healthcare systems are positioned for rapid market growth in the years to come. The molecular diagnostics segment stands out due to its accuracy and growing adoption, driving substantial market expansion across all key regions.

Several factors are poised to accelerate growth in the IVD infectious disease industry. These include advancements in point-of-care diagnostics enabling rapid testing outside traditional laboratory settings, the increasing adoption of multiplex assays which simultaneously detect multiple pathogens, and the integration of artificial intelligence and machine learning algorithms to improve diagnostic accuracy and efficiency. Government initiatives promoting public health and disease surveillance are also key drivers.

This report offers a detailed analysis of the IVD infectious diseases market, providing a comprehensive overview of market trends, drivers, challenges, and key players. It includes valuable insights into market segmentation, regional dynamics, and future growth prospects, empowering stakeholders to make informed strategic decisions. The report's in-depth analysis of technological advancements, competitive landscape, and regulatory landscape provides a complete picture of this dynamic and rapidly evolving market.

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of XX% from 2019-2033 |

| Segmentation |

|

Note*: In applicable scenarios

Primary Research

Secondary Research

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

The projected CAGR is approximately XX%.

Key companies in the market include BD, BioMerieux, Abbott, Quidel, Gen-Probe, Abbott, Danaher, Sysmex, Orasure, Hologic, Cepheid, Qiagen, Roche Diagnostics, Siemens Healthcare, Bio-Rad Laboratories.

The market segments include Type, Application.

The market size is estimated to be USD 21950 million as of 2022.

N/A

N/A

N/A

N/A

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4480.00, USD 6720.00, and USD 8960.00 respectively.

The market size is provided in terms of value, measured in million.

Yes, the market keyword associated with the report is "IVD Infectious Diseases," which aids in identifying and referencing the specific market segment covered.

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

To stay informed about further developments, trends, and reports in the IVD Infectious Diseases, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.