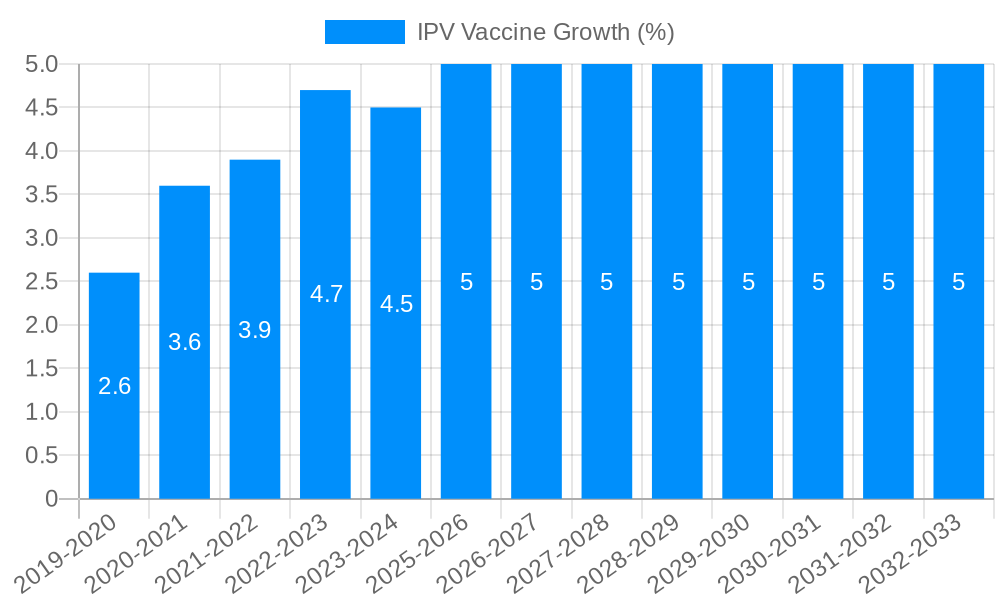

1. What is the projected Compound Annual Growth Rate (CAGR) of the IPV Vaccine?

The projected CAGR is approximately 5%.

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.

IPV Vaccine

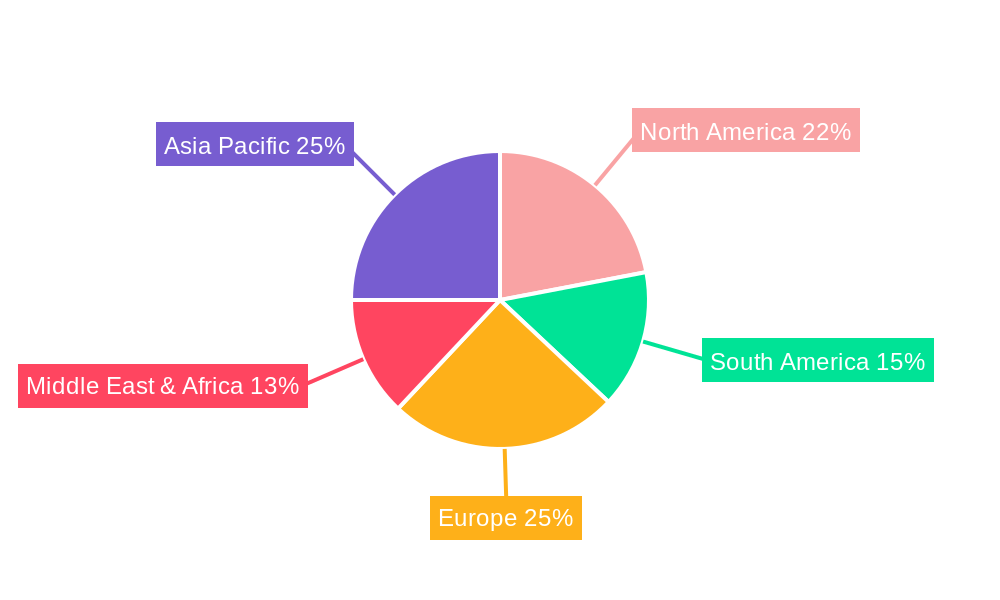

IPV VaccineIPV Vaccine by Type (Mahoney, MEF1, Saukett), by Application (Private Distribution Channel, Public Distribution Channel), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2025-2033

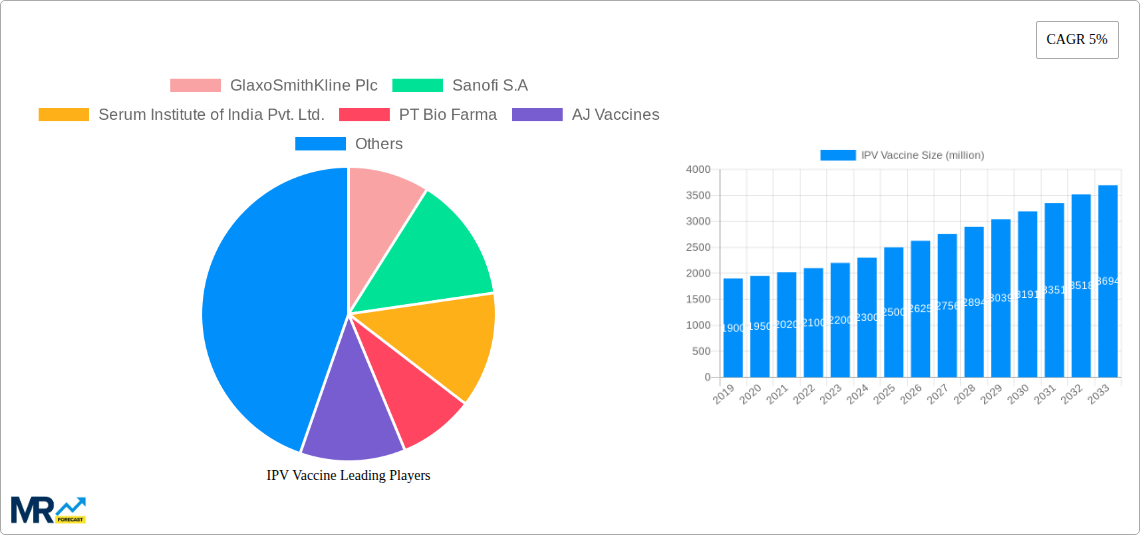

The Inactivated Polio Vaccine (IPV) market is poised for significant growth, projected to reach approximately $2,500 million by 2025, with a Compound Annual Growth Rate (CAGR) of 5% anticipated over the forecast period of 2025-2033. This expansion is primarily driven by a concerted global effort to eradicate polio, underscored by initiatives like the Global Polio Eradication Initiative (GPEI) and sustained vaccination campaigns. The increasing prevalence of infectious diseases and heightened awareness among healthcare providers and governments regarding the critical importance of routine immunization programs further bolster market demand. Technological advancements in vaccine production, leading to improved efficacy and safety profiles, alongside strategic collaborations between vaccine manufacturers and public health organizations, are key accelerators. The market's trajectory is also influenced by favorable regulatory frameworks and government funding allocated to public health programs, ensuring broader accessibility and uptake of IPV.

The IPV market is segmented by vaccine type, with Mahoney and MEF1 representing key formulations, and by distribution channel, encompassing both Private and Public Distribution Channels. The Public Distribution Channel is expected to dominate due to its extensive reach in developing nations and its role in national immunization programs. However, the Private Distribution Channel is gaining traction, driven by increasing disposable incomes and a growing demand for specialized healthcare services. Geographically, the Asia Pacific region, particularly China and India, is anticipated to be a significant growth engine, owing to large populations and ongoing public health investments. North America and Europe will continue to be substantial markets, driven by established healthcare infrastructure and high vaccination rates. Restraints, such as vaccine hesitancy in certain regions and challenges in cold chain logistics, are being actively addressed through public awareness campaigns and infrastructure development.

This comprehensive report delves into the dynamic global market for Inactivated Polio Vaccine (IPV). Analyzing the historical trajectory from 2019 to 2024, with a specific focus on the base and estimated year of 2025, the report provides robust forecasts for the period spanning 2025 to 2033. The analysis incorporates intricate details on key market drivers, emerging trends, significant challenges, and the strategic landscape of leading manufacturers. Utilizing data points in the million unit scale, this report aims to equip stakeholders with actionable intelligence for strategic decision-making within this critical public health sector.

The global Inactivated Polio Vaccine (IPV) market is characterized by a steady and significant upward trajectory, driven by a confluence of factors including heightened global polio eradication efforts, increasing immunization coverage mandates, and the persistent threat of wild poliovirus (WPV) and circulating vaccine-derived poliovirus (cVDPV) outbreaks. XXX market insights reveal that the demand for IPV, particularly fractional IPV (fIPV) doses, has seen a substantial increase, reflecting successful strategies to enhance accessibility and affordability in low- and middle-income countries. The transition from trivalent oral polio vaccine (tOPV) to bivalent oral polio vaccine (bOPV) and the subsequent introduction of IPV into routine immunization schedules by many nations have fundamentally reshaped the market.

Furthermore, industry developments indicate a growing emphasis on combination vaccines that include IPV, offering a streamlined approach to infant immunizations and boosting overall vaccine uptake. The estimated market size for IPV in 2025 is projected to reach [Insert Estimated Value in Million Units] million units, with a compound annual growth rate (CAGR) expected to be sustained at [Insert CAGR]% during the forecast period of 2025-2033. This growth is underpinned by ongoing surveillance programs that necessitate continued vaccination efforts and the proactive procurement of IPV by national health authorities and global health organizations. The market segmentation analysis highlights the increasing preference for public distribution channels, especially in regions with high endemicity or where outbreaks have occurred, as governments prioritize population-level protection. However, the private distribution channel is also anticipated to witness moderate growth, catering to specific demographics and private healthcare providers. The evolving landscape of polio epidemiology and the commitment to achieving a polio-free world will continue to shape the demand for IPV, making it a cornerstone of global public health initiatives for the foreseeable future. The strategic importance of IPV in preventing paralysis and ensuring a generation free from polio cannot be overstated, and this continued demand reflects the collective global commitment to this vital public health goal.

The IPV vaccine market is experiencing robust growth, propelled by several interconnected driving forces that underscore the ongoing global commitment to polio eradication and the prevention of poliomyelitis. Foremost among these is the unwavering dedication of international organizations, national governments, and public health bodies to achieve and maintain a polio-free world. This collective resolve translates into sustained procurement and distribution of IPV, even in regions where wild poliovirus has been eradicated, to guard against reintroduction and to combat the emergence of circulating vaccine-derived poliovirus strains.

Moreover, the increasing number of countries incorporating IPV into their national immunization programs, often as part of a sequential vaccination strategy with oral polio vaccines, is a significant market driver. This inclusion is a direct response to the recommendations from the World Health Organization (WHO) and the Global Polio Eradication Initiative (GPEI), aiming to provide enhanced protection against all strains of poliovirus. Industry developments also reveal a growing trend towards the development and adoption of fractional IPV (fIPV) doses. fIPV offers a cost-effective and logistically advantageous solution, allowing for more doses to be administered from a single vial, thereby expanding the reach of immunization campaigns, especially in resource-constrained settings. The ongoing threat posed by cVDPVs, which can arise from the weakened live virus in oral polio vaccines circulating and mutating in under-immunized populations, further reinforces the need for robust IPV campaigns to build population immunity and interrupt transmission.

Despite the positive market outlook for IPV vaccines, several challenges and restraints warrant careful consideration. A primary concern revolves around the cold chain management and logistical complexities associated with storing and transporting IPV. As an inactivated vaccine, it requires specific temperature conditions to maintain its efficacy, and maintaining a consistent cold chain, particularly in remote or underserved areas with limited infrastructure, can be a significant hurdle. This can lead to vaccine wastage and compromise immunization coverage.

Another challenge is the cost of IPV. Compared to oral polio vaccines, IPV is generally more expensive, which can strain the budgets of public health programs, especially in low- and middle-income countries. This cost factor can also impact the accessibility and affordability of the vaccine, potentially limiting its widespread use in certain populations. Furthermore, vaccine hesitancy and misinformation remain persistent issues, though perhaps less pronounced than for some other vaccines. Any public distrust in vaccines, even if unfounded, can lead to reduced uptake and pose a threat to achieving herd immunity. Finally, the procurement and supply chain dynamics can be subject to fluctuations based on global demand, manufacturing capacities, and political stability in key manufacturing regions, which can sometimes lead to temporary shortages or price volatility. Addressing these challenges is crucial for ensuring sustained and equitable access to IPV worldwide.

The IPV vaccine market is poised for significant growth, with certain regions and segments expected to lead this expansion. A key region exhibiting dominance in the IPV vaccine market is Asia Pacific, driven by its large population base, ongoing polio eradication efforts, and increasing healthcare expenditure. Countries like India, China, and Indonesia, with their substantial child populations and proactive immunization programs, are major consumers of IPV. The Public Distribution Channel is expected to be the dominant segment globally, primarily due to the essential role of national immunization programs in polio eradication. These programs, often supported by international organizations like WHO and UNICEF, aim to reach every child with vital vaccines. The public distribution channel ensures widespread accessibility and affordability, particularly in developing nations where the burden of polio remains a concern.

Within the Asia Pacific region, countries are increasingly adopting IPV into their routine immunization schedules, often in a fractional dose (fIPV) format, to enhance immunity against all poliovirus strains and mitigate the risks associated with circulating vaccine-derived polioviruses (cVDPVs). The Mahoney type of IPV, representing a significant portion of the global supply, is a critical component of these vaccination campaigns. The sheer volume of children vaccinated annually in countries like India, where significant progress has been made in polio eradication but vigilance is maintained, translates into substantial demand for IPV through public channels.

The Saukett type of IPV also plays a role, and the availability of various vaccine formulations influences procurement decisions by national health authorities. While the private distribution channel exists, particularly in more developed economies or for specific demographics seeking private healthcare options, its market share is considerably smaller compared to the public channel when considering the total global volume of IPV administered. The strategic importance of IPV in the context of polio elimination efforts cannot be overstated. For instance, the vast public health infrastructure in China and its commitment to universal immunization translate into considerable demand for IPV through public channels, securing [Insert Estimated Value in Million Units] million units in 2025. Similarly, India's ongoing vaccination drives and its role as a major vaccine manufacturer further solidify the dominance of the public distribution channel in the Asia Pacific region, with an estimated [Insert Estimated Value in Million Units] million units procured for public programs in 2025. The focus on achieving the final stages of polio eradication necessitates continued high coverage, making the public distribution channel the bedrock of IPV market growth.

Several key factors are acting as significant growth catalysts for the IPV vaccine industry. The ongoing global commitment to polio eradication, driven by initiatives like the Global Polio Eradication Initiative (GPEI), continues to fuel demand and procurement of IPV. The increasing adoption of IPV in national immunization programs worldwide, particularly in the form of fractional IPV (fIPV) for improved cost-effectiveness and accessibility, is a major catalyst. Furthermore, the persistent threat of circulating vaccine-derived polioviruses (cVDPVs) necessitates robust IPV campaigns to bolster population immunity and prevent outbreaks.

This report offers an all-encompassing analysis of the IPV vaccine market, providing in-depth insights into its current state and future trajectory. It meticulously examines market segmentation across vaccine types (Mahoney, MEF1, Saukett) and distribution channels (Private Distribution Channel, Public Distribution Channel). The report delves into industry developments, highlighting key trends and strategic initiatives by leading players. Furthermore, it thoroughly explores the driving forces propelling market growth, such as global polio eradication efforts and the increasing adoption of fractional IPV. Simultaneously, it addresses the challenges and restraints that could impact market expansion, including cold chain logistics and vaccine affordability. The comprehensive coverage ensures that stakeholders gain a holistic understanding of the IPV vaccine landscape, enabling informed strategic planning and investment decisions.

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 5% from 2019-2033 |

| Segmentation |

|

Note*: In applicable scenarios

Primary Research

Secondary Research

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

The projected CAGR is approximately 5%.

Key companies in the market include GlaxoSmithKline Plc, Sanofi S.A, Serum Institute of India Pvt. Ltd., PT Bio Farma, AJ Vaccines, .

The market segments include Type, Application.

The market size is estimated to be USD XXX million as of 2022.

N/A

N/A

N/A

N/A

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3480.00, USD 5220.00, and USD 6960.00 respectively.

The market size is provided in terms of value, measured in million and volume, measured in K.

Yes, the market keyword associated with the report is "IPV Vaccine," which aids in identifying and referencing the specific market segment covered.

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

To stay informed about further developments, trends, and reports in the IPV Vaccine, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.